Europe Electric Motor Market Size

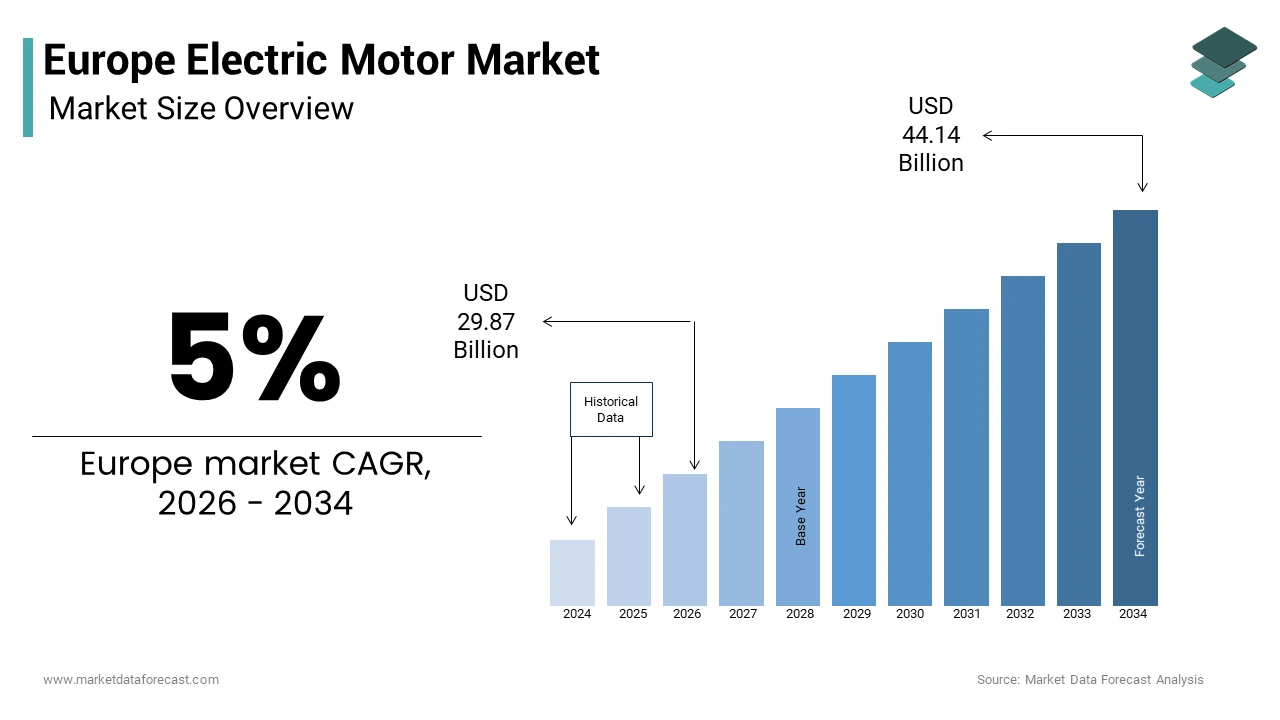

The European electric motor market size was valued at USD 28.45 billion in 2025 and is anticipated to reach USD 29.87 billion in 2026 and USD 44.14 billion by 2034, growing at a CAGR of 5% during the forecast period from 2026 to 2034.

Current Introduction of theEuropeane Electric Motor Market

An electric motor is a device that converts electrical energy into mechanical energy. It powers everything from household blenders and fans to massive industrial pumps and electric vehicles. These motors range from fractional horsepower units in household appliances tomulti-megawattt systems driving compressor,,s pump,,s and conveyors in heavy industry. The market is fundamentally shaped by the European Union’s commitment to energy efficiency and industrial decarbonization, with electric motors accounting for approximately 70 percent of total electricity consumption in the industrial sector. Under Regulation EU 2019 178, 1 all new motors placed on the EU market must meet at least the IE3 efficiency level,,s with IE4 mandated for certain power bands since July 2023. According to EU initiatives, significant annual electricity savings are being achieved through the replacement of IE1 and IE2 motors with high-efficiency models. This regulatory push is reinforced by national programs such as Germany’s BAFA funding scheme, which reimburses up to 40-60 percent of upgrade costs for premium efficiency motors in small and medium enterprises.

