Trucks and SUVs dominate U.S. auto sales and set the tone for the Detroit Auto Show in January 2026, while overseas EV sales are booming. Bill Pugliano/Getty Images

At the 2026 Detroit Auto Show, the spotlight quietly shifted. Electric vehicles, once framed as the inevitable future of the industry, were no longer the centerpiece. Instead, automakers emphasized hybrids, updated gasoline models and incremental efficiency improvements.

The show, held in January, reflected an industry recalibration happening in real time: Ford and General Motors had recently announced US$19.5 billion and $6 billion in EV-related write-downs, respectively, reflecting the losses they expect as they unwind or delay parts of their electric vehicle plans.

The message from Detroit was unmistakable: The United States is pulling back from a transition that much of the world is accelerating.

That retreat carries consequences far beyond showroom floors.

In China, Europe and a growing number of emerging markets, including Vietnam and Indonesia, electric vehicles now make up a higher share of new passenger vehicle sales than in the United States.

That means the U.S. pullback on EV production is not simply a climate problem – gasoline-powered vehicles are a major contributor to climate change – it is also an industrial competitiveness problem, with direct implications for the future of U.S. automakers, suppliers and autoworkers. Slower EV production and slower adoption in the U.S. can keep prices higher, delay improvements in batteries and software, and increase the risk that the next generation of automotive value creation will happen elsewhere.

In 2025, global EV registrations rose 20% to 20.7 million. Analysts with Benchmark Mineral Intelligence reported that China reached 12.9 million EV registrations, up 17% from the previous year; Europe recorded 4.3 million, up 33%; and the rest of the world added 1.7 million, up 48%.

By contrast, U.S. EV sales growth was essentially flat in 2025, at about 1%. U.S. automaker Tesla experienced declines in both scale and profitability – its vehicle deliveries fell 9% compared to 2024, the company’s net profit was down 46%, and CEO Elon Musk said it would put more of its focus on artificial intelligence and robotics.

Market share tells a similar story and also challenges the assumption that vehicle electrification would take time to expand from wealthy countries to emerging markets.

In 39 countries, EVs now exceed 10% of new car sales, including in Vietnam, Thailand and Indonesia, which reached 38%, 21% and 15%, respectively, in 2025, energy analysts at Ember report.

In the U.S., EVs accounted for less than 10% of new vehicle sales, by Ember’s estimates.

U.S. President Donald Trump came back into office in 2025 promising to end policies that supported EV production and sales and boost fossil fuels. But while the U.S. was curtailing federal consumer incentives, governments elsewhere largely continued a transition to electric vehicles.

Europe softened its goal for all vehicles to have zero emissions by 2035 at the urging of automakers, but its new target is still a 90% cut in automobiles’ carbon dioxide emissions by 2035.

Germany launched a program offering subsidies worth 1,500 to 6,000 euros per electric vehicle, aimed at small- and medium-income households.

In developing economies, EV policy has largely been sustained through industrial policies. In Brazil, the MOVER program offers tax credits explicitly linked to domestic EV production, research and development, and efficiency targets. South Africa is introducing a 150% investment allowance for EV and battery manufacturing, giving them a tax break starting in March 2026. Thailand has implemented subsidies and reduced excise tax tied to mandatory local production and export commitments.

Low prices from Chinese automakers such as BYD helped the EV industry take off, not just in China but globally. A car priced at 99,800 yuan is just over US$14,000. These were at an auto show in Yantai, in eastern China, in April 2025. Stringer/AFP via Getty Images

In China, the EV industry has entered a phase of regulatory maturity. After a decade of subsidies and state-led investment that helped domestic firms undercut global competitors, the government’s focus is no longer on explosive growth at home.

With their domestic market saturated and competition fierce, Chinese automakers are pushing aggressively into global markets. Beijing has reinforced this shift by ending its full tax exemption for EV purchases and replacing it with a tapered 5% tax on EV buyers.

EV manufacturing is governed by steep learning curves and scale economies, meaning the more vehicles a company builds, the better it gets at making them faster and cheaper. Low domestic production and sales can mean higher costs for parts and weaker bargaining power for automakers in global supply chains.

