Last year, almost every new car sold in Norway, the nature-loving country flush with oil wealth, was fully electric. In prosperous Denmark, which was all-in on petrol and diesel cars until just before Covid, sales of battery electric vehicles (BEVs) reached a share of 68%. In California, the share of zero-emissions vehicles hit 20%. And at least every third new car now bought by the Dutch, Finns, Belgians and Swedes burns no fuel.

These figures, which would have felt fanciful just five years ago, show the rich world leading the shift away from cars that pump out toxic gas and planet-heating pollutants. But a more startling trend is that electric car sales are also racing ahead in many developing countries. While China is known for its embrace of electric vehicles (EVs), demand has also soared in emerging markets from South America to south-east Asia. BEV sales in Turkey have caught up with the EU’s, data published this week shows.

Is the electric car revolution finally entering the fast lane? Let’s take a look – after this week’s most important reads.

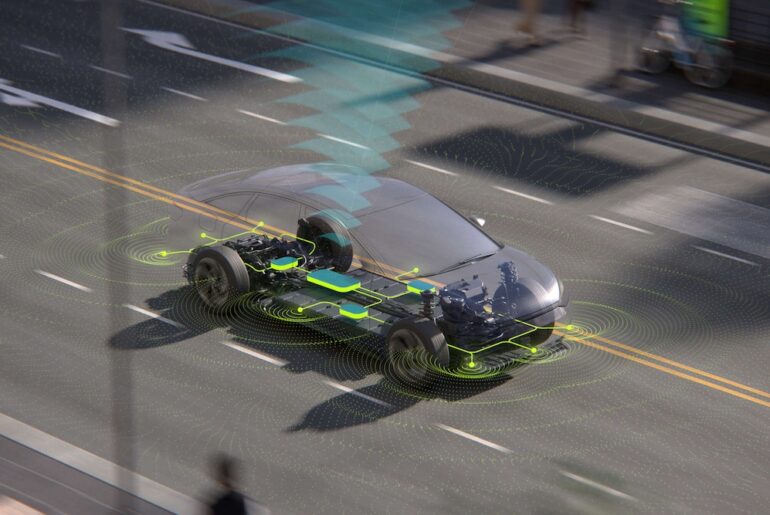

Essential readsIn focusCan infrastructure keep up with the demand for EVs? Photograph: Phil Wilkinson/Alamy

For decades, climate progress has largely come from cleaning up the power sector. Burn gas instead of coal, or replace power plants with wind turbines or solar panels, and you can slash the amount of planet-heating gas spewed into the atmosphere for little cost.

Now, early signs suggest transportation may be on the brink of delivering similar wins. EVs have quickly gained ground in markets outside Europe and North America, avoiding a rise in fuel-burning vehicles and “leapfrogging” the development path that richer countries have taken in transport.

“Five years ago you might have thought [transportation] is really going to be a bottleneck [for climate progress],” says William Lamb, a scientist at the Potsdam Institute for Climate Impact Research. “But now with the widescale adoption of EVs, it’s looking a little bit easier.”

The EV race has gone global, according to a report (pdf) published last month by Ember, a climate thinktank, which looked at BEV and plug-in hybrid sales for the first 10 months of last year. It found 39 countries around the world have an electric sales share above 10%, up from just four countries (all in Europe) in 2019. Singapore, Thailand and Vietnam have overtaken the EU in their EV uptake. India, Mexico and Brazil have overtaken Japan.

“It’s good news that we’re seeing growth in the EV market in more countries now,” said Robbie Andrew, a scientist who tracks electric vehicle sales at Cicero, a research centre in Oslo, the world’s EV capital. “In developing countries, this is largely about the recent arrival of much cheaper models from China. The Chinese companies have innovated extraordinarily quickly.”

Half of the cars registered in China last year were electric, and carmakers such as BYD have driven the boom in much of the global south. The Ember report found that three of the ten largest-value markets for Chinese EV exports are outside the OECD – Brazil, the United Arab Emirates and Indonesia – while the value of its exports to non-OECD countries and Mexico has tripled in the last two years.

The countries that benefit range from Ethiopia, which in 2024 became the first nation to ban imports of combustion engine cars, to Nepal, a polluted country scarred by a blockade 11 years ago that left it with severe petrol shortages. But it is not just the Chinese driving progress. Turkey’s share of BEV sales hit 17% last year – the same as the EU’s – in a transition led by domestic carmaker Togg. It has overtaken Tesla as the country’s leading supplier, with BYD in third place.

The question of whether to buy an electric vehicle has also been complicated by a culture war surrounding some of the brands that make them. Tesla has seen sales plummet across Europe and the US in response to Elon Musk’s support for far-right parties, and promotion of racist conspiracy theories. But in Turkey, the brand is viewed somewhat more favourably.

“If you have a Togg in Turkey, some people think you are a government-lover and a political Islamist,” says Berke Astarcioğlu, an engineer from Istanbul and an early adopter of EVs. “But if you have a Tesla, you are seen as secular, educated and open-minded.”

A challenge for developing countries seeking to sustain the EV boom is whether they can build charging infrastructure fast enough to avoid customer frustration. About two-thirds of the growth in public chargers since 2020 has occurred in China, which now has about 65% of the global charging stock, a report by the International Energy Agency found last year. But charging infrastructure in many other markets is lagging behind EV adoption rates.

There are also fears the surge in EVs may taper out as the rich customer base in lower- and middle-income countries is exhausted. New cars are generally bought by wealthier residents, while others buy theirs second-hand.

Still, in places like Turkey and Thailand (to name two of many), where falling prices and rising subsidies bring the price of EVs in line with petrol cars, Andrew says the question of whether only the rich can afford them falls away. “With price parity, people buy the cars because they’re simply better and cost less to run.”

If that trend continues to spread around the world, we may soon see electric cars leave their fume-belching rivals in the dust.

Read more:

To read the complete version of this newsletter – subscribe to receive Down to Earth in your inbox every Thursday.