Toyota’s HIT EV? EU’s China ‘Crisis?’ & Tesla Value Questioned?

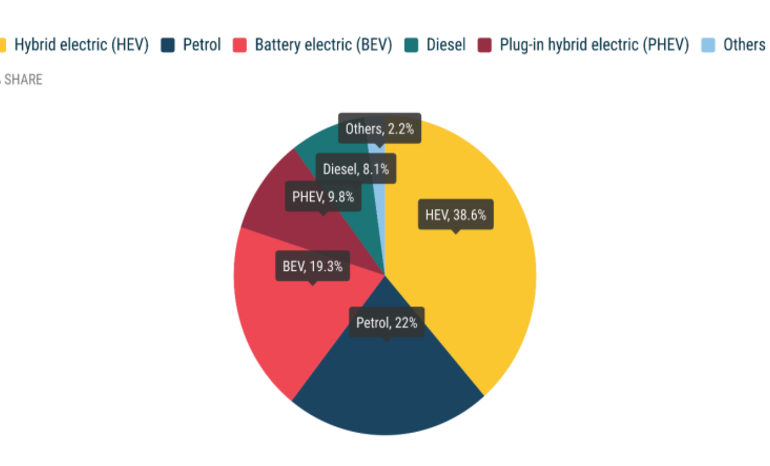

Hello and welcome to another episode of the Pulse Podcast. A brand new podcast for your feed which is all about the life and death decade of the automotive industry as told through the eyes of an entrepreneur Dan Caesar and a former automotive engineer me Image Bogle. Hello Imagin. Excited to catch up. We got some really good stories this week. Yep. We are talking Toyota. We’re talking Volvo, Polestar, a little bit of Tesla, and a couple of other bits and bobs as well. But before we get into any of that, how’s your week been? Good. It’s been a week of mixed emotions. We welcomed a criate kitten to our household just a few days ago. You’ve seen the videos. That was exciting. But at the same time, we paid a fond farewell to Quentyn Wilson. We’re at his uh funeral uh which was great to reflect on his life and his contribution. but has obviously left us um a bit sad as well. Yeah, it was um we were debating just before we clicked record, should should we mention this? We we don’t want to be Debbie Downers on this podcast, but actually it would be weird if we didn’t mention it. And as you say, it was a beautiful, beautiful ceremony and completely as you’d expect. There were so many different people from across the automotive industry. He was so well loved and contributed so much. So, I was very pleased that we were able to be there. um and support his family really. He was an incredible man full of integrity ahead of his ahead of his time and we will miss him uh deeply and we’ll keep working to promote EVs as he was doing for many years. Well, I um I’ll just share this with you because I texted Robert who was obviously very sad not to be able to make it cuz he’s presently in Australia with his in-laws and I said you’ll be really pleased to know it was probably the biggest gathering of electric vehicles outside one of our live shows. So he chuckled at that. But I I did admire the car park near the church. Yeah, it was impressive. It was impressive. It was a beautiful day. Um and we paid our paid our tributes, paid our farewells, and um no, I I always think about him and and he was, you know, a passionate advocate for the technologies we’re going to talk about today. Let’s get into today’s stories, but first a very quick advert break. This episode is brought to you by Hongok. The Hong Kong Ion tire is built exclusively for electric vehicles. Engineered to deliver what EV drivers need most. Confident grip, quietness, energy efficiency, and long mileage. As the official tire partner of Formula E, Hong Cook proves its EV technology is at the highest level of performance and brings that same innovation to every ION tire on the road. So, story number one, Toyota’s $15,000 electric SUV is a hit in China. That was from Electric. What’s going on there? Well, I mean, China is a market into itself. Uh, you might say Toyota is a company unto itself. It is the biggest car maker in the world. And you have to admire how it’s got to that uh position in the market. It has famously been quite slow to electrifying. And we are certainly hoping that it will accelerate, but it is I think slightly cynical to see it, you know, really accelerate in some markets more than others. So we know it is selling at quite a lick. In Norway, for example, they’re doing very well there. They’re very proE in that nation. And we know in China equally, it’s a market they can’t afford to ignore. And yes, the catchy entitled BZ 3X is selling like hot cakes. I think they’ve sold over 60,000 of them now. Uh in China, they’ve sold uh 10,000 for the last two consecutive months. It’s equivalent to about £11,500. Obviously, it would never be that here in England. About 15,000 uh US dollars. Um and it’s the bestselling sort of foreignowned EV in China, building out building beating out cars like the VW ID3, uh the Nissan N7, BMW, uh i3, and many many others. And it’s really interesting to see their strategy in China play out. I was at Shanghai Auto Show earlier this year. I don’t know if I’ve mentioned that before. It’s still I never mentioned it. I didn’t know there it left an indelible mark on me. But actually there they had a sort of flagship sedan that’s coming out soon. They’re opening the order book for called the BZ 7 and it’s stunning and it’s you know incredible car and that’s coming out and I suspect that will be very very successful as well. So, it’s really interesting to see Toyota on one hand really go for it in the Chinese market and get some success there. So, I do hope that their success in China with these cars will perhaps make them a little bit more uh a little bit less reluctant to to go full EV elsewhere. Yeah, it’s it’s really interesting because I think historically as the fully charged show, we’ve not necessarily been the most positive towards Toyota and that’s largely been driven by their I’m going to check my notes here, but the 1690 rule that they tend to have. So very much committed to this multiathway strategy and their argument on this 1690 rule is that the critical materials that go into one battery could actually supply six plug-in hybrids worth of batteries or 90 plugless hybrids, which we should say should not necessarily be called hybrids. And it’s a better distribution of resources. And they keep