Investors are likely to accelerate scrutiny of the firm’s growth narrative after late Thursday warning.

General Motors is taking a $7.1 billion hit to fourth-quarter results, an unusually blunt acknowledgment that its most ambitious electric vehicle and China strategies no longer justify their original price tags.

In a filing with the SEC late Thursday, GM disclosed special charges tied to a pullback in North American EV capacity and a restructuring of its China joint venture. Roughly $6 billion relates to its EV business, with the remaining $1.1 billion largely associated with the China overhaul.

The writedown may help clean up the balance sheet, but it also sharpens scrutiny of GM’s growth narrative and the durability of its earnings power.

Market reaction

Initial market reaction has been negative but measured, with shares down about 2% in after-hours trading with the muted response suggesting that investors were braced for some form of reset after the company signaled in October that it was reassessing its EV rollout. While one-time charges can obscure near-term earnings, they can also prevent deeper value destruction if capital is being redirected away from low-return projects.

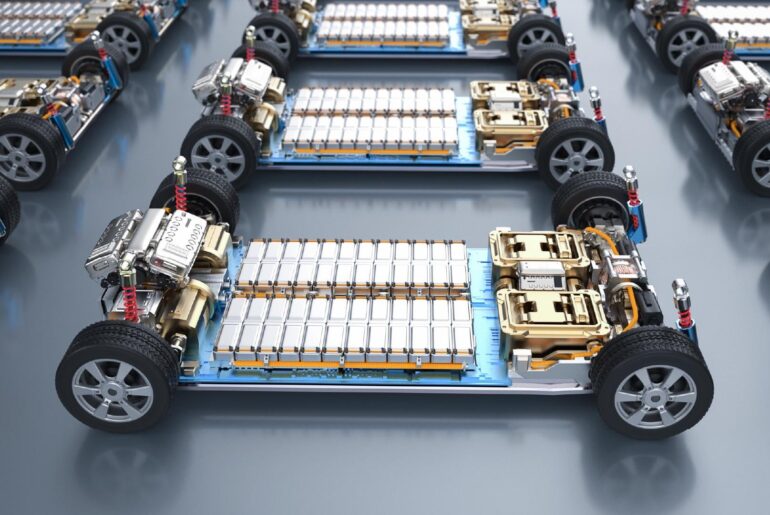

The EV-related charge includes approximately $1.8 billion in non-cash writedowns for idle or repurposed electric-vehicle equipment, and about $4.2 billion in cash costs tied to supplier settlements, contract cancellation fees and related items. These charges will weigh on reported net income but will be excluded from adjusted earnings, the metric most Wall Street analysts use for valuation.

GM had been among the most aggressive legacy automakers in betting on a battery-powered future, at one point signaling plans to invest roughly $30 billion in EVs and related capacity. That strategy assumed a rapid expansion of U.S. demand, underpinned by federal incentives, falling battery costs and tighter emissions standards.

Those assumptions have weakened. Policy shifts and softening consumer enthusiasm for mass-market EVs have slowed adoption, forcing automakers to scale back. GM now expects additional EV-related cash and non-cash charges in 2026, though it says they will be “significantly less” than in 2025.

Investors questions

For investors, the central question is whether this writedown represents a clearing event or the start of a longer re-rating of GM’s growth prospects. By classifying billions of dollars in EV spending as impaired, management is effectively conceding that forecast volumes and pricing no longer support the original capital investment. That admission undercuts the premium some investors had assigned to GM’s EV “option value” and reinforces a view of the company as a more cyclical, combustion-engine-heavy business.

At the same time, the retrenchment could improve future returns on invested capital. GM has already decided to repurpose at least one Michigan facility initially slated for EV production to instead build high-margin vehicles such as the Cadillac Escalade and full-size pickups. For portfolio managers, that renewed emphasis on proven profit centers may bolster near-term cash flow and earnings stability, even if it narrows the company’s long-term growth runway.

China restructuring

The China restructuring adds another layer of uncertainty. GM is recording about $1.1 billion in charges, including roughly $500 million in cash, as it reshapes operations in a market where domestic competitors, pricing pressure and shifting consumer preferences have eroded its position. A region once viewed as a source of growth optionality is now a restructuring risk that will demand sustained management attention.

Taken together, the EV and China charges leave GM with a cleaner but more modest equity story: slower electric growth, heavier reliance on legacy vehicles, and a management team under pressure to show that after $7.1 billion in write-offs, future capital allocation will be more disciplined and more clearly aligned with shareholder value.