Sales of new energy vehicles (NEV) from Chinese automakers in Israel jumped 45.8% year over year in January, as 26 brands now sell electric or hybrid vehicles in the country.

The growing dominance of Chinese automakers in Israel has received little public attention, with brands largely avoiding drawing attention to their operations in the country amid the war in Gaza that started in October 2023.

Chinese brands registered 15,108 vehicles in January, up from 10,357 a year earlier, according to data released by the Israeli Vehicle Importers Association.

In Israel, one of the Middle East’s most active EV markets, Chinese NEVs account for approximately 59% of all new vehicle registrations and 87% of fully electric car sales.

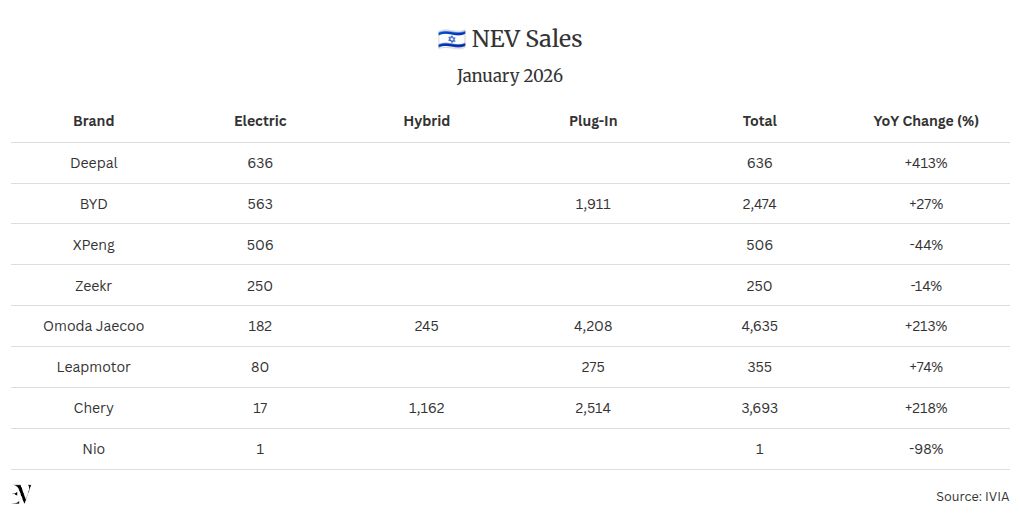

Total Sales Leaders

Omoda and Jaecoo, the Chery Group sub-brands, led all Chinese automakers with 4,635 total registrations in January — including 182 fully electric, 245 hybrid, and 4,208 plug-in hybrid units.

The figure represents a 212.5% increase from 1,483 units a year earlier.

Chery‘s main brand ranked second among Chinese automakers with 3,693 total registrations, including 17 fully electric, 1,162 hybrid, and 2,514 plug-in hybrid vehicles — up 217.5% from 1,163 units in January 2025.

Combined, the Chery Group registered 8,328 vehicles in January, making it the single largest automotive group in Israel by volume.

BYD ranked third among Chinese brands with 2,474 total registrations, comprising 563 fully electric and 1,911 plug-in hybrid units — a 27% increase from 1,948 a year earlier.

The Shenzhen-based automaker entered the Israeli market in late 2022 and currently offers the Atto 2, Atto 3, Dolphin, Seal, Sealion, and Tang, along with plug-in hybrid variants.

MG, owned by China’s SAIC Motor, registered 994 vehicles including 84 fully electric, 808 hybrid, and 102 plug-in hybrid units — nearly halving (-49.2%) from 1,958 in January 2025.

BEV Leaders

Changan‘s mass-market Deepal brand led all Chinese automakers in fully electric sales with 636 units, a 412.9% surge from 124 a year earlier.

BYD ranked second in the pure electric segment with 563 units, though the figure represents a 71% decline from 1,945 BEVs registered in January 2025 as the company shifts its Israeli sales mix toward plug-in hybrids.