saying things like, you know, combustion isn’t the enemy, carbon is, and I want to say, is efficiency also your your enemy in this one? Because it, you know, you just wouldn’t choose combustion on a on an efficiency basis. Um, but obviously since they’ve had their new CEO in, that commitment to that electric strategy feels like it’s got a little bit more seriousness and I think we’re going to see 30 new fully electric models by 2030. So, it is all steam ahead. Well, it’s encouraging, but you know, they they have lobbied very very hard for the combustion engine. So, on one hand, I’m feel, you know, mildly guilty that we’ve been critical of them over the years, but you know, they are sort of half-heartedly pushing electrification and at the same time they’re sort of lobbying against it and they’re doing that, you know, very significantly in in countries closer to home. We know that it’s it’s on the record. Uh and you know the reality is that’s obviously very very disappointing to see. It becomes a self-fulfilling prophecy. If you’re lobbying against something then uptake might for bevs might go more slowly and therefore then you can always turn around and say oh look people aren’t as interested in bevs as we thought. So it is a very very cynical ploy. But my hope is really that success in China will actually lead them to you know add more battery electric vehicles with a little bit more elacrity to get into the market and to to see the benefits. As I said, the cars we saw in Shanghai were incredible. You know, uh they’re actually Chinese-made uh Toyotas, and they’re fantastic. So, hopefully they’re starting to to turn a corner. But we’ve said that before, and only time will tell. Well, it’s interesting because they’ve also said that the BZ Forex equally very catchy named. What a naming strategy for goodness sake. But they have kind of confessed that that was a bit of a box ticking exercise and these future electric models are much more about instilling fun into EVs and the the current CEO um Koji Sato was like well you know if a car isn’t fun it’s not a car. So there is this sort of you know this commitment that okay EVs don’t need to be the spot ticking exercise. Of course we know they’re better to drive. Of course we know they can be super duper fun. Um, I just wanted to provide a bit of context in the numbers because sometimes I feel when you hear these numbers, oh, they’ve sold 62,000 of these models this year. I’m like, well, what does that really mean? How’s it compare? But to give some context, Polestar have sold about 45,000. Well, I think they sold 45,000 vehicles in total in 2024. So, 62,000 of a brand new model is enormous. It’s absolutely enormous. Um, and of course at that price point it’s competing with things like the BYD at3, the GAC AON Y, the Cherry IICAR03. So China is lucky to have this suite of very very lowc cost EVs. The new sedan that’s coming out is equivalent to £17,000 sterling and it, you know, it it looks a bit like a Tesla Model 3, maybe even slightly more attractive to be completely honest. So they can do it. So, it’s the cynicism that I object to really and that’s we have an issue with. But it has never been us wanting to see Toyota fail. It has always been our fear that they would shrink significantly on the basis that they hadn’t been on the front foot with battery EVs. And you know, the more and more I see of BYD and their output and China’s output in general and other progressive manufacturers from around the world, the more I think that Toyota still has its head in the sand a little bit. Um, I would certainly if I was uh in the hot seat there, I would be hoping they would move a little bit more quickly because you can get caught out. Things change very very fast. Um, and I did see a headline automotive news sort of congratulating themselves that they’ve backed the right horse with hybrids in America. But of course, America is only 4% of the global population. It isn’t the whole world. and BYD are making huge inroads way outside of China in Africa, in South America, obviously in Europe, in Australasia. You know, that’s got to start eating into Toyota’s uh sales figures. And if I was them, I would I would, you know, hasten the electric strategy and they they are capable of making these great cars. Well, you’ve mentioned a few things there that I think seamlessly segue to our next story, not least lobbying. uh how different markets are becoming increasingly interesting and of course the role of legacy automaker automakers in all of this. So without further ado, story number two. [Music] Story number two. The Chinese will not pause. Volvo and polestar urge EU to stick to 2035 petrol car ban. That was from the Guardian. I do think a better headline would have been uh to stick to 2035 ban of new petrol cars, not just a blanket ban on petrol cars because we know that’s not quite the case. Um yes, give us a little bit more context. Yeah, that’s really frustrating. The way it’s called a ban when it it really isn’t that is is always extremely frustrating. You know, the reality is and car companies are resistant to change and you can completely understand why. They’re huge organizations. They need long-term planning. They need certainty. So, what’s going on at the moment, just not with electrification, but a whole range of different things is obviously making it