Support CleanTechnica’s work through a Substack subscription or on Stripe.

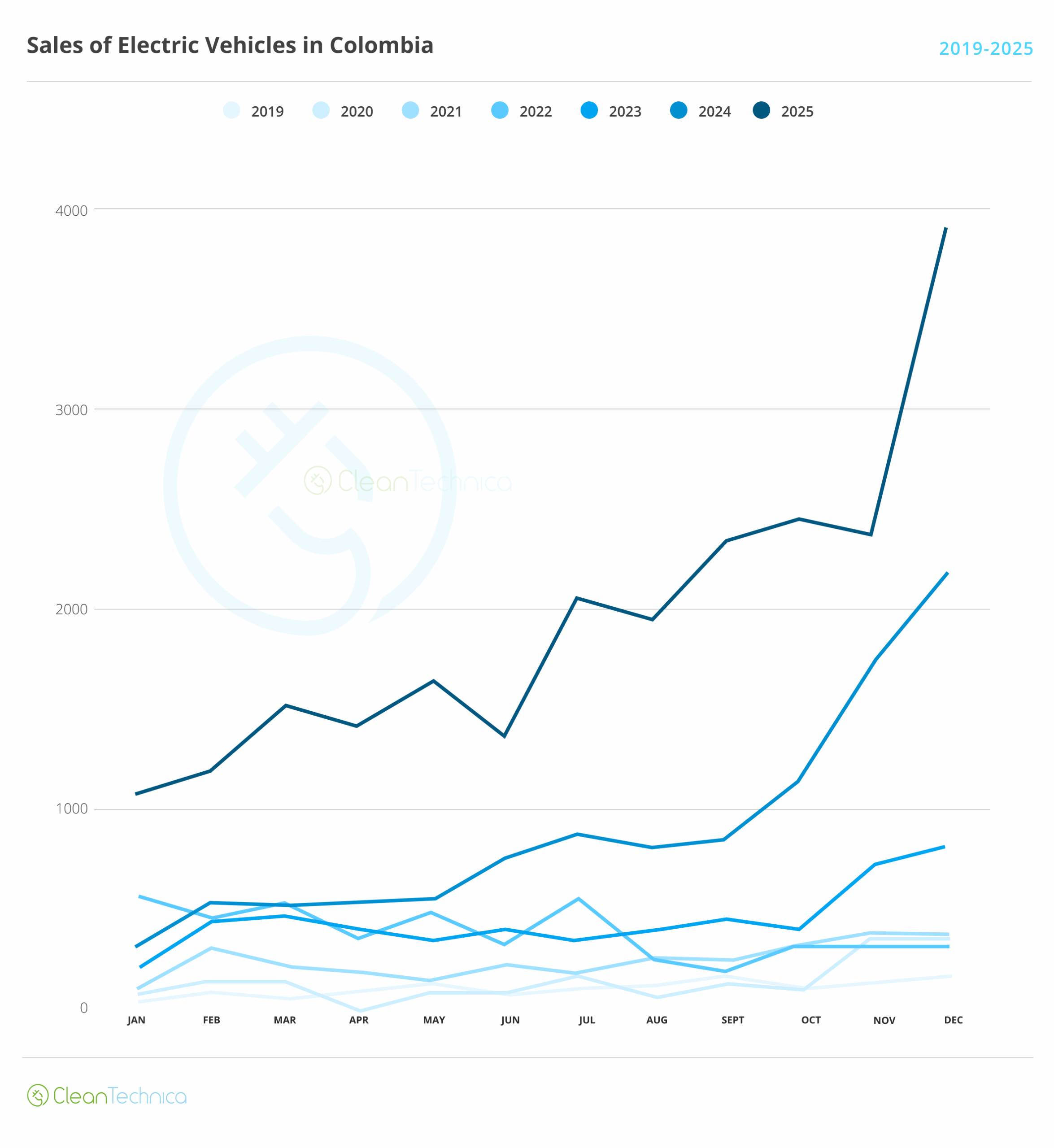

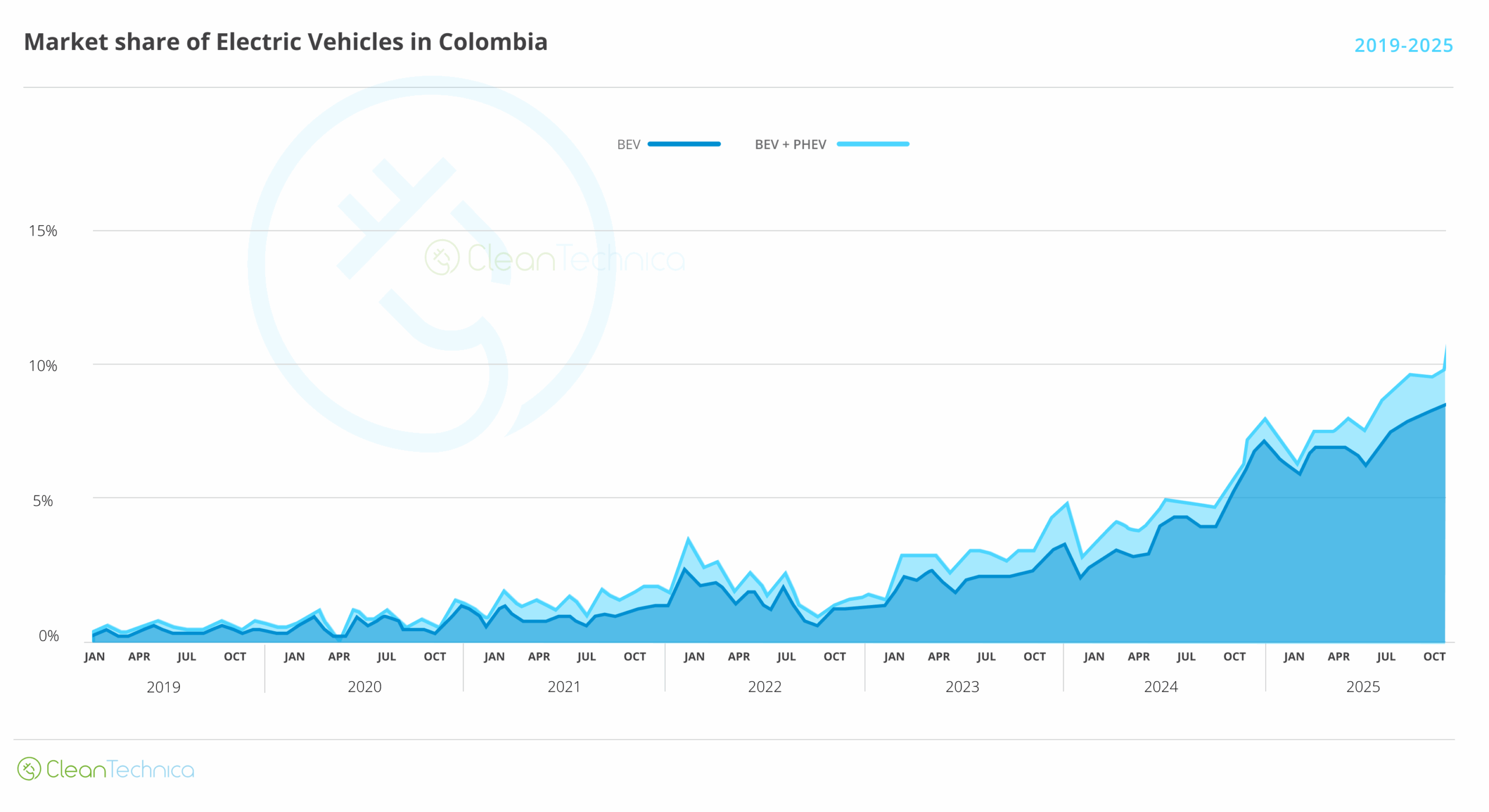

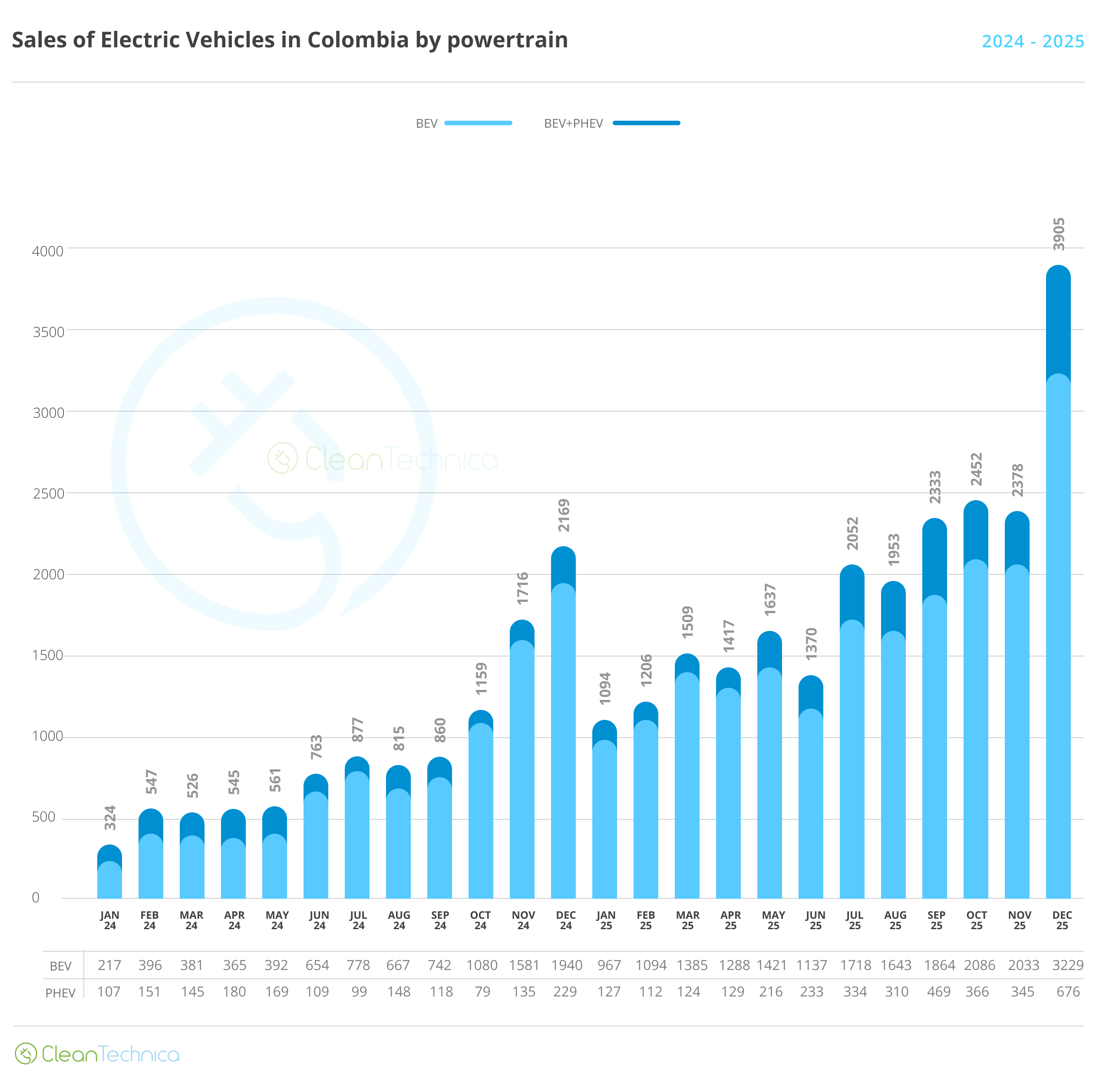

Colombia’s EV market has been setting record after record lately, reaching 10% market share in November and rising to 12.9% (10.7% BEV) in December! Last month, EV sales reached an all-time high of 3,905 units, 80% more than a year prior, and 60% above the previous record from October 2025. A lot of these sales are directly related to Bogota’s Automobile Hall of November 2025 and were likely contracted that month yet only delivered in December, due to logistical issues that delayed the transport of the cars from Buenaventura’s port to large cities inland.

More importantly, this all-time high record is happening before the arrival of the most affordable Tesla models in the world! As we mentioned in that article, Tesla has arrived at prices that put all competition (ICEV, HEV, PHEV and BEV) in danger, and since most people around here seem to not mind Elon Musk’s antics, it could well become the best-selling brand in the country in 2026. It was actually said in November that a lot of EV sales from Bogota’s Automobile Hall were cancelled once Tesla announced prices, so the impact is already being felt.

Let’s look at the numbers!

