The global automotive industry is a very complex and ever changing landscape, but there are clear and obvious signs everywhere that Chinese vehicles are dominating, no matter how you look at things.

China’s dominance looks set to become even more clear cut as the global shift towards electric vehicles gains momentum, with their early investments and leadership in the electric vehicle space paying off big time.

There are endless ways to analyse markets and data, so I will focus on just a few recent highlights in this area that stood out to me. Firstly, as Giles Parkinson wrote on The Driven recently, China EVs have more range at a lower price, no wonder they have taken the electric crown.

Chinese brands like BYD have been successful because they are fiercely competitive, offering buyers compelling electric vehicles with decent range and premium features for less money than equivalent cars from European or US based manufacturers.

A great example of this is Xiaomi with their first car, the SU7, and subsequent YU7 SUV. These first 2 vehicles from the phone maker and technology giant took the automotive world by storm, collecting nearly 300,000 orders in the first hour of the YU7 release.

The news above coincided with confirmation that BYD overtook Tesla as the world’s number 1 seller of battery electric vehicles in 2025, a significant milestone as Tesla dominated electric vehicle sales for several years since the Model 3 became their first mass market car.

Tesla’s ongoing global sales decline meant the numbers were not even close either, Tesla sold 1.64 million battery electric vehicles compared to BYD’s 2.26 million. If you include plug-in hybrid vehicles, BYD sold a total of 4.6 million vehicles in 2025. BYD clearly has their sights on Toyota and becoming the number 1 automaker in the world.

