Find your next quality investment with Simply Wall St’s easy and powerful screener, trusted by over 7 million individual investors worldwide.

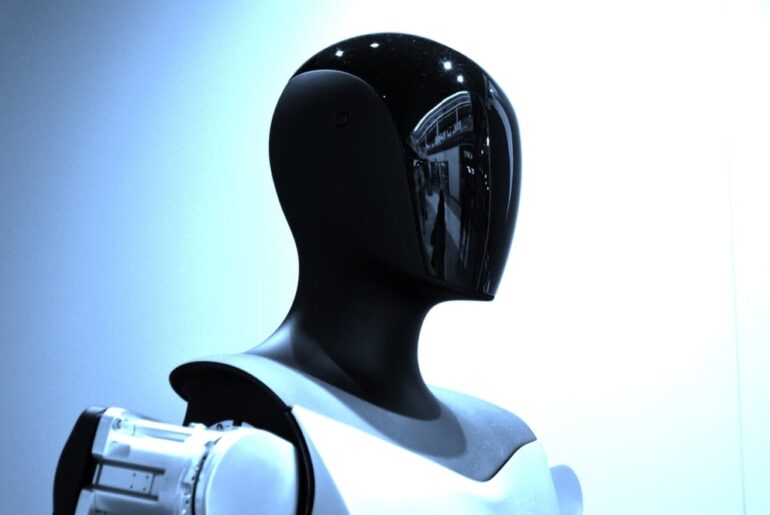

Tesla (NasdaqGS:TSLA) is overhauling its leadership as it leans harder into AI, robotics, and energy solutions.

Raj Jegannathan, who led North American sales and served as executive vice president in AI infrastructure, has exited the company.

Joe Ward has been appointed global head of sales as Tesla scales robotaxi efforts and prepares Cybercab and Optimus production.

Tesla is also rolling out vehicle to grid energy integration, starting with a Cybertruck program in Texas.

Tesla enters this transition with its shares at $428.27 and a return of 20.3% over the past year, 112.0% over three years, and 63.2% over five years. Those figures describe a company that has already experienced sizeable stock moves as it shifts focus beyond traditional vehicle sales.

For you as an investor, the key question is how this mix of leadership change, robotaxi expansion, humanoid robots, and vehicle to grid energy might influence Tesla’s revenue mix and risk profile over time. The rest of this article will examine what these moves could mean for Tesla’s business model, competitive position, and how the market may interpret this transition.

Stay updated on the most important news stories for Tesla by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Tesla.

NasdaqGS:TSLA 1-Year Stock Price Chart

NasdaqGS:TSLA 1-Year Stock Price Chart

For Tesla, the leadership reshuffle sits on top of a very busy to do list: scaling robotaxis, starting Optimus production, and turning vehicles into grid assets through programs such as the Cybertruck Powershare pilot in Texas. Moving Joe Ward into the global sales role while a long serving executive like Raj Jegannathan exits concentrates commercial responsibility in one leader at the same time as Tesla shifts focus away from its slowing core EV business toward AI heavy services and energy. That could simplify decision making, but it also raises execution risk while capital spending is set to exceed US$20b and management is juggling new factories, AI infrastructure and energy projects. Investors are already split on Tesla, with some calling it a “battleground stock” and others highlighting a catalyst rich year. Leadership stability and depth across autonomy, robotics and energy will be key to whether this transition supports the company story or adds to concerns about rising costs and weakening auto fundamentals.

The leadership changes align with the narrative that Tesla is leaning into AI powered robotaxis, FSD subscriptions and Optimus, which could shift the mix toward higher margin software and services over time.

At the same time, turnover across senior roles while auto margins are under pressure and capex is high could challenge the idea that Tesla can scale new businesses smoothly without denting profitability.

Potential tie ups with SpaceX or xAI, plus vehicle to grid initiatives and a 100 gigawatt solar build out, add optionality that is only partly captured in the existing narrative around autonomy and energy storage.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Tesla to help decide what it’s worth to you.

⚠️ Ongoing executive turnover, including five senior exits in a year, increases the risk of disruption just as Tesla is trying to ramp complex projects like robotaxis, Optimus and solar manufacturing.

⚠️ High planned capex above US$20b, combined with margin compression and a first annual revenue decline, raises the chance that Tesla experiences periods of weak free cash flow while new programs scale.

🎁 Tesla is investing heavily in what some analysts call “physical AI”, with live robotaxi fleets in Austin and the Bay Area, early Optimus plans and energy storage growth, giving multiple shots on goal beyond cars.

🎁 The push into solar, Megapacks and vehicle to grid services positions Tesla to participate in energy transition spending, an area where banks such as Morgan Stanley see material value potential for the energy division.

You may want to watch how quickly Joe Ward settles into the global sales role and whether further senior departures follow, as that will say a lot about leadership continuity. On the operating side, key markers include growth in paid robotaxi rides versus expectations, concrete progress on Optimus production after Model S and X wind down, and any evidence that vehicle to grid and solar projects translate into larger, steadier energy revenue. Regulatory decisions on unsupervised autonomy, especially as competitors like Waymo and traditional automakers such as Volkswagen and BYD push their own offerings, will also be important for Tesla’s positioning in both cars and AI powered mobility.

To ensure you’re always in the loop on how the latest news impacts the investment narrative for Tesla, head to the community page for Tesla to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSLA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

![‘[This will] influence global norms’ '[This will] influence global norms'](https://www.evshift.com/wp-content/uploads/2026/02/a052c50f968ef38037a0e134ba34e24c-770x515.jpeg)