Report Overview

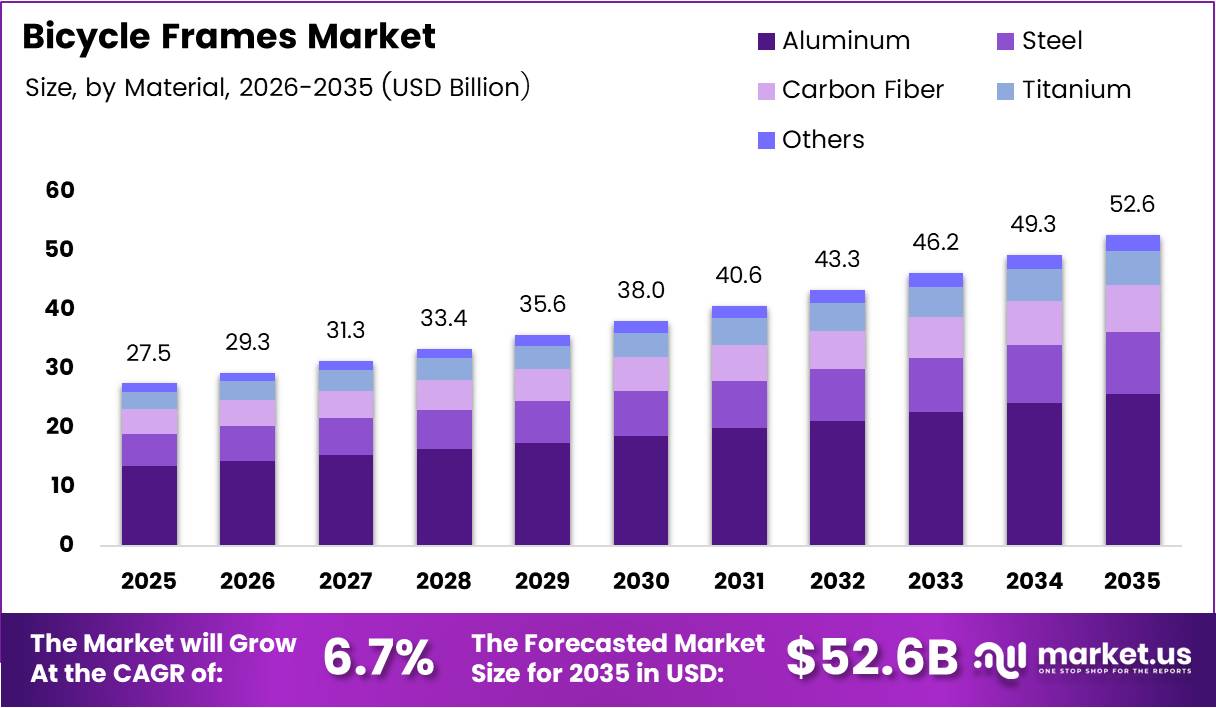

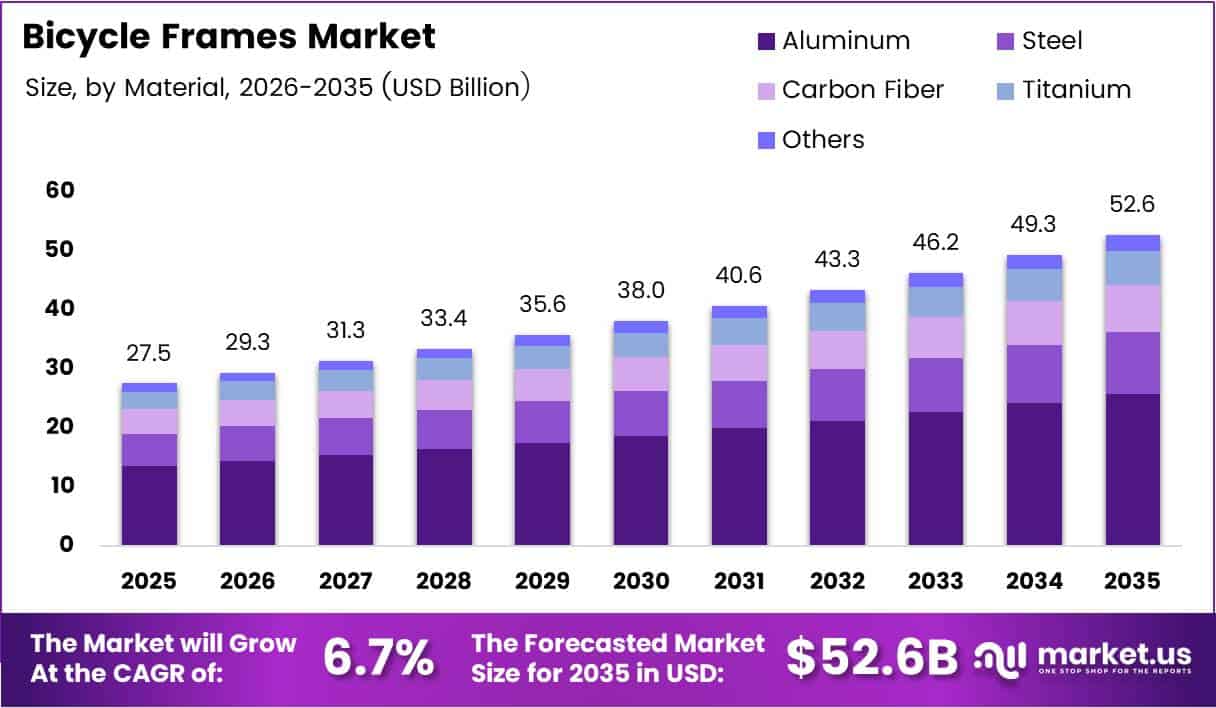

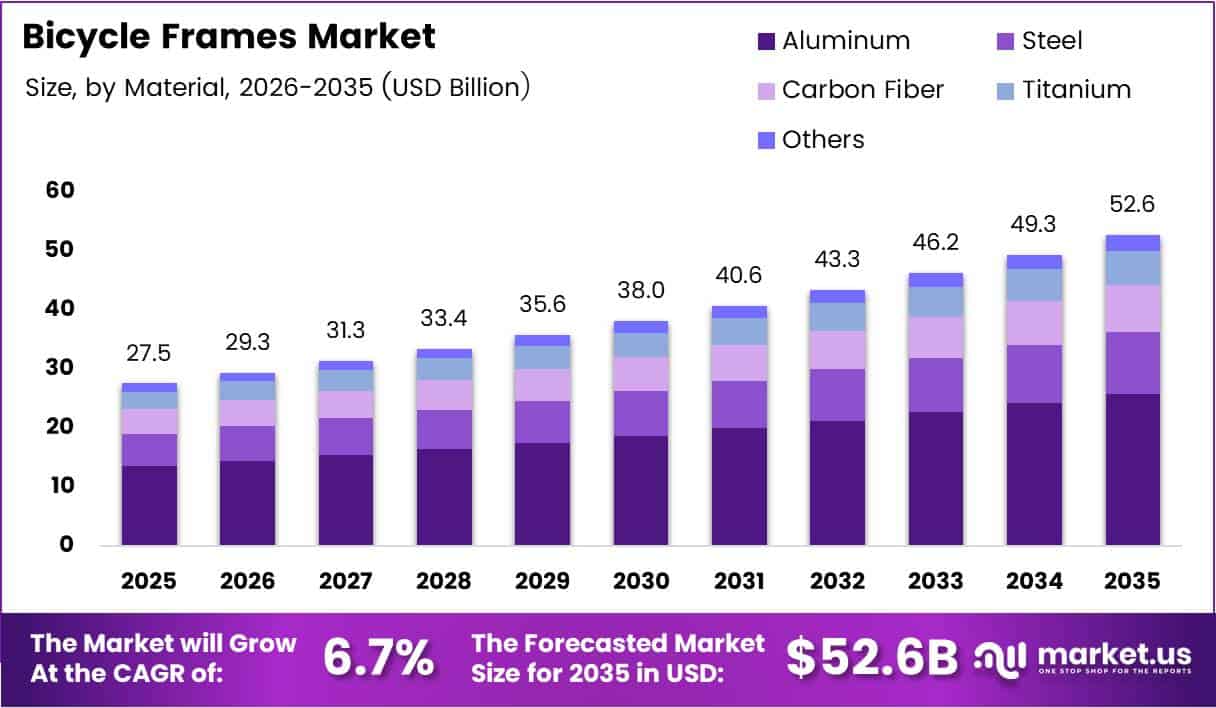

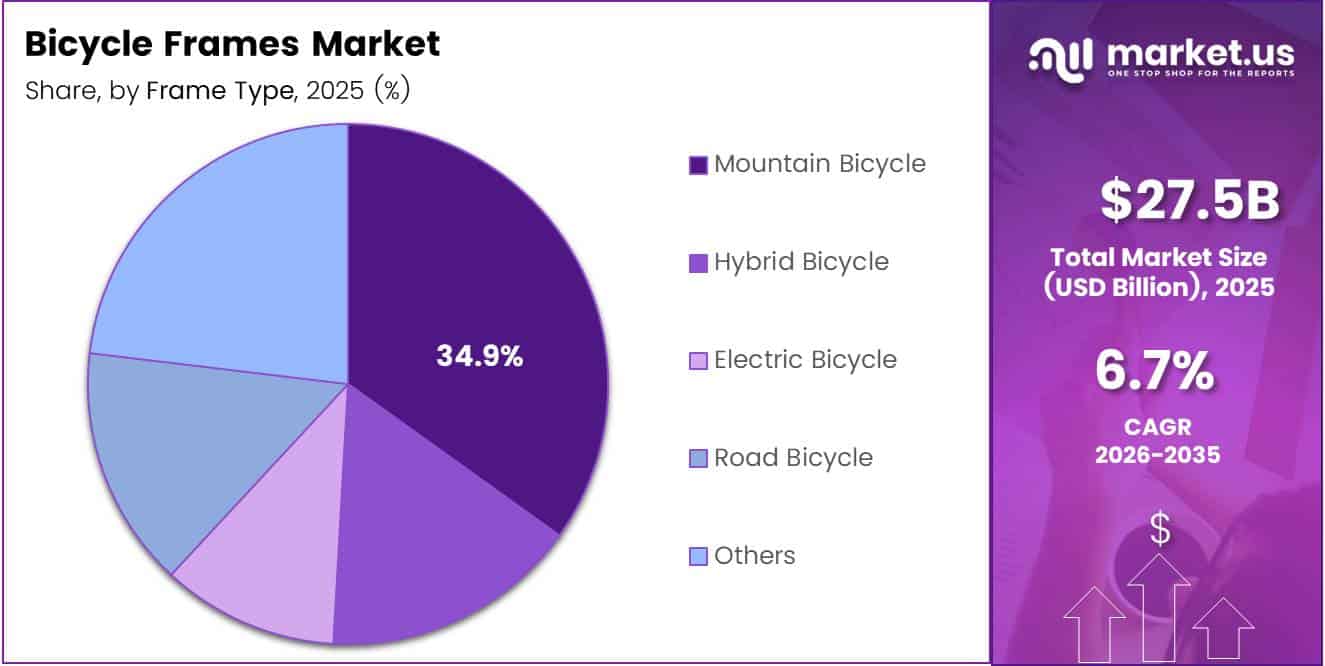

Global Bicycle Frames Market size is expected to reach approximately USD 52.6 Billion by 2035 from USD 27.5 Billion in 2025, expanding at a CAGR of 6.7% during the forecast period from 2026 to 2035. This substantial growth trajectory reflects evolving consumer preferences toward sustainable transportation and active lifestyle choices.

The global Bicycle Frames Market represents a dynamic segment within the broader cycling industry, encompassing the production and distribution of structural frameworks that form the core foundation of bicycles. These frames serve as the primary skeleton supporting all bicycle components including wheels, handlebars, pedals, and drivetrain systems. Market participants