The European automotive market has witnessed a historic turning point: In December last year, the monthly sales of electric vehicles exceeded those of traditional fuel-powered vehicles for the first time.

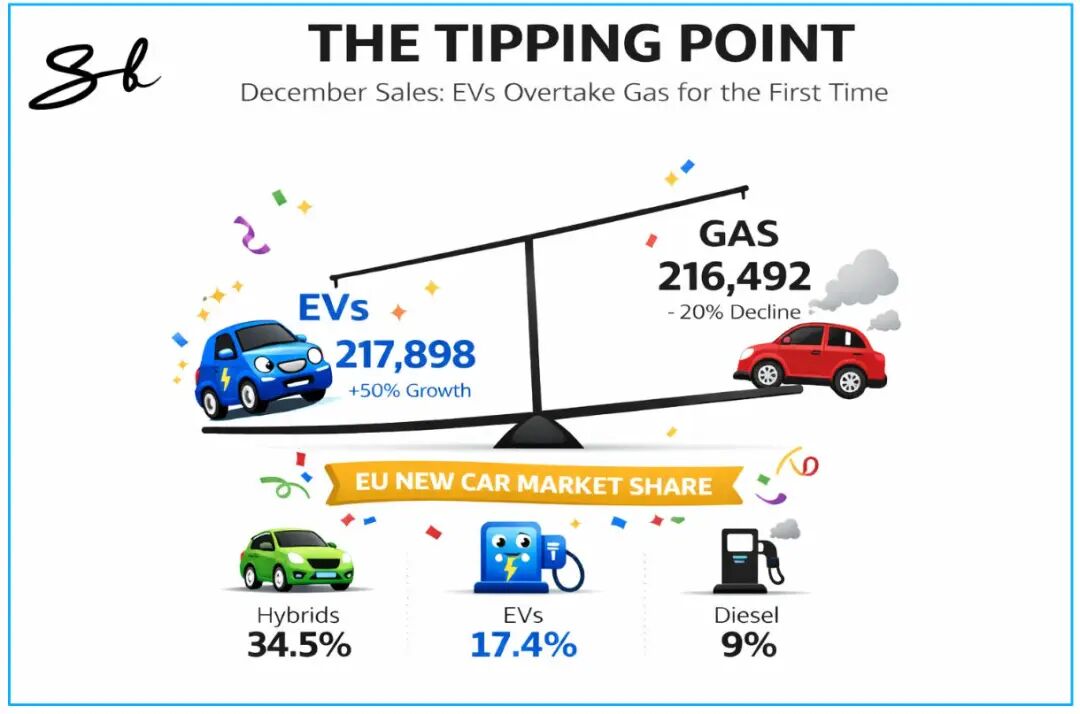

In the entire EU region, the number of electric vehicle registrations in December reached 217,898, slightly higher than the 216,492 gasoline-powered vehicles sold during the same period. This figure is not just a marginal monthly surpassing; it represents an accelerating structural transformation that has been ongoing for years. Compared with the same period, the sales of electric vehicles increased by as much as 50%, while the sales of gasoline-powered vehicles decreased by nearly 20%.

Currently, electric vehicles account for 17.4% of the total new car sales in the EU. Hybrid vehicles remain the most popular option in the market, accounting for 34.5%, while the sales of diesel vehicles, once the pillar of the European automotive industry, continue to shrink and now only account for about 9%.

This transformation is also evident in the UK and other non-EU countries in Europe. It is not caused by promotions or seasonal fluctuations but is an inevitable result of long-term and stable growth. Analysts point out that the success of electric vehicles is not due to the failure of fuel-powered vehicles but because more and more consumers are ready to embrace change.

The key reason why Europe has crossed this milestone earlier than the United States is that the market offers a wider range of choices. From small urban electric vehicles to an increasing number of Chinese brand models, the diverse products make it easier for consumers to find vehicles that suit their needs.

