Tesla is transitioning from an electric vehicle manufacturer to a leader in physical AI. Capital expenditures for Tesla in 2026 are projected to exceed 20 billion US dollars, far surpassing the market’s previous expectation of 11 billion US dollars. The substantial capital spending is expected to deteriorate cash flow, with Morgan Stanley forecasting that Tesla will burn through 8.1 billion US dollars in cash in 2026 and 500 million US dollars in 2027, not returning to positive until 2028. Meanwhile, Morgan Stanley has lowered Tesla’s target price from 425 US dollars to 415 US dollars.

Tesla is transitioning from an electric vehicle manufacturer to a leader in physical AI, but this strategic shift requires substantial capital expenditure. Tesla’s capital expenditure for 2026 is projected to exceed $20 billion, far surpassing the market’s previous expectation of $11 billion. The significant capital outlay has deteriorated cash flow, impacting Tesla’s current valuation.

According to the Storm Chaser trading platform, Morgan Stanley issued a report on January 29, lowering Tesla’s target price from $425 to $415 while maintaining a “hold” rating. This adjustment reflects concerns over Tesla’s anticipated substantial capital expenditures.

Morgan Stanley forecasts that Tesla will face up to $8.1 billion in cash burn by 2026, with adjusted EBITDA expectations for 2026 declining by 5%. Operating expenses as a percentage of sales are expected to rise from 13% to 14.5%.

Morgan Stanley forecasts that Tesla will face up to $8.1 billion in cash burn by 2026, with adjusted EBITDA expectations for 2026 declining by 5%. Operating expenses as a percentage of sales are expected to rise from 13% to 14.5%.

The report also notes that although the discontinuation of the Model X/S models symbolizes a strategic transition, it may lead to a deterioration in product mix, as these high-priced models contributed higher gross margins.

In the short term, room for valuation expansion is limited, but in the long run, investments in autonomous driving, robotics, and energy will solidify Tesla’s leadership position.

Major revision to financial projections: Cash flow turning negative becomes the biggest concern.

Morgan Stanley revised its financial forecast for Tesla in 2026. Capital expenditure expectations were significantly raised from $13 billion to $21 billion, with the company’s guidance being “over $20 billion,” far exceeding market consensus of $11 billion. This surge in capital spending is primarily aimed at supporting infrastructure development and computational capacity expansion for physical AI operations.

The most critical aspect is the free cash flow projection. Morgan Stanley expects Tesla to consume $8.1 billion in cash by 2026, a marked deterioration compared to the previous forecast of $1.3 billion in cash consumption. The cash burn is expected to persist into 2027, with an estimated $500 million, before turning positive again in 2028.

Regarding operating expenses, Morgan Stanley projects that by 2026, operating expenses will account for 14.5% of sales, up from 13% in 2025, reflecting a 12.5% increase. This underscores Tesla’s substantial investment to support growth prospects and AI projects.

In terms of revenue and EBITDA, Morgan Stanley forecasts 2026 revenue at $96.7 billion, with adjusted EBITDA at $14.3 billion, a 5% decline from prior expectations, resulting in an EBITDA margin of 14.8%.

Acceleration of Strategic Transformation: Comprehensive Layout from Electric Vehicles to Physical AI

Tesla CEO Musk announced several major strategic decisions during the earnings call, most notably the decision to halt production of the Model X and S in the next quarter.

Morgan Stanley pointed out that although these two models combined account for less than 2% of total sales in 2025, their higher price positioning contributes significantly more to gross profit.

Tesla plans to repurpose the dedicated space for the Model X/S at the Fremont factory for Optimus humanoid robot production, with an annual capacity reaching one million units. The company reiterated its plan to launch the third-generation Optimus in the first quarter of 2026.

In terms of autonomous taxis (Robotaxi), Tesla’s progress aligns with Morgan Stanley’s model expectations. The company confirmed that over 500 Robotaxis are now operating on roads between the San Francisco Bay Area and Austin, far exceeding the previously expected 200 vehicles.