incredibly difficult to run a car business. But at the same time, you know, progress is something that we need to accept in life. And it’s really interesting to see what Michael Lurella from Pstar who you’ve interviewed on on the podcast and what Hakan Samuelson from Volvo have been saying this week as the EU is being lobbied quite heavily seemingly by German manufacturers and by German stakeholders to weaken or delay the 2035 uh deadline. And Samuelson has sort of rightly pointed out really that you know had we not been pushed to progress the automotive industry probably would have resisted and did to an extent resist seat belts resisted catalytic converters. You know it has to be moved on and obviously we’re you know emissions are clearly an important part of this but electrification the cars are just simply more efficient. So, it’s interesting to see that play out in Europe at the moment. And I guess any block like Europe with Germany at its heart, which is I have to admire what the likes of BMW, Mercedes, uh, Volkswagen Group have achieved, but times are changing and they’re changing very, very fast. And I was at the Munich Auto Show and I saw lots and lots of battery electric vehicles, fantastic ones from the likes of BMW, from the likes of VW, Audi, etc. And it’s great to see that, but at the same time, behind closed doors, there’s clearly a lot of pressure on the EU at the moment to to to relent uh and to and to delay. So, the issue really for me is that it is kind of a false argument. Delay might seem like it’s going to help. might seem like it will keep Asian car makers in particular at bay and out of Europe, but the reality is Chinese car makers have been so agile they’re actually selling lots of hybrids into Europe already. So they are eating share significantly irrespective of powertrain. So they may think you know by lobbying against uh you know battery electric vehicles trying to slow that process down they’re doing themselves a favor. I think actually by not competing they’re actually going to hurt themselves and they’re actually going to mean they’re so far behind they’re going to really struggle to to catch up. Well, Volvo and Polestar would 100% agree with you on that. And their argument is say, well, if you, you know, in the German chancellor Friedrich Mertz, um, he says that he wants new hybrid and highly efficient combustion engines to be considered post 2035. And Volvo and Pstar argue that, you know, you’re just leaving yourself wide open to for especially Chinese car manufacturers to just eat the market up. um and especially then using taking advantage of lower um labor costs in Eastern Europe, etc., etc. But I really loved this quote from Michael Loshella, who you’re right, I uh I interviewed back in I think in May. He’s incredibly tall. He made me feel like a little teeny tiny human being. Um he’s run 126 marathons. Wow. Which by my Yeah, it’s ridiculous. It’s actually It’s horrendous. But by my calculation, that must mean about four marathons a year given his age and when you’re allowed to start running marathons. And given he’s had a number of different CEO titles, that makes me feel sick. But anyway, but he that’s relevant because he said, “I am a marathon runner. I’ve run 126 marathons in my life and do I train and say it’s difficult, so I’ll just do a half instead?” No. I thought that was great. Um, and that’s precisely, you know, what’s happening with the German manufacturers right now. It’s hard to transition, of course it is, but having a tantrum about it doesn’t change things and it’s not going to make you more competitive. Yeah. Samson’s quote was interesting as well. You know, he effectively alluded to the German manufacturers and he said they could do what they like, you know, but if they take the foot off the electrification pedal, they will just widen the gap for China because the Chinese will set up factories in Hungary and Slovakia, Romania in low labor cost markets. I don’t think it’s possible to keep them out of the EU with tariffs. And his recommendation to Savand Lion was actually you don’t have to make a decision now. You can actually delay it close to the cutoff date. We have time. We have 10 years. And that’s an interesting point I think. But I think we all know what’s going to happen. I think we all know that there is going to be a weakening and that is I think going to be to Europe’s detriment. Oh gosh. Well, continuing on that theme, that weakening of of the role of these legacy OEMs, you shared a really interesting article with me from Reuters. Um, the headline being, “China floods the world with gasoline cars it can’t sell at home. This is astonishing. Um, tell us a little bit more.” Well, we we definitely, you know, the whole purpose of this podcast is to keep you up to date on the automotive industry, to keep our finger on the pulse of what’s going on because we do think it’s a life and death decade. And that is going to apply equally to Chinese manufacturers as manufacturers elsewhere. And it may sound like I’m being uh, you know, indulging in exaggeration, hyperbole, but we think it some companies might go to the wall, but equally others will at least be significantly smaller than they are. And it will be the the employees who get caught out rather than the the people uh at board level. I would say what’s interesting with China