The wave isn’t coming. It is already here. Asian manufacturers are moving faster, listening harder, and taking the space the Western world left empty.

While Europe clings to heritage, they’re building product, narrative, and momentum.

Wake up now or get washed away.

This article is part of the Brixen Bike Papers – a 41 Publishing initiative from our 2025 Think Tank in Brixen, created with the goal of building a better bike world.

A series of essays diving into the uncomfortable truths, hidden opportunities, and real changes our industry needs. Click here for the overview of all released stories.

The Brixen World Bike Papers – The Bike Brands’ New Competitors

1. Global Power shift

For decades, Western brands defined the global bike industry. The storytelling came from Europe and the U.S. – Asia provided the factories. Even today, giants like Merida and Giant still manufacture for many of the most prestigious Western brands, quietly respecting the traditional power dynamics and never attacking Western business models head-on. But that era is ending. A new generation of Chinese brands is rising – hungry, fast, cost-efficient, and increasingly superior. Names almost no one in the West had heard of one or two years ago- Amflow, Avinox, Hepha, Gobao, Light Bicycle – are suddenly taking market share. And they are just the beginning.

These brands are no longer imitators; they are innovators. Their development cycles are shorter, their value creation are greater, and their products are tuned to what a global mass market actually demands: high-quality bikes at accessible prices. The power balance that once seemed unshakeable is tipping, and the bike world is entering a period of profound structural realignment.

2. The Next Leap: A New Direct-to-Consumer Model?

For two decades, direct-to-consumer reshaped the bike world. Brands like Canyon, YT, Propain and Rose cut out the dealer, moved faster, and won massive market share with better pricing and leaner structures. Removing one middleman felt revolutionary.

But the eBike era broke that model open.

Suddenly, the “dealer-free” dream hit reality:

eBikes need service, diagnostics, and physical touchpoints.

Result: Canyon, Rose and others now run or contract service hubs, showrooms, and partner shops. Direct to consumer didn’t fail—but it didn’t scale cleanly either.

For the next generation of “direct” brands, the dealer may still exist. But other middlemen are being eliminated: distributors are replaced by dropshipment, and Western brand shells are being replaced by Asian manufacturers.

Because the truth behind the industry is uncomfortable:

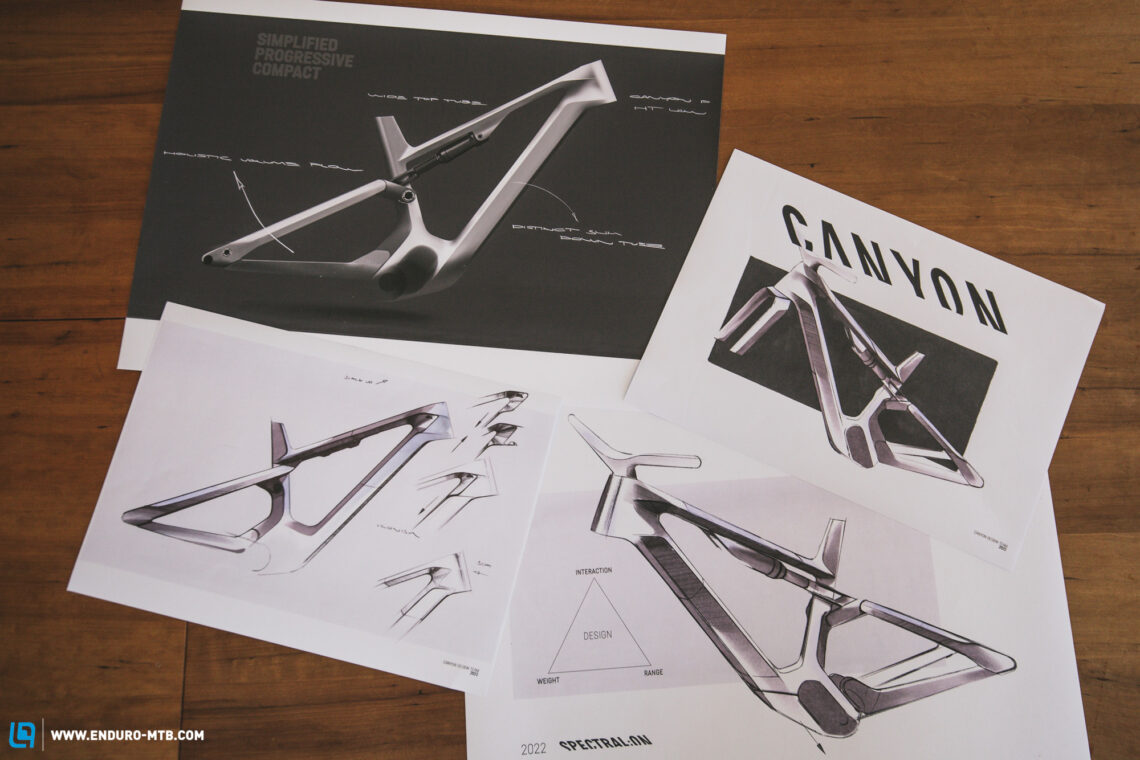

Many Western brands supply the logo and the story, while the real work—design, engineering, product development—is outsourced to studios like CERO, 360°ENGINEERING, Faction Studio, Radiate, and then industrialized by OEM manufacturers.

The result? Lots of stakeholders. Lots of compromises. Long, expensive development cycles.

Light Bicycle puts it brutally honest on their website: “With a long development cycle and numerous middle-men involved, it was frustrating to see end consumers suffer.”

This is where a new model emerges: Direct-from-Manufacturer (DfM).

3. Direct-from-Manufacturer (DfM) – Definition

Direct-from-Manufacturer (DfM) is a new value-creation and distribution model where manufacturers no longer act in the background but step forward as the brand. They design, industrialize, and sell their own products – directly to consumers and through retailers. DfM replaces traditional brand and distribution layers with a more integrated, leaner value chain that is faster, more efficient, and more price-aggressive. At its core, DfM shifts value creation away from Western brand intermediaries and back to the people who actually build the product.

DfM is the logical evolution of D2C: Not without dealers – but without unnecessary brands. Fewer middlemen, more value creation, maximal proximity to the source. We see the first wave of DfM brands already taking market shares that are hard to ignore. But the bigger waves are yet to come. The questions are:

What value proposition can Western brands still provide?

If the product is no longer the differentiator, can Western brands even survive without becoming cultural engines?

Are we prepared for DfM players buying Western brands just to acquire heritage and retail access?

What happens to the dealer role when they can buy straight from the source, without ten layers of “brand theater”?

Who owns the perception of quality when Asian manufacturers are already setting the standard?

4. Automotive déjà vu?

The bike industry may be heading toward the same crossroads the automotive world is facing today. European giants like Volkswagen, Renault and Stellantis are under massive pressure from Chinese brands such as BYD – supported by lower costs, scale advantages, and state-backed industrial strategy. Entire markets are shrinking, shifting, or becoming increasingly hard to access. And in cycling, the structural dependencies are even deeper: aside from a handful of European motor manufacturers like Bosch, TQ, FAZUA, Specialized/Brose/Qore, and maxon, most frames and a vast share of components are already produced in Asia. So the question becomes: what can we learn from the car industry before this dynamic fully reaches the bike world? The “Volvo model” offers a striking preview.

5. The Volvo model

Look at the car industry: Geely bought Volvo. A long-established European brand with heritage and credibility. The brand name stayed. The design studios stayed. The Scandinavian story stayed. But the technology, the platforms, and the strategic control shifted to China.

The logic for the Chinese investor was simple:

Why struggle with the hardest part of entering a Western market—building trust, credibility, and distribution—when you can just buy it?

They didn’t need to create a history. They acquired one. They didn’t need to build a dealer network. They inherited it.

Now bring this lens to the bike world.

We already see Asian manufacturers launching their own brands for Western consumers in bold ways, whilst controlling big parts of the value chain. Some are quietly buying into, or preparing to take over, the brands they’ve been supplying for years. Rumors have it that the share majority of a well-known European bike brand was just acquired by its manufacturer. The comparison is straightforward: it mirrors what happened with Rotor, the Spanish components brand that was taken over by WheelTop, the Chinese supplier that had been producing part of its components. A quiet OEM becomes the majority owner, the backstage moves to the front row, and the value chain flips as the maker of the product becomes the keeper of the brand.

