U.S. technology heavyweights Intel Corp (INTC), Advanced Micro Devices (AMD), and Tesla Inc (TSLA) stocks delivered powerful 12-month gains as artificial intelligence reshaped the investment landscape across semiconductors and robotics.

Shares of Intel have surged roughly 130% over the past year, recently trading near $48.29, marking one of the most dramatic turnarounds in the U.S. semiconductor space. AMD climbed about 90% year over year to approximately $213.57, while Tesla advanced around 30% for the year, hovering near $428.13, as investors increasingly price it as an AI and robotics company rather than solely an electric vehicle maker.

Intel’s 130% Surge: Foundry Pivot and AI Offensive

Intel Corporation (INTC) closed at $48.29, up $1.16 (+2.46%) at 4:00 PM EST, and continued to edge higher in overnight trading to $48.54, gaining another $0.25 (+0.52%). Intel’s rebound has been driven by a strategic overhaul under its foundry-first model and an aggressive push into AI infrastructure. After years of lagging in process leadership, Intel’s renewed focus on advanced manufacturing and U.S.-based semiconductor capacity has resonated strongly with investors.

Beyond traditional CPUs, Intel has launched what some analysts call an “AI offensive.” The company reportedly committed $100 million to SambaNova and unveiled a ZAM prototype, signaling ambitions in the AI accelerator market, a segment long dominated by rivals. Demand for AI-focused data center chips and rising hyperscaler capital expenditures have supported Intel’s recovery.

The broader semiconductor industry has benefited from structural AI infrastructure buildouts across the United States, with enterprise and cloud providers expanding compute capacity. Intel’s 12-month rally reflects optimism that it can regain relevance not only in CPUs but also in AI-specific silicon.

Intel’s market capitalization now stands near $241 billion, underscoring how sharply sentiment has shifted over the past year.

AMD’s 90% Rally: MI300X and AI Accelerators Lead

AMD has posted an approximately 90% 52-week gain, fueled largely by demand for its MI300X AI accelerator platform. Over the past year, AMD shares traded in a wide range — from a 52-week low near $76.48 to highs above $267.08, reflecting both volatility and sustained investor enthusiasm.

Analysts recently reiterated “Strong Buy” ratings on AMD, citing continued data center momentum and competitive positioning in AI workloads. The company’s ability to scale AI accelerators for enterprise and cloud customers has positioned it as a credible challenger in the high-performance compute space.

With a market capitalization of roughly $348 billion, AMD has solidified its role as a central player in the AI-driven semiconductor expansion.

Tesla’s 30% Gain: From Automaker to AI & Robotics

While Tesla (TSLA) experienced a volatile trading year, its stock has still advanced approximately 30% over the past 12 months. Increasingly, investors are valuing Tesla as a robotics and artificial intelligence platform rather than solely an EV manufacturer. Meanwhile, Tesla, Inc. (TSLA) closed at $428.61, up $3.73 (+0.88%) at 4:00 PM EST, and ticked slightly higher in overnight trading to $428.86, adding $0.25 (+0.06%).

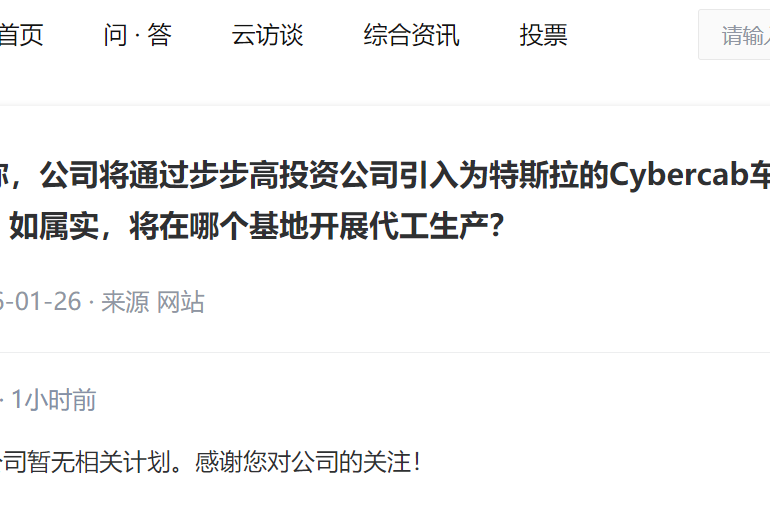

CEO Elon Musk has emphasized Tesla’s long-term autonomy strategy, including development of the Cybercab robotaxi platform, which remains on track for 2026 production. The company’s broader AI narrative has been supported by its $2 billion investment in xAI, reinforcing its positioning in machine learning and data-driven systems.

Tesla’s market capitalization sits near $1.4 trillion, making it one of the most valuable companies in the United States. Market participants have pointed to Full Self-Driving (FSD) software advancements and robotics ambitions as central valuation drivers.

Sector-wide enthusiasm has also been lifted by developments across the EV ecosystem, including anticipation surrounding the Rivian R2 reveal expected in March 2026, which has renewed interest in electric mobility.

AI Infrastructure Drives U.S. Tech Leadership

The common thread linking Intel, AMD, and Tesla is the market’s growing conviction that AI infrastructure, from data center silicon to autonomous systems, will define the next investment cycle.

Rising hyperscaler capex, enterprise AI adoption, and robotics integration are reshaping how capital flows into U.S. technology equities. While volatility remains, particularly in high-growth names, the past 12 months underscore how deeply AI has influenced equity performance.

As 2026 unfolds, investors will watch whether AI accelerator demand, foundry execution, and autonomous technology milestones can sustain the remarkable annual gains posted by Intel, AMD, and Tesla.

![[Gasgoo Express] Zotye Auto responds to manufacturing Tesla Cybercab; Reports say automotive solid-state battery Part 1 national standard to be released in July Gasgoo](https://www.evshift.com/wp-content/uploads/2026/02/1770896374_6388517001938359565414136-770x221.jpg)