Tesla (NASDAQ: TSLA) is a stock that, when it catches fire, can quickly become one of the best buys out there. It has a strong following of retail investors who are incredibly bullish about the company’s long-term future. All it may take is one strong catalyst to ramp up that bullishness and squeeze short-sellers out, leaving a clear path for the stock to rally.

CEO Elon Musk is optimistic about the company’s long-term future and often gives investors no shortage of reasons to be hopeful about the business. From electric vehicles to robotaxis to robots, Tesla’s business looks full of long-term growth opportunities. And when there’s a shorter-term catalyst to watch out for, that can be particularly noteworthy. Musk just gave investors a huge one to keep an eye out for.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

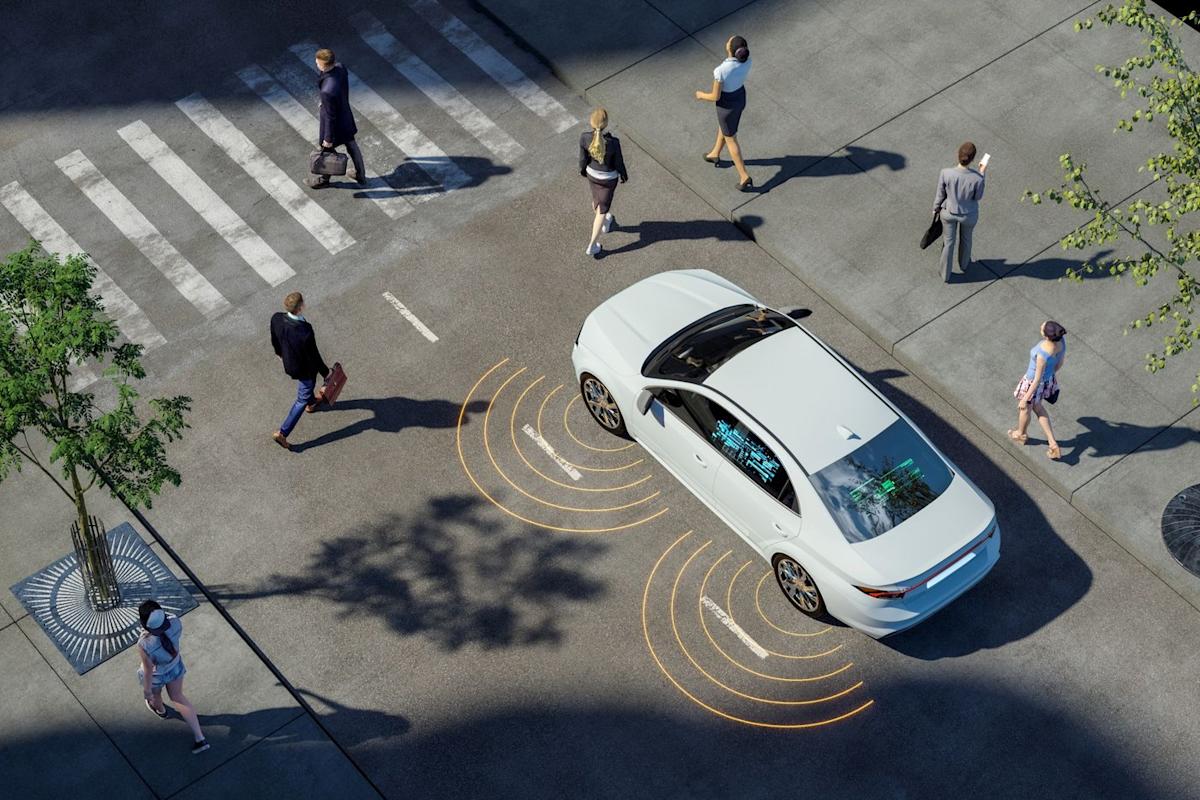

Image source: Getty Images.

Image source: Getty Images.

One of the big reasons investors have been excited about Tesla’s stock is the potential for it to dominate the robotaxi industry. While it’s far behind Alphabet’s Waymo, the company is looking to drastically pick up the pace. Tesla launched its first robotaxis in Austin, Texas, last year, and 2026 could be the year they reach many more markets.

Musk recently stated, “Tesla’s rolled out robotaxi service in a few cities, and will be very, very widespread by the end of this year within the U.S.” It’s a significant prediction because it’s based on the current year; it’s not a forecast for the distant future. If Tesla does indeed roll out robotaxis on a large scale this year, that could offer much-needed proof to investors that the company can seriously compete with Waymo, which is currently averaging 450,000 paid rides per week.

Tesla’s stock trades at a grossly inflated valuation — 390 times its trailing earnings. That’s incredibly steep when you consider that the average stock on the S&P 500 trades at an earnings multiple of just 26. For that kind of egregious valuation, you truly have to believe that the company is a leader in tech and that it will dominate the robotaxi market. But even then, the valuation still looks high.

Musk has made rosy projections in the past only for them to fall short or for Musk to alter them. This could be the same kind of situation. That’s why, when it comes to Tesla’s stock, it’s important to be extra careful, given both its high valuation and Musk setting an incredibly high bar for the business to meet, which may not be realistic.

Widespread growth of its robotaxi business could be a catalyst for Tesla’s stock this year, but investors would be wise to take a wait-and-see approach, rather than buying on those expectations.

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $451,801!*

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $52,599!*

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $432,297!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, available when you join Stock Advisor, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 2, 2026

David Jagielski, CPA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Tesla. The Motley Fool has a disclosure policy.

Elon Musk Makes a Bold Claim for Tesla in 2026. It Could Make the Stock a Scorching-Hot Buy. was originally published by The Motley Fool