Find winning stocks in any market cycle. Join 7 million investors using Simply Wall St’s investing ideas for FREE.

Stellantis (BIT:STLAM) is pulling back from several battery joint ventures, including projects with LG Energy and potentially Samsung SDI.

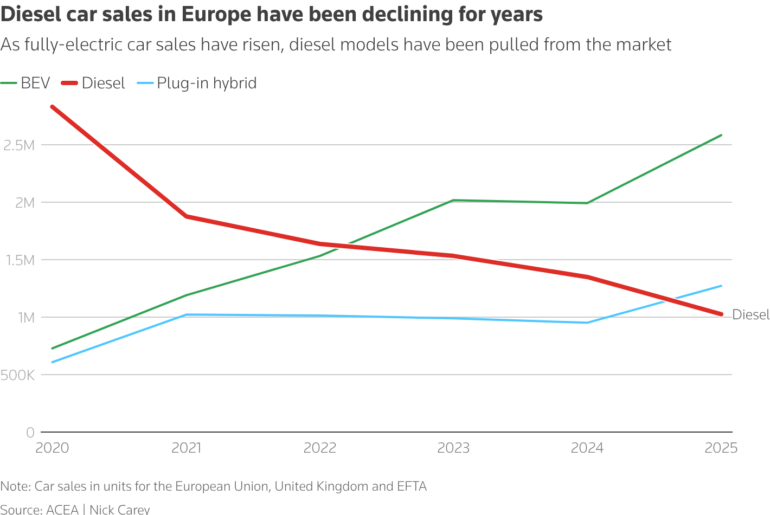

The company is reintroducing diesel models across Europe, aligning its line up with current demand patterns and regulatory conditions.

These moves mark a change from its earlier, more aggressive electric vehicle rollout plans and are drawing attention from partners and regulators.

Stellantis, the parent group behind brands such as Peugeot, Fiat, Jeep and Opel, had previously put electric vehicles at the center of its product roadmap. Now, by stepping away from certain battery partnerships and reviving diesel offerings in Europe, the company is leaning into a more mixed powertrain approach. For you as an investor, this sits against a backdrop of uneven EV adoption and shifting emissions rules across key markets.

This reset in plans may influence how Stellantis allocates capital between EVs, hybrids and combustion models, as well as how it works with suppliers and joint venture partners. As regulations and consumer demand continue to evolve in North America and Europe, you may want to watch how the company balances compliance requirements with profitability across its various brands and regions.

Stay updated on the most important news stories for Stellantis by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Stellantis.

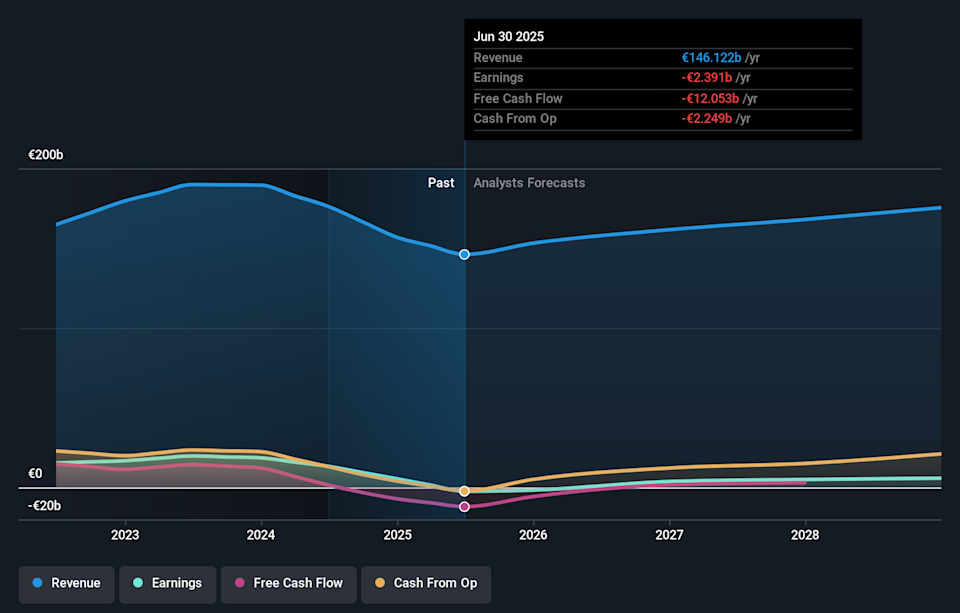

BIT:STLAM Earnings & Revenue Growth as at Feb 2026

BIT:STLAM Earnings & Revenue Growth as at Feb 2026

For Stellantis, pulling back from battery joint ventures and bringing diesel models back into the range looks like an attempt to match product and capital spend to what customers are actually buying today. After more than €22b in write downs tied to earlier EV plans and guidance for a sizeable net loss in 2025 with no 2026 dividend, scaling back long dated battery commitments can be read as a cash preservation move. At the same time, the company is not walking away from electrification entirely, with multi energy line ups at brands like Dodge and Jeep and continued access to battery supply from former partners’ plants.

The shift to a more mixed powertrain offer, including hybrids and combustion engines, aligns with the narrative’s focus on product rationalization and refreshed brands as levers for future margin improvement.

However, exiting or shrinking battery JVs could challenge the earlier view that electrification initiatives would be a clear source of market share gains against peers such as Volkswagen and Ford.

The scale and timing of EV related write downs and JV exits, including the token sale of the Canadian battery stake, are not fully captured in the original narrative’s discussion of restructuring and may change how you think about execution risk.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Stellantis to help decide what it’s worth to you.

⚠️ Large EV related write downs, the expected €19b to €21b net loss in 2025 and the decision to skip the 2026 dividend highlight financial pressure and execution risk around the transition plan.

⚠️ Scaling back battery partnerships with LG Energy and potentially Samsung SDI could leave Stellantis more exposed if EV demand re accelerates, especially against competitors such as General Motors and Tesla that retain sizeable battery capacity.

🎁 Refocusing capital away from underused battery assets and toward products with clearer current demand, such as revived diesel models and multi energy Jeep and Dodge offerings, may support near term cash generation.

🎁 Analysts have identified both good relative value and future earnings growth potential, so investors who are comfortable with higher share price volatility may see this reset as part of a longer term turnaround.

You may want to watch how quickly Stellantis can rebalance its product mix without losing ground in EVs, and whether new or reworked partnerships fill any battery supply gaps. The terms of any exit from the Samsung SDI venture, progress on talks about the Brampton plant in Canada, and updates to 2026 guidance will be important signposts. It is also worth tracking how regulators respond to the return of diesel models in Europe and how Stellantis’ volumes and pricing stack up against European and US peers that stick more closely to aggressive EV rollouts.

To stay informed on how the latest news affects the investment narrative for Stellantis, visit the community page for Stellantis to keep up with the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include STLAM.MI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com