In December, the electric vehicle (EV) market ended the year an up note, with sales rising for both new and used models. New EV supply remained elevated, and used EV days’ supply increased, though still below ICE levels. Pricing held largely flat across both segments, with heavy new‑vehicle incentives in place to counter softer retail momentum and used EV prices showing continued stability.

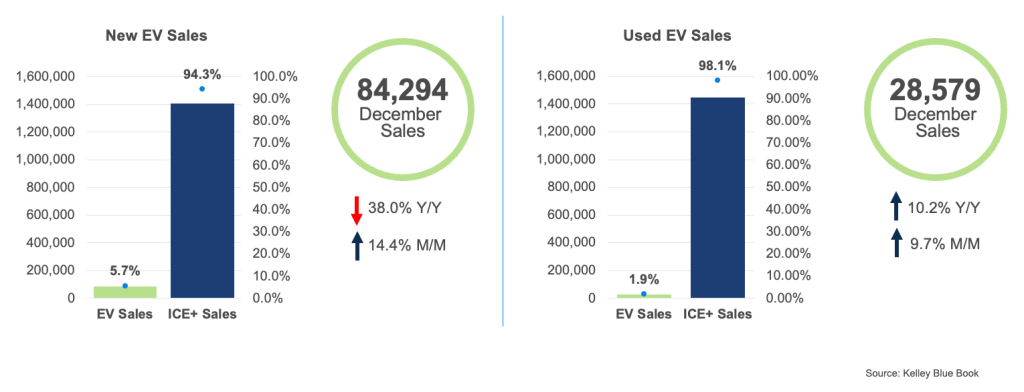

New and Used EV Sales – December

New EV Sales: December new‑EV sales totaled an estimated 84,294 units, down 38% from a year earlier but up 14.4% from November. EV share of total new‑vehicle sales held steady at 5.7%. The top five brands by unit volume were Tesla (48,300), Ford (5,052), Cadillac (3,919), Rivian (3,606) and Hyundai (3,135). Tesla grew 6.1% month over month; however, its market share eased to 57.3%, down from November’s elevated 61.8%, as several competitors bounced back more sharply from the post-tax credit slowdown. Most brands recorded month‑over‑month gains, with Genesis, Chevrolet and Audi being the key exceptions. Lucid stood out as the only major brand to reach its highest monthly volume of the year, delivering 2,415 units in December – a 146% increase from November.

Used EV Sales: In December, used EV sales reached 28,579 units, 10.2% higher than a year ago and up 9.7% from November. Market share held steady at 1.9%. For the full year 2025, used EV sales totaled 378,140 units, up 35.1% year over year and capturing 2.1% of the used‑vehicle market. In December, Tesla led the category with 10,837 units, followed by Ford at 1,915, Chevrolet at 1,904, BMW at 1,749, and Nissan at 1,429. Most brands posted month‑over‑month increases, with Ford down 2.7% and Audi down 19.3% as the key exceptions. Tesla’s dominance extended to the model level, taking four of the top five used EV positions, with the Mustang Mach‑E ranking third behind the Model 3 and Model Y. Among the top five brands, BMW delivered the strongest month‑over‑month growth, rising 18.6%.