Market overview

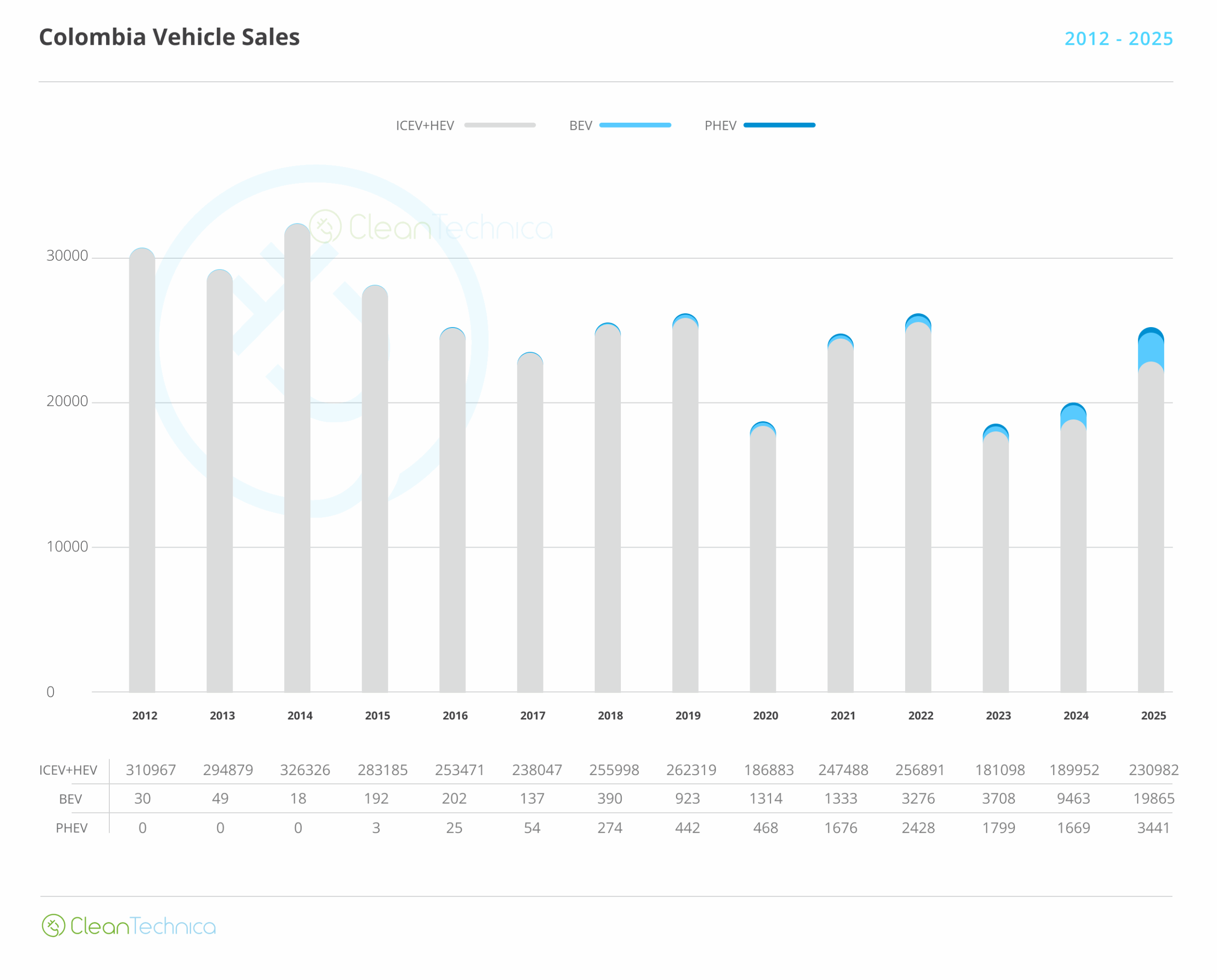

Colombia’s market, both in overall sales and regarding EVs specifically, is highly seasonal, with December sales sometimes doubling those of January from the same year and sales rising steadily throughout the year. 2025 was no exception. After a record in December 2024 (2,169 EVs being sold that month), sales fell in January to around 1,100 and would not top the previous record until September 2025. After that, a new record would be set in October, and then again in December, surpassing for the first time the 3,000-unit mark (and nearly reaching 4,000):

However, because overall sales also fluctuate, market share has remained relatively stable. Despite lower EV sales through the first months of 2025, market share hovered around 8% until July 25, breaking the 9% milestone in September and then the 10% in November. Then came December, surpassing 10% for the first time ever and almost reaching 13% even as ICEV sales also boomed.

It’s worth mentioning that EV sales stood at 9.1% (7.8% BEV, 1.5% PHEV) through all of 2025.

For a long time, there was a roughly 80/20 relationship between BEVs and PHEVs in the Colombian market. This relationship broke once more affordable BEVs started to arrive (most important of all the BYD Seagull and the BYD Yuan Up), becoming closer to 90/10, with around 9 in every 10 EVs sold being a BEV. However, thanks to the arrival of competitive PHEVs (the Deepal S07 and S05) and the lowering of price for the BYD Song DM-I, PHEVs are again rising, recovering to between 15% and 20% of total sales … but I believe that this renaissance will be short lived, as Tesla’s arrival will once again stack the deck in favour of BEVs:

Data source: https://zemo-la.com/

Data source: https://zemo-la.com/

But, of course, rising EV sales are of little help if they do not correlate with declining ICEV sales. At this point, I believe we can start forecasting a decline for combustion-only powertrains (ICEV+MHEV+HEV) in 2026 when compared to 2025. To track this development, I decided to present one more chart including total sales, showing the long-term trend for combustion-only vehicles:

Data source: https://zemo-la.com/

Data source: https://zemo-la.com/

The results were extremely interesting. A long-term decline in vehicle sales is visible after 2014’s all-time high, with small recoveries from 2017–2019 and 2020–2022. However, even after a decade, the market is still far from the numbers it reached in 2014.

The last period of recovery, after 2023’s semi-conductor crisis, has seen the growing influence of EV sales — though, the rapid growth in these years meant ICEV and HEV sales also grew. By 2026, further growth in the overall market is expected (around 10%), which, at current levels, means EV sales would need to double to cause a disruption large enough to cause combustion-only powertrains to fall. I think this is completely doable, more so as yet another tsunami of competitive EVs is landing in Colombia, including the best-selling Geely Geome (which will arrive at $22,000 at current exchange rates) and of course the Tesla Model 3 and Model Y. If I’m correct, 2026 will bring forth a new age of decline for combustion-only cars, only this time it will be permanent.

