could have paused sales in one of its biggest US markets, while it keeps selling a future centered on robotaxis and other self-driving software.

Why should I care?

For markets: Words can move markets when regulators are listening.

A California license suspension would have hit Tesla where US demand is deepest, raising the stakes for how it describes advanced driver-assistance systems. That matters because those paid software features underpin Tesla’s longer-term growth story, including its robotaxi ambitions. For investors, the point is that compliance and product messaging can speed up – or slow down – how quickly new services reach customers.

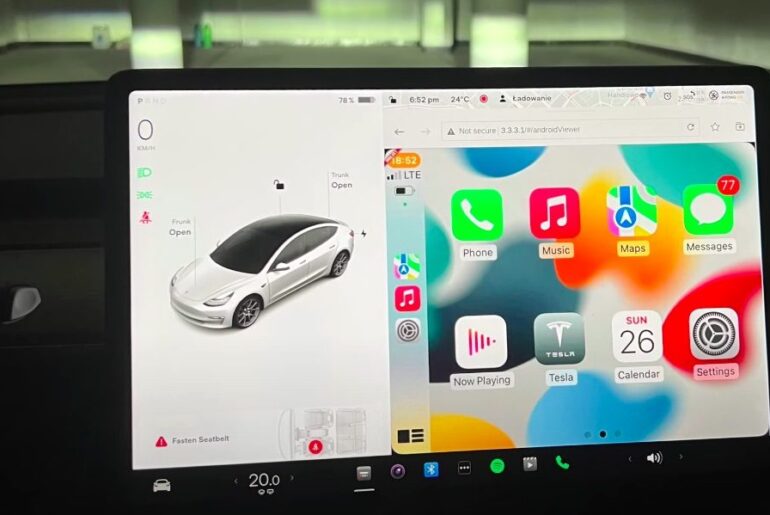

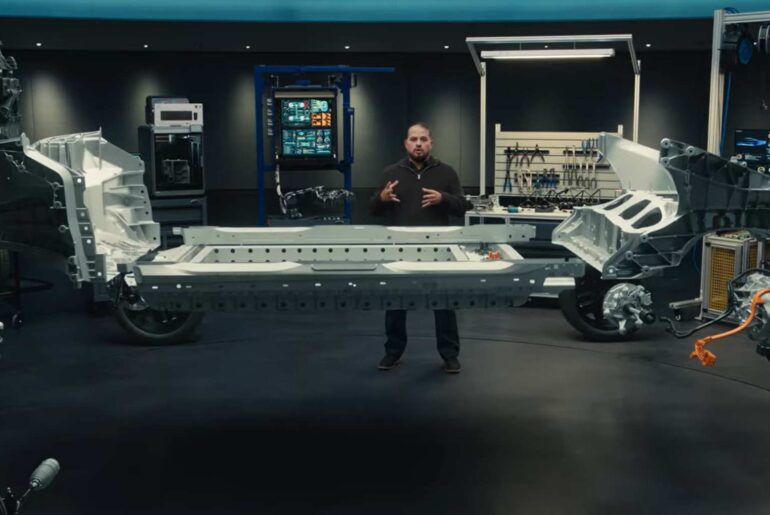

Zooming out: The EV battleground is shifting from hardware to software.

EV demand has cooled from its post-incentive boom, pushing automakers to chase profit through subscriptions and add-on software rather than just more vehicle sales. That makes driver-assistance revenue more important – and increases the cost of overstating capabilities. If the industry is moving from “sell more cars” to “sell more features,” then what companies can prove, and what regulators will let them imply, becomes central to the business model.