Canada is stepping up efforts to attract Asian automakers into the country, as trade policies continue to strain its relationship with the United States.

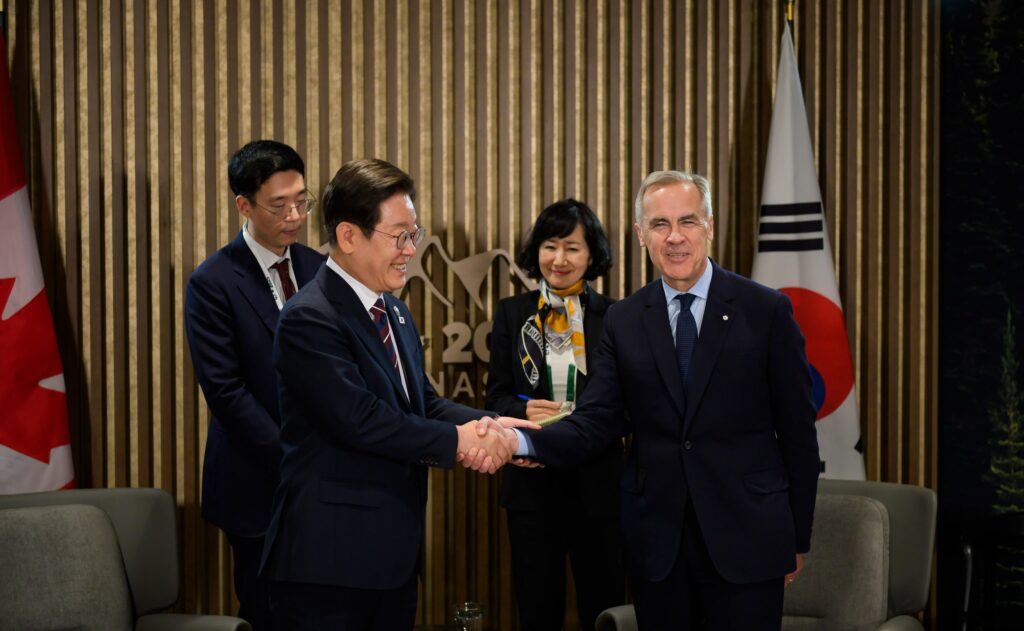

Prime Minister Mark Carney reaffirmed the initiative in an X post on Tuesday, saying the government is working with international partners to support Canada’s auto industry.

“We’re working with international partners to create new high-paying careers, build up our domestic auto sector, and boost productivity in Canada,” he wrote.

The move comes as US automakers scale back their production in the country.

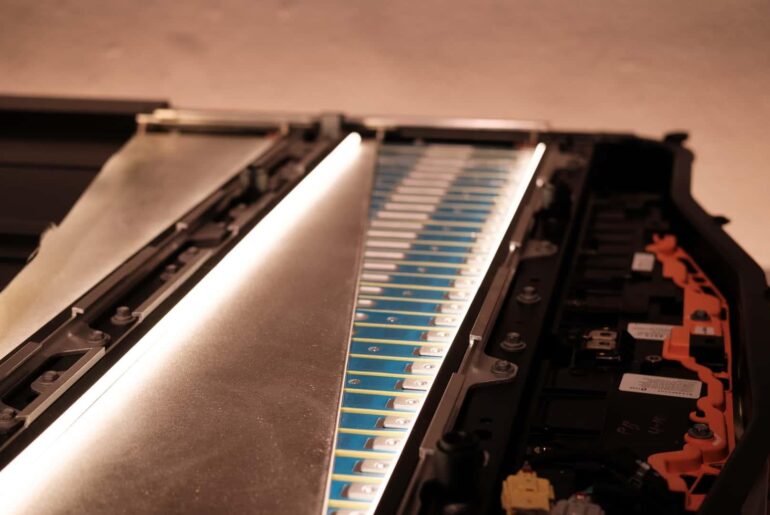

After reaching an agreement with China for an annual import of 49,000 Chinese EVs at a reduced tariff of just 6.1%, Canada signed a memorandum of understanding (MOU) with South Korea last week to promote mutual industrial collaboration.

Through the establishment of the Canada–Korea Industrial Cooperation Committee, the agreement includes potential investment in automobile and battery manufacturing in the North American country.

The Canada-China deal also aims at local production.

“It is expected that within three years, this agreement will drive considerable new Chinese joint-venture investment in Canada with trusted partners to protect and create new auto manufacturing careers for Canadian workers, and ensure a robust build-out of Canada’s EV supply chain,” the official statement by the Canadian Government reads.

Canada-US Relations

The deal forged between Canada and China last month has been criticized by Ontario Premier Doug Ford, who warned the deal could jeopardize Canada’s trade relationship with the US, its largest export market for vehicles.

The US Administration has also reacted negatively to it, with Commerce Secretary Howard Lutnick warning that renegotiations of the free-trade USMCA deal could be affected.

“When USMCA gets renegotiated… do you think the President of the United States is going to say, you should keep having the second-best deal in the world?” he said, before adding sarcastically, “I mean, you guys are such great friends.”

