The fact that the penetration rate of new energy vehicle sales has exceeded 50% is still just a superficial phenomenon. The new energy vehicle industry in China completed a crucial leap in 2025.

In 2025, the rules of the game in the Chinese automobile market were rewritten once again. Looking back on it years later, this might be the “Nokia moment” of the automobile market: the fact that the penetration rate of new energy vehicle sales has exceeded 50% is still just a superficial phenomenon. The deeper change lies in the fact that a test drive of a smart electric vehicle can make fuel vehicle owners “never go back to the past”.

This market experiences a “reshuffle period” every year, but the hand that reshuffles has changed. With a 50% penetration rate as the dividing line, the savage growth manifested in the form of “price wars” has become a thing of the past, replaced by “value wars”. The industry has officially shifted from being “policy-driven” to “product-driven”, and completed the reconstruction of the competition logic in the process of technological breakthroughs, global layout, and improvement of profitability.

From the early stage of “helping get on the horse and seeing off on the journey” to the current stage of “drawing red lines and pointing out directions”, policy guidance has steered the new energy market from “savage growth” to “high-quality development”. The players have tacitly stopped the involution and upgraded from “trading price for volume” to “value competition”. As foreign capital cedes the dominance of joint-venture brands, the competition pattern between new forces and traditional brands has been quietly reshaped, and the scale of exports continues to grow, seeking new increments from new territories.

We should make global car owners “never go back to the past”.

Fuel Vehicles Retreat, Electric Vehicles Advance, Ranking First Globally

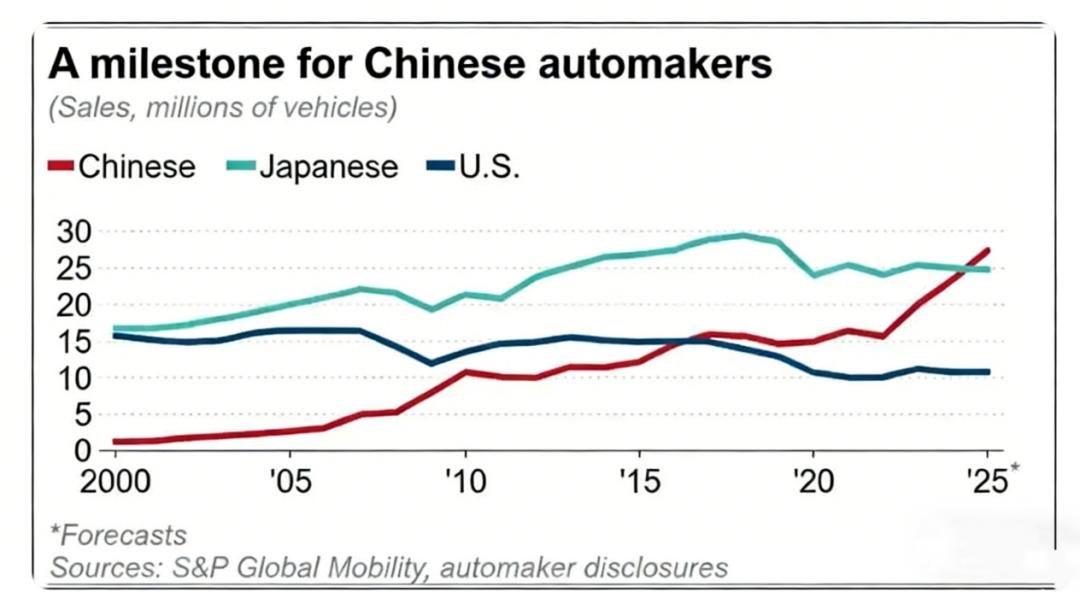

According to data released by Nikkei on December 30, 2025, Chinese automobile manufacturers will achieve an annual global sales volume of 27 million vehicles, topping the global new car sales list for the first time.