range from mass manufacturers supplying original equipment manufacturers to specialized artisans crafting custom performance solutions.

The market demonstrates remarkable momentum driven by urbanization trends and environmental consciousness. Cities worldwide are investing heavily in cycling infrastructure, creating dedicated bike lanes and parking facilities that encourage frame replacement and upgrades. Health-conscious consumers increasingly view cycling as a viable alternative to motorized commuting, stimulating demand across diverse frame categories.

Electric bicycle proliferation stands out as a transformative factor reshaping frame engineering requirements. Manufacturers are developing reinforced structures capable of supporting heavier battery systems and higher torque outputs. This technical evolution opens new revenue streams while challenging traditional frame design paradigms and material selection processes.

Government initiatives play a pivotal role in market expansion through bicycle-sharing programs and emission reduction targets. These policy frameworks generate bulk procurement opportunities while simultaneously boosting consumer awareness about cycling benefits. Regulatory standards governing frame safety and durability ensure consistent quality benchmarks across manufacturing operations.

Material innovation continues advancing with aluminum and carbon fiber dominating premium segments due to their superior strength-to-weight ratios. Meanwhile, steel maintains relevance in budget-conscious markets, and titanium attracts niche enthusiasts seeking ultimate performance characteristics. Customization trends are gaining traction as consumers seek personalized geometry and aesthetics tailored to individual riding styles.

