Earlier this month, Perrone Robotics filed lawsuits against Tesla and six other automakers, alleging unauthorized use of its patented robotics and automated driving technologies in their vehicle software systems. This legal action underscores the increasing importance, and complexity, of intellectual property in the competitive autonomous driving and automotive AI sectors. We’ll review how the Perrone Robotics lawsuit highlights legal risks for Tesla’s innovation-driven business model and future earnings outlook.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Tesla Investment Narrative Recap

Owning Tesla requires belief in its ability to commercialize autonomous driving technology and transition to high-margin software revenues, even as it faces rising costs and regulatory uncertainty. The recent Perrone Robotics lawsuit spotlights legal risks linked to Tesla’s reliance on proprietary AI for autonomy but does not appear to materially alter the most important near-term catalyst, the scaling of the robotaxi network, nor does it change the immediate risk of policy-driven declines in U.S. and China EV demand.

The integration of Tesla’s Supercharger network with Edenred’s UTA eCharge platform across Europe is one of the latest announcements, providing more evidence of Tesla’s evolving ecosystem, which could support product value and charging convenience even as legal, regulatory, and pricing headwinds persist.

But while headline legal risks seem remote for now, investors should know that if patent disputes over autonomy intensify …

Read the full narrative on Tesla (it’s free!)

Tesla’s outlook sees revenues reaching $148.1 billion and earnings reaching $15.4 billion by 2028. This is based on a projected annual revenue growth rate of 16.9% and an increase in earnings of $9.5 billion from the current $5.9 billion.

Uncover how Tesla’s forecasts yield a $392.93 fair value, a 9% downside to its current price.

Exploring Other Perspectives TSLA Community Fair Values as at Nov 2025

TSLA Community Fair Values as at Nov 2025

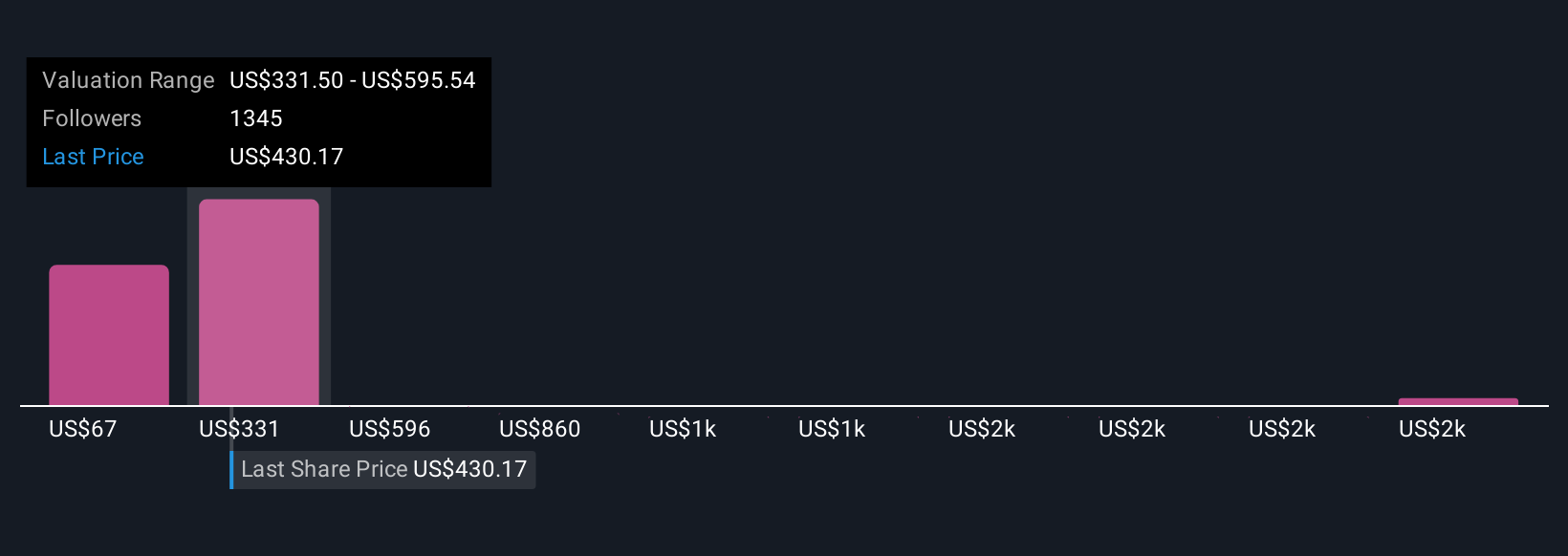

220 Community fair value estimates for Tesla range from US$67 to US$2,708, reflecting dramatically differing outlooks. While some expect rapid recurring revenue growth from robotaxis, others warn that unresolved IP risks could impact Tesla’s margins and long-term plans, showing how your own view may differ from the consensus.

Explore 220 other fair value estimates on Tesla – why the stock might be worth less than half the current price!

Build Your Own Tesla Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.Our free Tesla research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Tesla’s overall financial health at a glance.Curious About Other Options?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tesla might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com