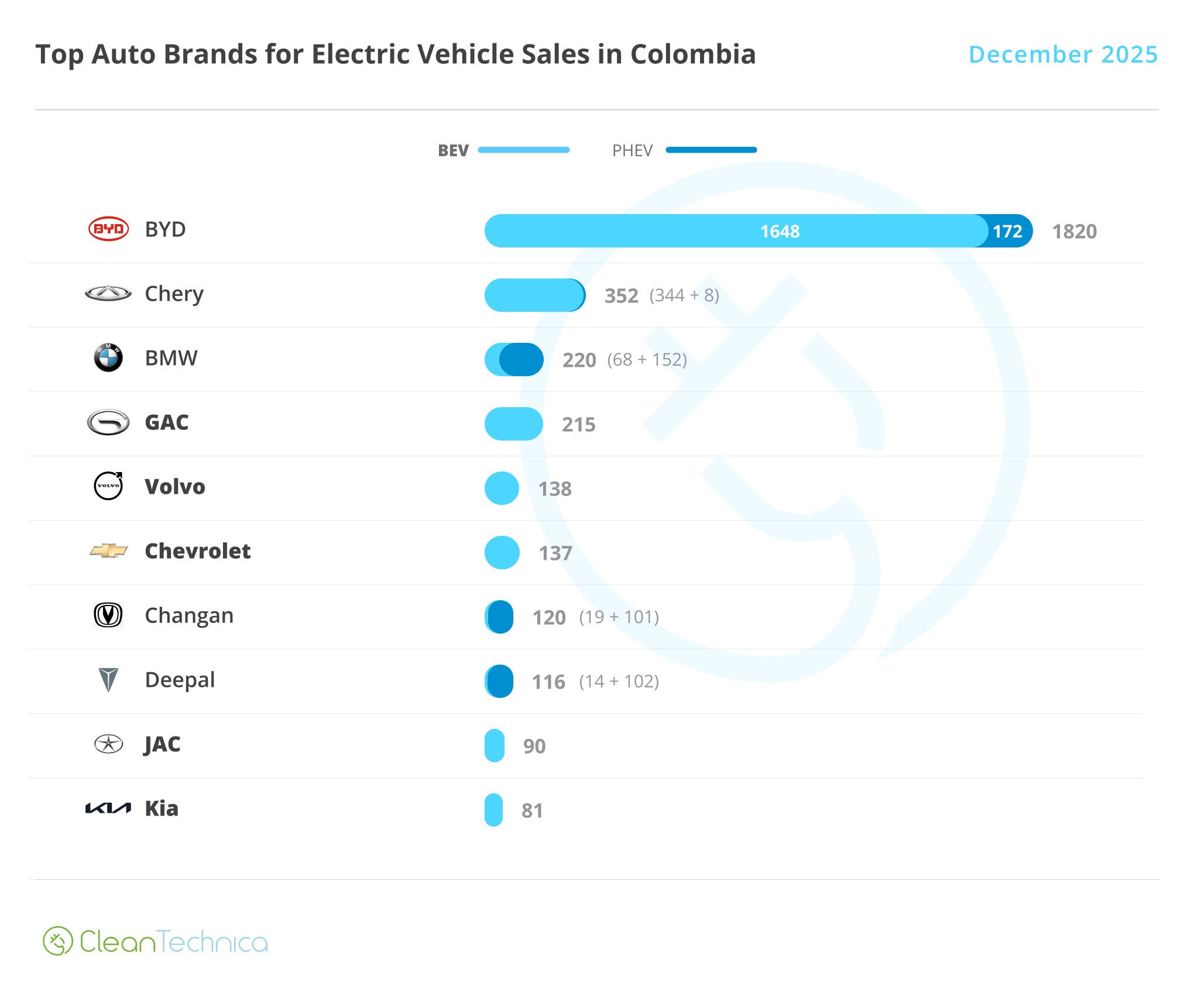

Brand-wise, BYD sustains the leadership position in December, but it now accounts for “only” for 47% of the market, losing share as other competitive companies arrive in force. Chery won silver thanks to its very popular ICar 03, an SUV with an in-your-face design that throws away any concern for efficiency to present a rugged exterior, something that has clearly won over Colombian consumers (also, its affordable sticker price does not hurt). BMW has the bronze thanks to a relatively affordable lineup for a luxury automaker, and something interesting is that, as far as I can see, most of its EVs come from Europe not from China, making it a bastion for Legacy Auto in developing markets. Notable mentions for GAC and Changan/Deepal, two brands that are entering the country in full force and rapidly gaining traction, and to Chevrolet, which has had significant success with its Spark EUV and Captiva EV, even if they’re relatively overpriced compared with other Chinese vehicles. Meanwhile, Kia, the former poster child for Legacy Auto, has been relegated to #10 as more competitive alternatives erode EV3 and EV5 sales.

