Find your next quality investment with Simply Wall St’s easy and powerful screener, trusted by over 7 million individual investors worldwide.

Tesla (NasdaqGS:TSLA) avoided a threatened 30 day suspension of its California dealer license by agreeing to stop marketing its driver assistance features as “Autopilot”.

The decision resolves a multi year dispute with the California DMV over allegations of deceptive advertising related to driver assistance capabilities.

At the same time, Tesla is discontinuing Model S and Model X production as it shifts resources toward artificial intelligence, robotics, and purpose built autonomous vehicles.

Initial production of the driverless Cybercab has begun, reflecting a stronger focus on mobility as a service and humanoid robots such as Optimus.

For investors watching Tesla, the move keeps one of its largest US markets open while the company repositions its business profile. The pivot toward AI, robotics, and robotaxis adds more weight to non traditional auto segments within the NasdaqGS:TSLA story, alongside its existing EV and energy operations.

Looking ahead, the key questions are how regulators respond to driverless Cybercab deployments and how quickly Tesla can scale its robotics and autonomous fleets. For shareholders and customers, this shift may change how they think about Tesla, from primarily a premium EV maker to a company more centered on software, automation, and recurring service revenue models.

Stay updated on the most important news stories for Tesla by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Tesla.

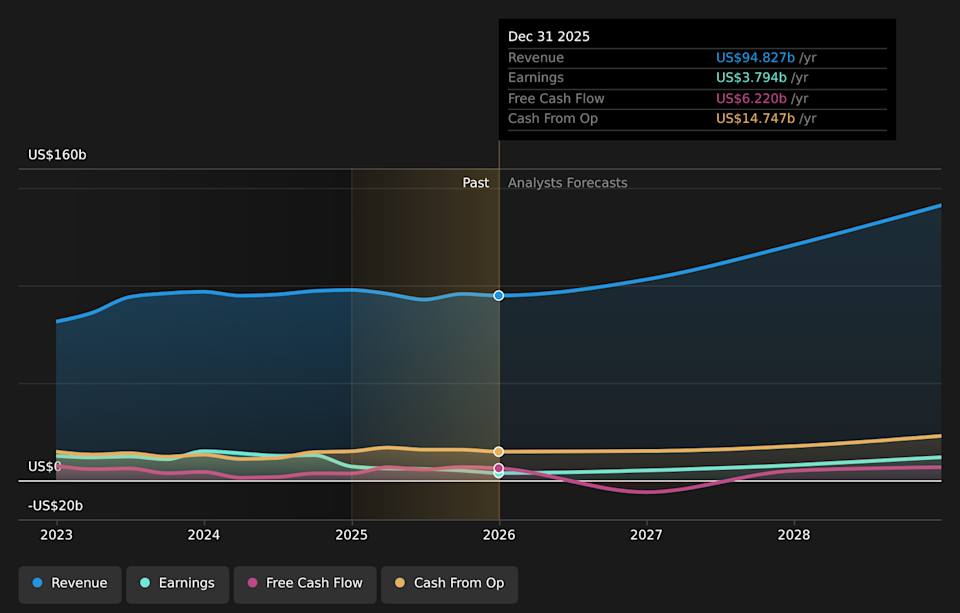

NasdaqGS:TSLA Earnings & Revenue Growth as at Feb 2026

NasdaqGS:TSLA Earnings & Revenue Growth as at Feb 2026

📰 Beyond the headline: 3 risks and 1 thing going right for Tesla that every investor should see.

For you as an investor, the key takeaway is that Tesla is tying its regulatory clean up in California directly to a reset of its business model. By dropping Autopilot branding and emphasizing “Full Self Driving (Supervised),” Tesla reduces the risk of a forced sales halt in one of its core markets while trying to reframe autonomy as a subscription software product. At the same time, closing Model S and Model X production lines, ramping Optimus robots and starting Cybercab builds shifts capital and management attention away from traditional, unit based auto sales toward AI powered services and robotics. This comes as Tesla faces weaker EV demand, more competition in China from players like Xiaomi, and high spending plans that some analysts already view as a pressure point. Compared with rivals such as Alphabet’s Waymo and General Motors’ Cruise, Tesla is pushing a camera only autonomy stack and an integrated fleet plus software model. That could give it more control over economics if robotaxis scale, but it also concentrates technical and regulatory execution risk into a smaller number of big bets.

This news backs the narrative that Tesla is leaning into autonomy and physical AI, with Cybercab and Optimus as central pieces and FSD subscriptions as a recurring revenue pillar.

It also highlights a challenge raised in the narrative, that higher AI and robotics spending alongside slow product ramps can weigh on near term margins and cash generation.

The specific regulatory compromise in California and the discontinuation of Autopilot branding are not explicitly captured in the narrative, yet they influence how quickly and profitably Tesla can roll out robotaxis in a key US state.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Tesla to help decide what it’s worth to you.

⚠️ Heavy capital spending on AI, robots and Cybercab production could pressure free cash flow if new services take longer than expected to reach commercial scale.

⚠️ Regulatory scrutiny of autonomous driving and driver assistance marketing, as seen in California, may limit how fast Tesla can deploy driverless fleets versus competitors like Waymo and GM Cruise.

🎁 Successful rollout of FSD subscriptions and robotaxis could increase the mix of high margin, recurring software and service revenue relative to car sales.

🎁 Repurposing factories for Optimus and Cybercab creates an option on new markets such as humanoid robots and autonomous ride hailing that traditional automakers like Ford and Rivian are only starting to target.

From here, it is worth tracking three things closely. First, how regulators in California and other key jurisdictions respond to real world Cybercab deployments and fully driverless operations. Second, the pace at which FSD subscription uptake grows, as that is the clearest near term test of Tesla’s software model. Third, evidence that Optimus and robotaxis move from prototypes to scaled fleets without repeated delays or cost overruns. Put together, these signals will show whether Tesla’s pivot away from legacy EV models is translating into a sustainable, service heavy business or simply raising execution risk.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for Tesla, head to the community page for Tesla to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSLA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com