This article first appeared on GuruFocus.

Catherine Wood (Trades, Portfolio) recently submitted the 13F filing for the fourth quarter of 2025, providing insights into her investment moves during this period. With over 40 years of experience, Cathie Wood founded ARK in 2014 to focus solely on disruptive innovation while adding new dimensions to research. Through an open approach that spans across sectors, market capitalizations, and geographies, she believes ARK can identify large-scale investment opportunities in the public markets resulting from technological innovations centered around DNA sequencing, robotics, artificial intelligence, energy storage, and blockchain technology. As chief investment officer and portfolio manager, Wood spearheaded the development of ARKs philosophy and investment approach and is ultimately responsible for investment decisions. Recognizing that disruptive innovation causes rapid cost declines, cuts across sectors, and spawns further innovation, ARK uses an iterative investment process that combines top-down and bottom-up research. The firm strives to identify innovation early in order to capitalize on the opportunity, providing long-term value to investors.

Catherine Wood’s Strategic Moves: A Closer Look at Tesla Inc’s Portfolio Impact

Catherine Wood’s Strategic Moves: A Closer Look at Tesla Inc’s Portfolio Impact

Catherine Wood (Trades, Portfolio) added a total of 7 stocks, among them:

The most significant addition was WeRide Inc (NASDAQ:WRD), with 2,001,896 shares, accounting for 0.12% of the portfolio and a total value of $17.38 million.

The second largest addition to the portfolio was Netflix Inc (NASDAQ:NFLX), consisting of 165,735 shares, representing approximately 0.1% of the portfolio, with a total value of $15.54 million.

The third largest addition was Tharimmune Inc (NASDAQ:THAR), with 3,252,033 shares, accounting for 0.07% of the portfolio and a total value of $9.85 million.

Catherine Wood (Trades, Portfolio) also increased stakes in a total of 110 stocks, among them:

The most notable increase was CoreWeave Inc (NASDAQ:CRWV), with an additional 1,456,299 shares, bringing the total to 1,924,256 shares. This adjustment represents a significant 311.2% increase in share count, a 0.69% impact on the current portfolio, with a total value of $137.80 million.

The second largest increase was Circle Internet Group Inc (NYSE:CRCL), with an additional 1,174,688 shares, bringing the total to 4,141,628. This adjustment represents a significant 39.59% increase in share count, with a total value of $328.43 million.

Story Continues

Catherine Wood (Trades, Portfolio) completely exited 9 of the holdings in the fourth quarter of 2025, as detailed below:

Catherine Wood (Trades, Portfolio) also reduced positions in 78 stocks. The most significant changes include:

Reduced Tesla Inc (NASDAQ:TSLA) by 675,130 shares, resulting in an -18.81% decrease in shares and a -1.79% impact on the portfolio. The stock traded at an average price of $443.03 during the quarter and has returned -2.51% over the past 3 months and -4.70% year-to-date.

Reduced Roku Inc (NASDAQ:ROKU) by 1,470,118 shares, resulting in a -20% reduction in shares and a -0.88% impact on the portfolio. The stock traded at an average price of $101.46 during the quarter and has returned -17.70% over the past 3 months and -18.99% year-to-date.

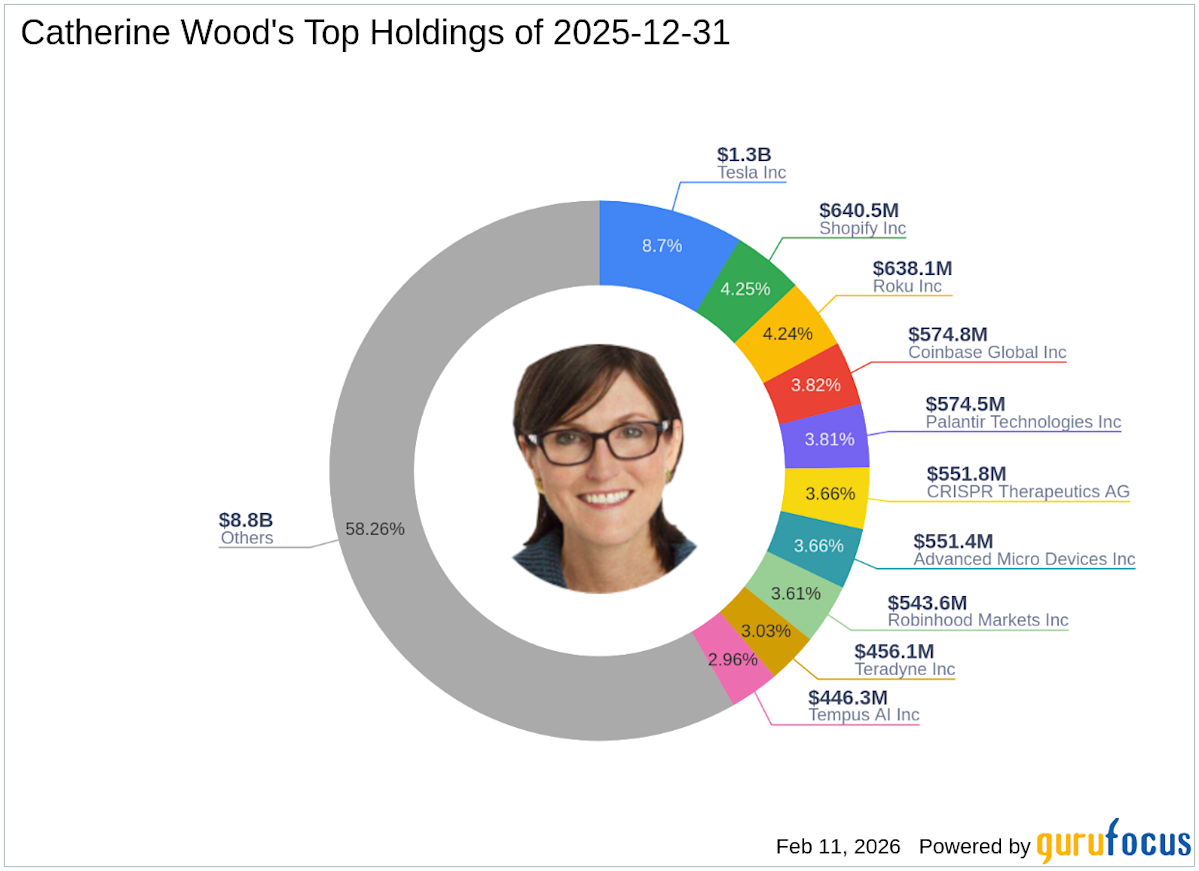

At the fourth quarter of 2025, Catherine Wood (Trades, Portfolio)’s portfolio included 196 stocks, with top holdings including 8.7% in Tesla Inc (NASDAQ:TSLA), 4.25% in Shopify Inc (NASDAQ:SHOP), 4.24% in Roku Inc (NASDAQ:ROKU), 3.82% in Coinbase Global Inc (NASDAQ:COIN), and 3.81% in Palantir Technologies Inc (NASDAQ:PLTR).

Catherine Wood’s Strategic Moves: A Closer Look at Tesla Inc’s Portfolio Impact

The holdings are mainly concentrated in 10 of the 11 industries: Technology, Healthcare, Consumer Cyclical, Communication Services, Financial Services, Industrials, Energy, Utilities, Consumer Defensive, and Basic Materials.