1. China’s rapid ascendance as a global electric vehicle (EV) powerhouse has unsettled Europe’s traditional automotive giants, prompting them to strengthen ties with Chinese firms and suppliers after years of slow adaptation to electrification trends. The shift comes as European automakers face mounting challenges in retaining market share within China, the world’s largest car market, due to the burgeoning dominance of domestic Chinese brands, especially in the EV and new-energy vehicle (NEV) sectors. [para. 1]

2. In response to competitive pressures and declining fortunes, Porsche AG announced in December a gradual shutdown of its proprietary EV charging network in China, opting instead to collaborate more closely with external charging providers. The luxury automaker, a subsidiary of Volkswagen AG, has lost market share and begun cutting its number of dealerships on the Chinese mainland—a reduction of about 30% planned in 2025, leaving it with 80 dealers. [para. 2][para. 3]

3. This strategic retreat occurs as Porsche’s sales in China plunged by 26% in 2025, down to roughly 42,000 vehicles. Other major European automakers—Volkswagen, Mercedes-Benz, BMW, and Audi—also experienced sales declines in China over the past year. The downturn underscores broader struggles among European brands to maintain relevance in China’s increasingly electrified and competitive auto market. [para. 4]

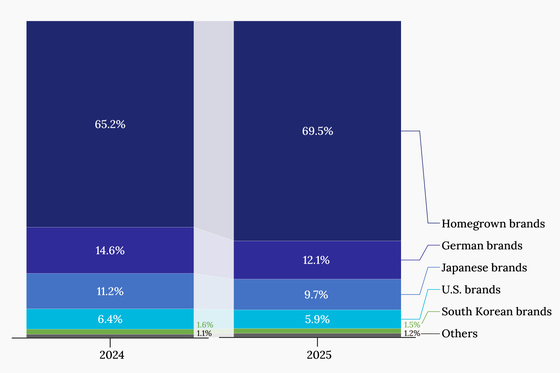

4. Meanwhile, boosted by robust demand for NEVs, Chinese brands soared to a record 69.5% share of passenger vehicle sales in China in 2025, up 4.3 percentage points according to the China Association of Automobile Manufacturers (CAAM). German and Japanese brands have simultaneously seen their market shares erode. The shift is partly attributed to Chinese automakers’ focus on low-emission family vehicles and affordable pure electric cars for daily commuting—a segment where European rivals have lagged due to slow adaptation. For instance, 96% of Volkswagen vehicles sold in China in the previous year were still powered by fossil fuels. [para. 5][para. 7]

5. Chinese carmakers like Chery and BYD have expanded their global reach, keeping China as the world’s top auto exporter for the third consecutive year in 2025. Exports hit a record 7.1 million vehicles, over one-third of which were NEVs. In Europe alone, Chinese EV sales doubled to around 810,000 vehicles in 2025, securing a 6.1% market share (up from 3.1% in 2024), according to Dataforce. [para. 8]

6. Europe has set ambitious electrification targets, including the European Commission’s 2023 plan to ban new fossil fuel car sales by 2035. Manufacturers like Porsche and Volkswagen announced multi-billion-euro investments and set targets for electric vehicles to account for at least half their sales by 2025–2030. However, these aims are hampered by Europe’s lack of major battery producers and a coherent supply chain. Most key battery technology suppliers are based in China, Japan, and South Korea. Europe’s flagship battery startup, Northvolt AB, filed for bankruptcy in March 2025. Chinese battery giant CATL’s chairman, Zeng Yuqun, attributes Europe’s weakness to a lack of electrochemistry education and lagging technology. [para. 10][para. 11][para. 12][para. 13]

7. In the face of cost and policy pressures, the EU relaxed its emissions targets, now requiring 90% of new cars sold by 2035 to be zero-emission, down from the original 100%. At the same time, major markets like Germany and France have scaled back EV subsidies due to budgetary concerns, further complicating the transition. [para. 15][para. 16]

8. Recognizing China’s technological lead, European automakers are deepening collaborations with Chinese partners. Volkswagen has invested in Chinese battery maker Gotion High-tech, autonomous driving chip firm Horizon Robotics, and EV maker XPeng. Mercedes-Benz is supporting Chinese tech players like Momenta and Afari. Renault has established an EV-focused research center in China, with ambitious plans to develop new global models. [para. 18][para. 19][para. 20][para. 21]

9. These partnerships are delivering results: in December 2025, German parts giant Bosch secured a contract to supply assisted-driving technology to Toyota, with significant support from its Chinese R&D team. Experts foresee even deeper Europe-China cooperation—including joint factory ventures—a move essential for building a robust EV supply chain in the EU, whose auto sector employs over 13 million people. Stellantis NV and Zhejiang Leapmotor have announced a $200 million venture for a Spanish EV factory targeting the European market from 2026 onward. [para. 22][para. 23][para. 24][para. 25]

10. Industry watchers and analysts expect the trend of European automakers seeking alliances with Chinese companies to continue, underpinning Europe’s competitive EV transition and supply chain resilience amid global market shifts and policy pressures. [para. 27]

AI generated, for reference only