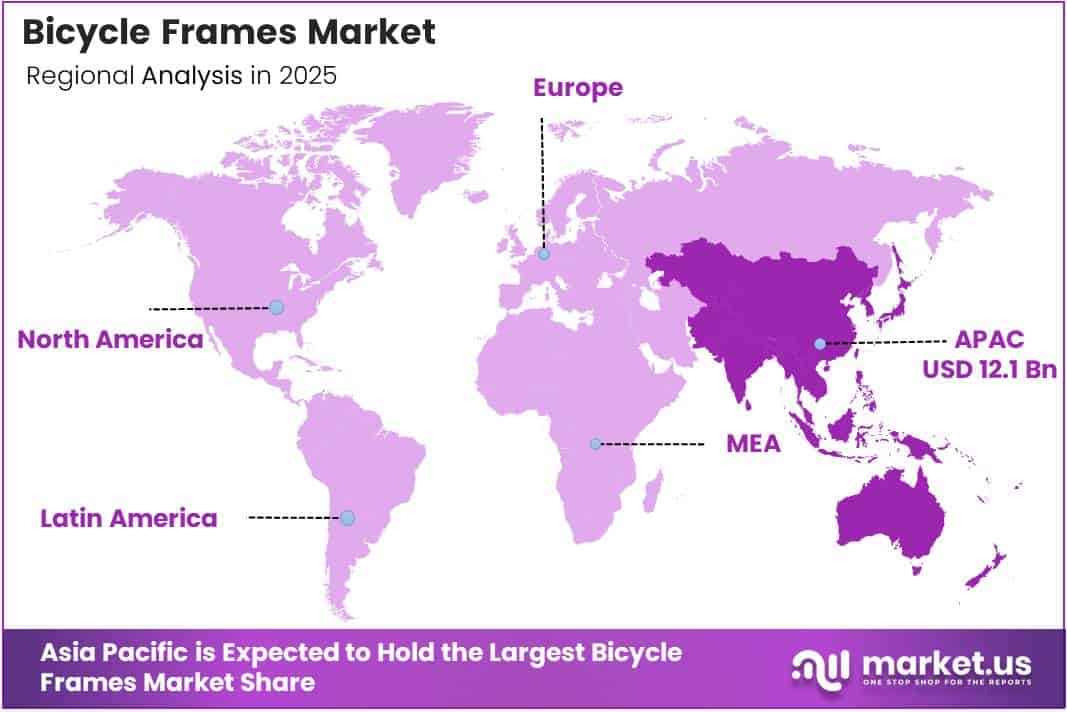

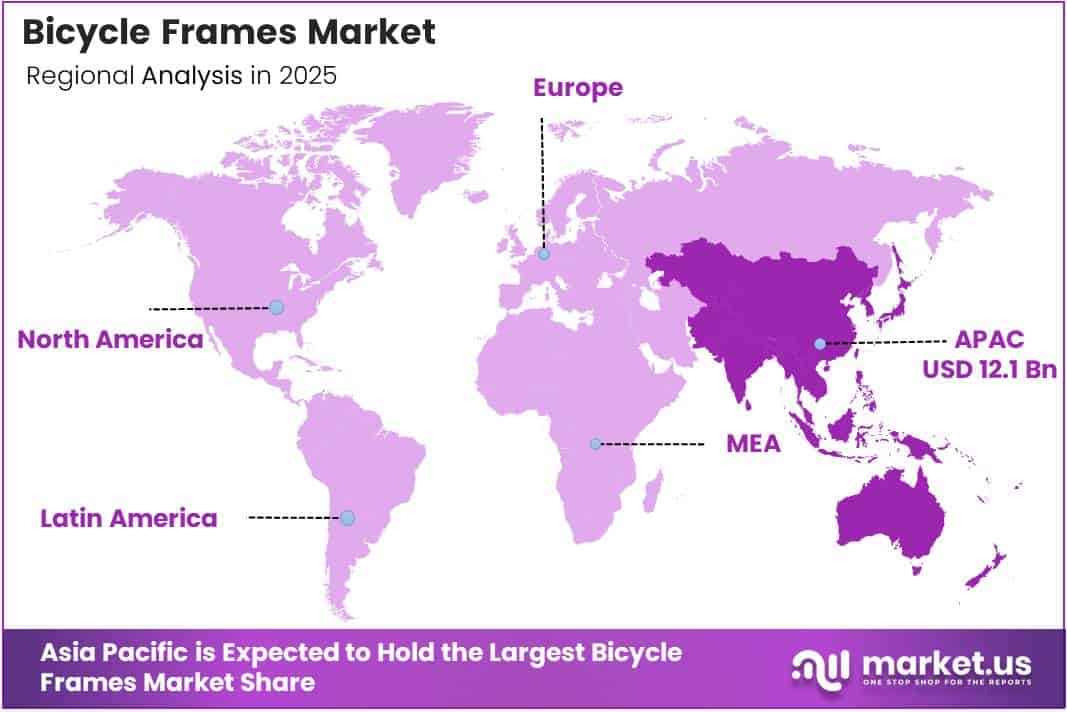

According to market analysis, Asia Pacific emerges as the dominant regional force with a 44.5% market share valued at USD 12.1 Billion, driven by robust manufacturing capabilities and large consumer populations. North America and Europe follow with strong demand for premium performance frames and growing e-bike adoption rates among commuters.

