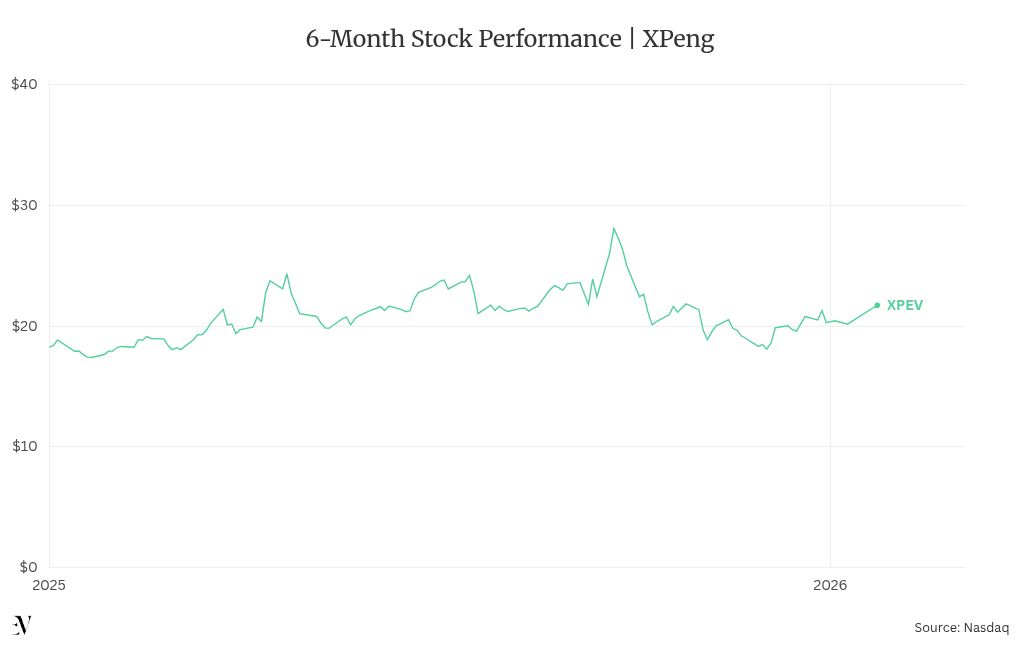

US-listed shares of the Chinese automaker XPeng jumped more than 9% on Monday, driven by progress in China-EU tariff negotiations, a major credit facility from one of China’s largest banks, and a leaked internal sales target and new model plans for 2026.

The stock rose as high as $21.99 in New York trading, up 9.3% from Friday’s close of $20.02.

XPeng shares have gained 84% over the past twelve months as both expansion and vehicle sales targets of 380,000 units were met.

EU Tariff Progress

Monday’s rally came hours after the European Commission published guidance for Chinese automakers seeking alternatives to countervailing duties through price undertaking offers — commitments to sell vehicles above minimum prices that could replace or reduce tariffs imposed last year.

XPeng faces a 20.7% countervailing duty on vehicles exported to the EU, on top of the bloc’s standard 10% import tariff, bringing total levies to 30.7%.

The European Union Chamber of Commerce in China endorsed what it called a “soft landing” in negotiations between Brussels and Beijing over electric vehicle tariffs.

The Chamber said resolving the dispute would “significantly boost market confidence” and “create a more stable and predictable environment for investment and operations in Europe by Chinese electric vehicle companies and related supply chain enterprises.”

XPeng has already moved to reduce its tariff exposure by signing an agreement with Magna Steyr to assemble vehicles in Austria.

Test production of the P7+ sedan was completed at the Graz facility earlier this month, with two other models being assembled at Magna’s plant.

ICBC Credit Line

Separately, XPeng announced Monday that it signed a strategic cooperation agreement with the Guangdong branch of Industrial and Commercial Bank of China (ICBC) to get a 10 billion yuan ($1.37 billion) credit line.

The funds will be earmarked for financing, international operations, and cash management.

Chairman and CEO He Xiaopeng said the company will continue to expand investment in Zhaoqing, where XPeng operates its first self-built vehicle manufacturing base globally.

The facility now produces one vehicle every 90 seconds, including the Mona M03 — the brand’s best-selling model.

He added that he expects the strategic partnership “to serve as a springboard to fuse finance and technology, jointly build a smart-mobility ecosystem, and support China’s self-reliant advancement in science and technology.”

2026 Sales Target

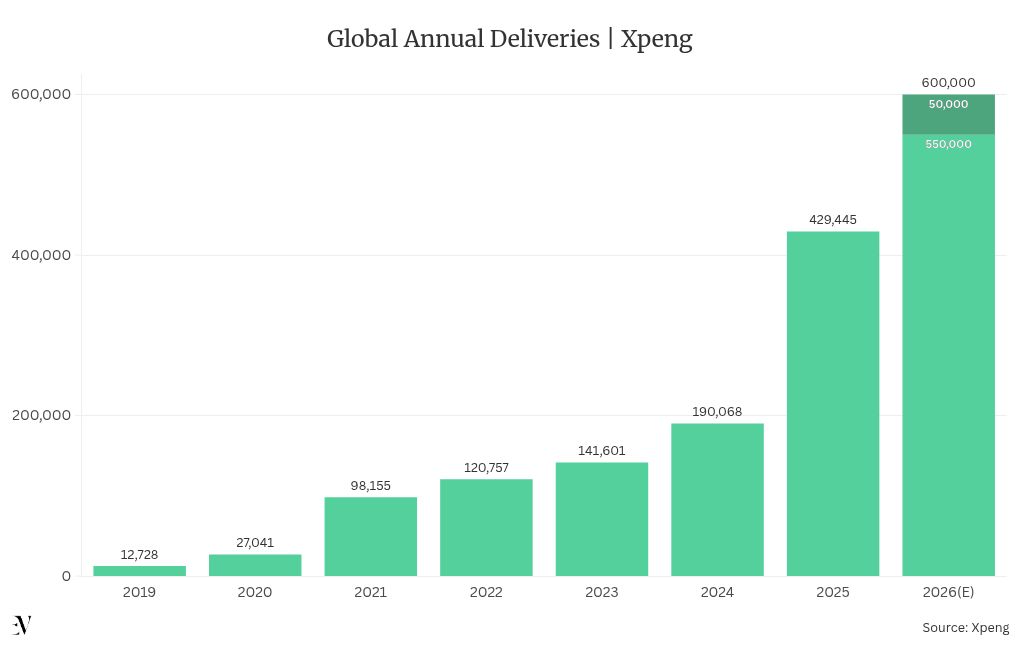

Adding to investor optimism, local media outlet 36Kr reported that XPeng is targeting between 550,000 and 600,000 vehicle deliveries globally in 2026 — a 28% to 40% increase from the 429,445 units delivered in 2025.

The guidance was communicated in an internal meeting on Monday, according to the report.

In early 2025, the company set a delivery goal of 380,000 vehicles, which it achieved in mid-November — one month ahead of schedule. Full-year deliveries ultimately exceeded the guidance by 13%.

New Models

The carmaker prepares to launch seven models this year, including extended-range variants of existing battery electric vehicles.

Last week, XPeng debuted the G7 extended-range SUV and unveiled the P7+ sedan internationally at an event where test production was completed at Magna Steyr’s Austrian facility.

According to 36Kr, XPeng plans to add two SUVs to its Mona series, which currently includes only the M03 sedan.

A full-size flagship SUV is also planned to compete with Li Auto’s L9 and Huawei-backed Aito M9, available in both fully electric and extended-range configurations.