Market analysts believe that this indicates that the consumer demand for electric vehicles has always existed, but there were not enough suitable products to stimulate it before. The brand competition landscape has also changed dramatically. Last year, Tesla’s market share in Europe shrank significantly, while BYD’s share climbed rapidly. Norway has become a leading example, with 96% of new car registrations being electric vehicles.

However, the popularization of electric vehicles still faces challenges. The EU is re-evaluating its policies related to electric vehicles, including considering relaxing the plan to stop selling new fuel-powered vehicles by 2035. In addition, how Europe copes with the import of low-cost electric vehicles from China will also affect its subsequent market development.

Nevertheless, the data for December has sent a clear signal: In Europe, electric vehicles are no longer a vision for future mobility but a reality that is happening.

01 Electric vehicle sales exceed those of fuel-powered vehicles in Europe for the first time

It is also certain that this is not an accidental event driven by policies but a profound transformation driven by real market forces. As truly affordable electric models such as the Renault 5 E-Tech enter the market at a price of about £23,000, electric vehicles have broken through the limitations of early adopters and are reaching a wider consumer group.

Chinese brand BYD has demonstrated astonishing market explosive power. Its sales in Europe reached 129,000 units, a year-on-year increase of 228%, and it quickly occupied nearly 2% of the market share from almost zero. This proves that even without a Silicon Valley background, one can still win the competition in the mature European market.

Tesla, which once led the electric trend, has seen its market share decline to 2.2%, making it the weakest performer among mainstream car manufacturers. This change reflects that when consumers have more choices besides the Model 3, the first-mover advantage does not guarantee long-term leadership.

Volkswagen continues to maintain its dominant position in Europe with a market share of 26.7%, demonstrating the resilience and adaptability of traditional manufacturers in the transformation process.

Geographically, Germany leads the European electric vehicle market with a growth rate of 43.2%, followed by the Netherlands, Belgium, and France. These four countries together contribute 62% of the total electric vehicle sales in Europe. Their well-developed charging networks and dealer systems have made electric vehicles a viable choice from a concept.

