Key Stats for Tesla Stock

This Week Performance: -1%

52-Week Range: $214 to $499

Current Price: $412

What Happened to Tesla Stock?

Tesla (TSLA) shares closed at $412 today, just roughly 17% below their 52-week high of $498.83, yet a mid-case valuation model prices the stock at over $3,000 by 2030, suggesting the market may be significantly underpricing Tesla’s autonomy and robotics transition.

Yesterday, a federal judge upheld a $243 million jury verdict against Tesla, reinforcing legal liability for the company’s Autopilot system following a 2019 fatal crash in Key Largo, Florida, where jurors found Tesla 33% responsible.

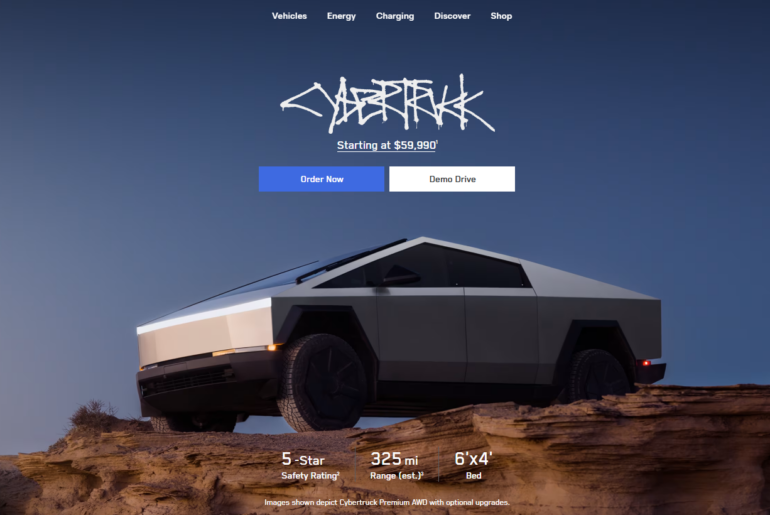

Meanwhile, Tesla simultaneously launched a cheaper dual-motor Cybertruck at $59,990 and slashed the Cyberbeast price from $114,990 to $99,990, signaling that the company is leaning on aggressive price cuts to sustain demand for a pickup truck line that has struggled with recalls, quality issues, and the departure of its program head in November 2025.

The market is increasingly re-reading Tesla less as an automaker and more as an autonomy and robotics bet, with the company winding down Model S and X production to convert Fremont factory space into an Optimus manufacturing line targeting one million humanoid robots per year.

Elon Musk, stated on the Q4 2025 earnings call that “we expect to have fully autonomous vehicles in probably somewhere between a quarter and a half of the United States by the end of the year,” grounding expectations in an active unsupervised Robotaxi service already operating with over 500 vehicles across Austin and the Bay Area.

Coatue Management cut its Tesla stake by 5.1% to 1.6 million shares as of December 31, 2025, while Viking Global raised its position by 5.6% to 1.7 million shares, reflecting a sharply divided institutional view on the stock’s direction.

With CapEx set to exceed $20 billion in 2026 across six new factories, a planned semiconductor Terafab, and an expanding Robotaxi fleet, Tesla is making its largest infrastructure bet ever, one where execution on autonomy and Optimus will determine whether the stock reclaims its highs or continues drifting toward its lows.

Where is the TSLA Stock Headed?

With Tesla simultaneously facing a upheld $243 million Autopilot verdict, aggressive Cybertruck price cuts, and the wind-down of Model S and X production, the stock’s next move hinges entirely on whether its autonomy and Optimus ambitions can replace a shrinking core auto business.

The fundamental case for the bull thesis rests on a recovery from a brutal 2025, where revenue fell 2.9% to $94.83 billion and normalized EPS collapsed 31.4% to $1.66, with consensus estimates projecting an 8.6% revenue rebound to $103.02 billion and EPS recovering to $2.06 in 2026.

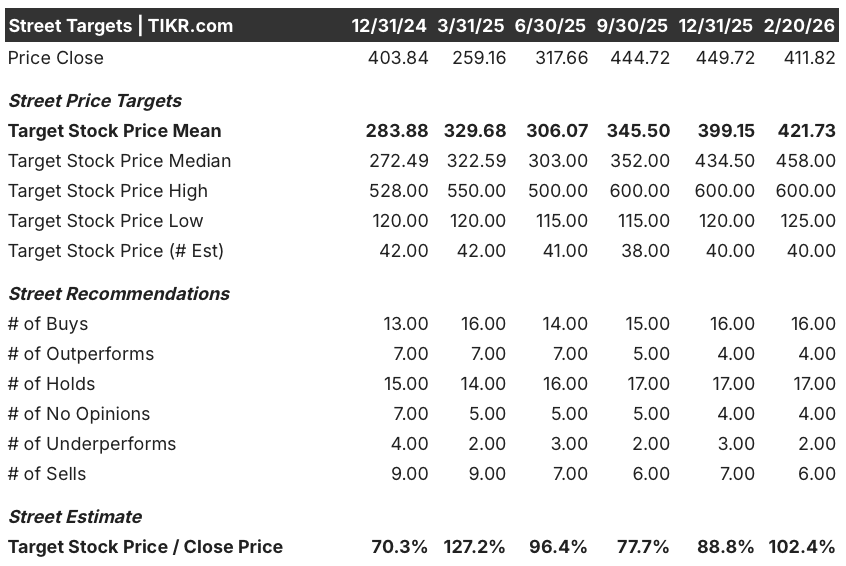

Street Analysts Target for TSLA Stock (TIKR)

Street Analysts Target for TSLA Stock (TIKR)

Wall Street’s mean price target as of February 20, 2026 sits at $421.73 across 40 analysts, with 16 Buys, 4 Outperforms, and 17 Holds, placing the consensus just 2.4% above the current close of $411.82 and reflecting a Street that is cautiously optimistic but far from convicted.

