Lemonade (NYSE:LMND) has introduced an autonomous car insurance product tailored for Tesla vehicles with full self-driving capabilities. The new coverage offers reduced rates for full self-driving and relies on real world driving data gathered in collaboration with Tesla. This move marks Lemonade’s entry into insuring self-driving technology within its auto insurance offering.

Lemonade, trading at $80.57, is rolling out this Tesla focused product as it continues to expand beyond its original renters and homeowners lines. The stock has seen 1 year returns of 142.9%, while its 5 year return shows a 43.2% decline, underscoring how volatile the NYSE:LMND share price has been over time.

For investors watching the insurtech space, this Tesla specific launch highlights how Lemonade is using external data partnerships alongside its own technology centric approach. The focus on real world autonomous driving data could influence how the company prices risk in auto insurance and may shape how it approaches similar products with other carmakers over time.

Stay updated on the most important news stories for Lemonade by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Lemonade.

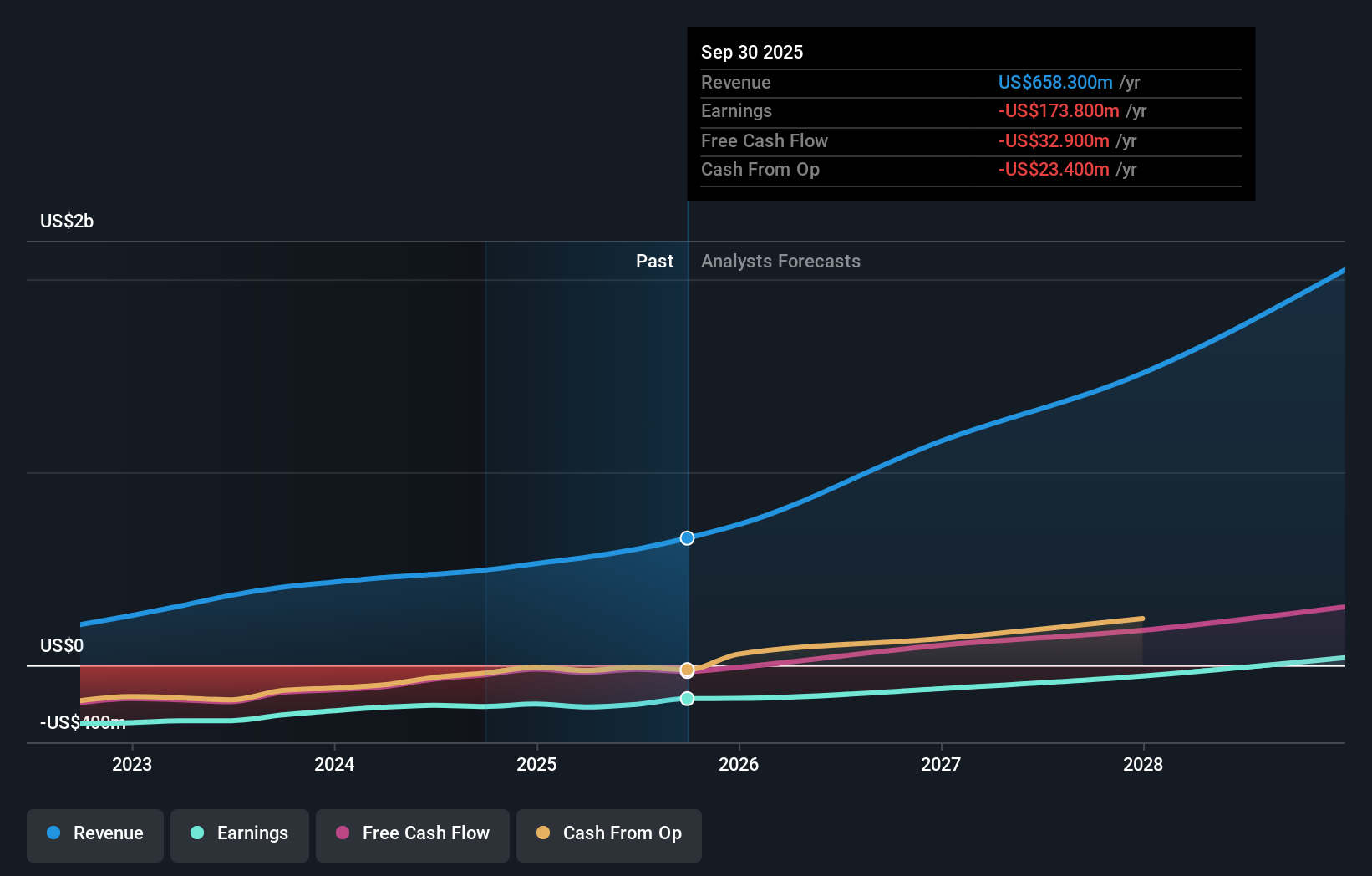

NYSE:LMND Earnings & Revenue Growth as at Feb 2026

NYSE:LMND Earnings & Revenue Growth as at Feb 2026

How Lemonade stacks up against its biggest competitors

Lemonade’s Tesla focused autonomous policy leans into usage based pricing, where per mile rates fall by about 50% when full self driving is engaged, which directly ties premiums to how the cars are actually used. For you as an investor, the key point is that access to Tesla’s real time vehicle data gives Lemonade a differentiated dataset for underwriting self driving risk, something traditional auto insurers like Progressive, Allstate or GEICO do not yet have in the same form.

Lemonade narrative, now with a self-driving twist

Both the more optimistic and more cautious narratives around Lemonade focus on whether its AI driven model and new product lines can eventually translate into durable earnings. This launch fits squarely into that debate, because it extends the same technology heavy playbook into a niche where data, software versions and sensor quality directly affect risk. It potentially reinforces the view that product expansion is central to the long term story, while still leaving open questions about execution and profitability.

Risks and rewards to keep on your radar Access to Tesla’s vehicle data may improve pricing accuracy and help Lemonade differentiate its auto offering from larger insurers that rely more on traditional actuarial inputs. If customers respond well to lower FSD engaged rates, the autonomous product could support policy growth in auto, adding another use case for Lemonade’s AI powered underwriting. Concentrating early autonomous efforts on a single carmaker exposes Lemonade to partner, regulatory and technology risks specific to self driving rollouts. Analysts have flagged 2 important risks for the company overall, including share price volatility and insider selling signals, which sit in the background as Lemonade takes on a new category of insurance risk. What to watch next

From here, it is worth watching how take up in Arizona and Oregon compares with Lemonade’s broader car book, whether the FSD engaged discount attracts higher quality drivers, and how quickly the company extends similar pricing models to other automakers or states. If you want to see how this product fits into the bigger picture for growth, risk and valuation, check out community narratives for Lemonade on its dedicated page.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com