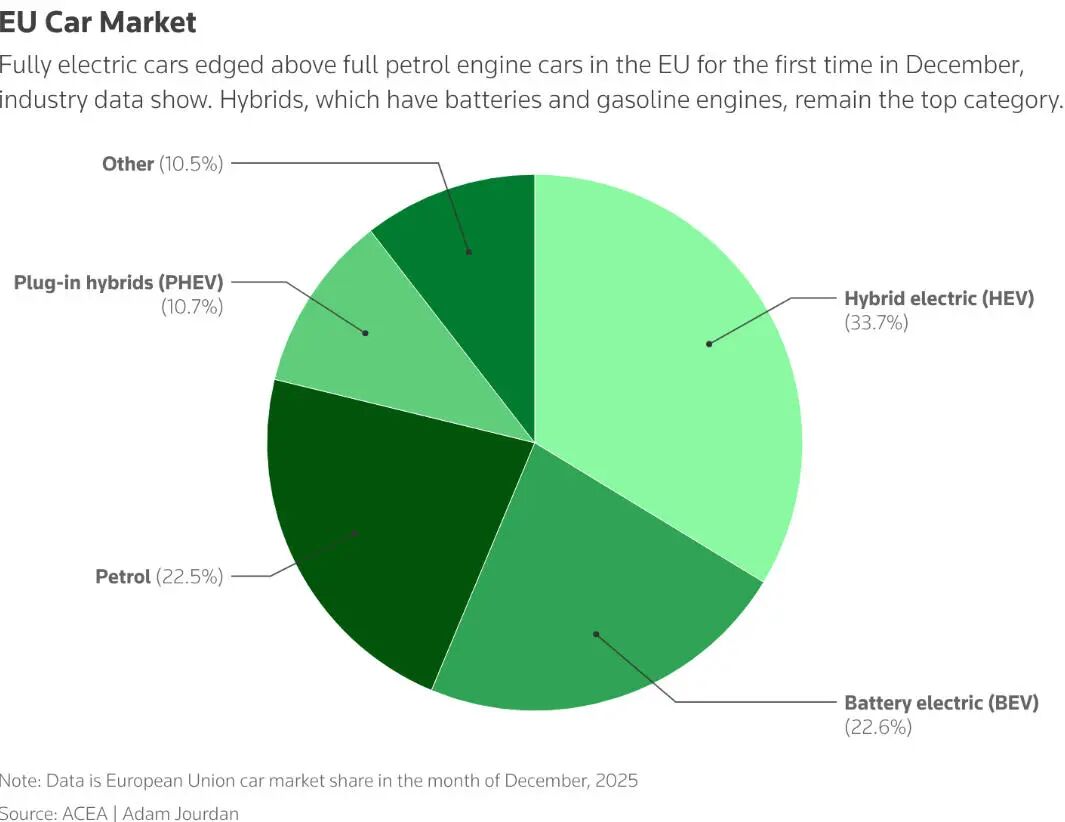

Although the EU has made minor adjustments to its zero-emission target for 2035, allowing 10% of the fuel to come from e-fuels or biofuels, consumers’ choices do not seem to be affected by policy fluctuations. Hybrid vehicles dominate the market with a share of 34.5%, and the annual penetration rate of pure electric vehicles has also steadily increased to 17.4%, indicating that the market is spontaneously tilting towards electrification.

When European people consider buying a car next, they will face a market environment with more choices, more competitive prices, and better infrastructure. The arrival of the turning point is not only because of environmental protection concepts but also because better products are already in place.

Independent automotive analyst Matthias Schmidt pointed out that some vehicles in the fuel-powered vehicle sales statistics have been reclassified as “mild hybrids.” These models still rely mainly on gasoline engines and contribute little to emission reduction. He said, “It may take about five years for pure electric vehicles to completely surpass fuel-powered vehicles across Europe, but this is undoubtedly a good start.”

Last month, the registration of pure electric vehicles in the EU accounted for 22.6%, slightly exceeding that of fuel-powered vehicles at 22.5%. Plug-in hybrid and ordinary hybrid models together accounted for the highest proportion, reaching 44%. In the broader European market, including the UK and Norway, car sales have increased year-on-year for six consecutive months.

Although the EU adjusted the fuel-powered vehicle ban for 2035 under industry pressure in December. Car manufacturers are facing competition from Chinese brands, tariff pressure from the United States, and the problem of electric vehicle profitability, but the industry still has confidence in the prospect of electrification.

Chris Herron, the secretary-general of the European Electric Vehicle Association, said that European brands have responded to market changes by launching more affordable electric models, and countries have also updated their incentive policies. “We can see that consumers are responding with actions,” Herron said. “We are confident that the European electric vehicle market will continue to grow in 2026.”