Key Takeaways

Global Bicycle Frames Market projected to grow from USD 27.5 Billion in 2025 to USD 52.6 Billion by 2035 at 6.7% CAGR

Asia Pacific dominates with 44.5% market share, valued at USD 12.1 Billion

Aluminum material segment leads with 48.7% market share driven by lightweight durability advantages

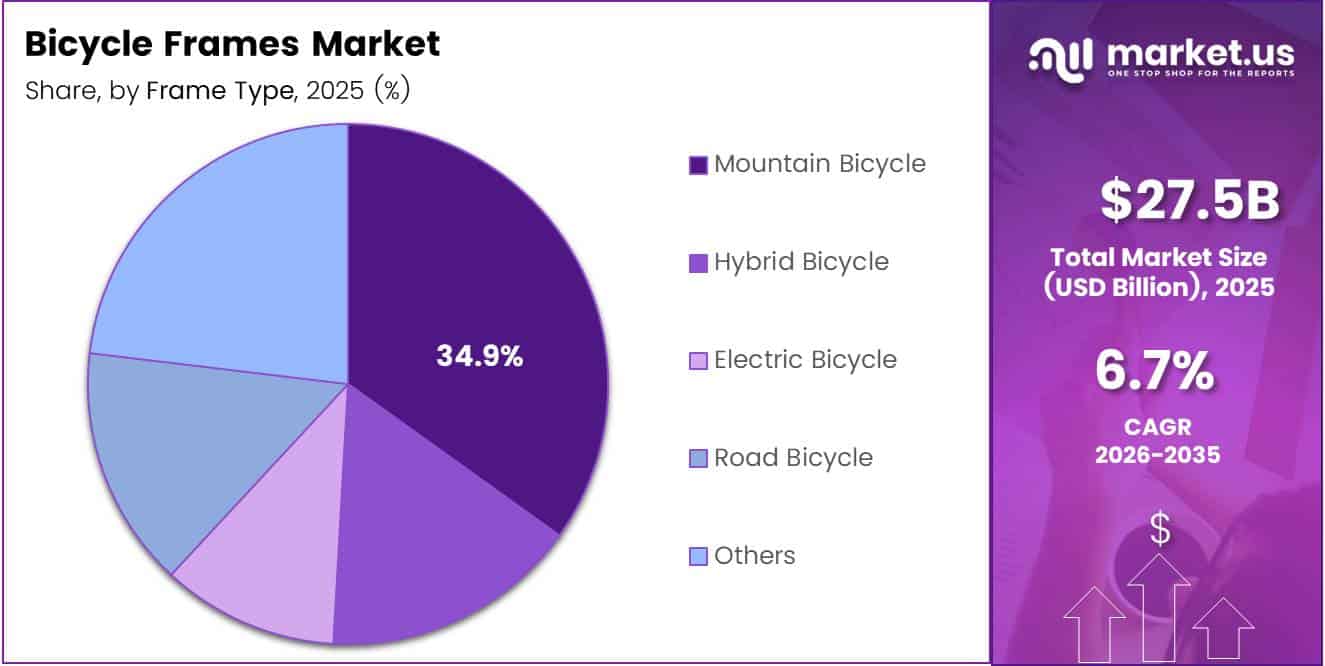

Mountain Bicycle frame type accounts for 34.9% share reflecting off-road cycling popularity

OEM distribution channel holds dominant 79.3% share in supply chain distribution

Offline sales channel commands 68.1% market share despite growing digital penetration

Material Analysis

Aluminum dominates with 48.7% market share due to its optimal balance of strength, weight, and affordability.

In 2025, Aluminum held a dominant market position in the By Material segment of Bicycle Frames Market, with a 48.7% share. This material continues leading due to its excellent corrosion resistance and formability characteristics that enable complex frame geometries. Manufacturers appreciate aluminum’s welding efficiency and lower production costs compared to exotic alternatives. The aerospace-grade aluminum alloys used in premium frames deliver exceptional stiffness-to-weight ratios, making them ideal for competitive cycling applications while remaining accessible to recreational riders.

Steel maintains steady demand across entry-level and heritage bicycle segments where durability outweighs weight considerations. This traditional material offers superior ride comfort through natural flex characteristics and remains the preferred choice for touring frames requiring load-bearing capacity. Steel’s easy repairability appeals to budget-conscious consumers and mechanics in developing markets. Custom frame builders continue utilizing chromoly steel for its predictable handling properties and timeless aesthetic appeal.

Carbon Fiber represents the premium segment attracting performance-oriented cyclists seeking ultimate weight reduction and vibration damping. Advanced composite layup techniques allow engineers to tune frame stiffness directionally, optimizing power transfer while maintaining compliance. Despite higher manufacturing costs, carbon fiber dominates professional racing applications and high-end consumer markets. The material’s design flexibility enables aerodynamic tube shaping impossible with metallic alternatives.

Titanium occupies a niche position valued for exceptional strength, corrosion immunity, and lifetime durability. This premium material commands higher prices justified by superior fatigue resistance and unique ride quality combining steel comfort with aluminum responsiveness. Titanium frames appeal to discerning enthusiasts willing to invest in long-term ownership. Others category includes emerging materials like bamboo and recycled composites gaining traction in sustainability-focused markets.

Frame Type Analysis

Mountain Bicycle frames dominate with 34.9% share driven by growing trail riding popularity and technical terrain demands.