In 2023, Chinese automakers surpassed Japanese automakers and became the world’s largest automobile exporter for the first time. This time, China has become the global champion in total automobile sales, and the structural changes in the domestic market are self-evident. Surpassing Japan twice and achieving two global number – one rankings have brought an end to the era of traditional fuel vehicles dominated by Japanese automakers.

In the new era of new energy and intelligent vehicles led by China, China is not only the largest exporter but also one of the core markets, contributing about 70% of the sales volume of local automakers. In the domestic automobile market, the sales volume of new energy vehicles has approached 60%.

In 2020, the retail penetration rate of new energy vehicles in the narrow – sense passenger car market in China was only 5.8%. In 2021 – 2024, it was 14.8%, 27.6%, 35.7%, and 47.6% respectively. The amplitude of the leap is astonishing, and the rapidly changing figures have given a strong sense of epic to the development context of the industry.

According to data from the Passenger Car Association, from January to November 2025, the retail penetration rate of new energy vehicles reached 53.6%, remaining above 50% for nine consecutive months since March. In November, it soared to a high of 59.5%, and the annual penetration rate is expected to reach 54.0%. From December 1st to 28th, the retail penetration rate of new energy vehicles in the national passenger car market reached 61.8%.

In just five years, new energy vehicles have completed a fundamental transformation from “niche consumer goods” to “mainstream choices”. The increase in penetration rate is the result of the long – term resonance of four major factors: policy, technology, infrastructure, and market demand.

On the policy front, although the purchase subsidy officially ended in 2023, the policy of exempting new energy vehicles from purchase tax was extended until the last day of 2025, directly saving consumers 10,000 – 30,000 yuan in car – buying costs. At the same time, measures such as subsidies for trade – ins, interest subsidies for personal consumer loans, and the promotion of new energy vehicles in rural areas have further reduced consumers’ car – buying costs. At the local level, support policies are formulated with the core of “precision and differentiation”, driving the market from aspects such as subsidies, infrastructure, and road rights.

The top – down support policies are being refined based on the bottom – up feedback of market data. Then the visible hand has begun to shift from strong promotion to directional regulation.

On the technology front, 2025 was a year of explosive development in new energy vehicle technology. Existing automakers have entered a stage where core technologies serve as competitive barriers. The accelerated popularization of the 800V high – voltage platform has greatly improved charging efficiency. Key progress has been made in solid – state battery technology, while reducing costs and safety risks. Intelligent driving technology has also been comprehensively upgraded. In addition to the commercial implementation of L3 – level driving, urban NOA (Navigation – assisted Driving) has become a standard feature of mid – to high – end models, and the perception ability and decision – making logic of the system continue to be optimized.

In the second half of the automobile intelligence era, technological innovation is no longer a single – point breakthrough but forms a full – chain upgrade of “three – electric systems + intelligent driving + chips”. The rapid application of large AI models in vehicles has brought a new voice interaction experience and has also become the decisive factor influencing consumers’ decisions.

On the infrastructure front, the improvement of charging infrastructure is the core support for the increase in the penetration rate of new energy vehicles. For new energy vehicle owners and potential new energy vehicle owners, range anxiety is actually charging anxiety. By the end of 2025, the number of charging piles nationwide reached 20 million, a 47% increase compared to 2024. The central urban areas basically achieved a “three – kilometer charging circle”. The number of battery – swapping stations exceeded 5,000, and the battery – swapping time was compressed to less than 3 minutes. The coverage rate of charging facilities in highway service areas reached 98%, and the charging network on major national traffic arteries was seamlessly connected.

At the same time, the infrastructure layout is achieving a leap from quantitative growth to qualitative improvement. The proportion of high – power fast – charging piles has increased significantly, and slow – charging piles and fast – charging piles are reasonably matched. The interconnection of charging apps is accelerating, allowing users to search and pay without switching between multiple platforms. The maintenance service of charging piles has been improved, and the response speed for fault reporting has been greatly increased. The maturity of charging infrastructure has completely dispelled consumers’ charging anxiety and laid a solid foundation for the full popularization of new energy vehicles.