So the real question for our industry is not: Will US or European bike brands disappear?

They probably won’t. The logos will still be there. The stories will still be told. The “European Brand” label will still sit on the downtube.

The real question is: Who will own these brands in 2035?

And who will control the value creation behind them?

Because the battle won’t be fought on the outside—the brand layer.

It will be fought behind the curtain: in ownership, in IP, in engineering control, in supply-chain domination, in platform technology.

And whoever owns that layer owns the future of the bike industry.

6. Are we already in the Volvo model era?

How big is the problem really? Inside the industry, most people know this is not an East vs. West confrontation. Many partnerships between Western brands and Asian manufacturers have been stable, healthy and mutually beneficial for decades.

But the ground has shifted.

Today, the ownership structures and value creation behind many Western brands already look Volvo-like. The brand may sit in Europe or US, but the engineering, the platforms, the industrialisation and the strategic leverage sit elsewhere.

This is not theory. It is already happening across the market, from premium e-bike labels to long-established mid-tier brands that rely almost entirely on external partners for product and development.

And here lies the real risk.

Western brands without a sharp value proposition, without clear USPs and without a strong dealer base are exposed. These long standing relationships can quickly turn into points of vulnerability. When the manufacturer becomes the brand, the Western player becomes optional.

DfM does not destroy these brands. It simply bypasses them. And in a compressed market, optional players do not survive for long.

The question is no longer if the Volvo model will reach the bike world.

The question is how many brands are already living inside it without realising it.

7. What value can Western brands still provide?

If Western brands are to stay relevant, they need to stop pretending they can win on production efficiency.

They will not outperform their own manufacturers on:

industrialisation

cost per unit

supply chain access

However, if Western brands decide to keep on pushing on innovating production, there are still possibilities.

So where can they still add real value?

Design and ride quality

Not as a list of buzzwords, but as a felt difference on the trail, on the commute, or on the road.

Heritage and credibility

Not as empty retro storytelling, but as real continuity: racing, advocacy, community building, long-term product responsibility.

Community and culture

Turning customers into a living ecosystem of riders, local events, ambassadors and retailers who feel part of something that matters.

Retail partnerships

Helping dealers with tools, training, storytelling and sell-through, instead of just pushing preseason orders and discount campaigns.

Western brands need to evolve from product shells into cultural engines. If they keep acting as simple logos pasted on anonymous platforms, they will be outcompeted by the very factories that build “their” products.

8. Morals or Capitalism? What does this mean for the buying decision of the customer?

For Western brands, the danger is very real. But what about the wider Western economy?

If value creation in the bike world keeps shifting East, the impact is not only:

the bikes themselves

but also the taxes, the industrial jobs, the ecosystem around them

At the same time, many “Western brands” already sit under Eastern ownership, or rely so heavily on Asian partners that the label “local” becomes blurry.

So the final question becomes deeply personal, for riders and for dealers:

Do we base buying decisions on regional origin and local value creation, even if it costs more or limits choice?

Or do we follow the cold logic of capitalism and pick the best performance per euro, no matter where the money finally lands?

Will the future of the bike world be shaped more by consumer values, or by consumer wallets?

There is no easy answer. But pretending that the question does not exist is a luxury the industry no longer has.

What is your opinion?

Does it still matter where a brand comes from?

Is the real issue the location of the headquarters or where value is truly created?

How much should ownership and local impact influence the choice in a bike shop?

We would like to hear from you.

What is your opinion? Send us an email: robin@41publishing.com

The quiet era is over. The factories stepped out of the backstage and onto the main stage, and they’re not giving the spotlight back. Western brands can no longer hide behind heritage, glossy storytelling or old victories. In this new landscape, only those who create real cultural gravity will stay relevant.By 2035, the downtubes may still wear familiar names, but the hands steering the industry will be very different.

Adapt with intent, build real value, or fade into the background of someone else’s script.

Words: Juansi Vivo, Robin Schmitt Photos: diverse