The target range tells a sharply divided story, with the high target sitting at $600.00 and the low at $125.00, a $475 spread that captures two completely different companies: one that successfully transitions to autonomy and robotics, and one that stalls out.

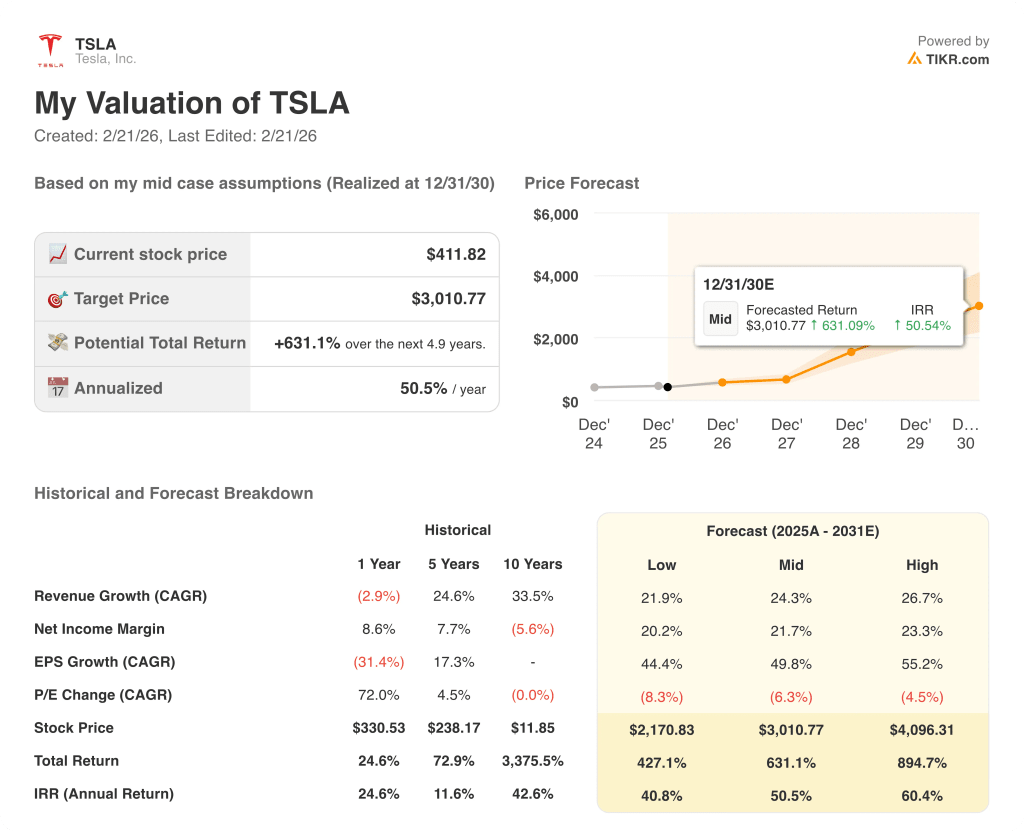

TSLA Stock Valuation Model Results (TIKR)

TSLA Stock Valuation Model Results (TIKR)

If Tesla’s Robotaxi and Optimus scaling plays out as Musk described on the Q4 2025 earnings call, a mid-case valuation model prices TSLA at $3,010.77 by December 31, 2030, implying a 631.1% total return and a 50.5% annualized IRR from the current price of $411.82.

The central risk is margin compression compounding further, as EBITDA margins have already contracted from 23.6% in 2022 to 15.4% in 2025, and the 2026 estimate of 14.7% suggests the cost of funding six new factories, AI compute, and an Optimus ramp will continue pressuring profitability before autonomy revenue meaningfully arrives.

At $411.82, Tesla trades as a deep optionality bet where the current price embeds almost no credit for a successful Robotaxi or Optimus business, making it a high-conviction buy only for investors willing to hold through years of elevated CapEx and execution risk.

Value Any Stock in Under 60 Seconds (It’s Free)

With TIKR’s new Valuation Model tool, you can estimate a stock’s potential share price in under a minute.

All it takes is three simple inputs:

Revenue Growth

Operating Margins

Exit P/E Multiple

From there, TIKR calculates the potential share price and total returns under Bull, Base, and Bear scenarios so you can quickly see whether a stock looks undervalued or overvalued.

If you’re not sure what to enter, TIKR automatically fills in each input using analysts’ consensus estimates, giving you a quick, reliable starting point.