Recent regulatory filings indicate that BYD is preparing a significant brand restructuring with the launch of its new sub-brand, Linghui, aimed at clearly separating a new group of vehicles from its core product portfolio. As part of this effort, four models – the Linghui e5, Linghui e7, Linghui e9, and Linghui M9 – have already been submitted for approval, signaling that the rollout is moving quickly from planning to execution.

Although positioned as a distinct brand, Linghui appears to be built on BYD’s proven engineering foundations. Early documentation suggests that several of the new models are derived from existing BYD vehicle platforms, but presented under a fresh visual and market identity.

This approach allows BYD to expand its lineup efficiently while reshaping how different segments of its business are perceived by consumers and investors alike.

Linghui lineup highlights battery-first strategy across new models

Rather than being positioned simply as new nameplates, BYD’s first Linghui models are designed to showcase the company’s latest battery and electrification strategy across multiple segments. All four vehicles rely on BYD’s in-house Blade Battery architecture, emphasizing energy density, thermal stability, and long-term durability – which are the key differentiators as competition intensifies in China’s EV market.

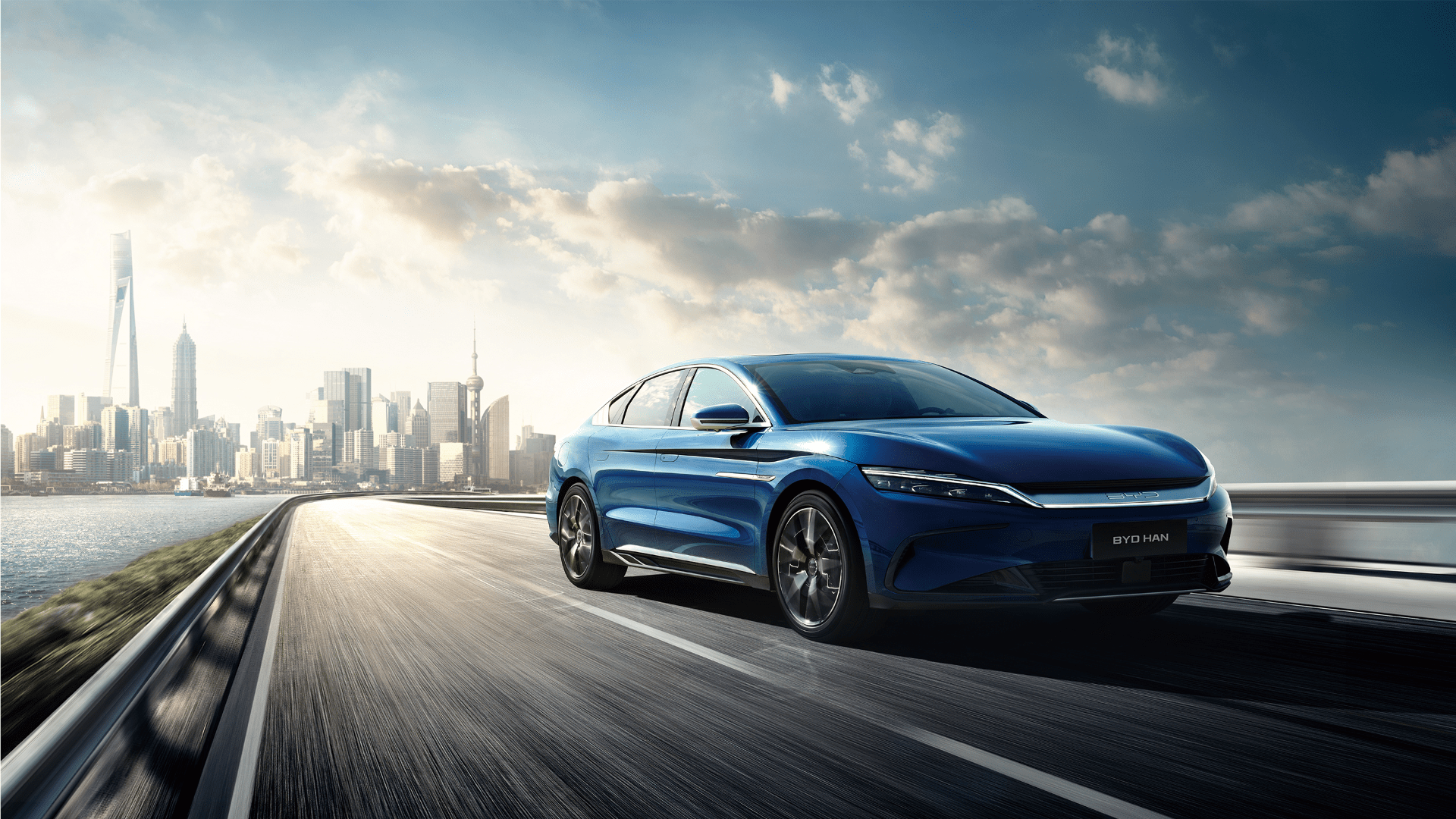

The flagship Linghui e9, derived from the BYD Han, will be offered with two electric motor options delivering up to 150 kW, aligning it with the brand’s premium electric sedan positioning. The Linghui e7 continues the approach with multiple motor configurations aimed at balancing efficiency and performance, CarNewsChina reported.

The more affordable Linghui e5, based on the Qin Plus EV platform, adopts a single-motor setup focused on cost-efficient electrification for high-volume buyers. At the top of the range, the Linghui M9 stands apart with a plug-in hybrid system that combines BYD’s proven 1.5-liter engine with a 200 kW electric motor, highlighting the brand’s dual-track electrification roadmap.

A defining trait of all of these models is their heavy use in ride-hailing fleets. Along with vehicles like the BYD Qin Plus, they have become popular among mobility platforms due to their strong value proposition and low operating costs.

Ride-hailing dominance is eroding consumer brand perception

Market dynamics show that ride-hailing operators prioritize vehicles that deliver the strongest cost-to-performance ratio, often selecting models purely on economic efficiency. While this approach ensures rapid fleet expansion, it creates a branding challenge for automakers whose vehicles become overly associated with ride-hailing services.

Once a brand is perceived primarily as a fleet or ride-hailing choice, consumer perception shifts, CarNewsChina notes. Private buyers increasingly view the brand as low-cost or utilitarian, making it difficult to sustain any premium positioning – and this effect has already reshaped parts of China’s EV market.

Against this backdrop, the launch of the Linghui brand reflects BYD’s effort to isolate its fleet and ride-hailing exposure from its main consumer business. With large numbers of BYD vehicles already operating in ride-hailing fleets across China, creating a dedicated ride-hailing-focused brand allows the Chinese automaker to protect its core brand positioning while responding to mounting competition and slowing domestic sales.