02 One in every ten cars sold in Europe is made in China

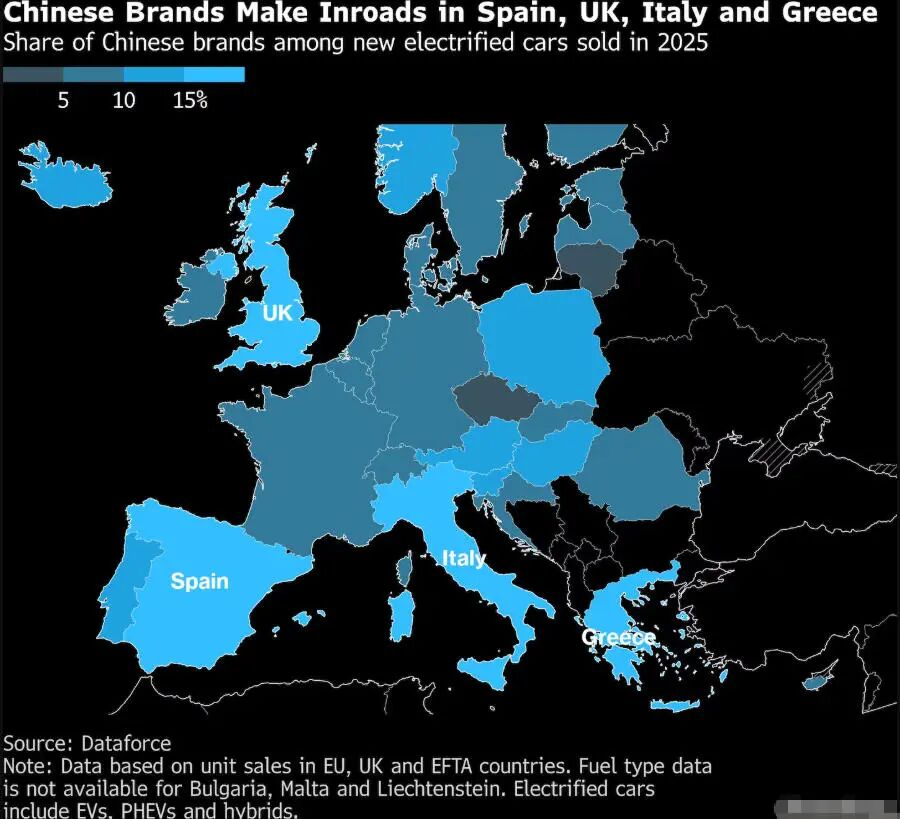

Last month, which was December last year, Chinese automakers set a new milestone in the European market: The sales of passenger cars they produced accounted for nearly one-tenth of the total sales in Europe. This record share puts a powerful full stop to the rapid growth of Chinese cars in Europe over the past year, mainly due to the strong sales performance of electric and hybrid models.