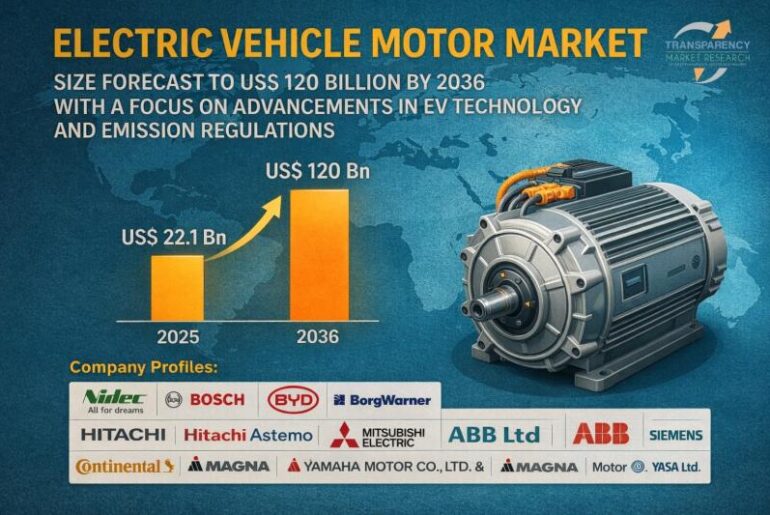

The competitive landscape is already changing. In 2025, China exported 2.65 million EVs, doubling its 2024 exports, according to the China Association of Automobile Manufacturers. And BYD surpassed Tesla as the world’s largest EV maker in 2025.

The U.S. risks becoming a follower in the industry it once defined.

Some people argue that American consumers simply prefer trucks and hybrids. Others point to Chinese subsidies and overcapacity as distortions that justify U.S. industry caution. These concerns deserve consideration, but they do not outweigh the fundamental fact that, globally, the EV share of auto sales continues to rise.

For U.S. automakers and workers to compete in this market, the government, in our view, will have to stop treating EVs as an ideological matter and start governing it like an industrial transition.

That starts with restoring regulatory credibility, something that seems unlikely right now as the Trump administration moves to roll back vehicle emissions standards. Performance standards are the quiet engine of industrial investment. When standards are predictable and enforced, manufacturers can plan, suppliers can invest in new businesses, and workers can train for reliable demand.

Governments at state and local levels and industry can also take important steps.

Focus on affordability and equity: The federal clean-vehicle tax credit that effectively gave EV buyers a discount expired in September 2025. An alternative is targeted, point-of-sale support for lower- and middle-income buyers. By moving away from blanket credits in favor of targeted incentives – a model already used in California and Pennsylvania – governments can ensure public funds are directed toward people who are currently priced out of the EV market. Additionally, interest-rate buydowns that allow buyers to reduce their loan payments and “green loan” programs can help, typically funded through state and local governments, utility companies or federal grants.

Keep building out the charging network: A federal judge ruled on Jan. 23, 2026, that the Trump administration violated the law when it suspended a $5 billion program for expanding the nation’s EV charger network. That expansion effort can be improved by shifting the focus from the number of ports installed to the number of working chargers, as California did in 2025. Enforcing reliability and clearing bottlenecks, such as electricity connections and payment systems, could help boost the number of functioning sites.

Use fleet procurement as a stabilizer for U.S. sales: When states, cities and companies provide a predictable volume of vehicle purchases, that helps manufacturers plan future investments. For example, Amazon’s 2019 order of 100,000 Rivian electric delivery vehicles to be delivered over the following decade gave the startup automaker the boost it needed.

Treat workforce transition as core infrastructure: This means giving workers skills they can carry from job to job, helping suppliers retool instead of shutting down, and coordinating training with employers’ needs. Done right, these investments turn economic change into a source of stable jobs and broad public support. Done poorly, they risk a political backlash.

The scene at the Detroit Auto Show should be a warning, not a verdict. The global auto industry is accelerating its EV transition. The question for the United States is whether it will shape that future – and ensure the technologies and jobs of the next automotive era are in the U.S. – or import it.

The authors do not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.