VinFast Auto (NasdaqGS:VFS) has signed a Memorandum of Understanding with Exposure SARL to potentially supply electric vehicles for green taxi services in Kinshasa, Democratic Republic of the Congo, signaling a new African market opportunity.

See our latest analysis for VinFast Auto.

The Kinshasa taxi MOU comes shortly after VinFast reported January EV deliveries of 16,172 units, a 55% increase year on year, and issued 2026 delivery guidance. However, the share price return has been weak, with a 1-year total shareholder return decline of 12.73% and a 3-year total shareholder return decline of 67.59%. This suggests that recent African expansion headlines sit against a backdrop of fading longer term momentum, despite the latest 1-day share price return of 2.81%.

If this expansion story has you looking beyond a single name, it could be a good moment to check out 34 AI infrastructure stocks as another way to find EV and charging related opportunities.

With VFS around $3.29 after a 1 year total shareholder return decline of 12.73% and a 3 year decline of 67.59%, yet showing annual revenue and net income growth, are investors overlooking value here, or is the market already pricing in future growth?

Most Popular Narrative: 48.3% Undervalued

With VinFast Auto last closing at $3.29 and the most followed narrative pointing to fair value at $6.36, the gap between today’s price and that narrative view is wide enough that many investors will want to understand what is driving it.

The rollout of dedicated VinFast charging infrastructure and ecosystem partnerships (GSM and V-GREEN) in Southeast Asia and beyond directly addresses the primary consumer barrier to EV adoption, supporting higher demand, increased deliveries, and ultimately greater revenue scale.

Transition to a more cost-efficient, next-generation vehicle platform and zonal E/E architecture is expected to materially lower bill of materials and production costs, improving gross and operating margins as scale and operational leverage increase.

Want to see what kind of revenue climb, margin shift, and future earnings multiple sit behind that fair value jump? The narrative leans on ambitious growth math, a sharp profitability swing, and a generous future valuation bar. Curious which assumptions have the biggest impact on that $6.36 figure and how they stack up over the next few years?

Result: Fair Value of $6.36 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, the story could look very different if heavy cash burn and liquidity pressures persist, or if weaker underlying B2C demand makes current delivery volumes hard to sustain.

Find out about the key risks to this VinFast Auto narrative.

Another View: Multiples Paint A Tougher Picture

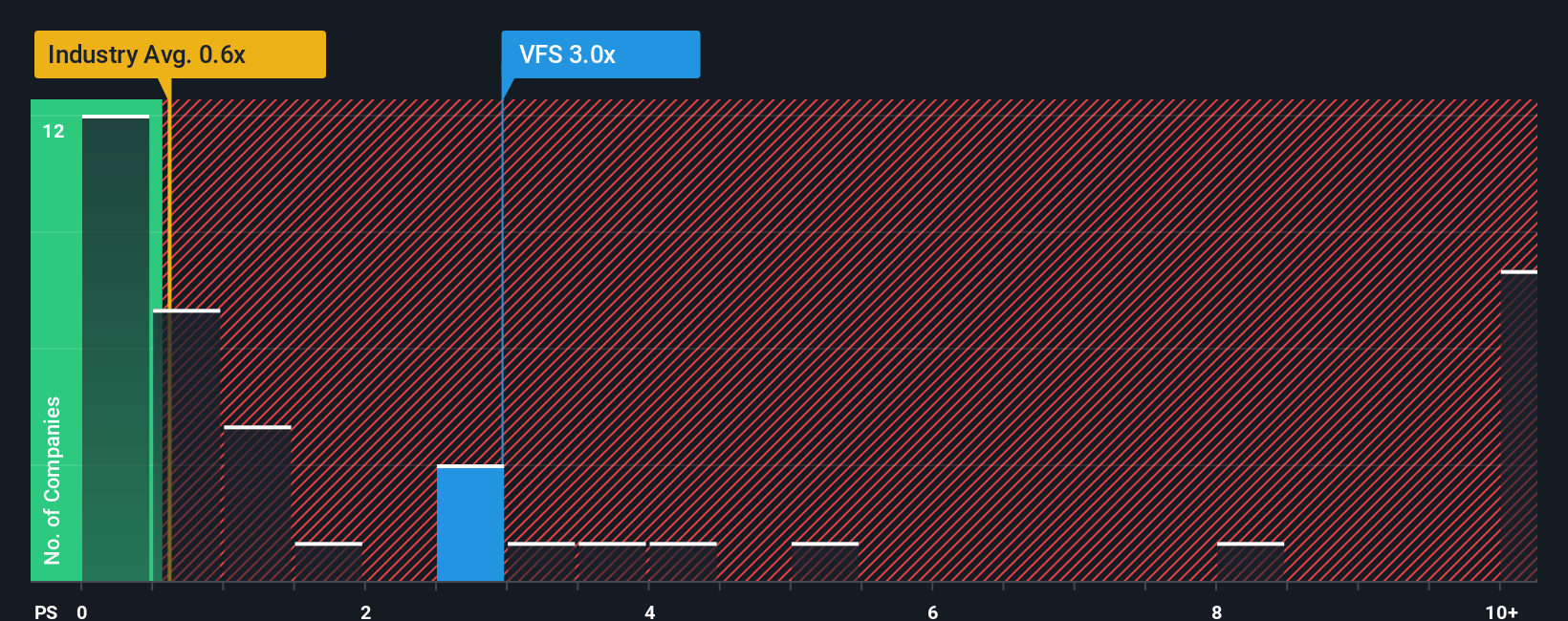

If you zoom out from the $6.36 fair value and look at simple sales based pricing, VinFast Auto starts to look expensive. The current P/S of around 3x sits well above the US auto industry at 0.6x, the peer average at 2x, and a fair ratio of just 0.1x that our model suggests the market could move toward.

That gap raises a practical question for you as an investor: is the market underestimating future revenue and margin potential, or are buyers already paying up for a story that still carries heavy execution and balance sheet risk?

See what the numbers say about this price — find out in our valuation breakdown.

NasdaqGS:VFS P/S Ratio as at Feb 2026 Build Your Own VinFast Auto Narrative

NasdaqGS:VFS P/S Ratio as at Feb 2026 Build Your Own VinFast Auto Narrative

If you look at this and come to a different conclusion, or simply prefer to rely on your own research and assumptions, you can put together a personalised thesis in only a few minutes, starting with Do it your way.

A great starting point for your VinFast Auto research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about putting your capital to work, do not stop at one stock. Use the screener to see what else might fit your style.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com