This article is being updated, please refresh later for more content.

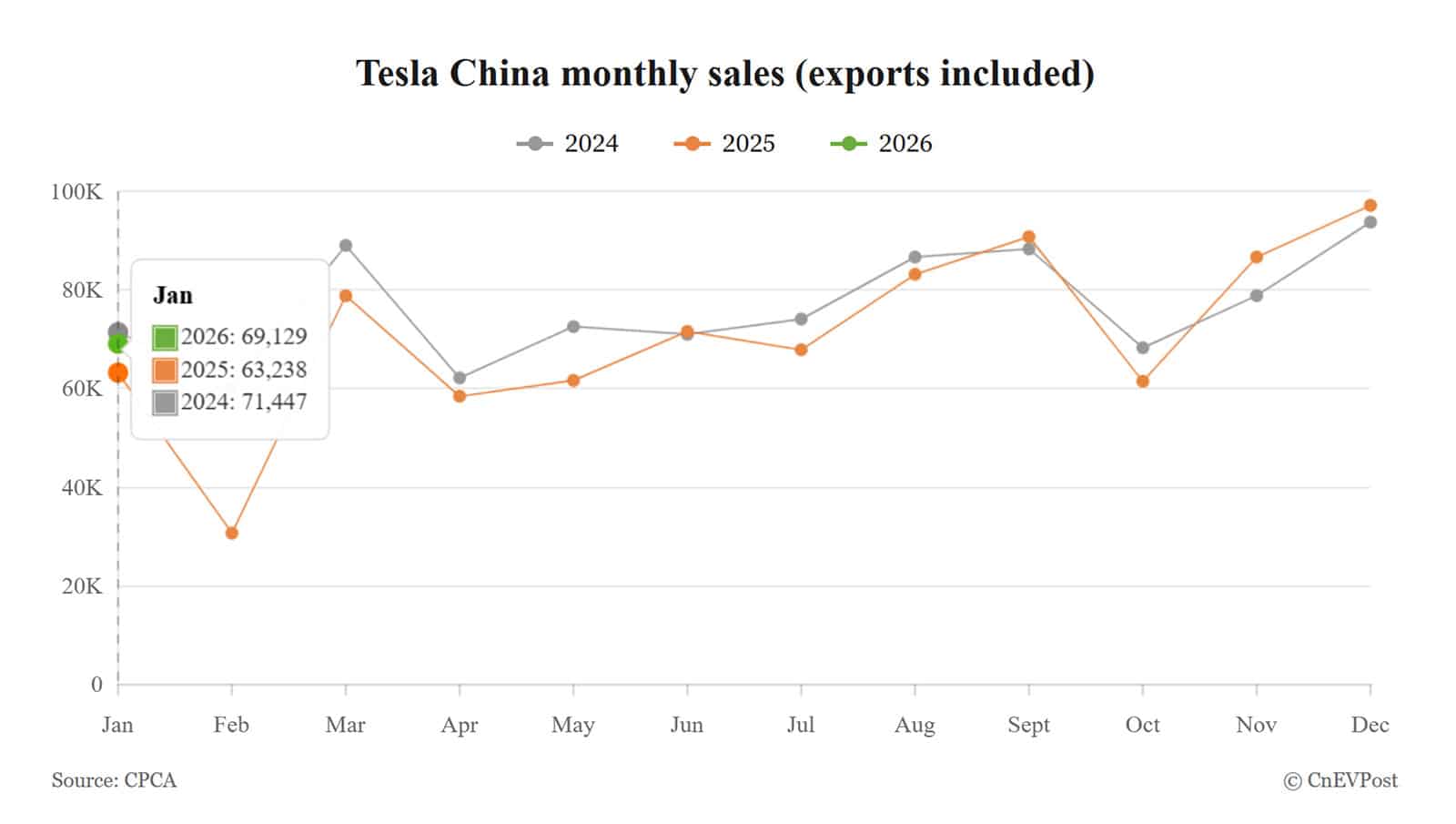

Tesla China’s January wholesale sales increased 9.32% year-on-year but fell 28.86% month-on-month.

Tesla China Monthly Sales (Exports Included) 2024-2026

Month

2024

2025

2026

January

71,447

63,238

69,129

February

60,365

30,688

March

89,064

78,828

April

62,167

58,459

May

72,573

61,662

June

71,007

71,599

July

74,117

67,886

August

86,697

83,192

September

88,321

90,812

October

68,280

61,497

November

78,856

86,700

December

93,766

97,171

Tesla China monthly sales (exports included)

2024

2025

2026

Tesla (NASDAQ: TSLA) saw year-on-year growth in China-made vehicle sales last month, despite a month-on-month decline like most other EV makers.

Tesla China’s wholesale sales in January came in at 69,129 vehicles, including both domestic sales and exports from China to overseas markets, according to data released today by the China Passenger Car Association (CPCA).

This represents a 9.32% increase from the 63,238 units sold in the same period last year, but a 28.86% decline from December’s 97,171 units.

The US EV maker’s January deliveries in China and exports from its Shanghai factory are expected to be released by the CPCA later this month.

The beginning of the year is typically a slow season for China’s auto market, while year-end usually sees a surge in sales.

Entering 2026, the EV industry faces added complexity as consumers grapple with a 5% additional purchase tax cost, while China’s vehicle trade-in subsidies remain in a transitional phase, impacting demand.

China’s new energy vehicle (NEV) leader BYD (HKG: 1211, OTCMKTS: BYDDY) sold 210,051 NEVs in January, down 30.11% year-on-year and down 50.04% month-on-month.

As the country’s largest NEV maker, BYD’s performance largely reflects the broader industry trend.

Chinese customers purchasing a Model 3 on or before February 28 are eligible for an insurance subsidy of RMB 8,000 ($1,150).