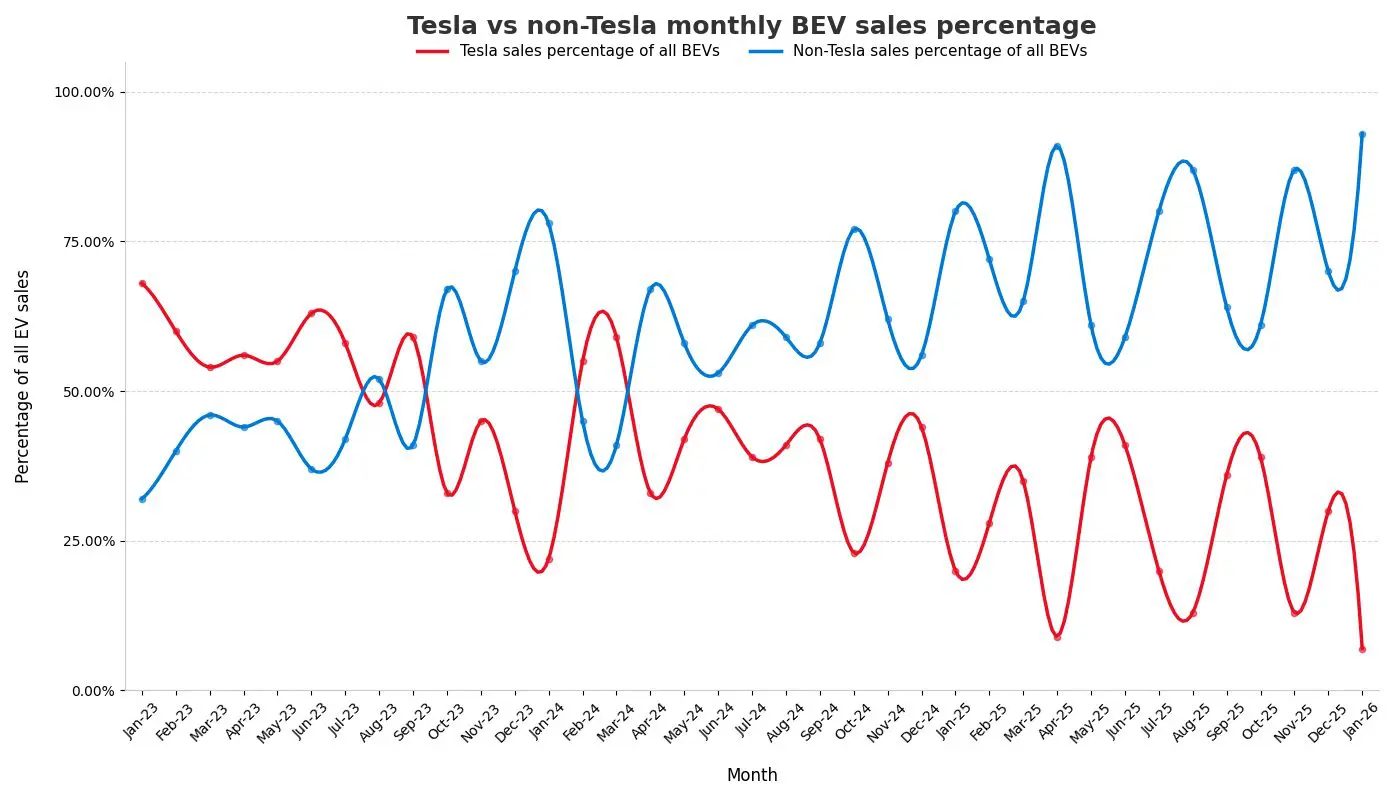

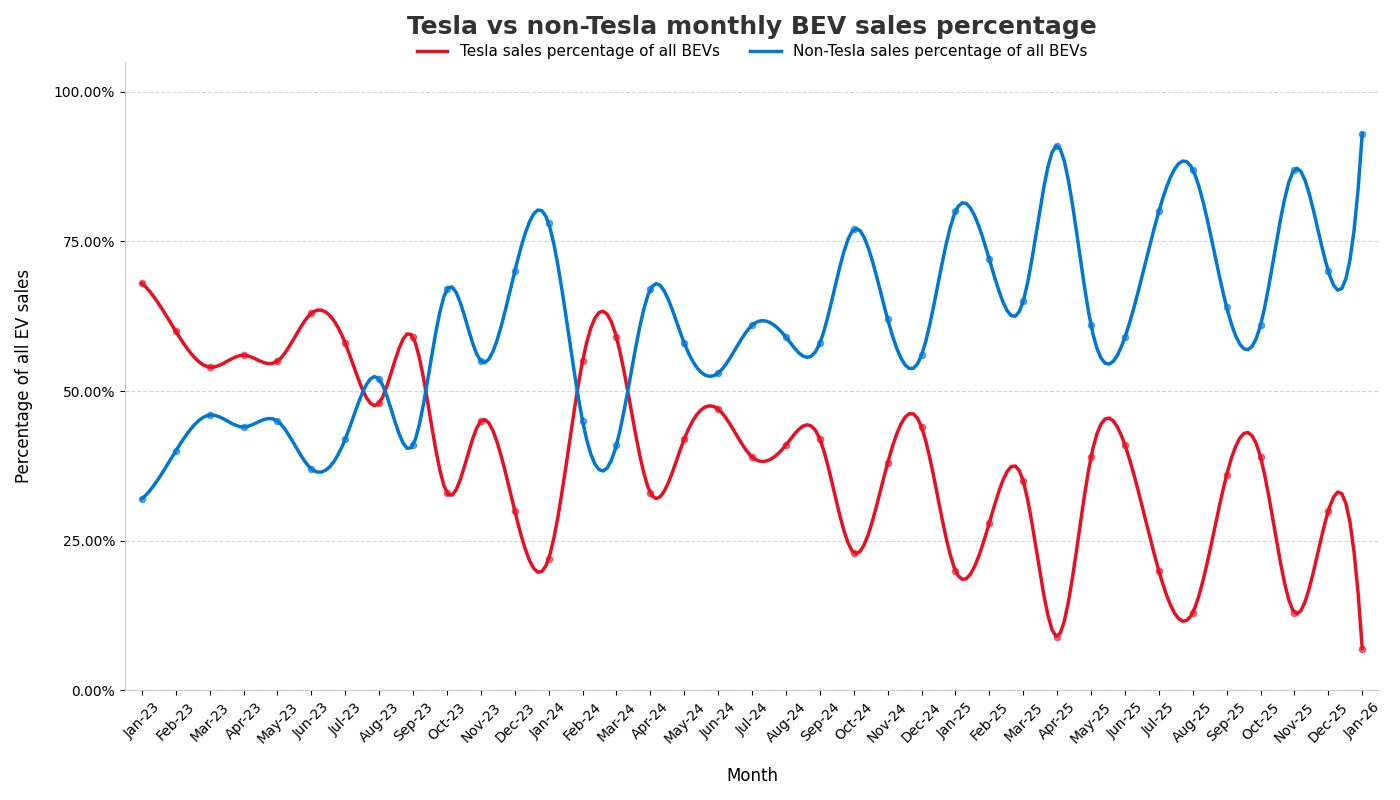

In many markets including Australia, early data for January 2026 confirms the downward Tesla trend continuing. With 501 sales, Tesla’s market share dropped to just 6.8 % of Australian battery electric vehicles, the lowest it has been for a long time.

