Tesla (TSLA) has seen its stock move erratically over the past month, and investors are taking a closer look at what is driving these swings. With the broader market shifting gears, Tesla’s recent performance stands out.

See our latest analysis for Tesla.

Despite a bumpy ride over the past month, with a 7.6% decline in share price, Tesla has regained positive momentum. The company posted a 27.8% share price return over the past quarter and delivered a strong 23.6% total shareholder return in the last year. These moves have reignited optimism among investors who see recent shifts as renewed belief in the company’s long-term growth potential, even as short-term volatility remains part of the story.

If Tesla’s recent rebound has you wondering what’s next for carmakers and electric vehicles, there’s never been a better time to explore the full universe of industry leaders with the See the full list for free.

So is Tesla’s recent rally a sign of undervaluation that the market has overlooked, or is the enthusiasm simply a case of future growth already being priced in? Could this be a true buying opportunity, or not?

Against Tesla’s last closing price of $426.58, the most popular narrative according to BlackGoat sees fair value much lower. The calculation ignites debate over whether current optimism reflects future value or just momentum.

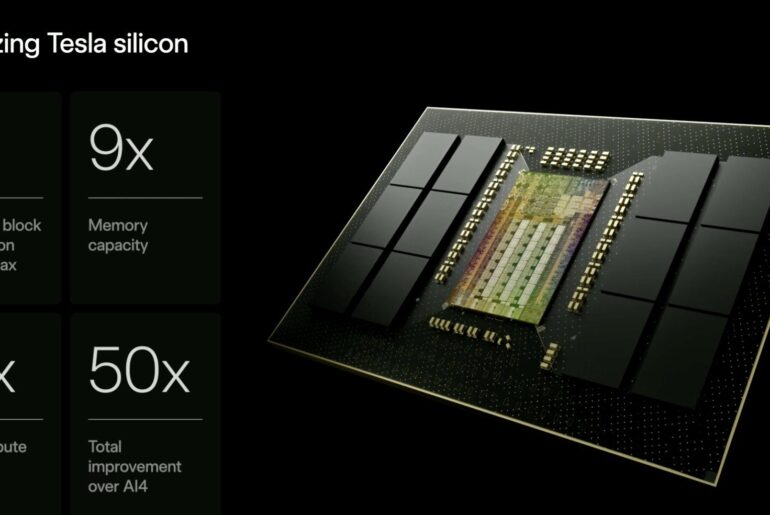

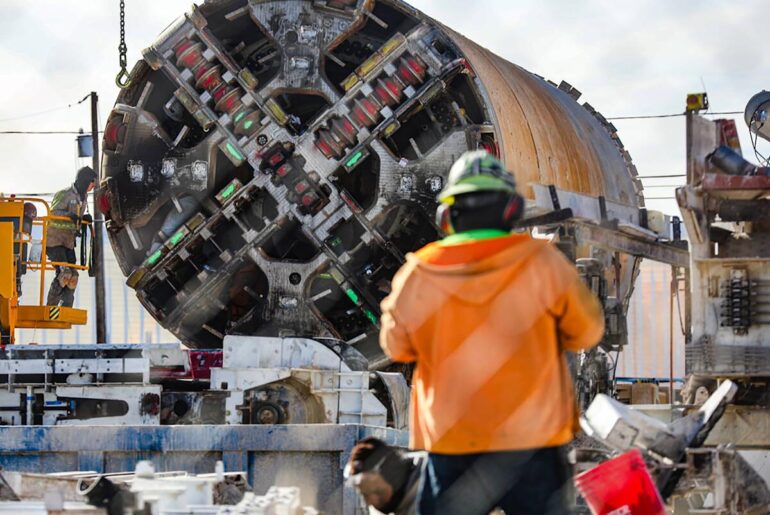

Tesla’s business model is shifting from one-time car sales to AI-powered software and service-based recurring revenue models. To estimate Tesla’s intrinsic value over the next 10 years, we model: • Automotive Growth – Continued expansion of Model Y sales and new models, with projected annual revenue growth of 15%. • Robo-Taxi Monetization – Gradual deployment and scaling of robotaxis, contributing to high-margin, recurring revenue. • FSD Licensing – Tesla monetizing self-driving technology by licensing FSD to other automakers. • Energy Business Expansion – Increased Megapack and Powerwall adoption, adding further revenue stability. • Optimus & Robotics – Potential long-term revenue stream that revolutionizes labor-intensive industries. If Tesla executes on these high-growth, high-margin opportunities, it could reach a multi-trillion-dollar valuation by 2035, making today’s sentiment-driven sell-off an attractive buying opportunity.

This narrative’s price target is built on Tesla’s rapid pivot to software, big bets on robotics, and recurring revenue streams. The full valuation argument includes surprising forecasts about profit margins and what could be a shift in how Wall Street prices Tesla as a tech powerhouse, not just an automaker. What exactly drives the bold future value? The full playbook is inside the narrative. Are you ready to see the game-changing details?

Result: Fair Value of $425 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, setbacks such as further regulatory delays for autonomous driving or fierce price competition from Chinese EV makers could challenge Tesla’s ambitious transformation story.

Find out about the key risks to this Tesla narrative.

If you see things differently or would rather dig into the numbers yourself, you can quickly pull together your own take on Tesla’s outlook in just a few minutes, then share your view: Do it your way

A great starting point for your Tesla research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Smart investors never settle for just one opportunity. Broaden your horizons with handpicked stocks and hidden gems before the next market surge leaves you behind.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSLA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com