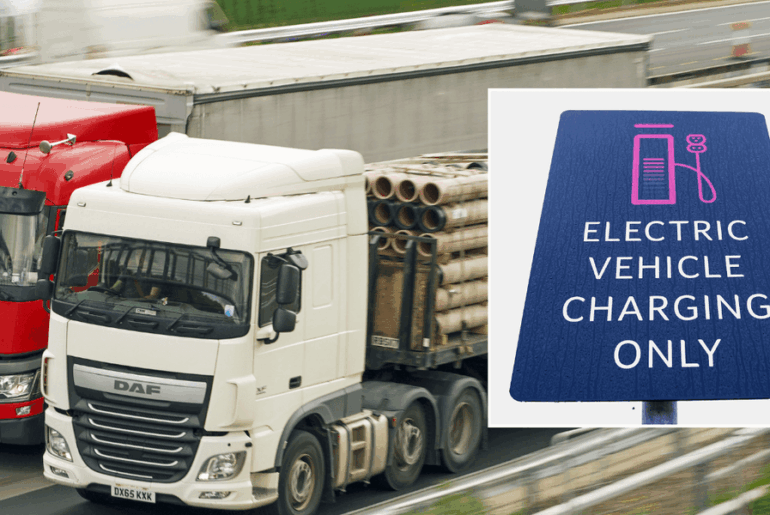

The end of federal EV incentives reshaped vehicle demand, pushing buyers toward hybrids and used electric models.

On the Dash:

• New EV inventory dropped sharply after the federal tax credit expired, slowing sales momentum.

• Used EVs gained demand due to lower prices and newer vehicle age.

• Hybrids emerged as the fastest-growing segment amid affordability and policy shifts.

The expiration of the federal electric vehicle tax credit at the end of September 2025 sharply disrupted the U.S. EV market, accelerating a consumer shift toward hybrids and used electric vehicles as affordability pressures intensified.

New EV inventory fell 33% year over year in the fourth quarter of 2025 after automakers cut production in anticipation of reduced demand. The pullback followed modest growth earlier in the year, when new EV inventory rose 9.2% through the first three quarters. Despite production cuts, new EVs sat on dealer lots an average of 91 days in Q4, the highest level in five years.

Federal incentives had played a central role in EV adoption. A Cars.com survey conducted in the first half of 2025 found that more than half of EV owners and lessees said the tax credit influenced their purchase decision. Nearly half of EV shoppers at the time said the incentive significantly affected affordability, particularly for lease payments.

As the new EV market slowed, used EVs gained momentum. In 2025, used EV prices averaged $29,000 less than new models, with much of the inventory only a few years old due to rapid EV expansion beginning in 2022. Used EV inventory grew 28.5% year over year, yet vehicles sold 25% faster, reflecting increased demand for lower-cost electric options.

Hybrids emerged as the strongest-performing segment following the policy shift. New hybrid inventory increased 25% in 2025, while vehicles sold two days faster than the prior year. Demand remained strong even as supply expanded, particularly from Toyota, Hyundai, Honda, Ford, and Kia, which broadened hybrid offerings across core models.

The trend extended to the used market. Used hybrid inventory climbed 31.5% year over year and sold three days faster in 2025. Prices rose 6.4%, driven largely by a greater mix of late-model and higher-end hybrid vehicles rather than broad price inflation.

With EV affordability challenged and incentives no longer available, hybrids increasingly represent a practical middle ground for consumers seeking fuel efficiency without the cost barriers of full electrification.