Tesla vs non-Tesla monthly BEV sales percentage. Source: Tim Eden

Tesla vs non-Tesla monthly BEV sales percentage. Source: Tim Eden

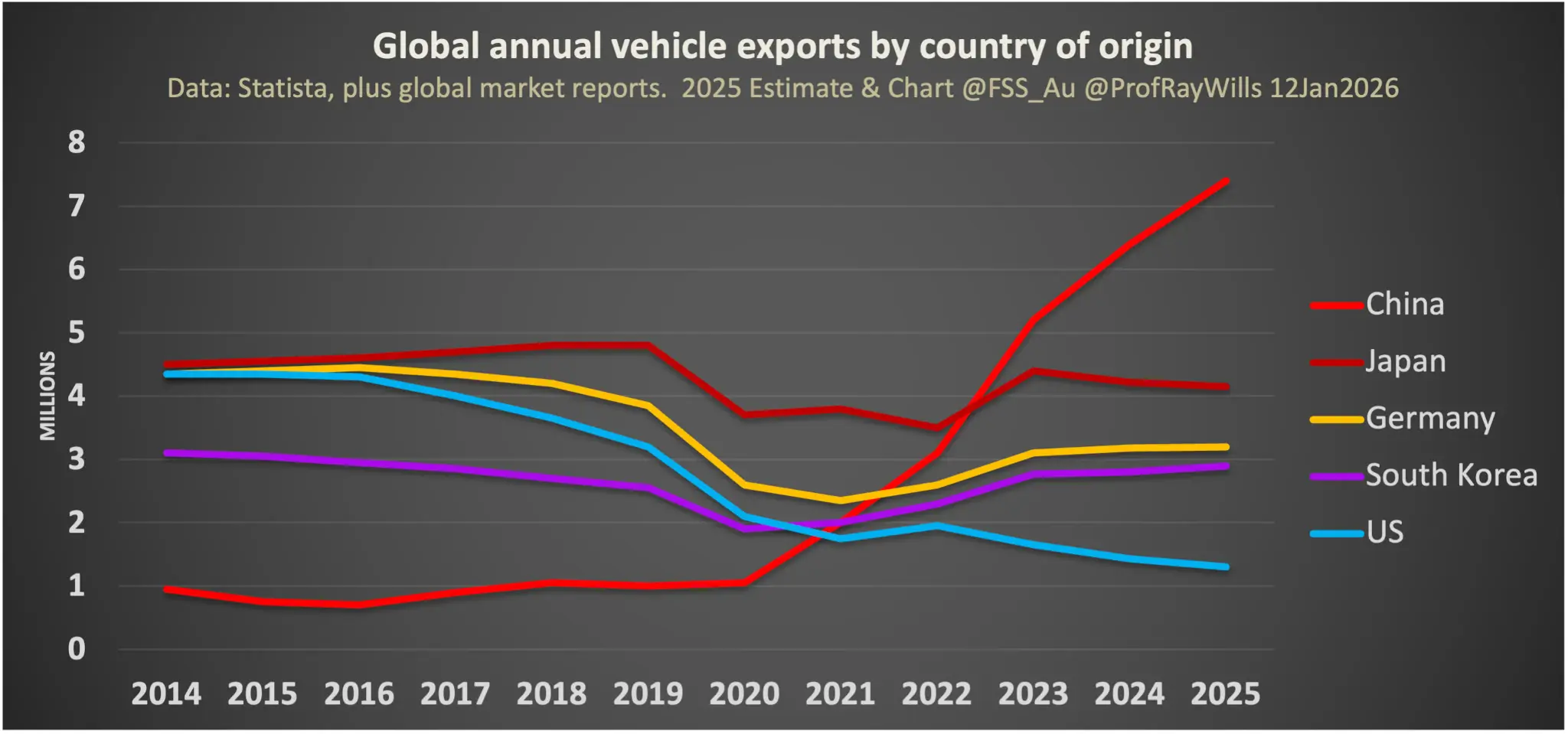

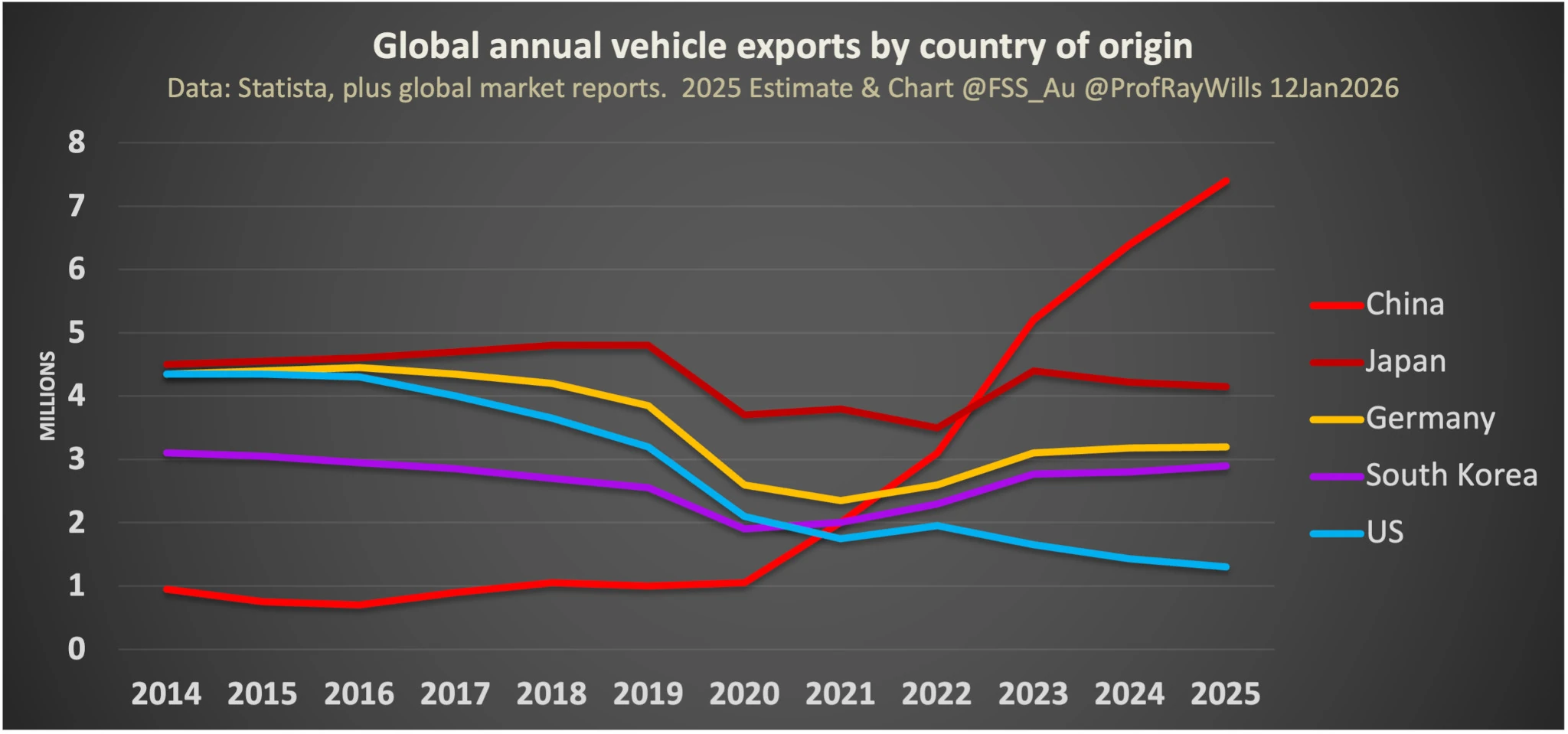

Prof Ray Wills also posted several very interesting graphs about global automotive trends on social media recently, pointing out 2025 was also the year that China became the central manufacturing and export hub for the global auto and EV industry.

“Chinese automakers sold 27.302 million vehicles in 2025, surpassing Japanese brands at just under 25 million and ending more than two decades of Japanese dominance,” Wills wrote.

Focusing on exports specifically, Wills added, “This total combines China’s vast domestic demand with exports now 7.1 million vehicles for 2025, with EVs (BEV+PHEV) taking around 40% of exports, and around two‑thirds of plug‑in sales worldwide produced in China. Most of China’s production of EVs is sold domestically.”

Global annual vehicle exports by country of origin. Source: @ProfRayWills

Global annual vehicle exports by country of origin. Source: @ProfRayWills

As the graph above illustrates, the rise of China’s vehicle exports between 2020 and 2025 is stark, and paints a clear picture of growing dominance into the future, assuming the trend will continue heading in the same direction.

