Winning the global electric-vehicle race is costing BYDiBYDBYD Auto is a Chinese carmaker that became the world’s leading EV manufacturer in 2023, competing with Tesla for market share and global attention.READ MORE dearly.

The Chinese EV giant reported a 33% drop in profit for the period from July to September, marking its second consecutive quarter of declining earnings. The financial squeeze reveals a company caught between mounting domestic price wars and expensive overseas expansion plans.

BYD cut vehicle prices by as much as 30% in May to defend market share at home, while boosting research spending by 31% to fuel global ambitions. Experts expect the profit decline to continue, with no clear bottom in sight.

“BYD is now in a scale-before-profit phase internationally. … This inevitably weighs on margins,” Bill Russo, founder and CEO of Shanghai-based advisory firm Automobility Limited, told Rest of World.

The trend of BYD’s profit slump has not bottomed yet.”

The company has told investors it plans to flip its entire business model by 2030, targeting overseas sales to overtake revenue at home. That transformation depends on whether BYD can replicate its low-cost China manufacturing model in markets with different labor rules, regulations, and brand perceptions.

Rest of World broke down BYD’s financials, innovations, and public image in five charts to show where the world’s biggest EV seller stands as it bets on global expansion.

Profit

After more than three years of positive growth, BYD’s net profit has reversed course.

This was largely driven by the domestic price war, for which BYD is partly responsible, Zhang Xiang, an expert on the Chinese automotive industry, told Rest of World.

“The trend of BYD’s profit slump has not bottomed yet,” Zhang said.

BYD’s profit prospects may only improve after market consolidation occurs, signaled by smaller brands exiting en masse, he said. That would create space for larger carmakers such as BYD to set sustainable pricing for their vehicles.

Revenue

While BYD sold more cars than Tesla for the first time in the fourth quarter of 2023, it lagged in revenue. In 2024, BYD’s $107 billion in revenue had outpaced Tesla’s $97.7 billion.

BYD continued to lead through the first three quarters of 2025. Even though Tesla posted its highest quarterly revenue yet in the third quarter, it still trails BYD’s performance.

Unit Sales

BYD’s sales dropped toward the end of 2025.

Unit sales, driven largely by the domestic market, declined year on year for the first time in 18 months in September.

BYD slashed its annual sales target to 4.6 million vehicles from 5.5 million after the September drop, and the downward trend has continued through November.

Founder and chairperson Wang Chuanfu placed the blame on competitors catching up and eroding BYD’s technological edge.

Exports

BYD’s exports in terms of units almost doubled year on year through October 2025. The company’s global success hinges on adapting its cost model to local conditions, Russo said.

“If they can localize manufacturing and maintain price competitiveness without sacrificing quality, their long-term global profitability will recover strongly,” he said.

Overseas expansion remains a bright spot, with BYD targeting sales of as many as 1.6 million vehicles outside China next year. Brazil, Belgium, and Mexico ranked as its top export markets through October.

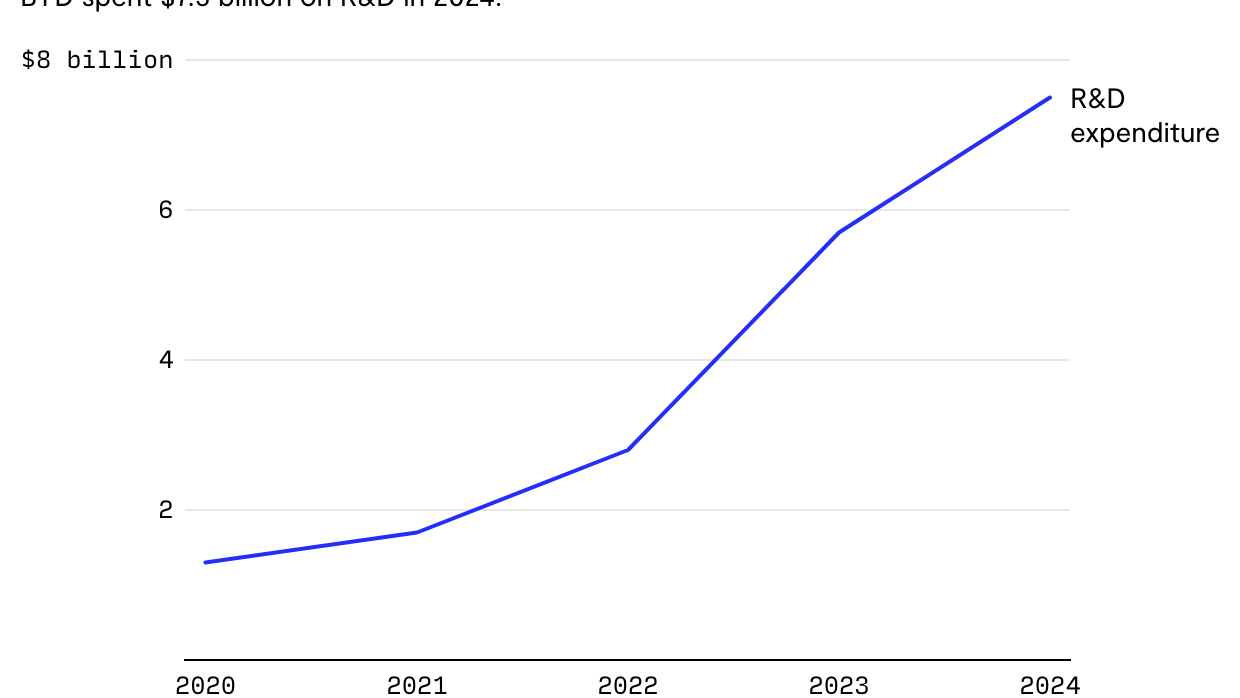

Research and development

BYD’s spending on research and development has surpassed the net profit of its parent company for at least the past four years, according to the company’s official records. BYD’s annual research budget has also exceeded that of Tesla since 2023.

Chairperson Wang told investors in December that BYD will continue heavy investment in research and development for the next two to three years, because “technology is the core competitive edge” of the company.

The spending also reflects BYD’s strategy of rapidly introducing a wide range of car models while expanding beyond vehicles into chips, software, and batteries, Zhang said.

“This is to dominate every aspect in the EV-making supply chain in the long run,” he said.