XPeng placed third with 506 fully electric registrations, down 43.8% from 901 a year earlier.

The Guangzhou-based company shipped its first 750 vehicles to Israel in September 2023 and currently offers the G6 and G9 crossover SUVs and the first-generation P7 sedan.

Geely‘s main brand registered 343 fully electric vehicles and 80 plug-in hybrids for a total of 423 units, up 35.6% from 312 a year earlier.

Zeekr, Geely‘s premium brand which recently executed a reverse takeover, recorded 250 fully electric registrations, down 13.8% from 290.

The brand launched in Israel in early 2024 with the Zeekr 001 shooting brake and Zeekr X subcompact crossover.

Exactly a year ago, Zeekr launched an ultra-fast charging network across Israel, also open to drivers of other EV brands at higher rates.

Dongfeng registered 196 fully electric vehicles, up 28.9% from 152 a year earlier.

Hybrid Sales Leaders

Hyundai led the hybrid segment with 3,417 units, though the South Korean automaker registered no fully electric vehicles in January — down from 276 BEVs a year earlier.

Toyota ranked second with 3,510 hybrid registrations, up from 3,222 in January 2025. The Japanese automaker sells exclusively hybrid vehicles in Israel.

Among Chinese brands, Chery led hybrid sales with 1,162 units, followed by MG with 808 and Suzuki — a Japanese brand — with 600.

New Entrants

Several Chinese brands entered the Israeli market for the first time in January.

China’s state-owned GAC registered 142 fully electric vehicles in its debut month. IM Motors, SAIC‘s premium brand, posted 62 units.

Avatr, the Changan and Huawei-backed premium brand, recorded 32 registrations.

Declining Brands

Several Chinese automakers saw sharp declines in January.

Lynk & Co, a Geely sub-brand that has recently merged with Zeekr, fell 50.8% to 418 units from 850 a year earlier.

Its sales mix shifting dramatically from 850 fully electric units in January 2025 to just 24 BEVs and 394 plug-in hybrids in January 2026.

Smart, the Geely-Mercedes joint venture, dropped 62.9% to 65 units from 175. Maxus plunged 82.4% to 31 units from 176. JAC fell 87% to seven units from 54.

Nio registered just one vehicle in January, down 97.7% from 44 a year earlier.

The Shanghai-based premium EV maker officially launched in Israel in November 2024 through a partnership with Delek Motors.

Four Chinese brands that were active in January 2025 recorded zero registrations: Forthing, SERES, Skywell, and WEY.

Leapmotor Expands

The Stellantis-backed Leapmotor registered 355 vehicles in January, up 74% from 204 a year earlier.

Of those, 275 were plug-in hybrids and 80 fully electric units.

Hongqi, the premium brand under state-owned FAW Group, surged 433.3% to 96 units from 18.

Voyah, Dongfeng’s premium electric brand, rose 66.7% to 65 units from 39.

Overall Market

Israel registered 25,492 vehicles across all powertrains in January, up 23.9% from 20,569 a year earlier.

Fully electric vehicles accounted for 3,972 units representing a 15.6% market share, down from 7,401 units and 36% market share in January 2025 — a 46.3% decline.

Hybrids totaled 11,754 units at 46.1% market share, up from 10,857 units a year earlier. Plug-in hybrids surged to 9,766 units at 38.3% market share, up dramatically from 2,311 units in January 2025.

The shift from fully electric to plug-in hybrid vehicles mirrors broader trends across the Israeli market, with Chinese automakers leading the transition.

Norges Bank

In August, Norges Bank Investment Management, which manages Norway’s $2 trillion sovereign wealth fund, announced it had removed five Israeli banks due to “an unacceptable risk that the companies contribute to serious violations of the rights of individuals in situations of war and conflict.”

The fund had previously sold stakes across 17 Israeli companies with a total portfolio value of $143.3 million.