MARKET DRIVERS Mandatory Minimum Efficiency Standards Accelerate Replacement Cycles

The European Union’s Ecodesign Regulation for electric motors has cleared the way for market renewal by legally phasing out inefficient models and compelling end users to adopt higher performance alternatives, which in turn drives the growth of tEuropeanope electric motor market. As per the European Commission (Regulation 2019/1781), as of July 1, 2021, all 3-phase motors between 0.75 kW and 1000 kW must meet at least IE3 efficiency, with IE4 mandatory for 2, 4, or 6-pole motors between 75 kW and 200 kW starting July 1, 2023. This requirement has triggered widespread retrofitting across manufacturing facilities where legacy IE1 motors—once ubiquitous—consume more electricity than their IE3 counterparts. A significant portion of the roughly 380 million low-voltage motors in operation across the EU still fall below IE3 standards (many being IE1 or IE2), representing a vast addressable replacement pool. Industry estimates in high-efficiency manufacturing zones suggest that accelerating the upgrade of substandard motors could significantly reduce national industrial electricity demand by over 1 TWh annually. Manufacturers have responded by expanding production of IE4 and IE5 permanent magnet synchronous motors,s which offer superior part load efficiency critical for variable duty applications. Compliance deadlines thus function not merely as regulatory thresholds but as structural demand generators reshaping procurement behavior across sectors.

Industrial Electrification and Automation Drive Volume Demand

The region’s strategic pivot toward automated and electrified production systems is significantly increasing the installed base of electric motors across discrete and process industries, and contributing to the expansion of t Europeannpe electric motor market. Robotics collaborative arms and automated guided vehicles alone require multiple precision servo motors per unit. The International Federation of Robotics (IFR) reported that 92,393 industrial robots were installed in European factories in 2023, a 9% increase from the previous year. Each robot typically integrates four to six high-dynamics motors for joint actuation and mobility. Concurrently, the food and beverage,ge pharmaceutical, cal and chemical sectors are modernizing batch processing lines with digitally controlled pump and mixer drives, necessitating integrated motor drive packages. According to multiple studies, the average modern packaging line now contains significantly more electric motors than a decade ago, driven by the replacement of centralized mechanical drives with decentralized, high-speed servo motors. This trend is amplified by the EU’s Chips Act and Critical Raw Materials Act,t which incentivizes the reshoring of electronics and battery production, facilities that rely heavily on clean room compatible motors withultra-loww vibration and electromagnetic interference. The maturation of Industry 4.0 architectures is increasing motor density per square meter, ensuring steady volume demand that is independent of economic cycles.

MARKET RESTRAINTS Supply Chain Volatility for Rare Earth and Copper Constrains Production Scalability

The manufacture oof high-efficiencypermanent magnet motors depends critically on rare earth elements such as neodymium and dysprosium,m alongside substantial quantities of refined copper,, er both of which face supply chain instability in the region, and thereby impede the growth of Europeanrope electric motor market. According to the European Raw Materials Alliance, the EU imports approximately 98 percent of its rare earth permanent magnets from China. Following intense price volatility in 2021-2022 and a 2023 correction, new Chinese export restrictions in late 2024 and throughout 2025 have sparked fears over supply security. This has prompted European manufacturers to engage in panic stockpiling to secure resources. Copper prices on the London Metal Exchange (LME) averaged lower than anticipated, with cash-settlement prices averaging approximately $8,478 USD per metric ton (roughly 7,800 EUR) in 2023, representing a slight dip from 2022 levels, though the long-term outlook remains bullish due to electrification projects. European motor producers lack domestic refining capacity and strategic stockpile,,s making them vulnerable to geopolitical disruptions and logistics bottlenecks. In 2022 and 2023, several European manufacturers, particularly in the German auto and industrial sector, experienced production constraints and delays in IE5 motor deliveries due to tightened supplies and increased volatility in the prices of critical raw materials. Despite efforts by initiatives such as SUSMAGPRO to recycle motor-based rare earths, scaling these processes to a commercial level remains a significant challenge. Production scalability for premium efficiency models will remain constrained until Europe establishes secure circular supply chains or develops viable rare-earth-free alternatives, such as switched reluctance motors.