of course it has a glut of capacity and that everyone knows that has a glut of capacity for electric vehicles and obviously that is heavily incentivizing it to accelerate its sales all across the world outside of China. But less well known is it has a glut of manufacturing capacity for non-electric vehicles as well. And the same thing is playing out. It does seem to be a consequence, a result of offshoring from the western world over many many years is now playing itself out in real time. And it is alarming and we understand that. But the way in which Chinese car makers have been able to even the ones that have started off as you know battery electric only have been able to actually add in plug-in hybrids uh e-revs uh you know the electric range extended uh vehicles as well and even hybrids without a plug uh means that they are here they are competing and you know the costs are very very attractive to the consumer and at the end of the day economics are hard to beat hard to defy so the reality is that you do wonder if with some of the kind of legacy automakers if they would be better just trying to get on with it, compete, make their products more competitive as soon as possible. Um because actually if you’re in denial and you don’t accept the reality, uh then that could be seriously problematic. So it is interesting to to see what’s happening since 2020. Little fact here is that the fossil fuel vehicles uh exported from China have been 76% of their exports. Yeah, that may surprise some because people may think actually they’re they’re bringing new energy vehicles whether it’s battery EVs or FS to market, but actually 3/4 of the cars they brought to they’ve exported so far have have not had uh any electrification at all. Well, that was the fact that I was like, “Oh, goodness me. I did not know that at all.” Um, and we will link to the the full article because it’s well worth a read. Some great diagrams in there. It shows you so clearly how in 2022, China absolutely took over everyone in terms of volume of vehicles that they’re able to export and they are doing so in plain sight to these secondary and emerging markets where they can massively undercut the existing OEMs, capture a huge portion portion of market share and are recognizing that these markets are going to take longer to transition to EVs and they’re capitalizing on that opportunity. Meanwhile, the traditional OEMs, they are seeing their market share correspondingly decrease. And it does make me think that in all of this, you know, as much as China really cares about clean energy within, sorry, uh, clean air within China, actually, it’s just competing fiercely and it’s not wasting time on, oh, well, you know, we want to have a range of different um, power trains available. They are cracking on and being competitive. And I feel like that’s just a great lesson for all the other OEMs to pay heed to. Well, the thing that’s keeping China China’s economy going is growth. And you know, there has been involution. You know, that’s an overco competition internally. And the instruction is clear. You know, we need that involution to come to an end. And you know, that means capacity needs to go overseas. That is a huge mega trend that is not going to change. And there may be borders thrown up or protectionism or talks of no one’s ever going to switch from our brands. They love our brands. But the reality is completely different. The market is changing very very fast and you you do do yourself no favors by putting your head in the sand. People have to act and realize accordingly and compete otherwise well you don’t need me to finish the sentence. But it is going to be fascinating few years. But yeah, China’s uh export capacity is not limited to to battery electric vehicles by any means. I do think there’s an existential debate to have though of you know part of the the bifocation in strategies between traditional OEMs and what’s largely happening in China is this idea of how aspirational the car is as a consumer product because certainly at these lower price points it’s not necessarily about aspiration it’s about accessibility and price and what you well value as well that you get for for that money and it feels like some of the German OEMs particularly are maybe taking a little while to catch up on the changing attitudes. And um I was having a debate yesterday with someone of let’s say you just sort of packed in your car and let’s say you took that number of thousands of pounds and put it in a bank account and you also put in the amount that you’d spend on charging or fuel if you had a petrol car and servicing etc etc. And you put all of that money in a bank account and that bank account could only be used for transport. How might it change your relationship with how you move around, with public transport, with the car? And I don’t know. I think that’s a good thought exercise. Maybe we should save that debate for a for a more lengthy podcast discussion. But on a positive note, I have to say the the the VW product range I’ve seen recently in Germany at BMW’s Neya class of vehicles, you know, that really really impressive. So maybe a slow start, you know, was inevitable, but ultimately, you know, I think BMW is in a fantastic position if it intends to produce the No Classer vehicles in sufficient volumes. But it no one said it was going