Tesla (TSLA) shares are slipping today after billionaire Elon Musk admitted on X that the Optimus robot could take until 2029 to have a “massive impact.”

His remarks placed TSLA’s plans of spending about $20 billion mostly on its artificial intelligence (AI) ambitions this year under intense scrutiny, as investors weigh immediate capex against distant returns.

Following today’s decline, Tesla stock is down a notable 10% versus its year-to-date high, but that isn’t enough for Wells Fargo to recommend loading up on it at $405.

www.barchart.comWells Fargo Reiterates Underweight Rating on Tesla stock

www.barchart.comWells Fargo Reiterates Underweight Rating on Tesla stock

On Tuesday, a senior Wells Fargo analyst, Colin Langan, maintained TSLA stock at “Underweight,” saying the giant’s core electric vehicle (EV) business is slowing more than expected.

“Of the four major markets we track, Tesla deliveries in January trended 18% lower year-on-year and 59% lower month-over-month,” Langan told clients.

He noted particularly grim performance in Europe and China, with domestic deliveries in the latter sitting at their lowest level since late 2022.

In short, he recommended caution in buying the dip in Tesla stock, given its high-growth EV story is stalling while physical AI and robotics moonshots remain years away from profitability.

2026 Capex Could Restrict TSLA Shares’ Upside

Tesla shares are also not as attractive based on fundamentals. They’re currently trading at a forward price-to-earnings (P/E) multiple of a rather stretched 276x.

This means the EV company remains priced for perfection, even after posting its first-ever annual sales decline and issuing capex guidance that threaten to turn it free cash flow negative in 2026.

TSLA’s recently disclosed pivot — discontinuing the Model S and Model X to make room for robots — leaves a revenue vacuum in the premium segment.

Note that the EV stock now looks headed to challenge its 200-day moving average (MA) at the $386 level. A decisive break below that price may accelerate bearish momentum in the near term.

Wall Street Isn’t Particularly Bullish on Tesla

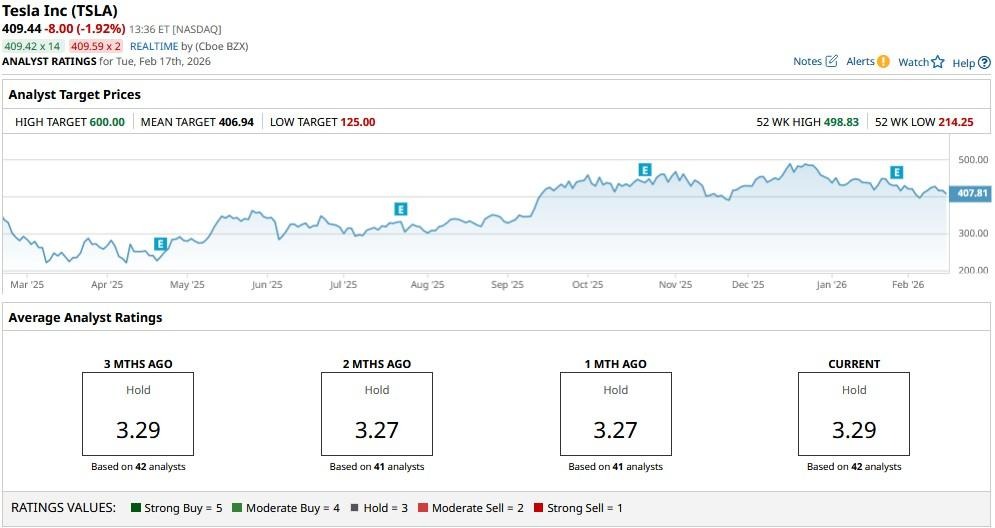

Wall Street analysts also seem to believe that TSLA shares lack further upside in 2026.

The consensus rating on Tesla Inc sits at a “Hold,” with the mean target of about $407 already in line with the price at which it’s trading currently.

On the date of publication,

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.