Skilled Labor Shortage Impedes Installation and Maintenance Capacity

The deployment and servicing of advanced electric motors increasingly require technicians trained in power electronicss digital communication protocols, ls and predictive maintenance toolsss yet the region faces a severe shortage of such specialized labor that restrains the expansion of the European electric motor market. According to Cedefop, a significant portion of European technical job openings will remain unfilled by the mid-2020s, driven by an aging workforce leaving the sector and vocational training curricula failing to keep pace with industry demands. Reports regarding Polish industrial maintenance staff suggest that a minority of personnel possess the necessary certifications to operate and maintain advanced high-efficiency motor drive systems with variable frequency inverters, reflecting a gap between current technological requirements and staff qualifications. This deficit leads to suboptimal installation practices such as improper grounding or cable sshieldingg which degrade motor performance and shorten lifespan. Moreover, the integration of condition monitoring sensors into motors generates data streams that plant engineers often cannot interpret without data analytics training. As a reresultmany high-efficiency motors operate below potential,,l negating energy savings. The full benefits of next-generation motor systems remain hindered by a workforce skills gap, as employee training struggles to keep pace with rapid technological adoption, despite initiatives like Germany’s Electro-mobility Skills program.

MARKET OPPORTUNITIES Retrofit Programs Unlock Latent Demand in Legacy Industrial Assets

Government-funded motor system upgrade schemes open up potential by lowering the capital barrier for replacing obsolete equipment, and ultimately provide new opportunities for the European electric motor market. These upgrades primarily benefit Small and Medium Enterprises (SMEs), which constitute a significant share of EU businesses according to sources. European, particularly French and Swedish, industrial energy efficiency initiatives are providing significant financial incentives to accelerate the transition from standard motors to ultra-premium efficiency (IE4/IE5) units, especially when paired with variable speed drives. Dutch industrial energy efficiency initiatives, facilitated by the RVO, are successfully accelerating the removal of obsolete, low-efficiency industrial motors (IE1 and IE2), resulting in substantial annual energy savings for the industrial sector. These schemes often include technical audits that identify system-level inefficiencies beyond the motor itself, such as oversized pumps or throttled valves, thereby amplifying impact. Crucially, they target sectors with long asset lifecycles like water treatment and district heating,, ng where motors installed in the 1990s remain operational. These initiatives transform mandatory compliance from a financial burden into a supported investment, activating latent demand untouched by the free market. Future EU regulatory updates will accelerate industrial adoption of IE5 and smart connected motors by tightening eligibility criteria.

Integration with Digital Twin and Predictive Maintenance Platforms

The convergence of electric motors with Industrial Internet of Things architectures enables continuous performance optimization through digital twin modeling and predictive analytics, which offers fresh expansion possibilities for theEuropeane electric motor market. This synergy creates new value that extends far beyond traditional mechanical output. Modern motors embedded with temperature vibration and current sensors transmit real-time operational data to cloud platforms where machine learning algorithms forecast failures and recommend maintenance. German mechanical engineering manufacturers are increasingly adopting digital motor management, which significantly enhances operational reliability and component longevity, despite facing challenging economic conditions and declining domestic orders. Major industrial technology providers are transitioning toward performance-based agreements where customers pay for utilization, allowing suppliers to assume responsibility for operational uptime and efficiency. This model shifts capital expenditure to operational expenditure, aligning with circular economy principles. The European Innovation Council supports the development of open-source digital twin platforms, facilitating advanced diagnostics for manufacturing fleets and improving accessibility for smaller enterprises. The expansion of private 5G in factories enables latency-sensitive, intelligent motor control, which acts as the core of modern adaptive manufacturing.