to be easy, and it certainly isn’t. No. Well, important things are often not easy. Um, maybe that’s the phrase, maybe it isn’t. Let’s move to story three. [Music] Story three, the big short Michael Bur slams Tesla valuation and warns of ridiculous dilution. So Michael Bur is the guy who predicted the big shoot the big short of which the film is then based on him. Um tell us a little more. Yeah, I was really interested in this story. I don’t know if anyone’s seen the the big short. It’s quite a well-known film. Uh there’s other films available. There’s a film called Margin Call about the 2008 crash. There’s a brilliant book uh called Colossal Failure of Common Sense which is about the layman brothers going under but effectively it was a financial uh collapse in 2008. So I’m I’m mentioning that because there might be some people listening to the podcast who who don’t remember that or weren’t around for uh for that. But obviously it had a huge huge impact. Uh, and Michael Bur was actually I think he trained as a neurologist, kind of a detective doctor basically looking at the nervous system and he transferred into into finance. And back in about 2005, uh, I watched the big short recently. He was sort of actually starting to short some of these subprime mortgages, felt that something was going to come and had to wait very very patiently for three years until uh, the collapse came. But he’s been on the money a number of different times. So, he’s highly respected. uh and he really has been sort of rattling the cages again this week and and you know questioning the value of Tesla uh the value of its you know it’s shareholdings very very high uh it’s higher than any other automotive company in the world obviously anyone who understands Tesla knows it has been an automotive and energy play and it is going through something of a pivot uh and he is questioning the the value of the company whether whether it’s actually realistic or it too is a bubble that’s about to crash. Well, he’s interesting because he’s also he’s um sold everything. He’s shut down his hedge fund and all that kind of stuff. So, he can speak much more freely um and has he has some opinions about the AI bubble that I know that a lot of tech companies aren’t particularly fond of. And actually, you can follow this all along in his Substack, but you have to pay $250 to access his Substack. So hopefully it’s got at least $250 worth of insights in there. But I think this is really interesting because basically he’s criticizing this trillion dollar compens compensation package that Elon Musk has recently been given. And his argument here is that in creating that trillion dollar compensation package which is linked to various um well basically the performance of the stock and that in doing so obviously lots of shareholders having to give up some of their stock and it’s also going to cause dilution of of that stock. But that dilution is fine if the amount that their stock is worth increases by a certain amount. And of course there will be shareholders within that who would have negotiated multipliers who are going to benefit very hugely if indeed the value of Tesla continues to rise. So I think trillion dollars is a buzzy headline worthy figure. There is definitely dilution but ultimately shareholders are still going to benefit. I think the bigger problem that I have with all of this is how Tesla is valued. Because there’s no question that right now from a market cap perspective, it’s the most valuable car company in the world and will continue to be so if it successfully delivers automation and robotics. But if we were purely looking at like income, profitability of cars, volume of cars that that it sells, it’s not even in the top five. And that bugs me because I’m like it’s it’s just it’s valuing something on potential rather than actual delivered goods. And I’m sure there’ll be finance people who will be like you don’t understand how the world works. And I’m sure they are absolutely correct for that statement. But as an engineer, I like tangible value and I don’t get it. Well, there are plenty of, you know, big stock picks at the moment like Nvidia and Palanteer and Tesla that fall into this bucket. people think they’re kind of ridiculously uh overvalued and obviously it’s all a gamble. It’s all it’s all a bet, you know, but not so long ago. Um I mean, I’m a known fan of the Tesla product, right? I’ve had a Model 3 for a long time. I love it. I’m still struggling to to to say if I think a better EV has been made than the Tesla Model 3. Some people might be saying Model Y in response to this, but it, you know, whether you like you like Tesla or you don’t like Tesla, um it is an exceptionally good car and they have dragged, you know, the industry forward by making that car. Um yeah. Yeah, definitely. We just had the Melbourne Everything Electric show. You know, there was I think best part of 700 test drives in the in the supervised full self-driving EV. There’s still huge amount of interest in their products. Obviously power wall has been another thing that they’ve sold very significant volumes home batteries also power packs which is a commercial equivalent energy storage product. They have been hugely successful and their whole model was based on accelerating the transition to sustainable energy and that has now changed to something