Data source: https://zemo-la.com/

Data source: https://zemo-la.com/

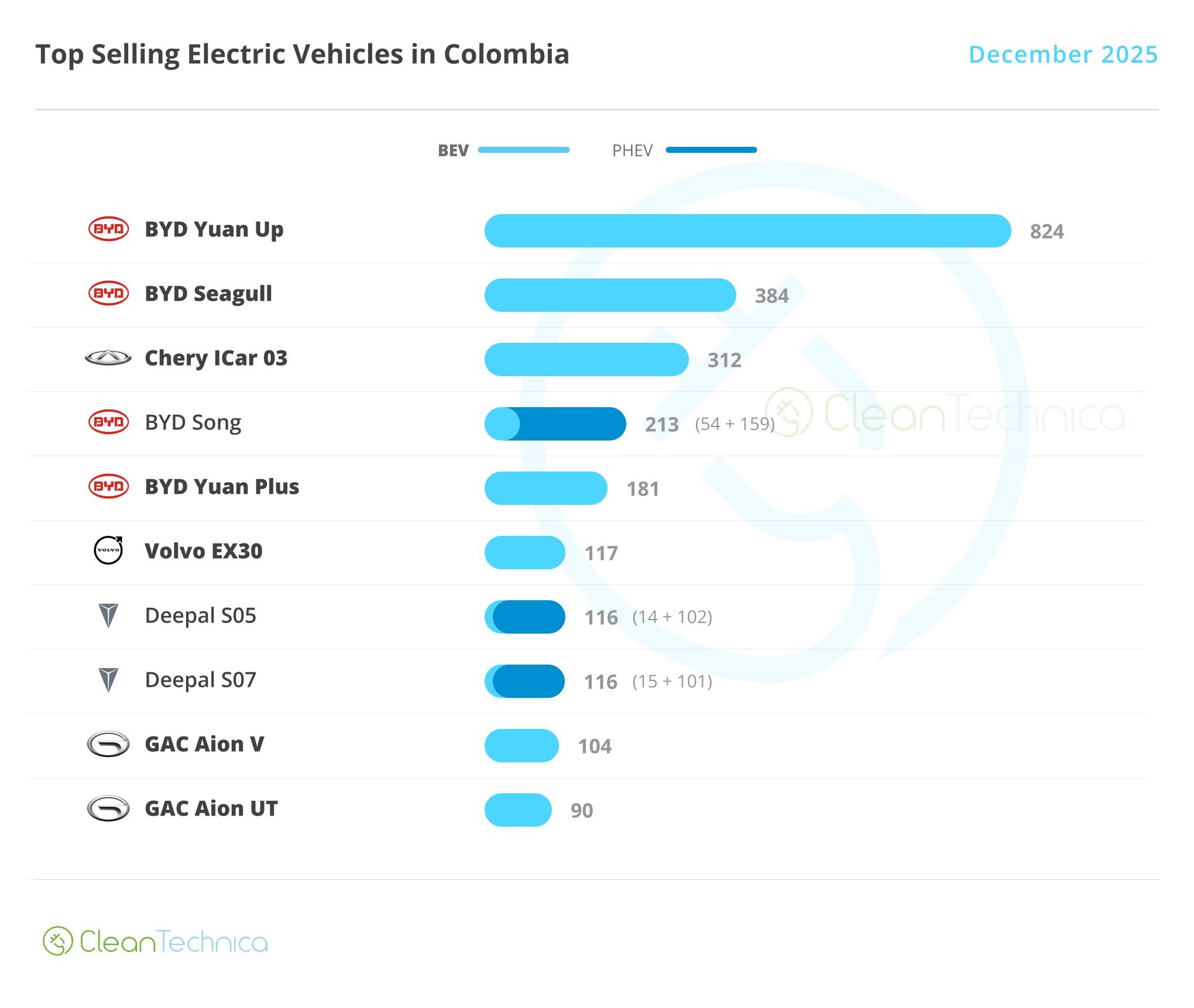

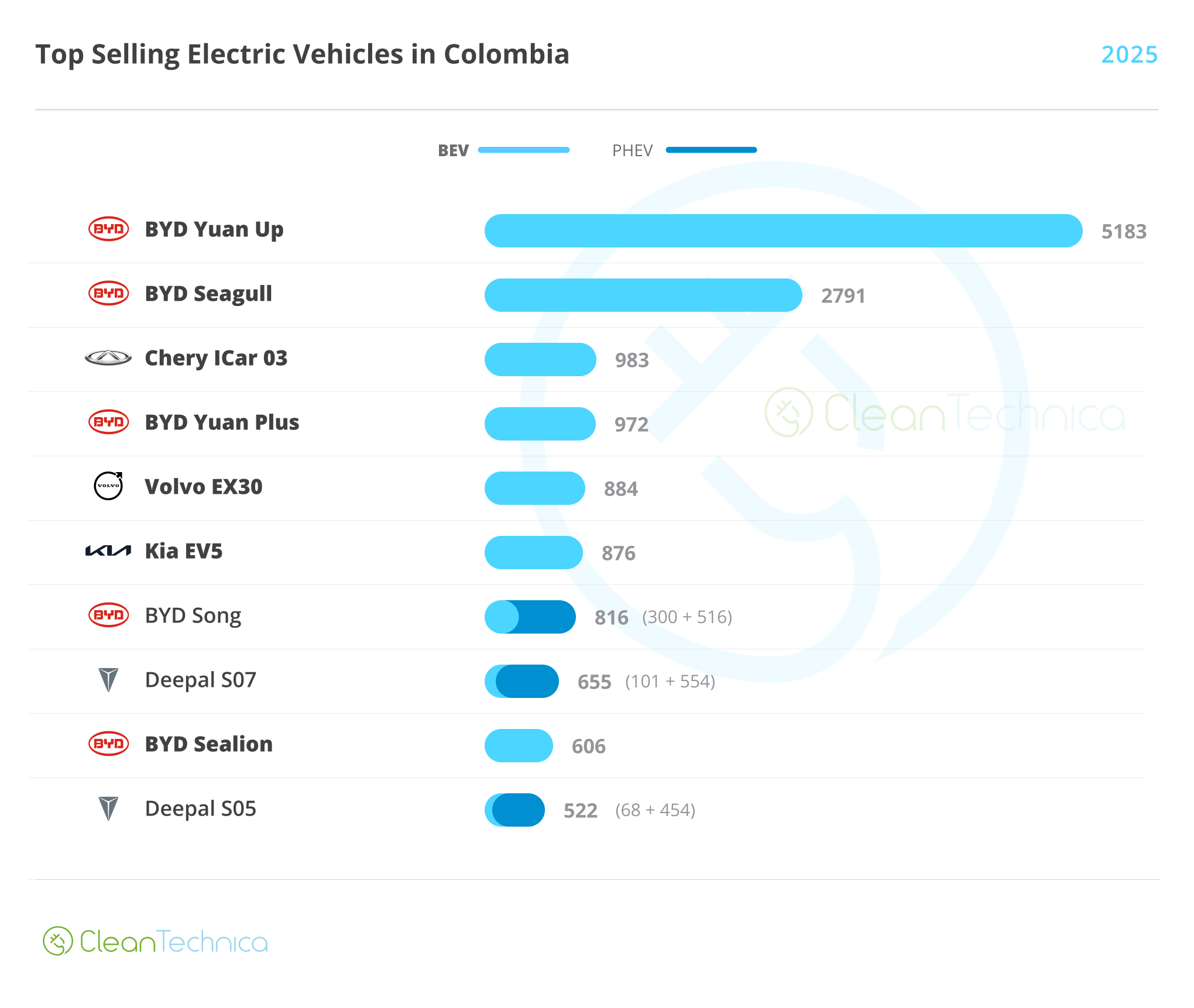

Unsurprisingly, the most-sold model in December was the BYD Yuan Up, followed by the BYD Seagull. In third place we find the Chery ICar 03, followed by yet another two BYD models (Song and Yuan Plus). In the second half of the table we find old leaders such as the Volvo EX30 as well as young contenders such as the Deepal S07 and S05 and the GAC Aion UT and Aion V.