MARKET CHALLENGES Fragmented Grid Infrastructure Limits High Power Motor Deployment

The rollout of large industrial electric motors, particularly in electrified process heating and hydrogen compression, is hindered by localized grid congestion and insufficient transformer capacity in many European regions, which is among the major challenges for tEuropeanope electric motor market. According to sources, a substantial portion of industrial electrification projects in Southern and Eastern Europe are facing significant connection delays, often exceeding a year and a half, due to inadequate substation and grid infrastructure, according to ENTSO-E. High-capacity compressor motors for green hydrogen production can consume as much electricity as a small town, placing immense strain on rural distribution networks that were not originally designed for such industrial loads. ed Eléctrica in Spain reports that grid reinforcement costs for new industrial motor installations are rising, resulting in significant upfront expenses for the Spanish industrial sector. Moreover, voltage fluctuations in weak grids can trigger protective shutdowns in sensitive variable speed drives,s reducing operational reliability. Despite EU Grid Planning Guidelines promoting proactive investment, coordination between industry and utilities remains ad hoc. High-power motor adoption in emerging green industries is restricted to specific locations until grid operators prioritize industrial corridors and implement dynamic line rating (DLR).

Lack of Standardized Testing Protocols for Real-World Efficiency

Current motor efficiency classification,,s such as IE3 or IE44,4 are determined under idealized laboratory conditions that fail to reflect real-world operating environments, which leads to a gap between laboratory and field performance among end users and constitutes a serious barrier to the European electric motor market. High-efficiency (IE4) motors frequently operate below their rated efficiency levels when used in actual, variable-load applications, such as wastewater pumping, due to increased losses from electrical noise, heat, and compatibility issues between the motor and its drive. The industry discrepancy arises because official motor efficiency standards (IEC 60034-30-1) are based on fixed-speed, pure sinusoidal power, whereas most modern industrial systems use Pulse Width Modulated (PWM) inverters that generate harmonics, resulting in lower operational efficiency than nameplate values. Consequently, plant managers hesitate to invest in premium models without verified operational savings. The International Electrotechnical Commission (IEC) is active in developing new technical standards (such as IEC 60034-2-3 and related TS) designed to address converter-fed motor losses, though full adoption of these new field measurement methodologies is an ongoing, multi-year process. In the interim, inconsistent validation undermines the credibility of efficiency claims and slows adoption ofnext-generationn motors despite their theoretical advantages. The lack of standardized testing threatens to commoditize products, prioritizing catalog data over real-world performance.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2025 to 2034

Base Year

2025

Forecast Period

2026 to 2034

CAGR

5%

Segments Covered

By Output Power, Type, End-User, And By Region

Various Analyses Covered

Global, Regional, and Country-Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, the Czech Republic, and the Rest of Europe

Market Leaders Profiled

Robert Bosch GmbH, General Electric Company, Siemens AG, Hitachi, Ltd., Mitsubishi Electric Corporation, ABB Group, Denso Corporation, Magna International, Inc., Toshiba Corporation, Emerson Electric Co.

SEGMENTAL ANALYSIS By Type Insights

The AC motors segment captured the majority share of the European electric motor market in 2025. The supremacy of the AC motors segment is driven by its robustness, simplicity, and compatibility with the continent’s standardized 50-hertz alternating current grid infrastructure. Three-phase induction motors, in particular, are the workhorses of industrial automation, powering pumps, fans, and conveyors across manufacturing sectors. Industrial motor installations in the German market demonstrate a high adoption rate of alternating current technology, favored for its consistent performance and lower maintenance needs. Regulatory frameworks in the European Union emphasize higher efficiency standards, accelerating the transition away from older motor models. Additionally, the integration of variable frequency drives with AC motors enables precise speed control without sacrificing torque, making them ideal for modern process optimization. Theircost-effectivenesss at scale and seamless interoperability with existing electrical distribution systems ensure continued primacy across both legacy and new installations.

