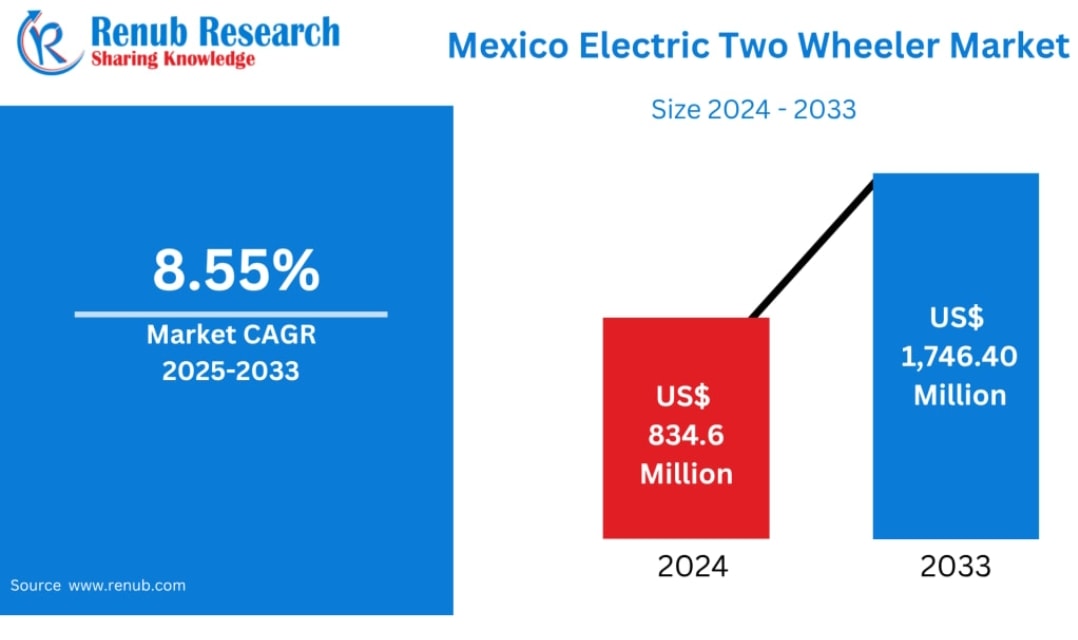

The electric two-wheeler (E2W) market in Mexico is rapidly gaining traction, fueled by environmental concerns, urban congestion, and government incentives promoting cleaner transportation. With electric scooters, motorcycles, and e-bikes becoming increasingly popular, the sector is poised for significant growth over the next decade. According to recent market analyses, Mexico’s E2W market is projected to expand steadily between 2025 and 2033, reflecting broader global trends toward sustainable mobility.

Drivers of Growth

Several factors are driving the adoption of electric two-wheelers in Mexico:

Environmental Regulations and Sustainability Goals – Mexico has committed to reducing greenhouse gas emissions and promoting sustainable urban transportation. Policies supporting electric mobility, such as tax incentives and reduced import tariffs on electric vehicles, encourage adoption.

Urbanization and Traffic Congestion – Major cities like Mexico City, Guadalajara, and Monterrey face chronic traffic congestion. Two-wheelers offer a nimble alternative for commuters, reducing travel time while lowering carbon emissions.

Rising Fuel Costs – Gasoline prices in Mexico remain volatile, prompting consumers and delivery operators to consider cost-effective alternatives. Electric two-wheelers, with lower operating costs, are increasingly attractive to urban commuters and fleet operators.

Technological Advancements – Improvements in battery technology, extended range, faster charging, and reduced costs are making electric two-wheelers more practical for everyday use. Leading manufacturers are introducing models tailored to local needs, combining affordability with reliability.

Market Size and Forecast

Recent reports estimate that Mexico’s electric two-wheeler market is set to experience a compound annual growth rate (CAGR) of around 12–15% between 2025 and 2033. The market expansion is driven by both consumer adoption and commercial fleet deployments, such as delivery services, ride-sharing, and last-mile logistics.

