Tesla is confronting significant delivery headwinds across its core markets, sparking concern among investors. The situation is compounded by a major stock sale from a company insider and a cautious reassessment from Wall Street analysts, with one prominent firm warning of a potential “EV winter” extending into 2026.

Analyst Downgrade Amid “EV Winter” Warning

On December 8, Morgan Stanley analyst Adam Jonas revised his firm’s stance on Tesla shares to “Equal Weight,” equivalent to a Hold rating. While he modestly increased the price target to $425, this still sits below the current trading level. Jonas acknowledged Tesla’s continued leadership in autonomous driving and artificial intelligence but expressed caution regarding the electric vehicle business for the coming year, suggesting challenging conditions could persist through 2026.

Significant Insider Transaction

Adding to the market’s unease, Kimbal Musk—brother of CEO Elon Musk and a member of the board of directors—sold 56,820 Tesla shares on December 9. The transaction, executed at an average price of $450.66, was valued at approximately $25.6 million. Following this sale, Kimbal Musk retains a holding of around 1.38 million shares. Transactions of this magnitude by company insiders are closely monitored, particularly during periods of operational difficulty.

Steep Declines in Key Regions

Recent sales figures from Tesla’s most important markets reveal a sharp contraction:

Should investors sell immediately? Or is it worth buying Tesla?

United States: Deliveries plummeted by 23% in November 2025 to roughly 39,800 vehicles, marking the weakest monthly performance since January 2022. The expiration of federal tax credits is cited as a primary cause.

Europe: The downturn is even more pronounced in Europe. New vehicle registrations fell 48.5% year-over-year in October. Tesla’s market share in the region collapsed from 1.3% to just 0.6%.

Competitive Pressure: Chinese rival BYD sold over 17,400 vehicles in Europe during the same period, more than double Tesla’s volume.

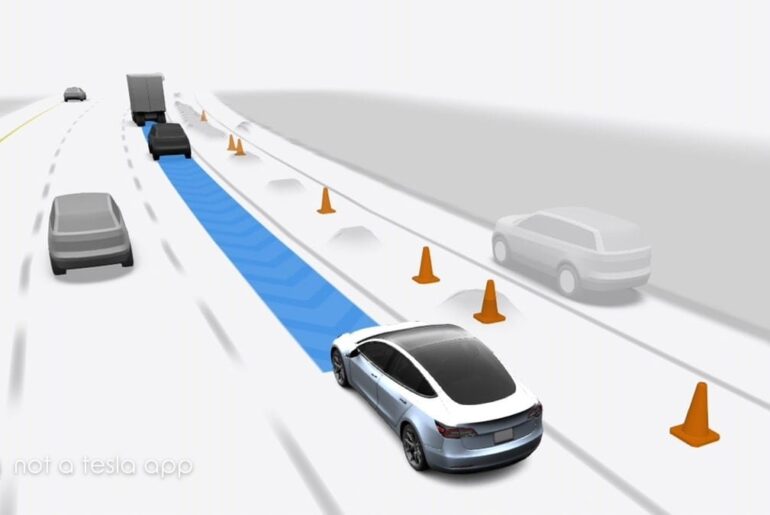

Aggressive Promotions to Stimulate Demand

In a bid to salvage its fourth-quarter performance, Tesla has rolled out aggressive incentives. In the U.S., the automaker is offering 0% financing and discounts of up to $2,000 on Model Y inventory vehicles. The company also introduced cheaper “Standard” versions of the Model 3 and Model Y in October.

These moves come as Tesla continues to compete with aging vehicle platforms against a wave of new rivals. The long-anticipated $25,000 model remains absent from the market, delaying a potential boost to the entry-level segment.

Technical and Market Performance

Tesla’s stock is currently trading near $447, representing a decline of nearly 16% from its 52-week high of $457 reached in mid-December 2024. The Relative Strength Index (RSI) stands at 73.7, indicating an overbought condition according to technical analysis. The confluence of weak delivery numbers, substantial insider selling, and growing analyst skepticism is exerting noticeable pressure on the share price.

Ad

Tesla Stock: Buy or Sell?! New Tesla Analysis from December 12 delivers the answer:

The latest Tesla figures speak for themselves: Urgent action needed for Tesla investors. Is it worth buying or should you sell? Find out what to do now in the current free analysis from December 12.

Tesla: Buy or sell? Read more here…