Key Morningstar Metrics for TeslaWhat We Thought of Tesla’s Earnings

The highlights of Tesla’s TSLA fourth-quarter earnings report were management’s plans to expand its autonomous driving ride-hailing to more US cities and begin mass-producing its humanoid robots by the end of 2026. Tesla shares were up in after-hours trading as the market reacted favorably to the news.

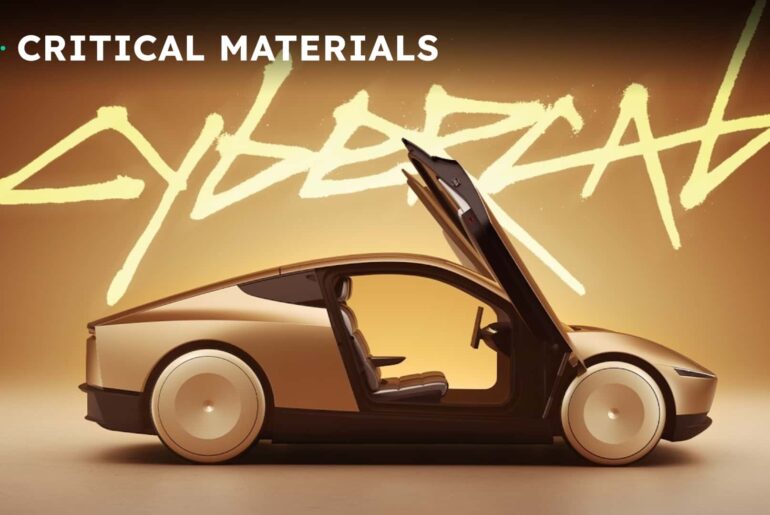

Why it matters: Tesla has been testing its robotaxi autonomous driving ride-hailing service in Austin, Texas, and the Bay Area of California. Tesla plans to expand to seven more US cities in the first half of 2026 and started removing its employees from its robotaxis in Austin.

This shows the autonomous driving software is progressing well through testing. Improving software should also support Tesla’s auto sales and its autonomous driving subscription software for Tesla owners.The plan to begin mass manufacturing the Optimus humanoid robot this year surprised us, as we thought the project was still several years away. To do this, Tesla will stop selling its Model S and X vehicles and retool the factory that produces them to enable robot production.

The bottom line: We raise our fair value estimate for narrow-moat Tesla to USD 400 from USD 300. The primary drivers are a higher robotaxi valuation, increased adoption of Tesla’s autonomous driving subscription software at a higher price, and a higher valuation of the humanoid robot business.

At current prices, we view Tesla shares as fairly valued, trading around 10% above our fair value estimate, placing it in 3-star territory.The bulk of our valuation comes from the long-term free cash flow generation of Tesla’s subscription software from its autos, robotaxis, and humanoid robots. While Tesla continues to test its software, we expect the stock to remain volatile as it progresses with these new products.

Editor’s Note: This analysis was originally published as a stock note by Morningstar Equity Research.

The author or authors do not own shares in any securities mentioned in this article. Find out about

Morningstar’s editorial policies.