Ferrari (NYSE:RACE) is preparing to unveil its first full-electric vehicle, the Ferrari Luce. The launch marks a key step in the company’s move into ultra-premium electric vehicles while it continues to focus on profitability and exclusivity. The Luce is positioned as Ferrari’s entry into electric mobility alongside its broader product diversification efforts.

For you as an investor, Ferrari sits in a very specific corner of the auto market, focused on high-end performance cars with tight control over supply and brand access. The decision to introduce the fully electric Luce puts Ferrari into the luxury EV conversation while maintaining its emphasis on pricing power and limited production.

The Luce also gives Ferrari a new product line that can address regulatory trends and customer interest in electric drivetrains at the top end of the market. The way Ferrari prices, allocates, and markets this model could influence how the broader luxury segment approaches EVs and could shape how investors evaluate ultra-premium electric offerings.

Stay updated on the most important news stories for Ferrari by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Ferrari.

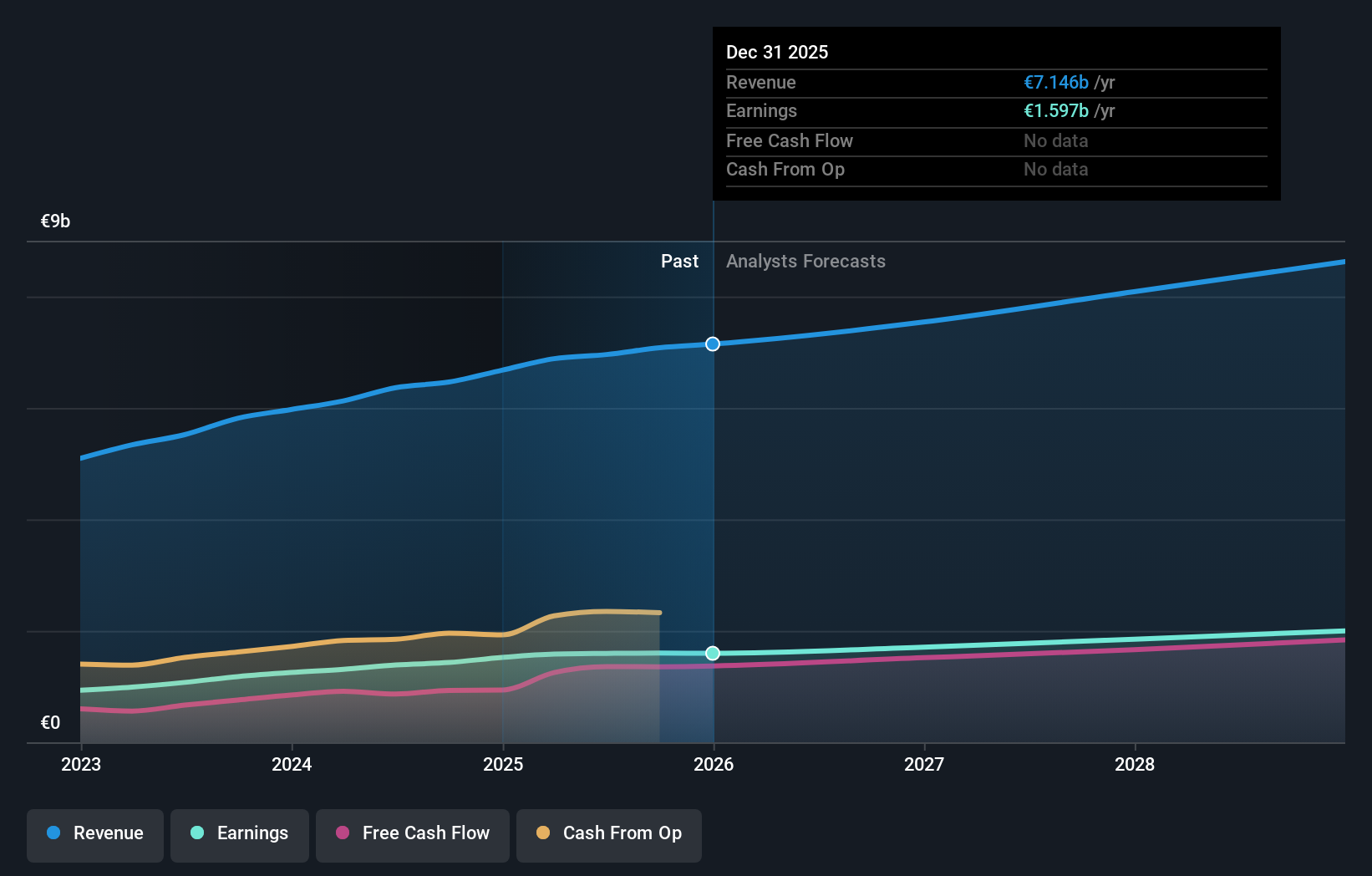

NYSE:RACE Earnings & Revenue Growth as at Feb 2026

NYSE:RACE Earnings & Revenue Growth as at Feb 2026

We’ve flagged 0 risks for Ferrari. See which could impact your investment.

This first all-electric Ferrari sits at the intersection of three things you care about as an investor: product mix, pricing power, and the addressable market at the very top of the EV segment. The Luce gives Ferrari a way to participate in premium EV demand without relying on volume growth, since management has reiterated its focus on industry-leading profitability and tight control of supply. That matters because many pure-play EV makers have leaned on high volumes and aggressive pricing, which is a very different playbook to Ferrari’s low-volume, high-margin model.

How This Fits Into The Ferrari Narrative The Luce directly supports the existing narrative that new models, including electrics, are intended to broaden the product mix while keeping margins supported through personalization and a richer content per car. At the same time, adding a full-electric line on top of multiple upcoming launches could test the concern that too many models risk diluting exclusivity and confusing customers about what is truly rare. The specific role of Ferrari’s EV-focused infrastructure and potential regulatory tailwinds for zero-emission models is not fully captured in the narrative, and could change how investors think about future product allocation.

Knowing what a company is worth starts with understanding its story.

Check out one of the top narratives in the Simply Wall St Community for Ferrari to help decide what it’s worth to you.

The Risks and Rewards Investors Should Consider ⚠️ The concentration of sales to existing customers raises the question of how much incremental demand a high-priced EV will attract beyond the current base. ⚠️ A fuller line up that spans internal combustion, hybrid, and now full-electric could, if not carefully managed, soften Ferrari’s tight grip on scarcity and pricing compared with rivals like Porsche or Lamborghini. 🎁 Earnings have been growing, with 4.9% growth over the past year, which gives Ferrari more flexibility to invest in electrification without relying on aggressive volumes. 🎁 Earnings are forecast to grow 7.09% per year, which, if achieved, would support the view that expanding into EVs can sit alongside high-margin supercar sales rather than replace them. What To Watch Going Forward

From here, keep an eye on how Ferrari positions the Luce against luxury EV offerings from brands like Porsche and Mercedes, especially on pricing, waitlists, and personalization options. Any commentary on how the EV mix affects margins will be important, as will management’s comments on order books relative to overall capacity. The balance between maintaining long waiting lists and introducing multiple new models, including the Luce, could be a key signal for how Ferrari intends to protect its brand and profitability over the next few years.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for Ferrari, head to the

community page for Ferrari to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com