This Week’s E-Bike News Headlines

Outdoor Master Recalls 24,000 Kids Helmets

Image Source: Yahoo / CPSC

Outdoor Master has issued a joint recall with the CPSC for two youth helmet models that don’t meet federal positional-stability and coverage requirements. The affected models are the OM-TD-BIKE, which features a dinosaur print, and the OM-KSKB, which comes in a green graphic.These helmets were sold between June 2024 and February 2025.

Fortunately, the recall is preventative; no injuries have been reported at the time of writing.

If you think you might have one of these helmets, see the official recall page on Outdoor Master’s website. This page provides instructions on how to identify the serial number and manufacturing date.

Outdoor Master states that most affected helmets have already been destroyed, but if you believe your helmet is from the recalled batch, you can request a full refund via the website.

Our Take:

As relatively frequent reporters of recalls, we know that these situations, while unfortunate, are part of the nature of production in many industries. We’re happy to know that no injuries were caused and that most of the affected helmets have already been destroyed. We urge any potential owners of recalled helmets to use the tool above to check their product and prevent any unsafe situations.

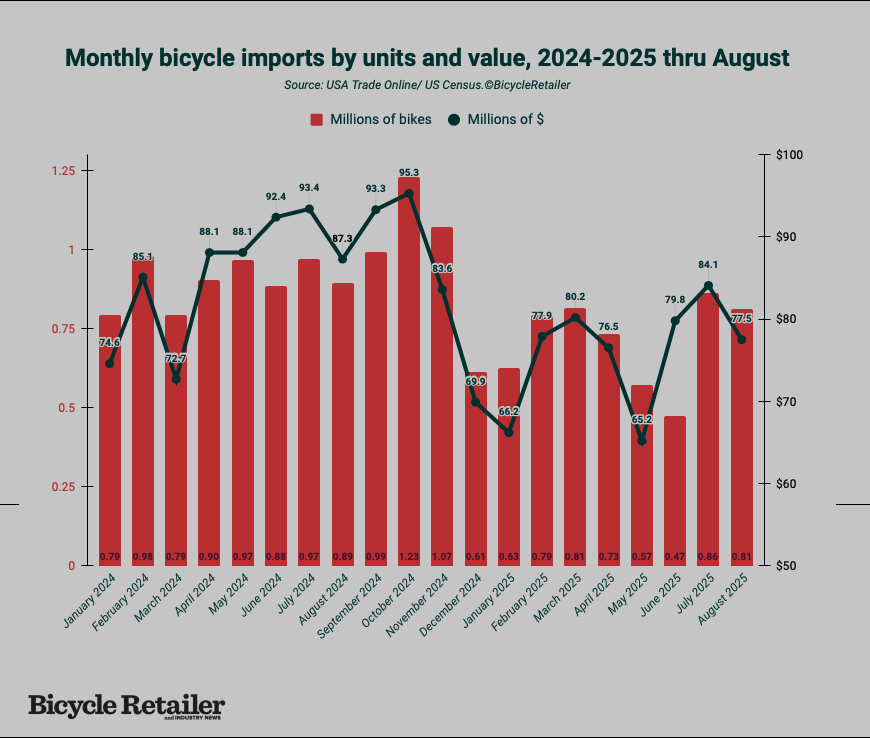

August Trade Data Shows a Continuation of July’s Uptick in Chinese Bike Imports

Image Source: Bicycle Retailer

Bike imports have been inconsistent this year, largely due to the uncertainty around tariffs. Brands have had to juggle wild swings in tariff rates while also balancing inventory with consumer demand (a continuation of problems that developed during the pandemic).

Imports of bikes originating from China reached a low point in May, with their value totaling just 65.2 million dollars. The smallest number of bikes (500,000), was imported in June, but their total value exceeded that of May’s imports.

The 42% YTD drop in Chinese imports was likely due to the threat of new tariffs set to begin in mid-August; in April, the US and China were embroiled in an escalating trade war that resulted in Chinese imports being taxed as high as 145%. Fortunately, China and the US reached an agreement to delay tariff increases until November.

As the trade war developed, the bike industry turned to Cambodia as the best alternative to China, but their tariff rates were ultimately similar. The Trump administration’s reciprocal tariff rates on products from Cambodia did not differ greatly from the total of reciprocal, fentanyl, and Section 301 tariffs on Chinese products.

Still, Cambodia surpassed China as the largest supplier of US bike imports by dollar value, even if more individual units continued to be brought in from China. According to Bicycle Retailer, the total yearly value of Cambodian bike imports was $204 million at the end of August, while the value of Chinese imports was $159 million. At that point, the US had imported just 1 million bikes from Cambodia this year, while 3.8 million units were imported from China.

Under normal circumstances, this data would have been released earlier in the year, but it was delayed by the month-long government shutdown that began in October. According to Bicycle Retailer, the US Census hasn’t announced when data for the rest of the year will be published.

Our Take:

We do our best to monitor the impact of tariffs, and this most recent data shows just how turbulent this year’s developments in US trade policy have been. Such inconsistency and volatility makes planning difficult for businesses in any affected sector; brands must attempt to anticipate future changes and plan accordingly.

While things seem to have settled somewhat in more recent months, no outcome is guaranteed. We hope that trade policies stabilize and remain more predictable for the foreseeable future to give the bike industry an opportunity to regain its footing.

Italian Component Maker Campagnolo Lays Off 40% of its Staff

Image Source: Velo / liewig christian/Corbis via Getty Images

Longtime cycling icon Campagnolo has cut 120 of its roughly 300 employees due to significant losses in recent years. This drastic move reflects the broader struggles the cycling industry has been facing this year.

Campagnolo, which was founded in 1933 and developed over 135 patents throughout its existence, is best known for producing high-end groupsets and wheels. Despite this rich heritage, reports indicate the company has been €24 million in the red over the past three years.

Layoffs are just part of the brand’s survival strategy. A statement from the company said that is has “produced a financial plan aimed at institutions and possible partners to reverse the trend and return to the Vicenza community a company not only technically to excellence, but also capable of supporting itself.”

Our Take:

Seeing a brand of Campagnolo’s status make such deep cuts underscores the difficulties both large and small cycling brands are navigating presently. It’s unfortunate to see any companies laying off employees—especially around the holidays—and we hope both Campagnolo’s affected employees and the brand itself can find success in the future.