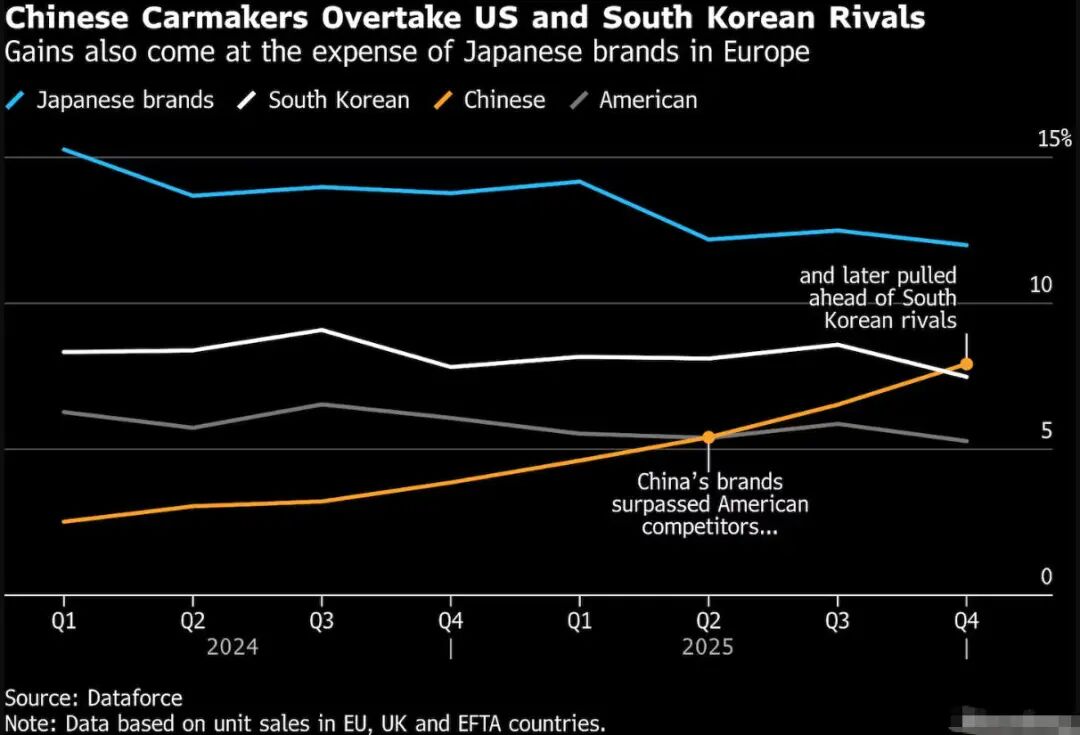

Data from market research institution Dataforce shows that in December last year, the market share of Chinese car brands in Europe reached 9.5%, and for the first time in the quarterly sales, they surpassed their South Korean competitors, including Kia. With the gradual opening of the trade environment and the continuous acceleration of China’s automobile export pace, brands represented by BYD are expected to further expand their market share.

The growth momentum mainly comes from the electric vehicle field, which is also the main driving force for the expansion of the current European automotive market. Relying on their significant advantages in battery technology, Chinese automakers have successfully attracted consumers from many countries such as Spain, Greece, Italy, and the UK, and have gradually established a foothold in the electric and hybrid vehicle segments.

“The rapid popularization of Chinese cars in Southern Europe is remarkable,” said Julian Lisinger, an analyst at Dataforce. “We originally knew that consumers in these markets were more flexible in brand selection, but the rapid trend change in the electric vehicle field still exceeded our expectations.”

In addition to established brands in Europe such as BYD and MG under SAIC Group, emerging forces such as Leapmotor and Chery have also achieved significant sales growth, jointly forming the dominant camp of Chinese cars in the European market.

If we also include vehicles produced in China by non-Chinese brands such as Tesla, Volkswagen, BMW, and Renault and exported to Europe in the statistics, China’s influence on the European electric vehicle market is even more profound. It is estimated that by 2025, about one-seventh of the electric vehicles sold in the European market are expected to be produced in China.

Currently, Chinese automakers are further ramping up their expansion in the European market. BYD announced on January 24 this year that it plans to increase its overseas delivery volume by nearly 25%. Facing the strong growth of Chinese brands, European local automakers have finally got a little breathing space after three consecutive years of market expansion.

They are responding by launching a number of competitive electric models, including the Citroën e-C3 under Stellantis and the upcoming Renault Twingo. Except for the UK, European automakers still maintain a certain share advantage in key markets such as Germany and France.

Non-European brands that have been operating in Europe for decades and have established mature dealer systems are now also feeling the competitive pressure from Chinese automakers. Data from Dataforce shows that Chinese brands exceeded the sales of US automakers in Europe in the second quarter of 2025 and surpassed South Korean automakers in the fourth quarter.

“We believe that the rise of Chinese brands in Europe will lead to the gradual withdrawal of some other brands from the market,” Lisinger analyzed. “The current overall sales are still lower than the level before 2021, and Chinese brands have occupied a considerable market share, which will make the living space of other brands more difficult.”

From the early acquisition of brands such as Volvo, MG, and Lotus to the in-depth localization operations in Europe through joint ventures and cooperation in recent years, the European strategies of Chinese automakers have been continuously deepened. Companies such as BYD have even directly invested in building factories and design centers locally and promised to adopt the European supply chain system to further integrate into the regional ecosystem.

Currently, the Stellantis Group plans to start producing Leapmotor electric vehicles in Zaragoza, Spain, this year, and Chery is also preparing to produce electric vehicles in Barcelona with local partners. While promoting local production, Chinese automakers are also continuously increasing the export of complete vehicles, accelerating their layout in the European market through a dual-track approach.

This article is from the WeChat official account “Automotive Commune” (ID: iAUTO2010), author: Yang Jing. Republished by 36Kr with permission.