In 2025, Mountain Bicycle held a dominant market position in the By Frame Type segment of Bicycle Frames Market, with a 34.9% share. These frames feature robust construction with suspension integration points designed to absorb impact forces during off-road riding. Geometry emphasizes stability and control through slacker head angles and longer wheelbases suited for descending steep trails. Manufacturers employ hydroformed tubing and butted construction techniques to balance strength requirements against weight constraints critical for climbing efficiency.

Hybrid Bicycle frames combine attributes from road and mountain categories, creating versatile platforms for urban commuting and recreational path riding. These frames typically utilize upright geometry for comfortable riding positions during extended city journeys. Mounting bosses accommodate fenders, racks, and kickstands transforming bikes into practical transportation tools. The segment benefits from growing car-alternative movements in metropolitan areas worldwide.

Electric Bicycle frames represent the fastest-growing segment requiring reinforced structures to support integrated battery systems and motor units. Engineers must accommodate additional weight while maintaining handling characteristics and ensuring proper weight distribution. Specialized cable routing conceals wiring while proprietary battery mounting systems integrate seamlessly into frame triangles. This category drives innovation in frame design as e-bike adoption accelerates globally.

Road Bicycle frames emphasize aerodynamics and lightweight construction for speed-focused applications including racing and long-distance riding. These frames feature aggressive geometry with steep angles and short wheelbases promoting responsive handling and efficient power transfer. Premium models incorporate wind-tunnel-tested tube profiles minimizing drag coefficients. Others category encompasses specialty frames for BMX, cargo bikes, and children’s bicycles serving distinct market niches.

Distribution Channel Analysis

OEM channel dominates with 79.3% share as bicycle manufacturers prioritize integrated supply chain partnerships.

In 2025, OEM held a dominant market position in the By Distribution Channel segment of Bicycle Frames Market, with a 79.3% share. Original Equipment Manufacturers maintain direct relationships with frame suppliers ensuring consistent quality standards and volume commitments. This channel enables just-in-time inventory management reducing warehousing costs while supporting rapid model year transitions. Large bicycle brands leverage OEM partnerships to secure proprietary frame designs and exclusive material specifications differentiating their product lines.

Aftermarket distribution serves replacement needs and custom build projects through independent retailers and direct-to-consumer channels. This segment caters to cycling enthusiasts upgrading damaged frames or pursuing bespoke geometry specifications unavailable through mass-market offerings. Aftermarket suppliers offer wider material choices and finishing options enabling personalization. The channel benefits from growing DIY bicycle building culture and frame refurbishment trends extending product lifecycles sustainably.

Sales Channel Analysis

Offline sales dominate with 68.1% share as consumers prioritize tactile evaluation and professional fitting services.

In 2025, Offline held a dominant market position in the By Sales Channel segment of Bicycle Frames Market, with a 68.1% share. Physical retail locations provide crucial touchpoints where customers assess frame quality through direct inspection and receive expert sizing recommendations. Bicycle shops offer test rides enabling buyers to evaluate handling characteristics before purchase commitments. In-person consultations address technical questions regarding material properties, geometry options, and component compatibility ensuring informed purchasing decisions.

Online sales channels gain momentum through improved product visualization technologies and comprehensive specification databases supporting remote purchasing decisions. Digital platforms expand consumer access to specialty frames unavailable in local markets while competitive pricing attracts value-conscious buyers. Enhanced return policies and virtual fitting tools reduce purchase anxiety associated with buying unseen products. The channel particularly resonates with experienced cyclists confident in their frame requirements and geometry preferences.

Key Market Segments

By Material

Aluminum

Steel

Carbon Fiber

Titanium

Others

By Frame Type

Mountain Bicycle

Hybrid Bicycle

Electric Bicycle

Road Bicycle

Others

By Distribution Channel

By Sales Channel

Drivers

Urban Cycling Infrastructure Expansion Increasing Demand for Lightweight and Durable Bicycle Frame Designs

Metropolitan areas worldwide are investing billions in dedicated cycling infrastructure creating safer commuting environments that encourage bicycle adoption. Protected bike lanes, secure parking facilities, and traffic-calming measures reduce barriers to cycling as daily transportation. These improvements stimulate frame purchases as casual riders upgrade to more suitable urban-specific designs. Infrastructure development signals long-term municipal commitment to cycling, boosting consumer confidence in bicycle investments.

Rising health consciousness drives commuter cycling adoption as professionals seek active transportation alternatives reducing sedentary lifestyles. Medical research highlighting cardiovascular benefits and mental health improvements from regular cycling encourages modal shift from automobiles. This trend generates replacement frame demand as entry-level riders progress to performance-oriented equipment. Employers increasingly provide cycling incentives and secure storage facilities further normalizing bicycle commuting.

E-bike production volumes surge globally as electric assistance technology democratizes cycling across age groups and fitness levels. Battery capacity improvements and motor efficiency gains expand practical riding ranges making e-bikes viable car replacements for longer commutes. Manufacturers require specialized reinforced frames accommodating electrical components and supporting higher speeds. This segment commands premium pricing supporting frame market value growth despite potential volume cannibalization from traditional bicycles.