called sustainable abundance which to me does sound naturally kind of more nebulous and and more woolly. I mean, the reality is they are kind of mid-pivot. If you go back a few years, um Elon Musk actually said we’re probably making about 20 million cars a year by 2030. Now, they’ve kind of plateaued at the 2 million mark. Um and they’ve switched into, okay, it’s going to be all about uh robotics. It’s going to be all about uh autonomous driving. Uh well, actually more so robotics actually is kind of one of their major areas. And this is what Michael Bur had to to say. He he said, you know, the shifting focus has been a way to keep people invested. Tesla has been all in on electric cars until competition showed up. Then all in on autonomous driving until competition showed up, and now is all in on robots until competition shows up. And it is about keeping ahead, keeping the valuation high. Actually, this is a this isn’t a car company anymore. This is much much more than that. The reality is at some point the company has to deliver on those promises. And for me it’s quite sad because I think they could have they could have maybe reached 20 million car sales or maybe 10 million car sales by the end of the decade. Obviously that’s now not going to happen. They’ve got a slightly an aging product lineup. Again I’m I’m a really big fan of it. But it is interesting to see people talking about the valuation of companies like this in the same breath as the Nvidas of this world. the palunteers. Um, and again, I I I say it from, you know, a point of view of really liking the company. I really want it to succeed, but it seems to be, you know, jumping the chasm at the moment from from automotive to to something else. And there’s just no guarantee of success. So, it is a very very high valuation. I don’t think anyone could uh deny that. Just depends how much faith you’ve got in in where they’re going to end up in 5 to 10 years. Well, but it’s interesting because I mean I totally agree with you in terms of forging new frontiers, always being ahead of the curve. There is no other company in the world that does it quite like Tesla. And let’s ignore the personality at the top of the chain for the for the time being. But you know, some of these numbers are silly like, you know, let’s say they could have produced 20 million vehicles a year. The point is is that the automotive industry benefits from having loads of competition within it because ultimately people are making practical choices but they’re also making emotional ones and people have different preferences on how things look. So it benefits from the variety in the market and it benefits from everyone in that market doing reasonably well. So 20 million was that ever a sensible thing to say? I don’t I don’t think it was. Um, so then if you apply that logic to okay, 20 million but plateaued at 2 million, do we divide his expectations on robotics by 10 or a similar kind of, you know, number? I don’t know. I just it just seems like silly silly numbers that actually defy any kind of reality. And I and I would love for someone to walk me through that valuation and help me make sense of it. For many years, I thought Tesla was undervalued actually. But I, you know, in the current circumstances, it’s hard to see how it isn’t overvalued. And, you know, time will time will tell. Yeah. You know, it is it’s still an amazing company with incredible people within it, but it is going through a change that we barely could have predicted three years ago. This is it. I I always think that’s such a useful way to think about it. Like, let’s look at the life that we live now. what things if we had a little whisper in our ear in 2020 would we’d be like what chat GBD are you joking um you know all those sorts of things and yeah you know the the rate of change is beyond anything that we ever could have imagined particularly now so it is it’s an interesting decade that’s why we’re doing this podcast it is I’m I’m a big subscriber to podcasts on AI at the moment and I that you know uh blows my mind even even more I mean it is just a completely unpredictable time. But obviously we’re here to kind of share the stories as we as we see them, but you know, all these companies, I’d love to see them do well, but the reality is they can’t all do well. That’s the market, you know, and um and the battery EV thing is going to be a big shakeup. Um and I think 2026 is going to be a year of real uh real change. I don’t think we’ve seen some smaller companies go under, some new companies go under, but you just wonder beneath the balance sheet what’s going on with some of these companies and and what the, you know, the ramifications are going to be uh in 2026. I think we’re going to start to see the beginnings of consolidation and I think then that could be the next two or three years could be fascinating to watch. So, sorry this is just a little tangent before we go on to our last segment, but I in 2015 I did quite a lot of work at the time on autonomous driving um when I was working at Jaguar Land Rover and various other projects. And it was interesting because there was a lot of work being done, but it was also largely being done on on combustion engine cars. Um then Jaguar had the partnership with Whimo and and actually autonomous vehicle development is easier on a electric car. And