Over the years, Musk has demonstrated a penchant for tying together his companies. In March, for example, xAI acquired X, the social media platform formerly known as Twitter.

And ahead of the Monday announcement of the deal involving SpaceX and xAI, there were reports that SpaceX was mulling a merger with Tesla. That talk hasn’t died.

“In our view there is a growing chance that Tesla will eventually be merged in some form into SpaceX/xAI over time,” Wedbush analyst Dan Ives wrote on X. “The view is this growing AI ecosystem will focus on Space and Earth together … and Musk will look to combine forces.”

AI and automation are increasingly being stressed at Musk’s firms and were emphasized as the reason for the SpaceX-xAI merger.

In Musk’s letter announcing the move, he described a plan to launch a constellation of 1 million satellites operating as orbital data centers to support rapid growth of AI. For its part, Tesla said 2025 saw the company continue its transition from a “hardware-centric business to a physical AI company.”

Ives isn’t alone in the belief the Austin automaker will eventually join Musk’s new mega-company. New York-based betting platform Polymarket reflected growing interest in the odds of Tesla merging with SpaceX. Users are predicting an 18% chance.

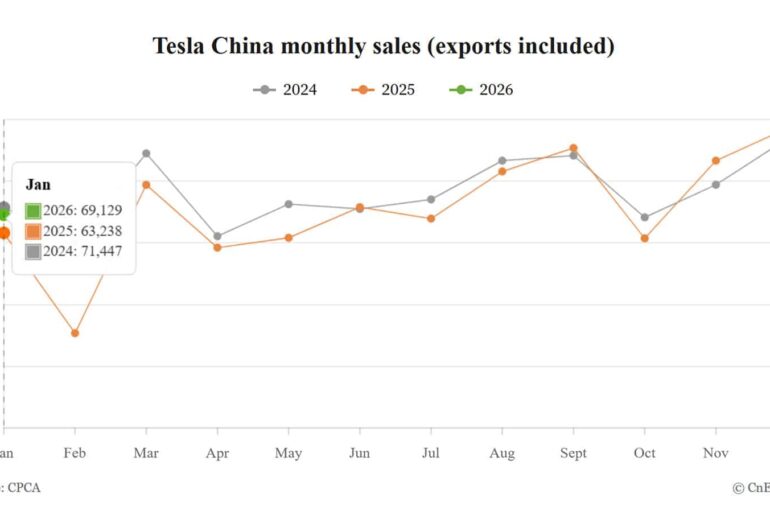

Already, Tesla products are intertwined with SpaceX’s mission to Mars. Musk has voiced his intention to have Starship take off for Mars this year carrying Optimus, the humanoid robot Tesla plans to begin building this year. Amid falling sales for its EVs, Tesla last week announced plans to eliminate the California production lines for its S and X model vehicles and use the space to instead produce Optimus robots.

“My companies are, surprisingly in some ways, trending towards convergence,” he wrote on X late last year.

Gary Black, co-founder of investment advisor The Future Fund, said a Tesla-SpaceX merger “makes no sense mathematically” for Tesla shareholders unless there are cost or revenue advantages.

Shareholders being convinced is a crucial part, as a merger would require their approval. But Musk has shown persuasiveness when it comes to getting investors and board members to vote his way.

Doubts plagued Tesla’s most recent acquisition of energy company SolarCity and the company saw its stock plunge after it was floated in 2016. But the deal was ultimately approved with more than 85% of shareholders voting to approve the $2.6 billion merger.

Still, if a Tesla-SpaceX merger is Musk’s next move, he isn’t letting on. As of Tuesday, he hadn’t commented much further than the sign-off of his first cheery announcement of the SpaceX-xAI merger, which said, “to the stars!”