Data source: https://zemo-la.com/

Data source: https://zemo-la.com/

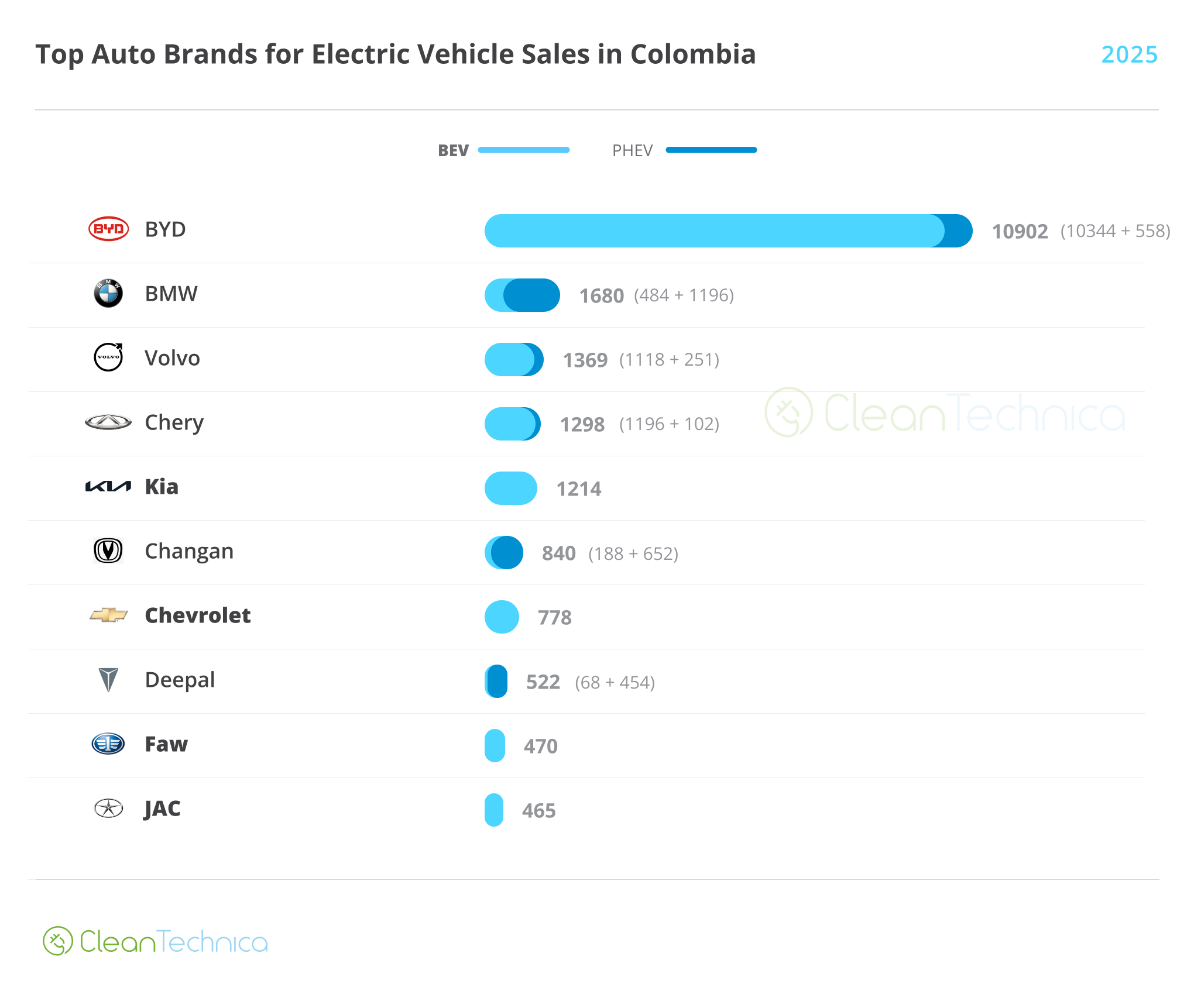

Through 2025, BYD keeps the gold (again with 47% market share), with BMW in second place and Volvo in third. The rising stars of Chery, Changan, and Deepal appear at #4, #6, and #8, whereas Legacy Auto has Kia at #5 and Chevrolet at #7.

Data source: https://zemo-la.com/

Data source: https://zemo-la.com/

Model-wise, we have the exact same podium (Yuan Up, Seagull, ICar 03), noting that the ICar 03 managed to get there despite only being available half of the year. Following come the BYD Yuan Plus and the Volvo EX30, with the now fading Kia EV5 in 6th position. Notable mentions for the aging BYD Song, which has gained popularity thanks to significant discounts on its new model; the Deepal S07 and S05; and the recently arrived BYD Sealion.

Data source: https://zemo-la.com/

Data source: https://zemo-la.com/

Final thoughts

It’s good to see EVs growing, but what we really want to see is combustion vehicles falling, and in this sense, Colombia’s market has brought good news since 2014. We’re significantly below the ICEV peak, and since I expect combustion-only powertrains to further decline in 2026, I think we can be certain those levels will never come back.

Has this impacted fuel consumption? Well, it’s hard to tell, as the market has been distorted by subsidies after the pandemic, which were lifted for gasoline in 2023 (resulting in 84 million fewer gallons being sold, -5%, between 2023 and 2025), but which remain for diesel (since a strike from truck owners led to the government backtracking on the phaseout). Consumption for diesel has thus risen by 126 million gallons between 2023–25, meaning overall road fuel consumption is still up, though by a mere 42 million gallons, or 1%, in the last 2 years. However, since at least part of this goes to cocaine processing, it may well be we’re pass “peak road fuel” in Colombia.

Yet not everything is good news. Colombia’s motorcycle segment is booming, with our country joining the “1 million club” this year after reaching that number of motorcycles sold through 2025, mostly from local production … and 99.5% of those were ICEVs. 4-wheeled vehicles are easily disrupted in our market since we have little industry to protect, but motorcycles are a tougher nut to crack, and since imports have focused on hyper-affordable light mopeds (which are not registered), the motorcycle market remains the last stronghold of the internal combustion engine. The good news is that motorcycles last much shorter than 4-wheelers, so once they electrify, the fleet should change much faster.

Charging stations are also lagging EV sales. It’s now imperative for new EV owners to have a solution to charge in their homes. Though, luckily, it’s becoming increasingly common to see installations in the parking spots under buildings (something extremely important since Colombia is a country of apartments). Travelling can also be a hassle, in particular during holidays, as I’ve personally nowseen 5 vehicles painfully waiting to use the only 50kW charger available at a charging station. Colombia’s government has no plans to publicly fund EV chargers, but the good news is that the private sector is reacting rapidly, but it’s natural that they will lag EV sales since this will mean higher utilization rates and, thus, better profits.

We’re still waiting for the impact that Tesla’s arrival will have on the market. On December 29th, a local outlet reported that the first Model 3 are already at Buenaventura’s port, and will likely be delivered in January, but we probably won’t know how the overall market behaves until March. My big hope is that Tesla will trigger yet another price war, this time one that will include ICEVs and HEVs, and that in the end, it’s only EVs that will be able to go down enough to compete, thus bringing forth an age of cleaner, greener transportation.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Advertisement

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy