Introduction

The global automotive industry is undergoing its most transformative phase in over a century. Rising environmental concerns, tightening emission regulations, and shifting consumer preferences are accelerating the adoption of cleaner mobility solutions. Among the various electrification pathways, Plug-in Hybrid Electric Vehicles (PHEVs) have emerged as a powerful bridge between traditional internal combustion engine vehicles and fully electric cars. By combining electric-only driving capability with the flexibility of a conventional engine, PHEVs offer a pragmatic solution for consumers who seek lower emissions without sacrificing range or convenience.

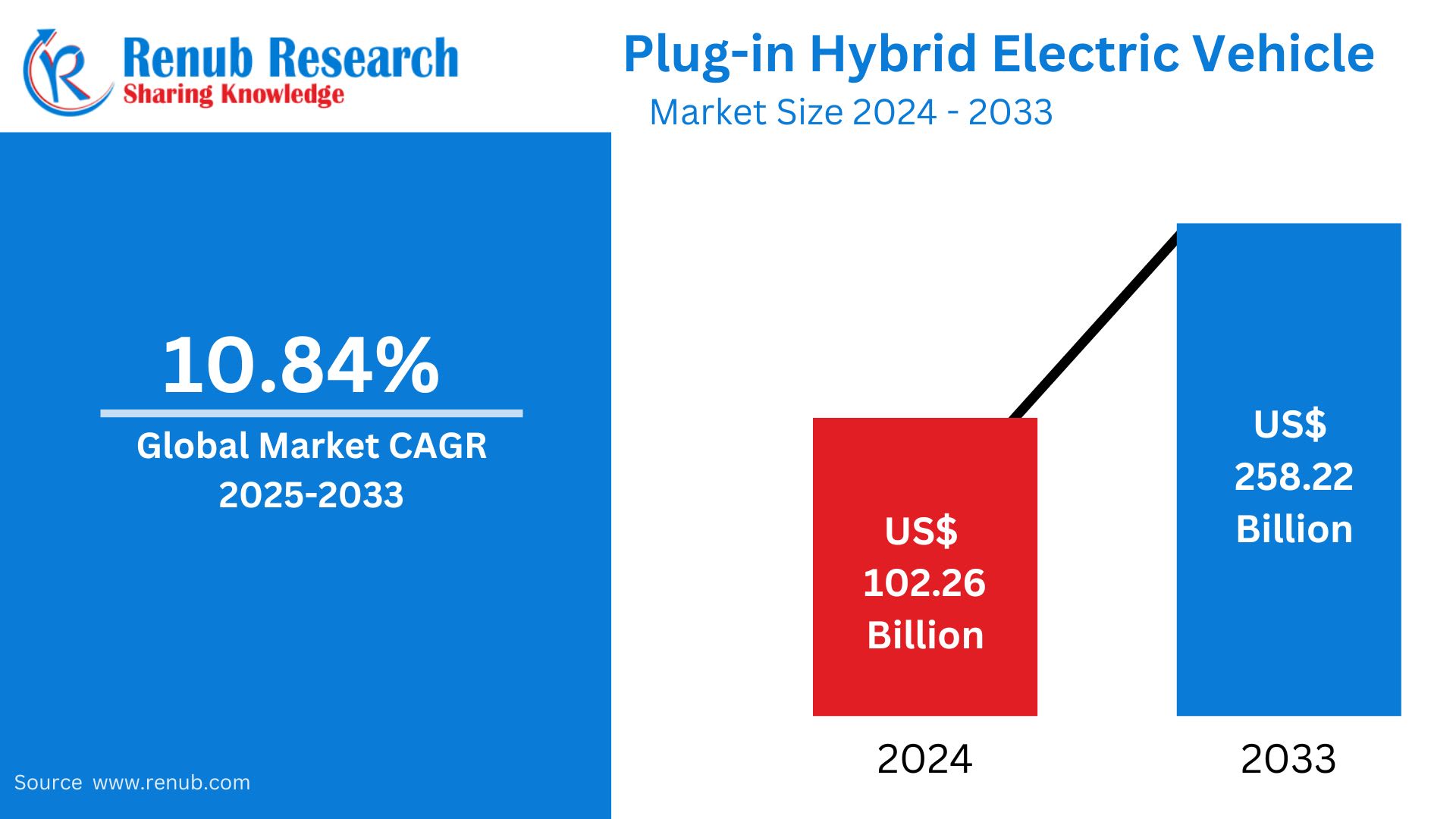

According to Renub Research, the international market for Plug-in Hybrid Electric Vehicles was valued at US$ 102.26 billion in 2024. It is projected to expand at a compound annual growth rate (CAGR) of 10.84% from 2025 to 2033, reaching an estimated US$ 258.22 billion by 2033. This robust growth highlights the increasing importance of PHEVs in the global transition toward sustainable transportation.

Understanding the Plug-in Hybrid Electric Vehicle Market

A Plug-in Hybrid Electric Vehicle integrates three key components: an internal combustion engine, an electric motor, and a rechargeable battery that can be charged externally. This dual-power system enables short-distance travel in fully electric mode while seamlessly switching to hybrid operation when the battery depletes. Compared to conventional vehicles, PHEVs significantly reduce fuel consumption and greenhouse gas emissions. At the same time, they provide longer driving ranges and greater flexibility than fully electric vehicles, particularly in regions with limited charging infrastructure.

As governments and automakers seek scalable decarbonization strategies, PHEVs have positioned themselves as an intermediate technology—supporting emission reductions today while paving the way for full electrification in the future.

Market Size and Forecast: Renub Research Perspective

Renub Research estimates that the global PHEV market will grow from US$ 102.26 billion in 2024 to approximately US$ 258.22 billion by 2033. This expansion reflects the convergence of multiple growth drivers:

Rising fuel prices pushing consumers toward energy-efficient alternatives

Stringent emission standards across Europe, North America, and Asia-Pacific

Government incentives, tax rebates, and subsidies for low-emission vehicles

Technological advancements in batteries and power management systems

With a projected CAGR of 10.84% between 2025 and 2033, PHEVs are expected to remain a critical segment within the broader electric mobility ecosystem.

Key Market Drivers

1. Environmental Regulations and Emission Standards

Governments worldwide are tightening regulations to combat climate change and urban air pollution. Policies such as the European Union’s CO₂ fleet targets and China’s New Energy Vehicle mandates have accelerated demand for low-emission vehicles. PHEVs provide automakers with a practical means of complying with regulations while maintaining market competitiveness.

2. Government Incentives and Fiscal Support

Subsidies, reduced registration fees, tax credits, and preferential access to low-emission zones are encouraging consumers to adopt PHEVs. These incentives lower the total cost of ownership, making plug-in hybrids attractive in both developed and emerging markets.

3. Technological Advancements

Improvements in battery energy density, power electronics, and regenerative braking systems have enhanced electric-only range and driving performance. Modern PHEVs now offer seamless transitions between electric and hybrid modes, improving user experience and operational efficiency.

4. Infrastructure Limitations for Full EVs

While fully electric vehicles continue to gain traction, charging infrastructure remains uneven across regions. PHEVs address this gap by offering electric driving for daily commutes while retaining gasoline engines for long-distance travel, making them a preferred choice for consumers in semi-urban and developing markets.

Top Companies in the Plug-in Hybrid Electric Vehicle Industry

Leading automakers are aggressively expanding their PHEV portfolios:

Tesla – A global pioneer in electric mobility with vertically integrated energy solutions.

BMW Group – Combining premium engineering with innovative electrification strategies.

BYD Company Ltd. – A dominant force in battery technology and new energy vehicles.

Ford Motor Company – Expanding hybrid and electric offerings across passenger and commercial segments.

General Motors Company – Driving electrification through a diverse global brand portfolio and next-generation platforms.

These companies are shaping the competitive landscape through investments in R&D, manufacturing capacity, and strategic partnerships.

SWOT Analysis of the Plug-in Hybrid Electric Vehicle Market

Volkswagen Group

Strength – Manufacturing Scale and Modular Electrification

Volkswagen’s modular platforms, such as MEB and MQB, allow rapid deployment of PHEV variants across brands including Audi, Škoda, and SEAT. This architecture reduces development costs, accelerates time-to-market, and strengthens supply chain efficiency.

Opportunity – Expansion in Emerging Electrification Markets

In Asia, Latin America, and Eastern Europe, where charging infrastructure is still developing, PHEVs serve as a transitional solution. By localizing production and offering affordable models, Volkswagen can secure early market leadership and build future EV adoption pipelines.

Hyundai Motor Company

Strength – Advanced Hybrid Technology and Product Diversity

Hyundai’s extensive hybrid expertise, combined with a broad product range spanning sedans, SUVs, and luxury vehicles, enables it to serve diverse customer segments. Its reputation for reliability and value enhances consumer confidence in PHEVs.

Opportunity – Growth in Government-Supported Green Mobility Markets

With supportive policies across Europe, North America, and parts of Asia, Hyundai can leverage incentives and partnerships to scale PHEV production, strengthen charging networks, and align with national decarbonization strategies.

Sustainability Analysis: Mitsubishi Motors Corporation

Mitsubishi Motors Corporation exemplifies how sustainability is becoming central to corporate strategy in the PHEV market. Through its Environmental Plan 2030, Mitsubishi aims to reduce CO₂ emissions across both vehicle lifecycles and manufacturing operations. The Outlander PHEV, one of the world’s earliest mass-produced plug-in hybrid SUVs, underscores the company’s leadership in electrified mobility.

Mitsubishi integrates renewable energy sources into its production facilities, improves energy efficiency, and implements waste reduction and water conservation measures. Its investments in battery recycling and circular economy initiatives further enhance environmental stewardship. Beyond environmental goals, Mitsubishi emphasizes ethical governance, responsible supply chains, and workforce diversity, positioning itself as a socially responsible automaker in the global transition to sustainable mobility.

Recent Developments in the Plug-in Hybrid Electric Vehicle Industry

February 2025: Mercedes-Benz introduced a plug-in hybrid variant of its compact GLC model, the GLC 350e 4MATIC, featuring a 24.8 kWh battery and advanced hybrid powertrain for enhanced efficiency and performance.

June 2022: Honda Motor (China) Investment Co., Ltd. began construction of a new EV manufacturing plant to strengthen electrification capabilities in China.

May 2022: Nissan collaborated with British adventurer Chris Ramsey on a historic all-electric expedition from the North Pole to the South Pole, demonstrating innovation and commitment to sustainable mobility.

These developments highlight the industry’s focus on innovation, capacity expansion, and brand leadership in clean transportation.

Market Structure and Competitive Landscape

The PHEV market is characterized by intense competition among established automakers and emerging electric vehicle specialists. Strategic initiatives shaping the market include:

Mergers and Acquisitions: Companies are acquiring battery manufacturers and software firms to secure critical technologies.

Partnerships: Collaborations with charging infrastructure providers and energy companies are strengthening ecosystem integration.

Investments: Heavy capital expenditure in R&D, production facilities, and digital platforms is accelerating innovation.

As competition intensifies, differentiation increasingly depends on battery performance, software integration, driving range, sustainability credentials, and customer experience.

Company Analysis Framework

To evaluate competitive positioning, market participants are assessed across multiple dimensions:

Market & Forecast Analysis

Historical growth trends

Regional performance patterns

Long-term forecast outlook

Market Share Analysis

Global and regional market leadership

Brand-specific performance metrics

Company Profiles

Corporate history and mission

Business models and operations

Workforce, executive leadership, and governance structures

Strategic Activities

Mergers and acquisitions

Partnerships and investments

Product launches and technological innovation

Sustainability Assessment

Renewable energy adoption

Energy-efficient infrastructure

Water conservation and waste management

Circular economy and recycling initiatives

Product and Revenue Analysis

Product pipelines and benchmarking

Quality standards and compliance

Revenue segmentation and growth strategies

This framework is applied to major players including Tesla, BMW Group, BYD, Mercedes-Benz Group, Ford, GM, Nissan, Toyota, Volkswagen, Hyundai, Honda, Volvo, Mitsubishi, Audi, Porsche, Kia, Renault, Chery, and Stellantis.

Regional Outlook

Europe remains a leader in PHEV adoption due to strict emission norms and strong incentive programs.

North America shows increasing demand driven by fuel efficiency concerns and expanding hybrid offerings from domestic manufacturers.

Asia-Pacific, particularly China and Japan, is experiencing rapid growth as governments prioritize electrification and automakers invest in local production.

Emerging Markets are adopting PHEVs as a practical alternative to full electrification, benefiting from lower infrastructure requirements.

Future Outlook

Looking ahead, the PHEV market is expected to play a critical role in the automotive industry’s electrification roadmap. While fully electric vehicles will continue gaining momentum, PHEVs will remain essential in bridging infrastructure gaps, supporting regulatory compliance, and meeting diverse consumer needs.

Advances in battery technology, integration of artificial intelligence in energy management systems, and increased investments in sustainable manufacturing will further enhance the appeal of plug-in hybrids. Moreover, as automakers align their strategies with global net-zero targets, PHEVs will serve as a cornerstone of transitional mobility.

Final Thoughts

The Plug-in Hybrid Electric Vehicle market stands at the intersection of innovation, sustainability, and practicality. With Renub Research projecting growth from US$ 102.26 billion in 2024 to US$ 258.22 billion by 2033, PHEVs are set to become an indispensable component of the global automotive ecosystem. They offer consumers an environmentally responsible alternative without compromising convenience, while providing manufacturers with a scalable path toward full electrification.

As governments, corporations, and consumers collectively move toward a low-carbon future, plug-in hybrid vehicles will continue to bridge the gap between today’s mobility needs and tomorrow’s sustainable transportation vision—making them not just a transitional technology, but a strategic enabler of the electric revolution.