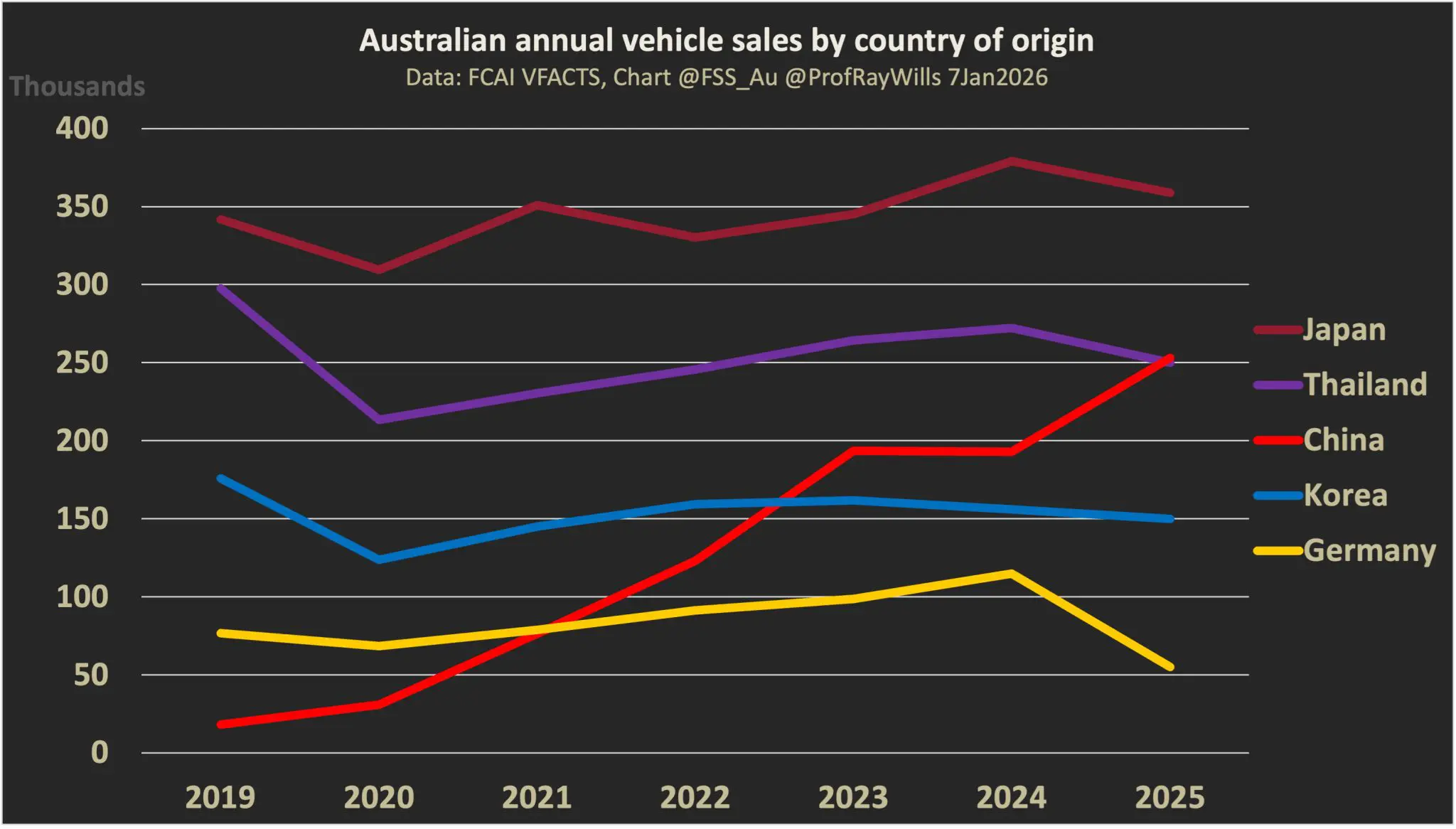

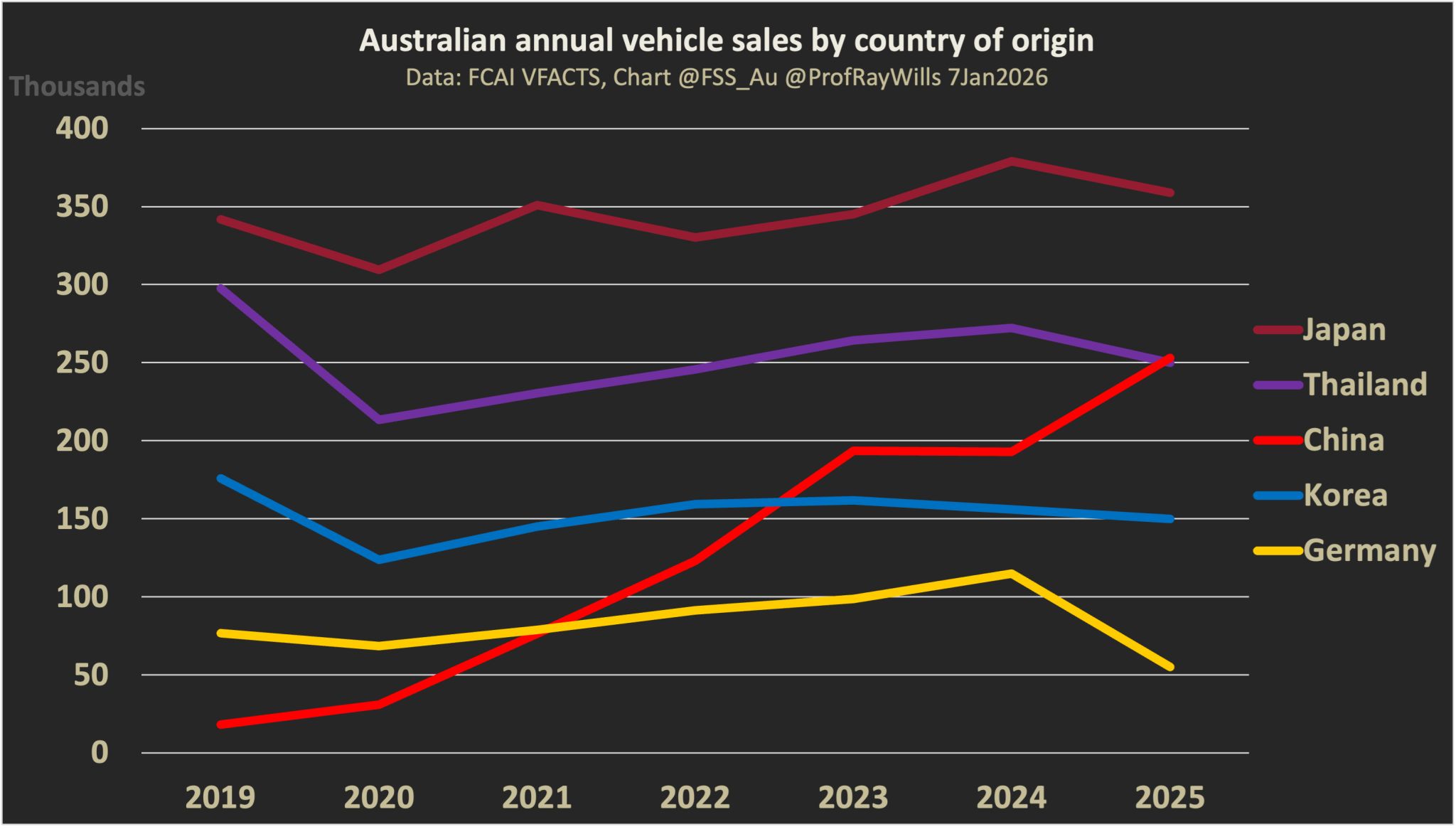

Zooming in on the Australian market now, the trend towards vehicles made in China also started to emerge from 2020, with a significant uptick from 2024 to 2025. This uptick primarily impacted German built vehicles, but is slowly showing up in terms of declining imports from Korea, Thailand and Japan which remains our largest source of vehicles.

Australian annual vehicle sales by country of origin. Source: @ProfRayWills

Australian annual vehicle sales by country of origin. Source: @ProfRayWills

Prof Ray Wills’ data above includes all fuel types, but the numbers are more astounding when looking at sales of pure battery electric vehicles in Australia. For January 2026, it is not until you reach the Toyota bZ4X in 13th place that you’ll find the first vehicle manufactured outside of China, excluding Tesla Model Y Performance variants that are made in Berlin.

Things are slightly less impressive when looking at things from a country of ownership perspective, rather than where vehicles are made, but Chinese companies still took 8 out of the top 10 spots for January. The Tesla Model Y and Kia EV5 in 6th and 7th place were the only 2 cars sold by non-Chinese owned brands.

Perhaps the Chinese dominance in Australian EV sales is unsurprising given the nature of manufacturing and global trade. I still find it very interesting though, particularly when thinking about the future makeup of vehicles on Australian roads as the electric vehicle transition gathers pace.

If China continues to make compelling EVs at a great price, and I see no reason why they won’t, the vast majority of Australians will be driving around in Chinese owned or made vehicles well into the future.

Tim has 20 years experience in the IT industry including 14 years as a network engineer and site reliability engineer at Google Australia. He is an EV and renewable energy enthusiast who is most passionate about helping people understand and adopt these technologies.

![Genesis GV90 goes royal green in new sighting [Images] Genesis GV90 goes royal green in new sighting [Images]](https://www.evshift.com/wp-content/uploads/2026/02/1771282238_Genesis-GV90-green-EV-770x515.jpeg)