Restraints

Volatile Aluminum and Carbon Fiber Raw Material Pricing Impacting Frame Manufacturing Costs

Global commodity markets experience significant aluminum price fluctuations driven by energy costs, trade policies, and production capacity constraints affecting frame manufacturing economics. Carbon fiber precursor availability remains concentrated among few suppliers creating vulnerability to supply disruptions and price manipulation. These input cost variations complicate pricing strategies and margin management for frame manufacturers operating on thin profit margins. Smaller producers lacking hedging capabilities face particular challenges maintaining competitive pricing during commodity spikes.

International trade barriers impose substantial import duties on complete bicycle frames limiting cross-border commerce and regional market integration. Protectionist policies favor domestic frame production while disadvantaging specialized overseas manufacturers with superior capabilities. These tariffs increase end-consumer prices reducing affordability and dampening demand growth particularly in price-sensitive markets. Complex customs classifications and origin determination requirements add administrative burden increasing transaction costs throughout supply chains.

Growth Factors

Government-Backed Bicycle Sharing Programs Creating Bulk Demand for Standardized Frame Platforms

Municipal bicycle-sharing systems deploy thousands of frames designed for durability and standardized maintenance protocols generating substantial bulk procurement contracts. These programs require rugged construction withstanding intensive daily use and weather exposure while minimizing maintenance intervals. Frame specifications emphasize commonality enabling efficient repair operations and parts interchangeability across large fleets. Sharing program expansions in developing markets represent significant growth opportunities for manufacturers capable of meeting volume and durability requirements.

Electric cargo bicycle adoption accelerates in logistics and delivery sectors as companies seek sustainable last-mile transportation solutions. These applications demand heavy-duty frames supporting payload capacities exceeding traditional bicycle specifications while maintaining maneuverability in urban environments. Frame development focuses on weight distribution optimization and structural reinforcement accommodating cargo boxes and extended wheelbases. The segment benefits from e-commerce growth and urban delivery zone restrictions favoring zero-emission vehicles.

Direct-to-consumer bicycle brands disrupt traditional distribution models by selling custom-geometry frames online eliminating retailer markups. These companies leverage modular frame architectures allowing size and component customization without bespoke manufacturing costs. Digital marketing and customer relationship management enable targeted marketing to niche cycling communities. The DTC model creates demand for flexible frame designs accommodating diverse customer specifications while maintaining production efficiency.

Emerging Trends

Adoption of Recycled Aluminum and Sustainable Composite Frame Materials

Environmental sustainability concerns drive manufacturers toward recycled aluminum sourcing reducing carbon footprints associated with primary metal production. Closed-loop recycling systems recover end-of-life frames reintroducing material into manufacturing streams without quality degradation. Bio-based composite resins and natural fiber reinforcements emerge as alternatives to petroleum-derived carbon fiber addressing fossil fuel dependency. These material innovations appeal to environmentally conscious consumers willing to support sustainable manufacturing practices.

Smart sensor mounting interfaces integrate into modern frame designs accommodating power meters, GPS devices, and performance monitoring systems. Internal cable routing conceals electronic wiring maintaining aesthetic cleanliness while protecting connections from environmental exposure. Manufacturers collaborate with electronics suppliers ensuring compatibility with emerging connectivity standards. This convergence of mechanical and digital technologies creates value-added frames commanding premium pricing in tech-savvy consumer segments.

Gravel and all-terrain bicycle geometry gains popularity as riders seek versatile platforms capable of road efficiency and off-road capability. These frames feature relaxed angles and increased tire clearances enabling exploration across varied surfaces. The trend reflects shifting recreational preferences toward adventure cycling and bikepacking activities. Manufacturers respond with dedicated gravel frame lines featuring unique geometry specifications and component mounting options.

Regional Analysis

Asia Pacific Dominates the Bicycle Frames Market with a Market Share of 44.5%, Valued at USD 12.1 Billion

Asia Pacific commands the global Bicycle Frames Market with a dominant 44.5% market share valued at USD 12.1 Billion, driven by concentrated manufacturing capabilities in China, Taiwan, and Vietnam. The region benefits from established supply chains, skilled labor forces, and proximity to raw material sources enabling cost-competitive production. Domestic demand surges across India and Southeast Asian nations as urbanization accelerates and middle-class populations expand. Government initiatives promoting cycling infrastructure and environmental policies favoring non-motorized transport further stimulate regional market growth.

North America Bicycle Frames Market Trends

North America demonstrates strong demand for premium performance frames and rapid e-bike adoption among urban commuters and recreational riders. The region’s mature cycling culture supports aftermarket customization and frequent upgrade cycles driving replacement sales. Environmental consciousness and health trends encourage modal shifts toward cycling particularly in metropolitan areas implementing Vision Zero traffic safety programs. Domestic manufacturing experiences resurgence as brands seek supply chain resilience and promote local production narratives.

