Electric Cars – The Budget Is Announced!

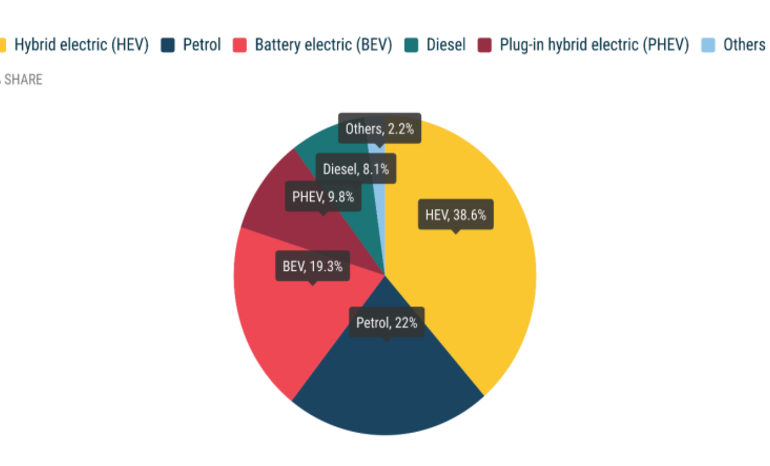

Few week ago, I did a video talking about the reported leak of the 3P per mile EV driver thing that uh was or wasn’t happening. And it was all take it with a pinch of salt sort of thing. We didn’t know if it was happening. It’s just a paper said we think this is going to happen. Um and now the budget the budget has happened. In fact, it was done about an hour ago. Two notable things have changed. One, the luxury car tax or ECS as it’s called has changed. the barrier and the price and I can tell you whether or not this 3P per mile thing’s actually happening. Well, let’s just not beat around the bush any longer. Yes, it is. So the budget again has been announced and from 2028, so this isn’t tomorrow or anything, from 2028 April onwards, it will be three pence per mile for a full electric vehicle on top of your normal VED rate, which at the moment is £190. So effectively, if you did, let’s say 10,000 miles peranom, which is above the UK average, but let’s say 10,000 miles, that would be obviously 3 P times 10,000. So £300 on top of the £190 ve meaning that you would pay £490 VED plus rate as it seems to be called for that year. And I believe how it’s going to be done is that when you tax the car, I assume you will put the mileage in, which at the moment is optional. Uh you’ll put the mileage in and you’ll say, “Right, how many miles do you think you will do over the next 12 months?” So if you say 8,000 mi then you will pay 3 * 8,000. If you say 10,000 mi you will pay 3 * 10,000 and so forth. By the end of that year when you retax the vehicle obviously you will uh either you know pay more if you underestimated or pay less if you overestimated. So there’s that. Uh, now a lot of people said, “Why don’t they add it onto the MOT?” Well, what do you do for the first three years of a car? Well, it doesn’t need one for one, but that for me is it’s it doesn’t make any sense cuz it’ have to be done by the garage. It’s a different thing entirely. This is probably the simplest way. I’m not saying it’s the best. I’m saying it’s the simplest way for a government to collect tax because the VED system is already in place. You would just pay more um than you would do for car tax anyway. and all you have to do is put your mileage in. When you sell the car, the new owner would put their mileage in, of course, which is what you have to do now, and retax it. So, that would mean that you would then pay or, you know, the shortfall or the extra, whatever it may be. Now, charging from home at the moment, I pay less than 2 p per mile for my EV in terms of fuel because I I can charge at home on a cheap nighttime rate. This will obviously put it to 5 p per mile, which is still probably about 40% of the total cost of a petrol or diesel car per mile just for fuel. So, it’s still considerably cheaper to fuel one of these, for example, than it is a petrol car and doing the same miles. And that’s again just purely based on fuel, nothing else. Um, but it is of course reducing the gap unless fuel duty goes up, which apparently it will be doing I think next September 2026, as in it’s they’re going to start to in to increase what has been a frozen fuel duty for quite a few years now. So, they’re obviously going to start increasing petrol prices or the tax on petrol as well. Now, the luxury car tax, let’s go on with that. the ECS. The barrier at the moment as it stands is £40,000. So if you buy a car whose list price, not the price you pay, list price is above £40,000, you pay an extra £425 on top of what I’ve already said. That is changing uh in line with previously announced stuff by previous governments to £440 per year. But they are at least raising the bar. So it’s not £40,000 anymore. It’s £50,000. So if you buy a car for 45 grand from April 2026 onwards, not from now, from next April and it’s between4 and 50 grand, then you won’t be paying £425. You’ll be paying nothing in regards to the ECS. If you currently pay the luxury car tax because you bought your car like now, so you’re paying 425 plus 190, that doesn’t change next year just because they’ve raised the barrier. It’s only for new car purchases. So to recap, it’s 3 p per mile from April 2028 onwards for full electric cars. It’s 1.5p per mile for plug-in hybrids. VED rate that’s just basically staying the same and will progressively get more expensive as time goes on. The luxury car tax or the ECS that is currently at £425 but will go to 440 and the barrier will also go from4,000 to50,000 for new car purchases only. So what’s my opinion on this? Well, it’s kind of what I said earlier before. If you want to incentivize something, making it more expensive to run isn’t the way of do to to do that. If you don’t want to incentivize things, then fine. I mean, logically, the government was always going to do this. We’ve known this for a decade or so that at some point when the fuel receipts so, you know, drop, then the EV receipts will have to kick in at some point. I’m not saying that they have to. I’m not saying they should. I’m just saying it was inevitable. There’s going to be no telematics. A lot of people worried that we were going to be tracked. No, that that would be ridiculous. It would never happen again because you’d have to retrofit stuff. It wouldn’t make sense. Um and people would just circumn it very easily. I do think there’s a a missed thing here that they could have implemented which would make more sense. Uh, and I’m just picking figures off my head to to highlight my point, but make it 1 pence per mile for cars under a certain weight. Two pence per mile for the middle cars and 3 p per mile for heavier cars. Maybe even 5 p a mile or something for the real big beefy ones. So that would account for weight, not just mileage, which I think is a fairer, better way of doing it and would encourage people to get smaller cars, um, which are better for the environment and and so forth. As a few people delighted in the comment section, the anti-EV types, a bubbles bursting, haha, you have to pay tax. Yeah, I’ve had over a decade’s worth of not I have no regrets in this at all. And it will still be a lot cheaper for me, at least for now. And I don’t think it’s going to do that so much in terms of imagine this is petrol per mile and this is electric per mile. It’s doing this, but then all they’re going to do is make petrol do that. So, for the next two and a bit years, I guess guess get your miles in, I suppose. It’s going to it’s going to have an effect, isn’t it? There we have it. Let me know what you think. Um, and anything else from the budget. Why not? Let’s go nuts. Uh, it’s a lot duller than I expected. So, apologies if it’s a bit darker than normal, but I thought, let’s do this just after the budget. Let’s get it edited quickly. Let’s get it on the channel so so we know what’s going on. So, thanks for watching, guys. See you soon. And um yeah.

Rachel Reeves Budget for 2026 has landed and it has a profound affect on the future of electric cars.

Podcast Channel: https://www.youtube.com/@drivingohm

Website: https://www.ev-man.co.uk

Twitter: https://twitter.com/evmanuk

Tesla Referral: https://ts.la/andrew31112

Octopus Referral: https://share.octopus.energy/ore-cobra-425

#budget2026 #cartax #electriccar