The hermetic motor segment is predicted to witness the highest CAGR of 6.9% between 2026 and 2034 due to rising demandfor energy-efficientt refrigeration and air conditioning systems in residential,commerciald cold chain logistics applications. Hermetic motors are sealed within compressor housings, preventing refrigerant leakage and ensuring long term operational integrity, a critical requirement under the F-Gas Regulation, which mandates reduced global warming potential refrigerants that are often more corrosive. Household ownership of cooling appliances is nearly universal, with shorter product lifespans driven by energy efficiency upgrades. The growth of online shopping and specialized medical logistics has increased demand for temperature-controlled transport. Leading manufacturers have responded by developing brushless DC hermetic motors with integrated inverters that achieve IE4 equivalent efficiency while reducing noise and vibration. These innovations position hermetic motors at the intersection of climate policy, food safety, and public health, driving sustained growth.

By End User Insights

The industrial machinery segment is expected to account for a 42% share in 2025. The leading position of the industrial machinery segment is attributed to the sector’s intensive reliance on electromechanical systems for material handling, fluid transfer, and process actuation across chemical,,s food processing meta, metals, ls and paper industries. Motor-driven systems, particularly those powering pumps and fans, represent the dominant share of total electricity demand within the industrial sector. The EU’s Industrial Emissions Directive and Energy Efficiency Directive compel continuous modernization with mandatory audits identifying obsolete IE1 and IE2 motors for replacement. German federal funding programs are driving significant industrial renewal by incentivizing the early replacement of older motors with high-efficiency alternatives, bolstering energy efficiency goals. Furthermore, Industry 4.0 adoption increases motor density per production line as automated guided vehicles, robotic arms, and smart conveyors require precision servo and stepper motors. The shift toward modular manufacturing also favors standardized motor interfaces, enabling rapid reconfiguration. Industrial electrification is central to EU decarbonization efforts, ensuring the sector remains the primary driver of motor demand despite economic volatility.

The motor vehicles segment is estimated to register the fastest CAGR of 9.3% from 2026 to 2034 o,g owing to the electrification of road transport, with each battery electric vehicle requiring between two and four traction motors plus numerous auxiliary units for steering and braking. The European passenger car market is shifting toward electrified powertrains, with electric models accounting for a significant share of new registrations. These vehicles frequently utilize high-power permanent magnet synchronous motors, which require sophisticated thermal management strategies. The manufacturing of these traction motors demands a consistent supply of specific rare earth materials. Electric power steering systems using brushless DC motors are now standard in the majority of new European vehicles. Commercial fleets are also contributing to urban delivery vans increasingly adopting dual motor architectures for All Wheel Drive capability. Regulatory tailwinds include the EU’s 2035 ban on internal combustion engine sales and CO2 fleet targets that incentivize OEMs to accelerate electrification. This structural shift transforms the automotive sector from a minor motor consumer into a high-growth engine powered by clean mobility mandates.

COUNTRY LEVEL ANALYSIS Germany Electric Motor Market Analysis

Germany dominated theEuropeane electric motor market by holding a 26.4% share in 2025. The prominence of the German market is credited to itsworld-classs machinery engineering sesectorr which includes global leaders like Siemens SE and Bosch Rexroth that design and manufacturehigh-efficiencyy motors for export and domestic use. Industrial motor systems constitute a substantial portion of total manufacturing electricity consumption, prompting increased focus on energy efficiency. Upgrading to advanced motor technology is recognized as a key strategy for reducing energy demand, with government support programs assisting enterprises in adopting this equipment. Additionally,y Germany hosts Europe’s most advanced motor testing facility,s including the VDE Testing and Certification Institute, ute which validates compliance with IEC 60034 standards. The presence of automotive giants transitioning to electric platforms further fuels demand for traction and auxiliary motors. Germany’s position as the innovation epicenter of the European motor industry is maintained by its expert vocational training and commitment to precision engineering.