Europe Bicycle Frames Market Trends

Europe maintains sophisticated cycling infrastructure and cultural traditions supporting robust frame demand across utility, sport, and leisure applications. Northern European markets lead in e-bike penetration rates with cycling integrated into daily transportation routines. Regulatory frameworks mandating emission reductions accelerate bicycle adoption as urban planning prioritizes sustainable mobility solutions. The region supports thriving custom frame building communities serving discerning enthusiasts seeking artisanal craftsmanship and bespoke geometry.

Middle East and Africa Bicycle Frames Market Trends

Middle East and Africa represents an emerging market with growing recreational cycling interest and nascent urban cycling infrastructure development. Oil-producing nations diversify transportation options as part of economic transformation initiatives while African markets benefit from bicycle’s role in affordable rural transportation. Youth populations embrace cycling culture influenced by global trends though infrastructure limitations constrain mass adoption. International development programs support bicycle distribution initiatives addressing transportation poverty in underserved communities.

Latin America Bicycle Frames Market Trends

Latin America experiences gradual market expansion driven by urbanization, traffic congestion, and growing environmental awareness in major cities. Brazil and Mexico lead regional demand with established manufacturing presence and large urban populations. Economic volatility and currency fluctuations create challenges for premium frame imports though domestic production capacity continues developing. Bicycle-sharing programs and cycling advocacy groups promote infrastructure improvements encouraging broader cycling adoption across socioeconomic segments.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Bicycle Frames Company Insights

Giant Manufacturing Co Ltd. stands as the world’s largest bicycle manufacturer leveraging vertically integrated operations spanning frame production through finished bicycle assembly. The Taiwan-based company operates global manufacturing facilities ensuring supply chain resilience and regional market responsiveness.

Giant’s engineering capabilities encompass advanced composite layup techniques and proprietary aluminum forming processes delivering performance frames across price segments. Their direct retail presence combined with OEM supply relationships creates diversified revenue streams while extensive R&D investments maintain technological leadership in frame innovation.

Specialized Bicycle Components Inc. exemplifies premium brand positioning through continuous frame technology innovation and professional racing heritage. The California-based company pioneered numerous frame design advancements including rider-first engineering methodology optimizing performance across size ranges.

Specialized maintains proprietary material specifications and wind tunnel testing facilities ensuring competitive advantages in aerodynamics and weight reduction. Their vertical integration in carbon fiber production controls quality while direct-to-consumer initiatives complement traditional dealer networks expanding market reach.

SCOTT Sports SA delivers Swiss engineering precision in frame design emphasizing lightweight construction and technical innovation across mountain and road categories. The company’s motorsports heritage influences frame development philosophy prioritizing performance optimization through computational analysis and materials science.

Scott maintains strong presence in European markets while expanding Asian distribution through strategic partnerships. Their sponsored athlete programs generate valuable product development feedback while competitive success validates frame technology credibility among performance-oriented consumers.

Cicli Pinarello SRL represents Italian craftsmanship excellence with heritage dating back decades focusing on premium road racing frames. The company’s asymmetric frame design philosophy addresses differential force vectors during pedaling optimizing structural efficiency.

Pinarello’s collaboration with professional cycling teams provides real-world testing environments informing continuous design refinement. Their limited production volumes maintain exclusivity while commanding premium pricing justified by handcrafted quality and competitive pedigree reinforcing luxury brand positioning.

Key Market Players

Advanced International Multitech Co. Ltd.

Topkey Corporation

Dengfu Sports Equipment Co. Ltd.

Ideal Bike Corporation

Giant Manufacturing Co Ltd.

Cicli Pinarello SRL

Quest Composite Technology Corporation

Specialized Bicycle Components Inc.

SCOTT Sports SA

Velocite Tech Co Ltd.

Recent Developments

In October 2024, Specialized launched the all-new Vado SL 2 Carbon e-bike featuring an ultralight carbon frame designed for urban commuting and fitness riding, demonstrating continued innovation in electric bicycle frame engineering.

In November 2025, Upway secured a $60 million Series C funding round led by A.P. Moller Holding to expand refurbished e-bike operations across the U.S. and Europe, highlighting growing investor confidence in sustainable bicycle markets.

In March 2025, Rivian spun out its micromobility business as a new company called Also, Inc. focused on small electric vehicles, signaling automotive industry recognition of cycling market opportunities.

In October 2025, the Rivian spinoff Also unveiled its first e-bike model (TM-B) and quad vehicles targeting utility and commuting segments, expanding electric frame applications beyond traditional bicycle categories.

In December 2025, Belgian e-bike maker Cowboy was acquired by ReBirth Group Holding, accompanied by €15 million in fresh investment toward restarting production after operational challenges, reflecting consolidation trends in competitive e-bike markets.

Report Scope