Tesla, Inc. (NASDAQ:TSLA) is one of the stocks that Jim Cramer shared takes on, along with navigating market shortages. Cramer noted that the company delivered a “surprisingly strong set of numbers,” as he remarked:

Tesla reported too. As I told you on Monday, this is the Magnificent Seven stock where the numbers barely matter, especially this time, because we already had Tesla’s production and delivery results, both of which we know fell short of expectations. So when Tesla reported tonight and delivered a surprisingly strong set of numbers, top and bottom line beat for the fourth quarter, very impressive, $1.4 billion in free cash flow, that was good enough to send the stock higher in after-hours trading. Hey, by the way, robot and robotaxi intros look ahead of expectations. Real driver of the after-hours moves. We can’t wait to see that stuff.

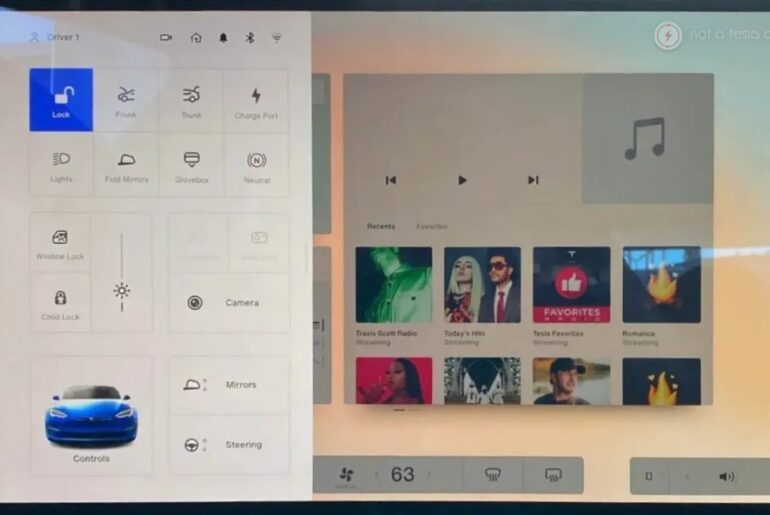

Photo by Tesla Fans Schweiz on Unsplash

Tesla, Inc. (NASDAQ:TSLA) designs and sells electric vehicles and also develops and installs solar energy and storage systems for residential, commercial, and industrial customers. In addition, the company is working on autonomous vehicles and robots.

While we acknowledge the potential of TSLA as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy Right Now.

Disclosure: None. This article is originally published at Insider Monkey.