I remember that the one show came and were like, “When do you think we’ll see uh autonomous driving in any kind of meaningful way that could be ready to roll out in a meaningful way?” And obviously the PR response was like, “Well, I think we’ll see increasing levels of um assisted driving,” which is true. We have like just think about, you know, we’ve got level two plus in pretty much every car now. But I was like, in 10 to 15 years time, that’s when things are really going to change. So, we’re at that point and who knows where FSD is here. So, hopefully that prediction was was correct. We’ll see. Anyway, um shall we go on to our last bit which is peaks and troughs? That’s not what it’s called. Ups and downs. Peaks and troughs. It’s all the same. That’s what that’s what uh that’s that’s one way of putting it. I mean, it is interesting. My up this week really is is BYD. Um we’ve seen their sales are up 20% uh November uh year on year. But the thing that kind of interested me about that was uh over the full year uh their battery EV sales are up 32% and their plug-in hybrid sales are down 5.5%. So we’re seeing this, it’s very different in every market. Norway’s obviously gone pure battery electric vehicle. In China, plug-in hybrid sales are down versus battery electric vehicles. And for BYD the same and I guess that peak or up leads to the trough or the down which is uh Scout. So Scout is the uh VW part-owned I think brand in North America uh that’s looking at to bring out a new range of kind of rugged uh SUVs originally conceived as pure electric vehicles and in the last week they’ve announced that actually they’re going to mainly focus on gasoline electric hybrids. And I think that’s a an unfortunate backward step. I can actually I do have quite a lot of sympathy for the notion that electric range extended vehicles in big country like Canada and America and Australia will do quite well. I can see them being appealing to people who do those really really long trips. But I think in ostensibly responding to what customers want, scouts have actually they listen to customers aren’t necessarily as up to- date as future thinking as the market will need them to be. So it’s interesting that Scout have kind of the pendulum swung back towards hybrids there. And I wonder if that’s going to be a strategic error, but you know they’re trying to meet the moment. And in in Trump’s America, you know, clearly battery EV sales are down because the rebates have been uh pulled. So, you’re going to see some pretty horrific numbers from the likes of Ford uh and GM and others in in America from their battery electric vehicle sales over the next few months. But America is not an island, that’s for sure. Well, I I completely agree and I think Scout have made that bet with hybrids, but responding to the current political climate and the current supply chain as it is in the US and you can see why they’ve made that decision. It’s just it’s a bit of a shame, but it’s logical, I guess. I can I can see it. And, you know, go Rivian. That’s all I’m saying. You know, hope we get through they get through this uh tricky spell. Must be difficult for for them. And again, that’s another great podcast you did with with RJ at Rivian. There’s also a new entrance slate which is a sort of cheaper pickup truck uh company as well but ultimately on getting them on the podcast very shortly. Fantastic. But I mean ultimately you know battery electric vehicles we believe will win. It’s not a matter of if it’s just a matter of when. So I do understand what Scout have have done and why they’ve done it. But to me I think yes you want to listen to your customer but do you want to let your customer dictate the future of your business? I don’t think that’s the way they should do it. And that’s what they’ve done. They’ve listened to a lot of people wanted the hybrids for now, but actually it’s being ahead of the game that will mean you’re still in the game in a few years time. And I think that’s where they’ve made a strategic error. Even if they do quite well out of their their strategy for the next year or two, I think in the long run, it is an error. Well, I’m going to add a little peak uh to finish on a high if that’s okay. Um and that is the world of commercial electric vehicles. Something I spotted today is that Royal Mail have just taken delivery of eight fully electric HTVs that are going to be running be running in Daventry and Warrington. So, you know, we can have our parcels delivered electrically uh this year for Christmas. And also, um, Stage Coach have just had 42 electric bus, well, they’ve just ordered 42 electric buses which will be running in Chelenham, Chukesbury, and Glouester from 2026. So, good news on commercial EVs. Lor’s buses and trucks and things like that were supposed to be the domain that hydrogen was going to play a role and that has proven to be completely false. Again, battery electric is the way forward in those markets too. Well, that is all that we have time for today. Um, we really hope that you are enjoying this format. Um, as ever, if you could do us the honor of liking, subscribing, sharing with a friend, leaving a comment, all of the above, we so appreciate it. It is so important uh to our organization. Um, but that’s it. If you have been, thank you for listening and slash or watching and see you next

