Musk is expecting a lot of growth in Tesla’s robotaxi business this year.

Tesla (TSLA 2.23%) is a stock that, when it catches fire, can quickly become one of the best buys out there. It has a strong following of retail investors who are incredibly bullish about the company’s long-term future. All it may take is one strong catalyst to ramp up that bullishness and squeeze short-sellers out, leaving a clear path for the stock to rally.

CEO Elon Musk is optimistic about the company’s long-term future and often gives investors no shortage of reasons to be hopeful about the business. From electric vehicles to robotaxis to robots, Tesla’s business looks full of long-term growth opportunities. And when there’s a shorter-term catalyst to watch out for, that can be particularly noteworthy. Musk just gave investors a huge one to keep an eye out for.

Image source: Getty Images.

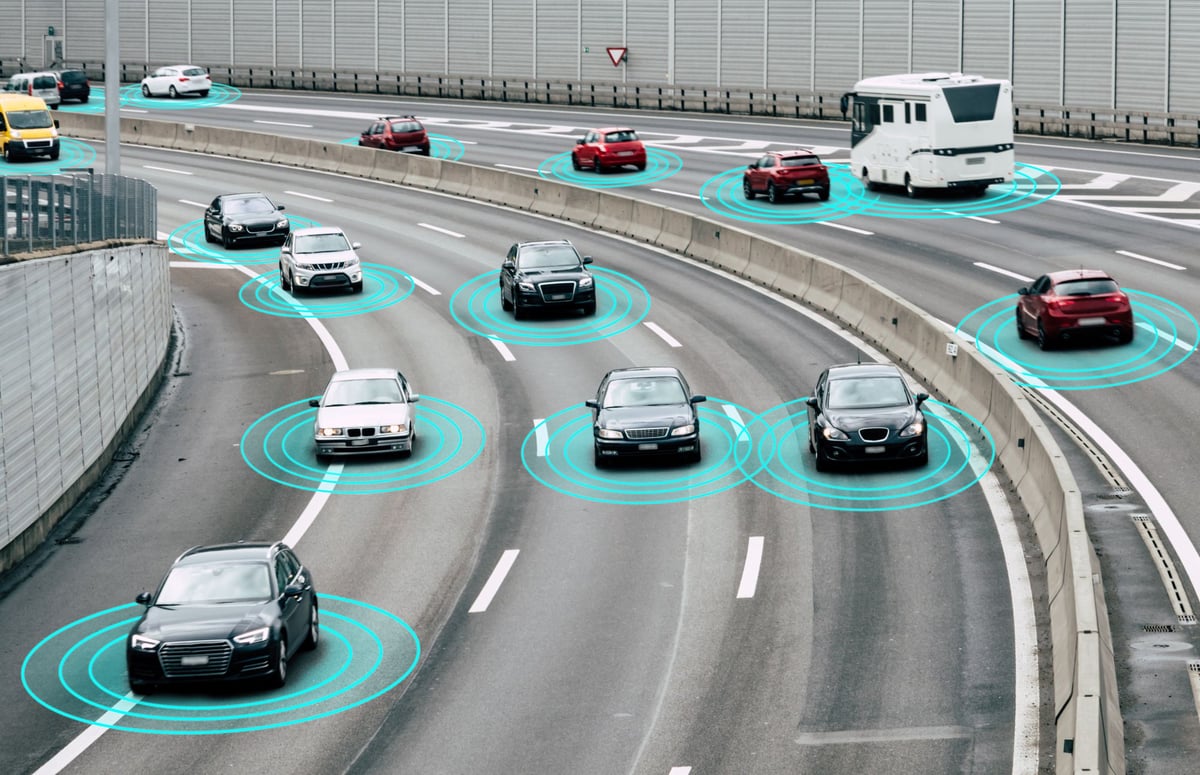

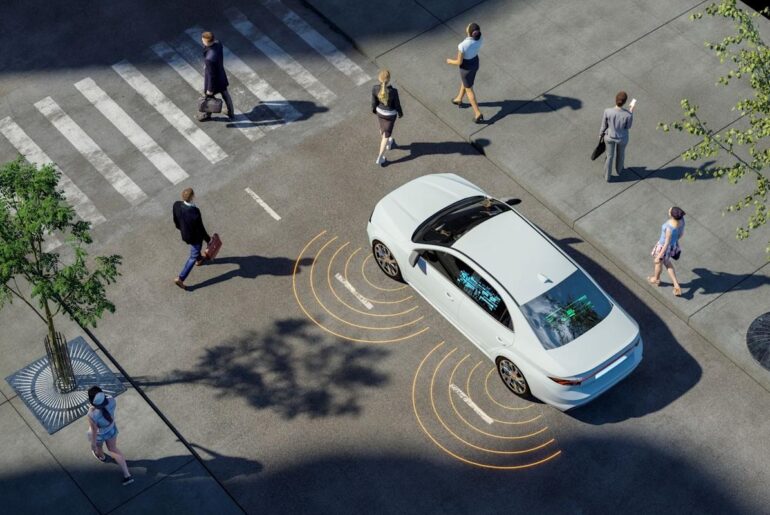

Robotaxi business to take off in 2026?

One of the big reasons investors have been excited about Tesla’s stock is the potential for it to dominate the robotaxi industry. While it’s far behind Alphabet’s Waymo, the company is looking to drastically pick up the pace. Tesla launched its first robotaxis in Austin, Texas, last year, and 2026 could be the year they reach many more markets.

Musk recently stated, “Tesla’s rolled out robotaxi service in a few cities, and will be very, very widespread by the end of this year within the U.S.” It’s a significant prediction because it’s based on the current year; it’s not a forecast for the distant future. If Tesla does indeed roll out robotaxis on a large scale this year, that could offer much-needed proof to investors that the company can seriously compete with Waymo, which is currently averaging 450,000 paid rides per week.

Today’s Change

(-2.23%) $-9.04

Current Price

$396.97

Key Data Points

Market Cap

$1.3T

Day’s Range

$387.55 – $402.02

52wk Range

$214.25 – $498.83

Volume

2.9M

Avg Vol

73M

Gross Margin

18.03%

Investors should always tread carefully with Tesla and Musk’s predictions

Tesla’s stock trades at a grossly inflated valuation — 390 times its trailing earnings. That’s incredibly steep when you consider that the average stock on the S&P 500 trades at an earnings multiple of just 26. For that kind of egregious valuation, you truly have to believe that the company is a leader in tech and that it will dominate the robotaxi market. But even then, the valuation still looks high.

Musk has made rosy projections in the past only for them to fall short or for Musk to alter them. This could be the same kind of situation. That’s why, when it comes to Tesla’s stock, it’s important to be extra careful, given both its high valuation and Musk setting an incredibly high bar for the business to meet, which may not be realistic.

Widespread growth of its robotaxi business could be a catalyst for Tesla’s stock this year, but investors would be wise to take a wait-and-see approach, rather than buying on those expectations.