Speaking about the USMCA recently, US President Donald Trump said “there’s no real advantage to it” and that “it’s irrelevant” for the US. On the other hand, he added that “Canada would love it. Canada wants it. They need it.”

While the President initially endorsed the Canada-China deal, he has later threatened to impose a 100% tariff on the neighboring country.

“If Governor Carney thinks he is going to make Canada a ‘Drop Off Port’ for China to send goods and products into the United States, he is sorely mistaken,” Trump wrote.

Canadian-manufactured vehicles that don’t qualify for duty-free trade under USMCA had their tariff raised from 25% to 35%, on top of an already-existing 15%.

US Tariffs

In late July, the United States and South Korea reached a trade agreement under which the Trump administration agreed to reduce the tariff on imports to 15% from the 25% announced in April.

In return, South Korea pledged to invest $350 billion in the United States and to allow more US cars into the country, removing certain non-tariff barriers.

However, US President Donald Trump threatened late last month to return South Korean tariffs to the initial rate, citing the delay in the legislative process needed for the implementation of a bilateral trade deal.

Last week, commenting on the threats, Trump said, “We’ll work something out with South Korea.”

On Tuesday, South Korea’s Trade Minister, Yeo Han-koo, said the US administration is holding interagency consultations to formally publish President Trump’s announcement in the Federal Register.

Yeo travelled to Washington DC late last week as part of Seoul’s efforts to discourage the US from raising tariffs on South Korean goods.

Canadian Production Scale Back

Last year, Ford Motor Co., GM and Stellantis sold over 700,000 vehicles in Canada.

Despite recent decisions to relocate production to the US, Detroit automakers still rely on Canada for both manufacturing and sales.

As of mid-2025, GM produced about 30% of vehicles entering the US market in Mexico and Canada.

Last week, GM confirmed it will go ahead with the previously announced layoff of 750 workers at its Oshawa plant, affecting 1,500 more workers across the supply chain.

The company previously halted BrightDrop production at CAMI Assembly, which also affected over 1,000 jobs.

Both factories are located in Ontario, Canada.

Reacting to the production scale back, the Government of Canada last year imposed reductions to the annual remission quotas on imported vehicles for Detroit automakers GM and Stellantis.

“This action follows the automakers’ unacceptable decisions to scale back their manufacturing presence in Canada, directly breaching their commitments to the country and Canadian workers,” the Government stated.

Following GM’s decision to reduce production at its Oshawa and Ingersoll facilities, the company was subjected to a 24.2% reduction.

Korean Manufacturing Push

At the same time, General Motors‘ subsidiary GM Korea has announced this week that its production will increase to 500,000 vehicles this year to meet growing overseas demand.

Despite the tariffs imposed on South Korea by the United States, “parent company GM has recently requested GM Korea to operate the two plants at full capacity to produce 500,000 units,” a company spokesperson said Tuesday.

Of the total 462,310 vehicles produced there last year, only 15,094 were for domestic sales, with 447,216 units being exported — the vast majority destined for the United States.

Other automakers are pushing towards manufacturing in South Korea to avoid high tariffs on North American exports.

It is the case of Geely-backed Polestar, which began last year producing its Polestar 4 in Busan, South Korea, in collaboration with Renault Korea.

While the Polestar 3 SUV is produced in Volvo‘s factory in South Carolina, US, both the Polestar 2 and 4 were only manufactured in China.

According to the company, the first batch of Korean-manufactured Polestar 4s have been exported to Canada late last year.

As Polestar seeks to raise brand awareness in South Korea following the start of local production, it announced on Wednesday that actor Kim Woo Bin has been named its latest brand ambassador.

South Korean Brands in NA

Despite policy changes in the final quarter of 2025, Hyundai Motors delivered a total of 55,624 vehicles across all powertrains in the US last month — making January 2026 the strongest start to a year in the brand’s history.

The Hyundai Group‘s brand Kia also recorded a 13.1% increase in the country last month, despite seeing its EV sales drop significantly.

In 2025, the company achieved its strongest-ever annual retail sales result for the fifth consecutive year in the US.

However, upon announcing its financial results for the fourth quarter and full year 2025, Hyundai Motor Group disclosed that its operating profit for the last quarter fell 40% year over year due to the impact of US tariffs on South Korean imported vehicles.

In Canada, Hyundai and Genesis sold over 154,000 vehicles last year, according to Automotive News, a 11% increase from 2024.

Hyundai Auto Canada is targeting another record-breaking sales year in 2026, however, CEO Steve Flamand told the outlet the company will not pursue growth by “buying market share” through heavy incentives or other short-term tactics.

Electrification remains a key part of Hyundai’s long-term strategy, but Flamand acknowledged that reduced government incentives have made EVs less affordable for consumers.

“We’re ready. And when the market appetite grows, we want to be the leader in electric vehicles in Canada,” he concluded.

Canada has a nationwide target for all new light‑duty vehicles sold to be zero‑emission by 2035, with interim targets set along the way — roughly 20% by 2026, 60% by 2030, and 100% by 2035.

However, late last year, the government announced a one‑year pause on the mandate while it reviews the policy framework.