On the market front, the cost – saving advantage of new energy vehicles has become increasingly prominent. Calculated based on an annual mileage of 20,000 kilometers, the electricity cost of a pure – electric vehicle is only 1/5 of the fuel cost of a fuel vehicle, and the maintenance cost is lower. Coupled with the configuration advantages of intelligent driving and vehicle – machine interconnection, it has become the first choice for more and more family users.

2025 was the year when the retail penetration rate of new energy vehicles in China first exceeded the critical threshold of 50%. New energy vehicles have become the core growth engine of the domestic automobile market. This milestone leap marks that the new energy vehicle market has shifted from being “policy – driven” to “product – driven”, and the trend of “fuel vehicles retreating and electric vehicles advancing” has become an irreversible market trend.

The leap with a penetration rate exceeding 50% has not only changed the consumption structure of the automobile market but also promoted the comprehensive reconstruction of the industrial ecosystem. Traditional fuel vehicle enterprises are accelerating their transformation to new energy. Joint – venture brands are increasing their investment in new energy products. New – force brands, despite having the first – mover advantage, cannot afford to be slack because there is no all – winning situation in this competitive market, only “continuous energy replenishment”.

Anti – involution, Value War

In 2025, the three – year “price war” in the new energy vehicle industry finally came to an end, and “anti – involution” became the industry consensus.

From 2023 to 2024, the industry experienced a vicious competition of “you cut the price by 30,000 yuan, and I cut it by 50,000 yuan”. Some models were even sold at a loss, resulting in a significant decline in the overall profitability of the industry. In 2025, the players seemed to have reached a certain tacit understanding: simply “trading price for volume” was no longer sustainable. The industry’s competition logic was shifting from “competing on price and scale” to “competing on technology and value”, and the price war was upgraded to a value war.

For any automaker, if the growth in volume cannot be translated into profit growth, the numbers on the battle report are just castles in the air. Simple scale cannot serve as an admission ticket to the second half of the intelligent era. The accumulation of advantages at the technical level places higher demands on cash flow. Therefore, profitability was a key issue for automakers in 2025.

Traditional automakers still need a long investment period to develop their new energy sectors. New – force brands also faced the problem of low capacity utilization in the early stage. In 2025, some automakers began to break through the dilemma of “increasing revenue but not profit”.

Leapmotor was the “dark horse” in 2025, delivering over 596,500 vehicles throughout the year, a year – on – year increase of 103%, and topping the annual sales list of new – force brands. In the first half of 2025, Leapmotor achieved positive net profit for the first time in a half – year period. In the third quarter, Leapmotor’s single – quarter net profit reached 150 million yuan.

Xiaomi Auto also achieved its first profit in the third quarter of 2025. In this quarter, the innovation business division of Xiaomi Auto and AI achieved positive single – quarter operating income for the first time, with a single – quarter profit of 700 million yuan. Thus, Xiaomi Auto became the fastest – growing new – force automaker to achieve profitability.

In the third quarter, XPeng’s revenue exceeded the 20 – billion – yuan mark for the first time, reaching 20.38 billion yuan, a year – on – year increase of 101.8%. The net loss was significantly narrowed by 78.9%, dropping to 380 million yuan, approaching the break – even point. He Xiaopeng, Chairman and CEO of XPeng, said, “In the last quarter of this year (2025), XPeng will fight a tough battle to achieve single – quarter profitability.”

In the third quarter, NIO’s revenue reached 21.79 billion yuan, also setting a new record. The net loss was narrowed by 31.2% year – on – year, dropping to 3.481 billion yuan. NIO CEO Li Bin has said many times that achieving profitability in Q4 of 2025 will be an important turning point for NIO “towards high – quality development after more than a decade of losses”. For this reason, “there will be no new car launches or large – scale capital – intensive activities such as NIO Day in the fourth quarter, and most high – cost matters have been completed in the third quarter.”

The joys and sorrows of automakers are not the same. Li Auto, which had maintained profitability for 11 consecutive quarters, turned from profit to loss in the third quarter. Its revenue was 27.4 billion yuan, a year – on – year decline of 36.2%, and the loss reached 624 million yuan. Li Xiang, the founder of Li Auto, admitted that learning the professional manager system in the past three years had made Li Auto “become a worse version of itself”. At the same time, he announced that the company would fully return to the startup – company model from the fourth quarter.

Scale does not represent everything, but the scale effect is still the key support for vehicle – manufacturing enterprises to achieve profitability. Automakers with sales of over 200,000 vehicles (BYD, SAIC, Geely, Li Auto) generally have higher gross profit margins than the industry average. Automakers with a high proportion of high – end models (Geely, Great Wall, Li Auto) have even higher gross profits.

The fact that the penetration rate of new energy vehicles has exceeded 50% means that the transformation of fuel vehicle enterprises is an important sub – plot in the story. These enterprises still have their volume and scale, which means that their connection with consumers still exists. As long as they can complete the transformation before consumers’ mindsets are completely changed, they don’t need to re – introduce “who they are”, and the diversification of user needs is their foundation.

In 2025, an invisible shackle was quietly broken. The Chinese automobile market completed a historical power transfer. The decades – long pattern of “foreigners controlling technology and Chinese managing the market” was completely overturned, and the dominance of foreign capital in joint – venture automakers was completely lost. In this year, the retail market share of domestic brands was 65%, a 4.8 – percentage – point increase compared to the same period last year, and the sales myth dominated by foreign capital came to an end.

The transfer of dominance is mainly reflected in three dimensions. At the R & D decision – making level, joint – venture automakers are tilting decision – making power towards Chinese teams, and the “China – content” is increasing. For example, Toyota broke a nearly 70 – year tradition by transferring the leadership of new – car development from Nagoya to the Chinese team and established a Chinese chief engineer system. The first locally – led developed bZ3X received over 15,000 orders in its first month on the market.

At the technical route level, foreign capital is no longer insisting on “global synchronization”. The next – generation Highlander of Toyota will be developed with extended – range power under the leadership of the Chinese team. Audi, Toyota and other brands are actively adopting local technologies such as Huawei’s intelligent driving and Hongmeng cockpit, completely bidding farewell to the passive follow – up of “converting fuel vehicles to electric vehicles”.

At the market decision – making level, the price barriers of foreign – owned brands have completely collapsed. The starting prices of models such as the Buick Regal have dropped by more than 30%, but they still can’t withstand the impact of the BYD Qin PLUS plug – in hybrid with a starting price of 99,800 yuan. The penetration rate of new energy vehicles of joint – venture brands is less than 5%, far lower than the industry average of 49.5%. The technological gap and cost disadvantage have made the product – definition power dominated by foreign capital completely ineffective.

This power transfer is essentially a qualitative change in the Chinese automobile industry from “exchanging the market for technology” to “leading with technology”. Behind foreign capital ceding dominance is the arrival of a new era in which Chinese teams, local technologies, and market demand jointly define the future of joint – venture automakers.

The start of the value war reflects the deep – seated changes in the next stage of the industry: when the marginal benefit of market – scale expansion decreases, a sustainable profit model needs to be established to leave enough buffer for the next “reshuffle period”.

Compliance in Intelligent Driving, Technological Premium

In 2025, Chinese automakers used the dual – wheel drive of “cost reduction through scale” and “efficiency improvement through self – research” to enhance profitability.

Full – stack self – research at the technical level brings independent control of costs and shortens the iteration cycle, becoming a key means to reduce costs and improve efficiency. Taking intelligent driving as an example, the R & D investment ratio of leading automakers generally exceeds 15%. Although hardcore technologies such as the 800V high –