Tesla also plans to roll out Robotaxi services in seven cities—Dallas, Houston, Phoenix, Miami, Orlando, Tampa, and Las Vegas—in the first half of 2026.

Massive Investment Supports AI Ambitions: $2 Billion Investment in xAI

Tesla announced a $2 billion investment in xAI as part of its broader strategy to accelerate advancements and efficiency in the physical AI terminal market. xAI’s chatbot Grok has been integrated into Tesla vehicles, with potential to enhance Tesla’s management capabilities for future large-scale autonomous fleets such as Optimus and the Robotaxi network.

Management stated that this xAI investment received shareholder support. Additionally, Musk emphasized that potential shortages in chip and memory production represent the biggest bottleneck in scaling Tesla’s autonomous fleet and Optimus business. While this will not become a constraint within the next 3-4 years, supplier capacity will eventually limit Tesla’s growth relative to its production expectations.

As a result, Tesla is exploring the possibility of building its own large-scale domestic chip manufacturing plant, integrating logic, memory, and packaging, to reduce reliance on external suppliers.

Energy business cannot be overlooked: Planning for hundred-gigawatt-scale solar capacity

Management emphasized the positive development prospects of the energy business by 2026, driven by increased deployments due to the launch of Megapack 3 and Megablock. However, the profit margin of this business segment will face certain pressures, primarily due to higher tariff costs and competition from peers.

Musk particularly highlighted the undervalued energy opportunities, especially in the solar sector. He disclosed preliminary plans to build approximately 100 gigawatts of annual solar manufacturing capacity, achieving full integration from raw materials to finished panels. This demonstrates Tesla’s long-term strategy in the renewable energy field.

Valuation adjustment: Price target reduction reflects short-term pressures

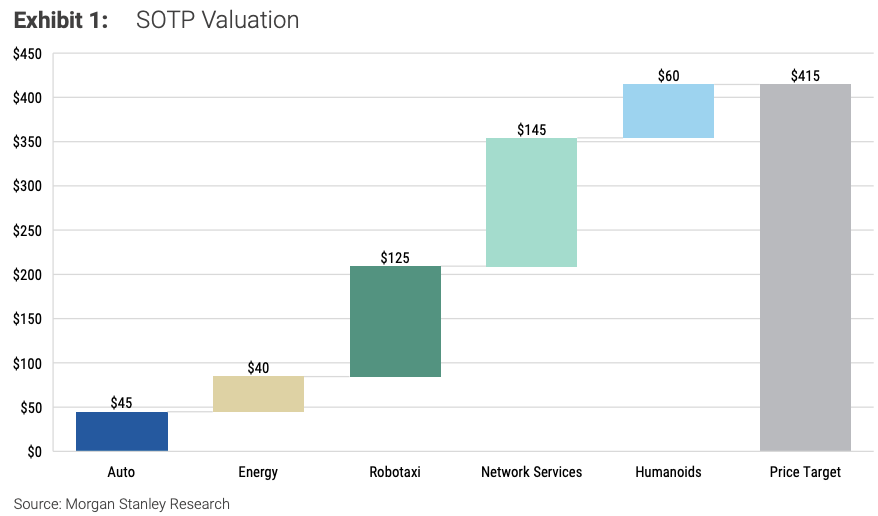

Morgan Stanley lowered Tesla’s price target from $425 to $415 based on the sum-of-the-parts (SOTP) valuation method. The breakdown is as follows: core automotive business at $45 per share, network services at $145 per share, Robotaxi network at $125 per share, energy business at $40 per share, and humanoid robots at $60 per share (with a 50% probability discount applied).

The reduction in the price target reflects a 5% and 10% decrease in adjusted EBITDA expectations for 2026 and 2027, respectively, as well as intensified cash burn due to accelerated capital expenditures. While the growth in capital expenditures supports Tesla’s leadership in the physical AI domain, high levels of cash consumption in the short term may limit valuation multiple expansion.

Morgan Stanley’s base-case scenario price target of $415 implies a 50x valuation of 2030 EBITDA, consistent with the previous model. The bull-case scenario price target was reduced from $860 to $845, while the bear-case scenario was lowered from $145 to $135.