Find winning stocks in any market cycle. Join 7 million investors using Simply Wall St’s investing ideas for FREE.

Tesla (NasdaqGS:TSLA) is discontinuing its long running Model S and Model X vehicles to free up capacity for Optimus humanoid robots and robotaxi production.

The company has outlined an initial rollout schedule for Optimus units and robotaxi services that targets 2026 for broader deployment.

Following SpaceX’s acquisition of xAI, Tesla’s links to Elon Musk’s wider tech group have deepened, fueling discussion about a possible future mega merger involving Tesla, SpaceX, and xAI.

Tesla, with a recent share price of $397.21, sits at the center of a shift toward AI, autonomy, and robotics that extends beyond its original role as an EV maker. The stock is up 9.8% over the past year and has returned 101.7% over three years, while the year to date return stands at a 9.3% decline. Those mixed returns illustrate how investors are processing the company’s move away from established vehicles toward new products that are still early in their commercial life.

For investors, the focus now is less on incremental EV demand and more on how Tesla executes on Optimus and robotaxis, and how any tighter integration with SpaceX and xAI might reshape the business. These developments concentrate the story around AI, robotics, and autonomous services. That, in turn, can influence how the market evaluates risk, capital needs, and potential long term opportunities tied to NasdaqGS:TSLA.

Stay updated on the most important news stories for Tesla by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Tesla.

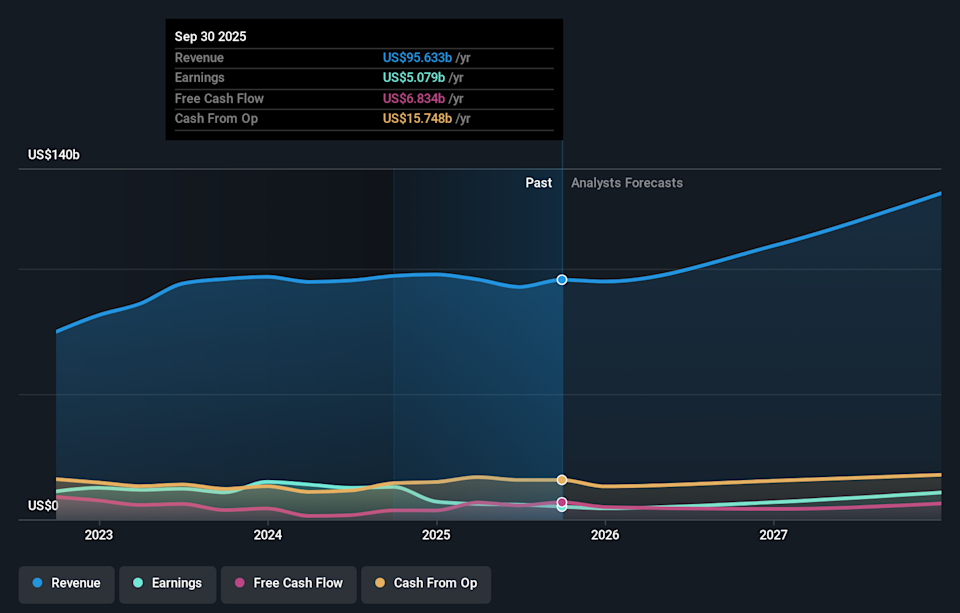

NasdaqGS:TSLA Earnings & Revenue Growth as at Feb 2026

NasdaqGS:TSLA Earnings & Revenue Growth as at Feb 2026

How Tesla stacks up against its biggest competitors

⚖️ Price vs Analyst Target: At US$397.21 versus a consensus target of US$418.81, the share price sits about 5% below where analysts on average see it.

❌ Simply Wall St Valuation: The stock is trading at about 202.2% above the Simply Wall St estimated fair value, which flags a rich valuation.

❌ Recent Momentum: The 30 day return of roughly 7.9% decline shows weaker short term momentum as the new AI and robotics focus beds in.

Check out Simply Wall St’s in depth valuation analysis for Tesla.

📊 The shift from long standing EV models toward Optimus and robotaxis concentrates the story on AI, robotics, and services. This can change how you think about Tesla’s risk and return profile.

📊 Watch execution milestones around the 2026 rollout timetable, P/E of about 393 versus the Auto industry average of roughly 24, and any concrete steps toward closer ties with SpaceX and xAI.

⚠️ Key flagged issues include shareholder dilution over the past year, lower profit margin at 4% versus 7.3% last year, and significant insider selling in recent months.

For the full picture including more risks and rewards, check out the complete Tesla analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSLA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com