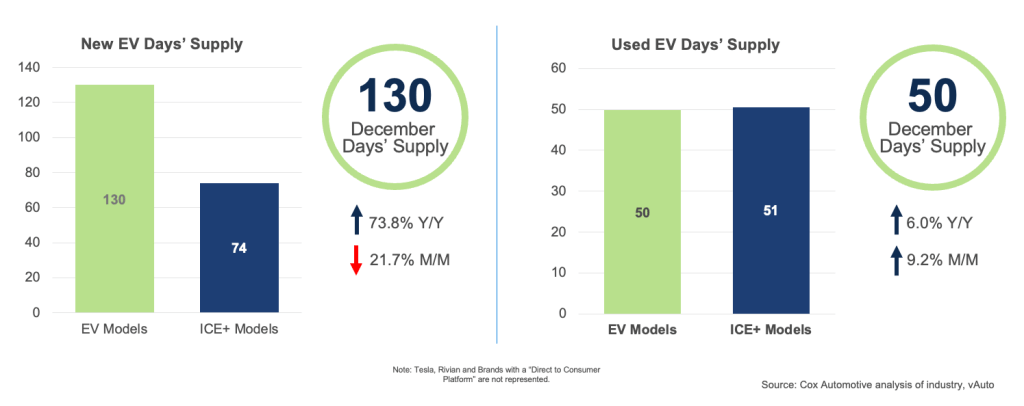

New and Used EV Days’ Supply – December

EV Days’ Supply: At the start of January, new EV days’ supply was at 130 days, up 73% from year-earlier levels, a significant gain. EV days’ supply, however, did decline through the month of December and is now lower by 22% month over month. The gap between EV and ICE+ days’ supply also declined over the past month, falling to 56 days. EV inventory has been elevated for more than two months now, following September’s near-record low of 46 days.

Used EV Days’ Supply: Used EV days’ supply reached 50 days in December, up 6% year over year and 9.2% month over month, remaining below ICE+ levels for the ninth consecutive month. Supply varied widely by brand, ranging from 35 days (Cadillac) to 67 days (Ford), while Tesla held 41 days of supply. Note: Tesla figures reflect only vehicles available through traditional dealerships, excluding vehicles at Tesla-owned outlets.

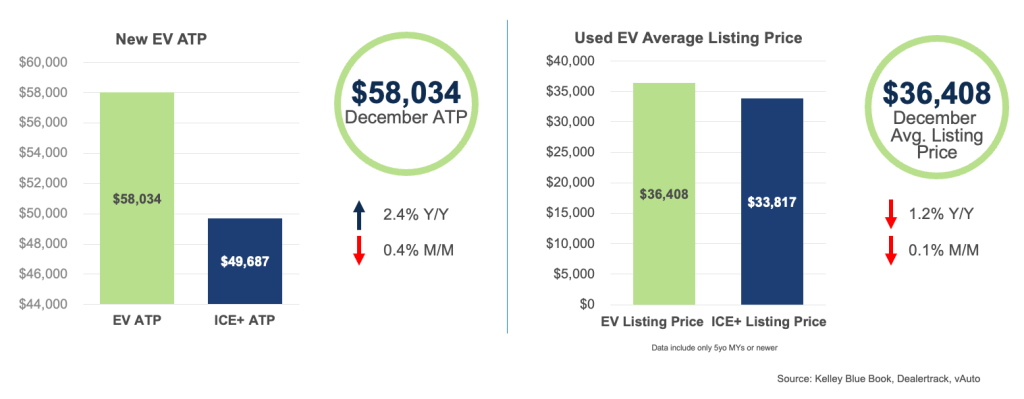

New and Used EV Prices – December

New EV ATP: The average transaction price (ATP) for new EVs in December was $58,034, up 2.4% year over year but down 0.4% month over month. Incentives climbed sharply to a year‑high of $10,473, or 18% of ATP, up 5 percentage points from November and reaching record territory. The price premium over ICE+ vehicles narrowed to $8,347, driven by elevated discounting. Tesla’s below‑segment pricing and large volume continue to exert downward pressure on the overall EV ATP, especially as incentives on Tesla models rose sharply in December.

Used EV Listing Price: The average listing price for used EVs was $36,408 in December, down 1.2% year over year and flat month over month, narrowing the price premium over ICE+ vehicles to $2,591. Tesla’s stable pricing helped anchor the market. Most brands posted month-over-month declines, though two brands saw notable increases, with Cadillac up 8.6% and Volvo up 4.2%. Affordability remained steady, with 39% of models selling below $25,000; the Nissan Leaf remained one of the most accessible options at $11,746.

Looking Ahead

As 2026 begins, the EV market is poised for another challenging year, with elevated inventory, pricing pressures and a post-incentive landscape continuing to test demand. Even so, the successful rollout of new EV models offers a meaningful counterbalance. Fresh entries across key segments can help revive consumer interest, provided automakers maintain discipline in production, deploy targeted incentives, and clearly communicate the value of newer, more efficient EV offerings.

For more details, read: Despite Q4 Collapse, 2025 EV Sales Decline Only 2% Versus 2024; Policy Shifts, New Product Set Stage for Next Chapter

The EV Market Monitor gauges the health of the new and used electric vehicle (EV) markets by monitoring sales volume, days’ supply and average pricing. Each metric will be measured month over month and year over year. For the official quarterly report of EV data, see the Q4 Electric Vehicle Sales Report.