Italy Electric Motor Market Analysis

Italy was the second-largest player in Euthe ropean electric motor market, capturing a 14.6% share in 2025. Its dense network of small and medium enterprises specializing in food processing, packaging, textiles, and ceramics, all highly motor-intensive sectors, drives the growth of the Italian market. Northern Italian manufacturing regions contain a high density of industrial units, many of which utilize older motor systems that are candidates for modernization. National recovery initiatives have established specific funding avenues to support the adoption of high-efficiency motor and drive systems within the industrial sector. A significant portion of Italian industrial sites are small-to-medium enterprises, which collectively represent a substantial share of total electricity consumption, heavily driven by motor systems. The widespread use of older equipment in these numerous smaller facilities indicates potential for energy efficiency improvements through targeted upgrades. Local manufacturers like Regal Beloit Italia and Leroy Somer have expanded production of compact fractional-horsepower motors tailored to artisanal production lines. Despite challenges in grid stability in the Southern region,s the north’s industrial clusters ensure steady demand for reliable motor solutions aligned with EU ecodesign timelines.

France Electric Motor Market Analysis

France held a promising share of theEuropeane electric motor market due to its ecological transition through a comprehensive national investment plan, channeling significant funding into industrial decarbonization and the acceleration of electric mobility infrastructure. This includes subsidies for replacing fossil-fuel-based thermal processes with electric alternatives such as induction heating and heat pumps, all reliant on high-performance motors. The French Environment and Energy Management Agency, through the CEE scheme, is actively promoting industrial efficiency by incentivizing the modernization of industrial equipment. Ambitious national targets for electric vehicle adoption are driving demand, resulting in increased local production of electric motors and components by major French automotive manufacturers. Nuclear-powered grid stability provides low-carbon electricity ideal for motor operation, while regulatory pressure on data centers to improve PUE ratios drives HVAC motor efficiency. These converging forces position France as policy-leded growth market.

United Kingdom Electric Motor Market Analysis

The United Kingdom grew steadily in the European electric motor market. Despite exiting the EU, the UK maintains alignment with IEC efficiency standards and continues to lead in high-value niche applications, including aerospace defense, and medical equipment. Rolls-Royce and Dyson exemplify this focus, with the former developing electric propulsion motors for hybrid aircraft and the latter pioneering digital switched reluctance motors for cordless appliances. Motor systems consume a substantial portion of electricity within the manufacturing sector, making them a primary focus for energy efficiency improvements. Industrial sectors are increasingly focusing on technological upgrades, such as variable speed drives, to enhance efficiency in motor-driven applications. The absence of a domestic rare earth supply has spurred research into alternative motor topologies, such as axial flux designs that reduce magnet dependency. The UK excels in premium, high-reliability, and miniaturized segments, commanding superior margins despite modest volume growth.

Sweden Electric Motor Market Analysis

Sweden is predicted to register a notable CAGR in theEuropeane electric motor market from 2026 to 2034 due to early adoption of smart connected motors integrated into predictive maintenance and energy management platforms. A significant majority of major industrial operations in Sweden utilize advanced monitoring technology for real-time motor health tracking. Governmental procurement guidelines for motors prioritize high efficiency standards and require digital connectivity capabilities. The prevalence of renewable energy sources, particularly wind and hydro power, enhances the economic and environmental attractiveness of motor electrification. Companies like ABB Robotics, headquartered in Västerås, develop collaborative robots powered by ultra-compact servo motors that redefine motion control in assembly lines. Furthermore, the government’sfossil-freee steel initiative HYBRIT relies on massive electric arc furnaces driven by mulmotorssgawatt motor,s underscoring the role of electromechanical systems in green heavy industry. Sweden’s combination of clean power,,wer digitreadingead,,iness and industrial innovation cements its role as a forward-looking motor market.