By 2033, market analysts project that electric two-wheelers could account for up to 25–30% of all two-wheeler sales in Mexico, reflecting a clear shift toward electrification. Urban areas will remain the primary growth hubs, although adoption in smaller towns and suburban regions is expected to rise as charging infrastructure improves.

Competitive Landscape

Mexico’s E2W market is becoming increasingly competitive. Key players include both international manufacturers and local startups focused on affordable electric scooters and motorcycles.

International brands: Companies like NIU, Yadea, and Super Soco are expanding their footprint in Mexico, leveraging global expertise and advanced battery technologies.

Local brands and startups: Domestic companies are introducing low-cost electric motorcycles and e-bikes designed for urban commuting and delivery services, emphasizing cost efficiency and durability.

The competitive environment encourages product innovation, better after-sales support, and marketing strategies aimed at urban commuters, students, and delivery fleet operators.

Challenges and Barriers

Despite the optimistic outlook, the market faces several challenges:

Charging Infrastructure – Widespread adoption depends on the availability of reliable and convenient charging stations. While private charging is an option, public infrastructure remains limited in many areas.

High Upfront Costs – Although operating costs are lower, electric two-wheelers still have higher initial purchase prices than conventional scooters or motorcycles, which can deter price-sensitive consumers.

Consumer Awareness and Trust – Many consumers are still unfamiliar with electric mobility benefits or skeptical about battery life and reliability. Education and demonstration programs are critical for market growth.

Regulatory Complexity – While incentives exist, inconsistent policies across states can create uncertainty for manufacturers and consumers, affecting market expansion plans.

Opportunities in Commercial Applications

One of the most promising segments is commercial use, particularly in urban logistics. E-commerce growth in Mexico has boosted demand for fast, cost-efficient last-mile delivery solutions. Electric motorcycles and scooters are ideal for this sector, providing lower operational costs, reduced emissions, and easier navigation through congested streets.

Companies like Rappi and Mercado Libre are already testing electric fleets, signaling a potential shift in the delivery ecosystem over the next decade. Partnerships between fleet operators and electric vehicle manufacturers are expected to accelerate adoption further.

Government Initiatives and Policy Support

Government policies play a crucial role in shaping the E2W market. Mexico has introduced tax incentives, subsidies, and import duty reductions for electric vehicles, making them more accessible to consumers and businesses. Additionally, environmental programs targeting urban air pollution encourage municipalities to support electric mobility adoption.

City-level initiatives, such as designated e-scooter lanes and pilot programs for electric public transport, also create a favorable ecosystem for electric two-wheelers to thrive.

Technological Trends

Battery technology continues to evolve, with longer ranges, faster charging, and improved safety making electric two-wheelers more viable. Integration with smartphone apps, GPS tracking, and fleet management systems enhances user experience for both consumers and businesses.

The emergence of swappable battery stations could overcome infrastructure limitations, enabling users to quickly exchange depleted batteries for charged ones, reducing downtime and increasing convenience.

Outlook for 2025–2033

By 2033, Mexico’s electric two-wheeler market is expected to be highly diversified, with multiple manufacturers, widespread urban adoption, and growing commercial fleet utilization. Key drivers will include government support, technological advances, and rising consumer awareness of cost and environmental benefits.

Market growth will likely be concentrated in metropolitan areas initially, with expansion into smaller cities as infrastructure and public confidence improve. The combination of affordability, efficiency, and environmental sustainability positions electric two-wheelers as a core component of Mexico’s future urban mobility ecosystem.

Conclusion

Mexico’s electric two-wheeler market is entering a period of rapid growth, driven by urbanization, environmental concerns, and technological innovation. While challenges remain in infrastructure, cost, and consumer awareness, the opportunities in both personal mobility and commercial applications are significant.

From 2025 to 2033, the market is projected to expand substantially, offering benefits to consumers, businesses, and the environment. As manufacturers, startups, and policymakers collaborate, electric two-wheelers are poised to become a key part of Mexico’s sustainable transportation future.