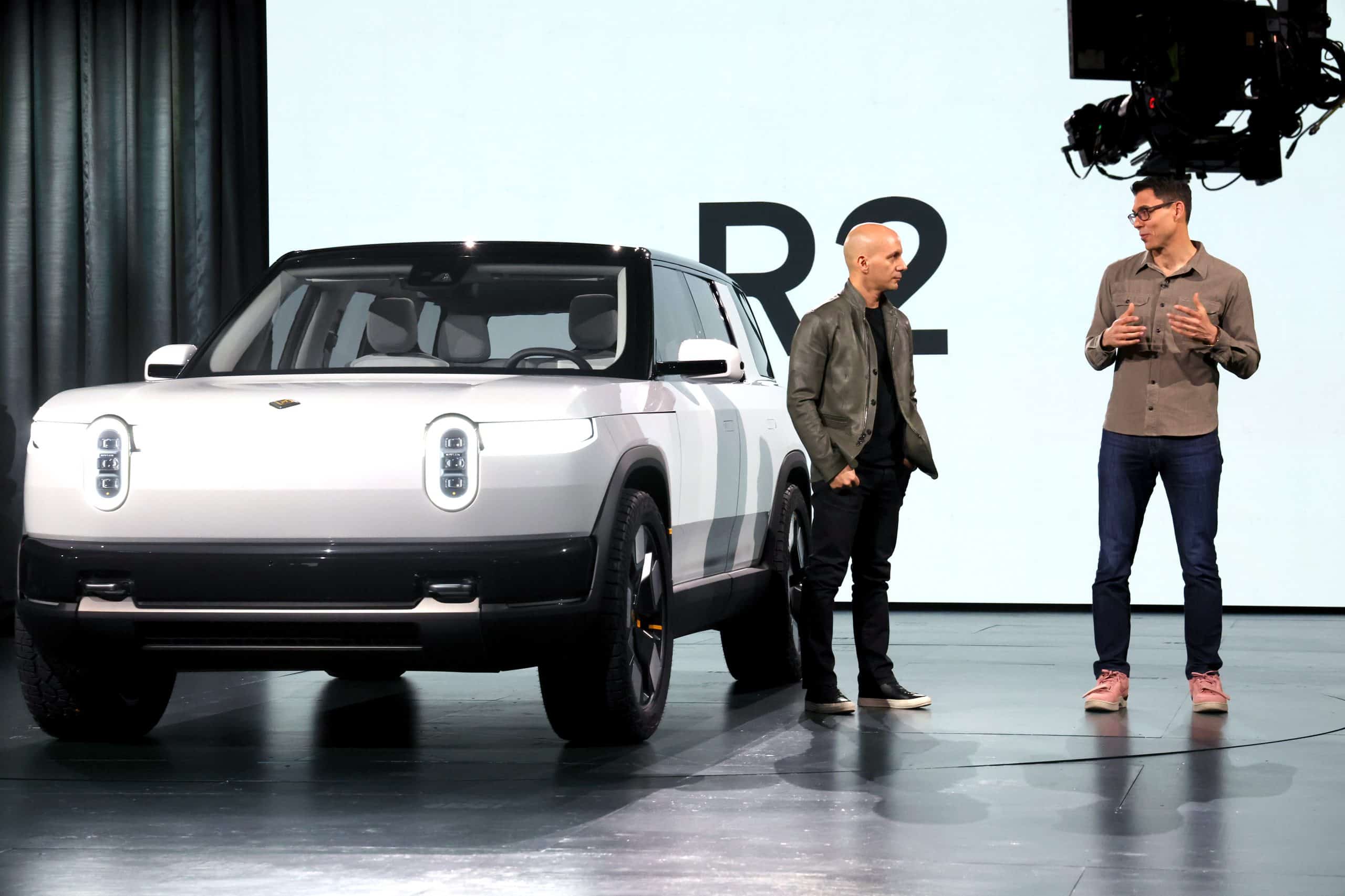

© 2024 Getty Images / Getty Images Entertainment via Getty Images

Rivian Automotive Inc (NASDAQ:RIVN | RIVN Price Prediction) gained 19.8% this week, closing at $17.73 on Friday, February 13, 2026. While Tesla Inc (NASDAQ:TSLA) managed just 1.54% over the same period, Rivian’s surge came despite year-to-date losses of 10.05%.

Three storylines drove this momentum: Rivian’s Q4 earnings that revealed hidden strength, the imminent R2 launch, and software revenue growth reshaping the business model.

Rivian Q4 Earnings: Profitability Emerging Through the Noise

Rivian’s February 11 earnings were immediately cheered by the market. Revenue of $1.29 billion beat estimates by $13 million, and automotive revenue plunged 45% year-over-year to $839 million. The culprit? A $270 million drop in regulatory credit sales and collapsing demand after the federal EV tax credit expired on September 30, 2025.

But the profitability story improved dramatically. Rivian posted $120 million in Q4 gross profit and $144 million for the full year, a $1.3 billion improvement from 2024’s losses. Cost of goods sold per vehicle improved by more than $7,200 year-over-year. CEO RJ Scaringe framed it clearly: “In 2025 we focused on execution as we laid the foundation for dramatically scaling our business.”

The company beat EPS estimates, posting an adjusted loss of $0.53 versus the $0.67 expected loss. With $6.08 billion in cash and equivalents, Rivian has runway to reach the R2 launch without immediate financing pressure.

R2 Launch: Q2 2026 Timeline Solidifies

The R2 SUV, Rivian’s answer to Tesla’s Model Y, is on track for first customer deliveries in Q2 2026. Manufacturing validation builds were completed in mid-January 2026, and Scaringe noted “early strong reviews of the R2 pre-production builds.” Additional product details will be revealed on March 12, 2026.

The company guides for 62,000 to 67,000 deliveries in 2026, up from 2025’s 42,247 units. R2 represents Rivian’s first mass-market vehicle, priced to compete directly where Tesla dominates. The 1.1 million square foot manufacturing expansion at the Normal facility is complete, positioning Rivian to scale production rapidly once R2 ramps.

Software Revenue Surge: The Volkswagen Effect

The most overlooked storyline is software and services revenue, which exploded 109% year-over-year to $447 million in Q4. This growth came primarily from the Volkswagen Group joint venture, where Rivian provides vehicle electrical architecture and software development services.

While automotive revenue collapsed, software revenue grew sequentially from $416 million in Q3 to $447 million in Q4, cushioning the blow from vehicle sales. This segment now represents over a third of total revenue and carries significantly higher margins than vehicle manufacturing. If Rivian can maintain this trajectory while ramping R2 production, the business model starts to look less like a traditional automaker and more like a hybrid technology platform.

The week’s 19.8% gain suggests investors are looking past near-term delivery headwinds and focusing on structural improvements: unit economics turning positive, R2 on schedule, and a software business becoming material. With 2026 guidance calling for negative $2.1 billion to $1.8 billion adjusted EBITDA, profitability remains distant. But the trajectory is bending in the right direction, and the R2 launch could be the inflection point that determines whether Rivian survives the EV shakeout.