COMPETITIVE LANDSCAPE

Competition in the European electric motor market is characterized by a blend of global industrial giants,,s regional specialists, and agile innovators vying across efficiency tiers and application domains. Established players like Siemens, ABB, and Nidec dominate through technological leadership, compliance with stringent EU ecodesign regulations, and integrated automation ecosystems. MMeanwhileile niche manufacturers compete on customization,n rapid delivery, and sector-specific expertise, particularly infood-gradee explosion-proofoof motors. The market is increasingly polarized between high-volume standardized motors for pumps and fans and high-value engineered solutions for electric vehicles, robotics, and aerospace. Digitalizatio,n has raised the competitive barwith real-timee monitoring, remote diagnostics, and over-the-air updates, becoming differentiators. Supply chain resilience, particularly for magnets and ccopperr is now a strategic priority, ty prompting vertical integration and recycling partnerships. Regulatory pressure ensures continuous innovation but also compresses margins for non-differentiated products, intensifying the race toward smart, ssustainable e andservice-enabledd motor systems.

KEY MARKET PLAYERS

A few of the dominating players that are in the European electric motor market are

Robert Bosch GmbH General Electric Company Siemens AG Hitachi, Ltd. Mitsubishi Electric Corporation ABB Group Denso Corporation Magna International, Inc. Toshiba Corporation Nidec Corporation Emerson Electric Co. Top Players In The Market Siemens AG is a leading provider of electric motors and drive systems across Europe,e offering a comprehensive portfolio ranging from standard IE3 induction motors to high efficiency IE5 permanent magnet motors for industrial and infrastructure applications. Headquartered in Germany,ny the company plays a pivotal role in global motor innovation through its Simotics and Sinamics product lines,s which integrate digital twins and condition monitoring capabilities. Siemens contributes to worldwide decarbonization byenabling energy-efficientt motion in sectors such as water treatment, mining,g and renewable energy. These actions reinforce its position as a technology integrator bridging automation and sustainability. ABB Ltd maintains a strong presence in theEuropeane electric motor market through its extensive range of low and high voltage motors drives and integrated powertrain solutions. The company is globally recognized for pioneering IE5 synchronous reluctance motor technology,y which eliminates rare earth dependency while achieving ultra premium efficiency. ABB supplies critical motor systems to industries including pulp and paper,,r oil a d, and electric mobility with manufacturing hubs in Finland,d Germany, and Italy. Recently,y ABB enhanced its Ability digital ecosystem to provide real-time performance analytics and predictive maintenance alerts across connected fleets. Nidec Corporation has significantly expanded its footprint in Europe by supplying high precision fractional and integral horsepower motors forautomotiveA, household appliances, es and industrial automation. As a global leader in small motor manufacturing,g Nidec leverages its scale to deliver cost-efficient yet highly reliable solutions tailored to European efficiency standards. The company’s traction motors for electric power steering and thermal management systems are embedded in millions of European vehicles annually. Additionally, the firm has deepened partnerships with white goods manufacturers toco-design noise-optimizedd motors for next-generation heat pump dryers and refrigeratorss reinforcing its integration into essential consumer and industrial value chains. Top Strategies Used By The Key Market Participants

Key players in thEuropeanpe electric motor market focus on advancing motor efficiency beyond regulatory minimums by developing IE4 and IE5 compliant designs using permanent magnet and synchronous reluctance technologies. They integrate digital capabilities such as embedded sensors andcloud-basedd analytics to enable predictive maintenance and energy optimization. Companies invest in localized manufacturing and R&D centers to ensurea pid response to regional standards and customer needs. Strategic emphasis is placed on circular economy initiatives,s including motor remanufacturing, take-backprograms, and rare earth-free designs to address supply chain and sustainability concerns. AAdditionally our firms deepen vertical integration by offering complete motor drive and control packages that simplify system deployment and enhance performance reliability across industrial and mobility applications.

MARKET SEGMENTATION

This research report on theEuropeane electric motor market is segmented and sub-segmented into the following categories.

By Output Power Type

Fractional Horsepower (FHP) Integral Horsepower (IHP)

By Type Insights

AC Motor DC Motor Hermetic Motor

By End User Type

Motor Vehicles Industrial Machinery HVAC Equipment Household Appliances Aerospace & Transportation Others

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe