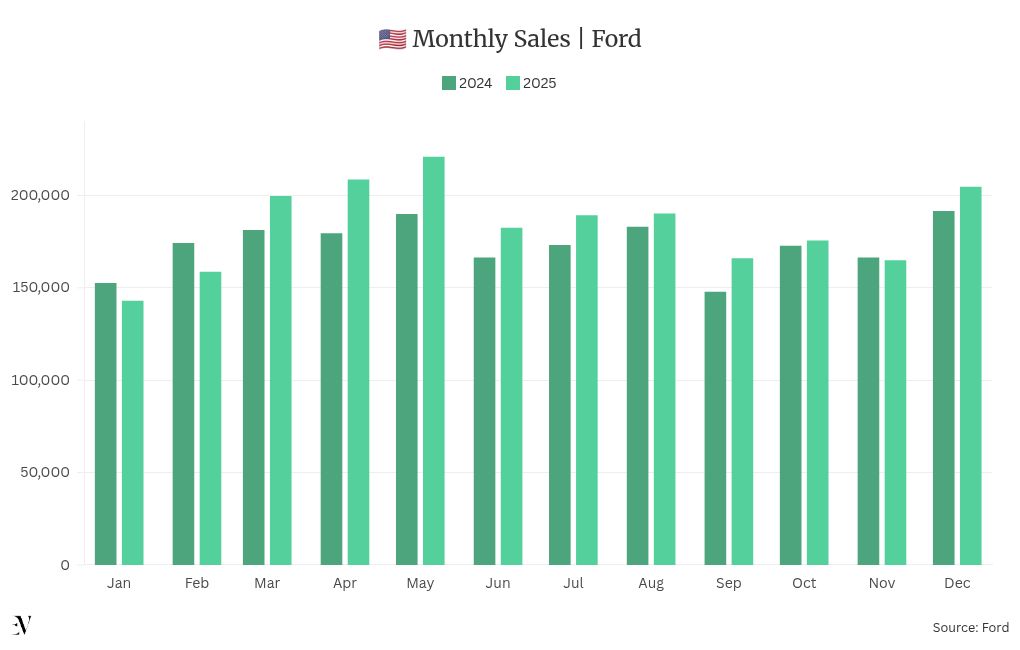

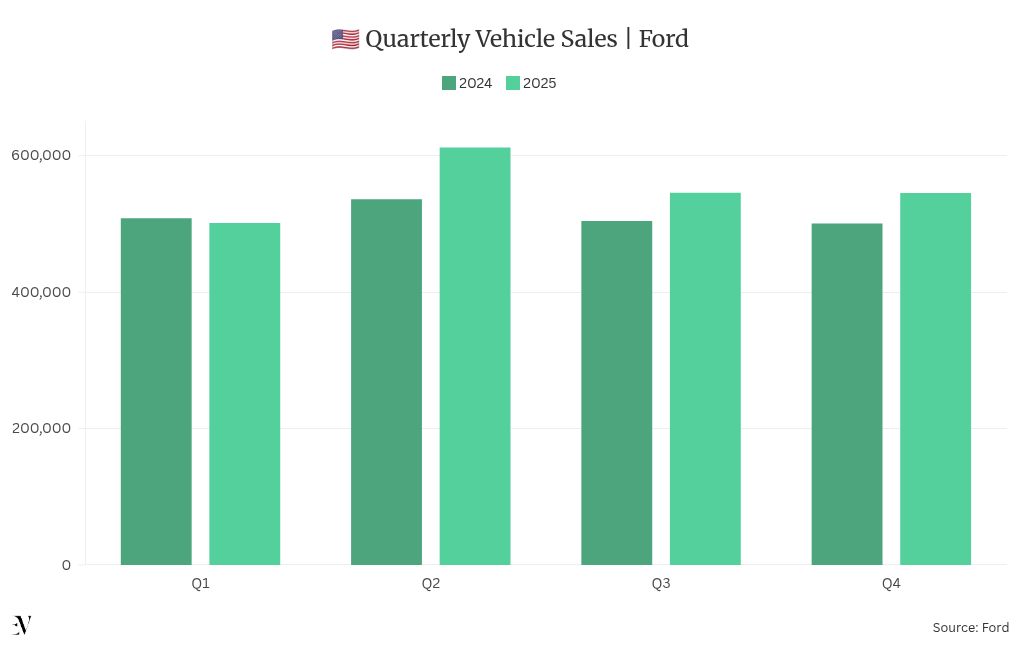

Detroit automaker Ford reported on Tuesday that it sold 2.2 million vehicles in the United States in 2025, a 6.0% increase year over year.

Its domestic market share rose by 0.6 percentage points to 13.2%, making it the best-selling truck manufacturer in the United States, the company said in a statement.

Last quarter’s figures marked a second sequential decline, despite year-over-year growth for the third straight period.

The only period in which Ford recorded a year-over-year decline in overall sales was from January to March, which is typically the weakest sales period for the auto industry.

BEV Sales Slashed by Half in Q4

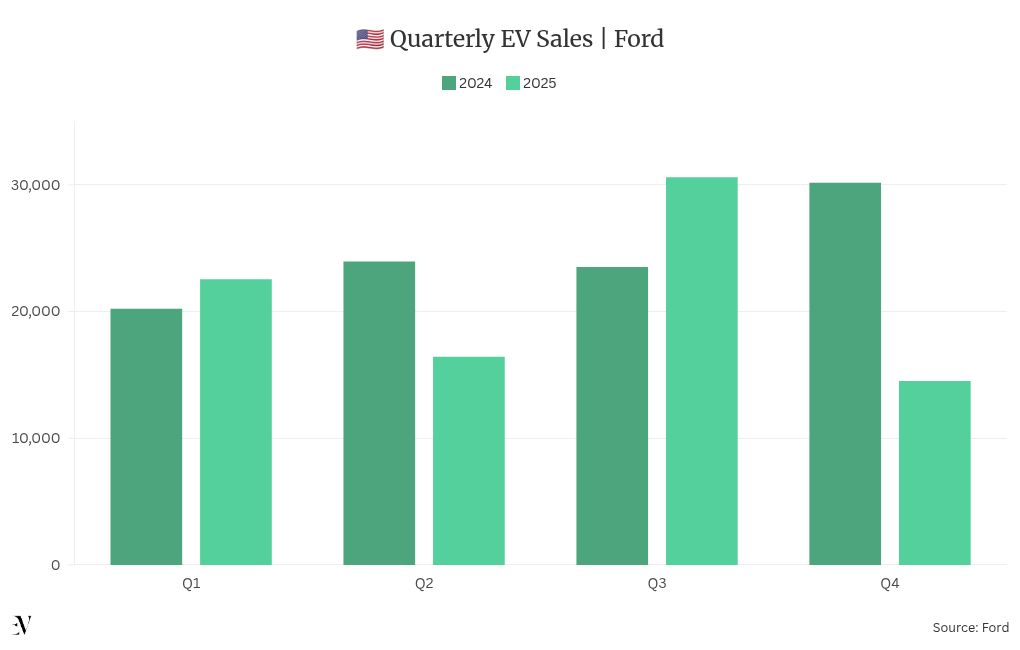

The scenario changes when considering only battery-electric vehicles (BEV).

Of the total units sold last year, 84,113 were fully electric vehicles — a 14.1% tumble from a year ago, when 97,865 units were registered.

With 5,557 EVs sold in December, and despite the slight sequential increase, the company continued the year-over-year decline seen in October and November, after the termination of the federal $7,500 tax credit.

Sales more than doubled in July and exceeded 10,000 units in both August and September — a level Ford EV sales hadn’t seen since December 2024 — as consumers rushed to purchase EVs before the tax deadline.

They were then cut in half.

November sales plunged over 60% year over year, while December’s dropped by 57.6%.

Following the strongest quarter of the year, the automaker reported its lowest EV registration figures in the past three months.

Ford sold a total of 14,513 electric vehicles in the fourth quarter, halving from the 30,176 units registered a year ago.

The figures show that the company’s 2025 growth came mainly from sales of hybrid and internal combustion engine (ICE) vehicles.

Both Ford and General Motors, two American legacy automakers, have stated last year that they will refocus on petrol and hybrid models, as US policy on EV adoption changes.

GM‘s overall sales increased by 6% as well in 2025.

However, contrary to Ford, the company saw a 48% increase in BEV registrations last year, even considering a 43% decline in the fourth quarter.

General Motors ranked as the second best-selling brand in the US when it comes to EVs, just below Tesla.

EV Business Restructure

Ford established its EV unit in 2022; however, it has yet to reach profitability.

Under the company’s latest plans, the ‘Model e’ division is expected to become profitable by 2029, recovering from an additional $19.5 billion impairment announced in December as part of a change in its EV strategy.

The automaker unveiled in August its ‘Universal EV Platform,’ in which a $30,000 pick-up truck will be built.

As it pivots towards building more affordable vehicles, it has permanently discontinued production of the fully electric F-150 Lightning.

According to CEO Jim Farley, “the very high-end EVs, the $50,000, $70,000, $80,000 vehicles, they just weren’t selling.”

In the Summer, the company had also announced plans to invest in electric vehicle (EV) battery production, including a partnership with South Korean manufacturer SK On.

The BlueOval SK battery production facilities were located in Ford‘s Kentucky and Michigan manufacturing facilities.

However, four months later, the company dropped its plans for battery production and will now focus on energy storage systems, leading to the termination of the partnership and the layoff of over 1,000 workers in the Kentucky plant alone.

US Senate Hearing

In a letter addressed to the US Senate Commerce Committee Chair Ted Cruz, Ford‘s CEO showed reluctance to appear at a hearing in Washington on January 14.

The three Detroit automakers — Ford, General Motors and Stellantis — are expected to testify on topics related to vehicle sales, such as consumer choice and affordability.

According to Jim Farley’s attorney, the main objection was that Tesla was treated differently: while the three legacy automakers were asked to send their CEOs, Tesla was only invited to send its VP of Vehicle Engineering, Lars Moravy, rather than CEO Elon Musk.

Approached by the Detroit Free Press, a spokesperson for General Motors said the company has “told the committee its CEO will be there assuming all invited CEOs attend as well.”