The electric vehicle (EV) industry is a fascinating option for long-term investors. The global automotive industry is heading toward electrification, some regions faster than others, but it has created full-EV makers like Tesla and BYD.

There are also other ways to play the coming growth, including solid-state battery company QuantumScape (NASDAQ: QS), and automakers taking a slower approach, such as supercar maker Ferrari (NYSE: RACE).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Here’s why these two overlooked EV stocks should be high on your list to research.

Choosing which automaker is well positioned to thrive can be incredibly difficult, but regardless of which brand or automaker reigns supreme, QuantumScape can thrive. QuantumScape is far along in developing solid-state batteries that can improve recharge time, increase energy density for longer range, lower bill of materials for reduced costs, and improve safety with less flammable materials involved.

QuantumScape is attempting to do what no company has done: Produce solid-state batteries at commercial volume. It could be the holy grail all automakers covet to improve the performance and cost of their vehicles. The good news is that QuantumScape has finally turned the corner from a research and development business to generating revenue, and is taking steps forward with its production process.

More specifically, its newer Cobra process achieves a roughly 25x speedup in ceramic processing compared to its previous process, named Raptor. This is a huge step toward making gigawatt-hour (GWh) scale production possible. QuantumScape is a high-risk, high-reward type of investment and should be limited to small positions.

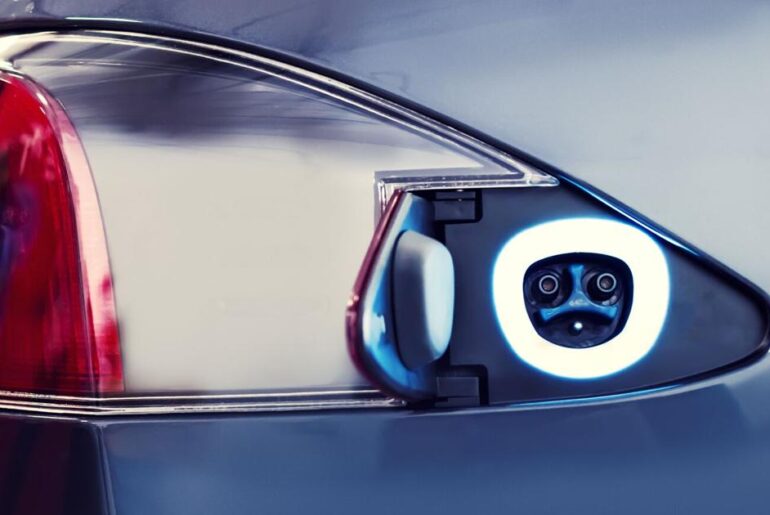

Image source: QuantumScape.

Image source: QuantumScape.

When investors think of Ferrari, they might imagine Formula 1 racing heritage that transfers technology to its street-ready supercars, or its intense exclusivity that helps drive pricing power. Investors likely don’t imagine an EV maker, but that’s increasingly the case, with Ferrari’s hybrids accounting for 43% of third-quarter shipments.

While many of the world’s automakers are struggling with EV profitability, Ferrari’s margins have only become more juicy in recent years. Better yet, as you can see in the graph below, despite Ferrari’s rising margins and other positive developments, the automaker is trading at a rare discount per its price-to-earnings ratio.

RACE PE Ratio data by YCharts.

Ferrari plans to unveil its first full-electric vehicle later this year, and if it’s as successful designing, producing, and selling full EVs as it is hybrids, it could quickly establish itself as an ultra-premium EV maker.

While both companies are positioned to thrive in certain circumstances as the world transitions to EVs, Ferrari is a far more stable investment compared to QuantumScape. Ferrari has established competitive advantages, pricing power, a durable brand moat, and profitability rarely, if ever, seen in the automotive industry.

QuantumScape has immense upside with its solid-state battery development, and could make investors incredibly happy long-term, but the risk is equally high with competitors chasing the same technology. Ferrari is a top automotive stock for investors, but QuantumScape will likely remain highly volatile and should be limited to small positions. Research and invest accordingly.

Before you buy stock in QuantumScape, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and QuantumScape wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $429,385!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,165,045!*

Now, it’s worth noting Stock Advisor’s total average return is 913% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 12, 2026.

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends BYD Company and Ferrari. The Motley Fool has a disclosure policy.

2 Top Overlooked EV Stocks to Buy in 2026 was originally published by The Motley Fool