The automotive industry’s existential crisis continues, and Imogen Bhogal & Dan Caesar sift through the rubble. Toyota receives electric encouragement, the EU’s resolve is tested by the businesses with the most to lose, and ‘Big Short’ investor eviscerates Tesla valuation.💡Links to Stories:

🚗 Toyota – https://electrek.co/2025/12/01/toyotas-15000-electric-suv-hit-china/

🚗Polestar and Volvo – https://www.theguardian.com/business/2025/dec/02/china-volvo-polestar-eu-2035-petrol-car-sweden-germany

🚗Chinese Gasoline Cars – https://www.reuters.com/investigations/china-floods-world-with-gasoline-cars-it-cant-sell-home-2025-12-02/

🚗The Big Short?! – https://electrek.co/2025/12/01/the-big-short-michael-burry-slams-tesla-tsla/

🚗BYD – https://cleantechnica.com/2025/12/01/byd-bev-sales-up-20-in-november/

🚗Scout – https://www.ttnews.com/articles/vw-reviving-scout-hybrids

🚗Royal Mail – https://www.fleetnews.co.uk/news/first-fleet-of-fully-electric-hgvs-deployed-by-royal-mail

🚗Electric Buses – https://www.electrive.com/2025/12/02/stagecoach-buys-42-battery-electric-buses-for-gloucestershires-fleet/

Why not come and join us at our next Everything Electric expo: https://everythingelectric.show

To partner, exhibit or sponsor at our award-winning expos email: commercial@fullycharged.show

Everything Electric SYDNEY – Sydney Olympic Park 6th, 7th & 8th March 2026

Everything Electric NORTH (Harrogate) – 8th & 9th May 2026

Everything Electric WEST (Cheltenham) – 12th & 13th June 2026

Everything Electric GREATER LONDON (Twickenham) – 11th & 12th Sept 2026

Check out our sister channel Everything Electric TECH: https://www.youtube.com/@EverythingElectricShow

Support our StopBurningStuff campaign: https://www.patreon.com/STOPBurningStuff

Become an Everything Electric Patreon: https://www.patreon.com/fullychargedshow

Become a YouTube member: use JOIN button above

Buy the Fully Charged Guide to Electric Vehicles & Clean Energy : https://buff.ly/2GybGt0

Subscribe for episode alerts and the Everything Electric newsletter: https://fullycharged.show/zap-sign-up/

Visit: https://FullyCharged.Show

Find us on X: https://x.com/Everyth1ngElec

Follow us on Instagram: https://instagram.com/officialeverythingelectric

To partner, exhibit or sponsor at our award-winning expos email: commercial@fullycharged.show

Everything Electric SYDNEY – Sydney Olympic Park 6th, 7th & 8th March 2026

EE NORTH (Harrogate) – 8th & 9th May 2026

EE WEST (Cheltenham) – 12th & 13th June 2026

EE GREATER LONDON (Twickenham) – 11th & 12th Sept 2026

#fullychargedshow #everythingelectricshow #homeenergy #cleanenergy #battery #electriccars #electric-vehicles-uk