Europe Electric Bicycles Market Report Summary

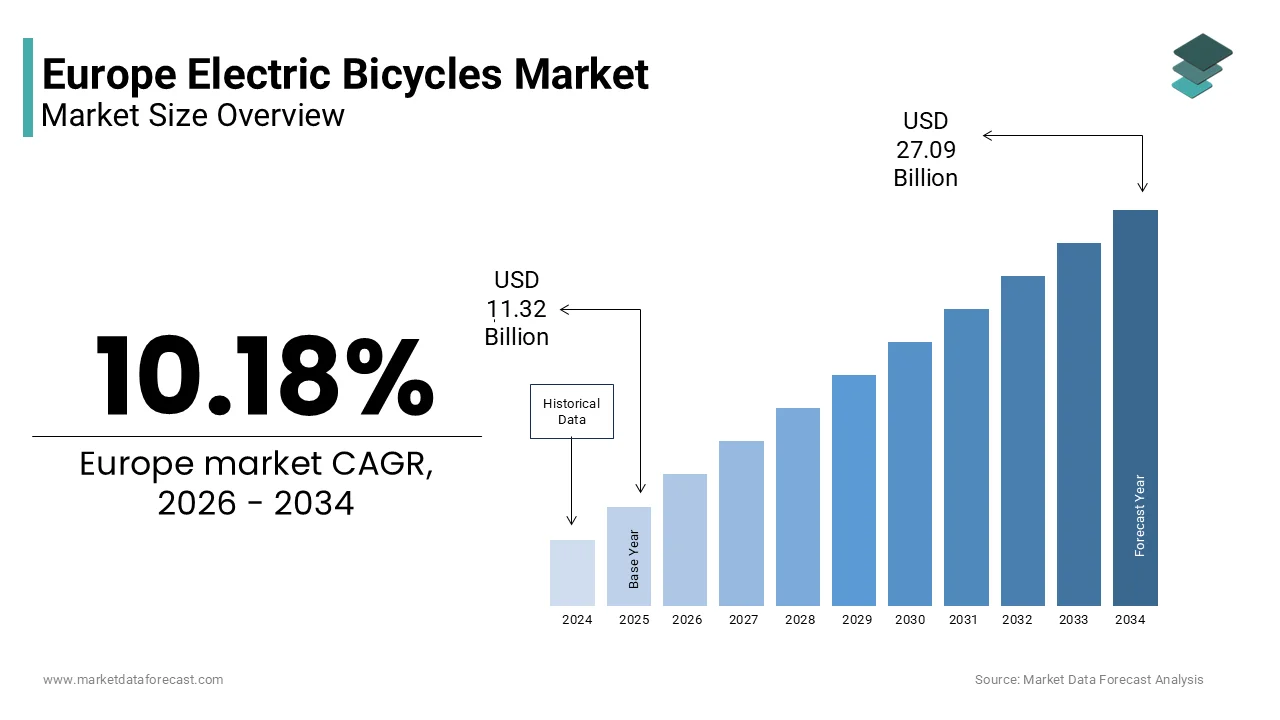

The Europe electric bicycles market was valued at USD 11.32 billion in 2025 and is estimated to reach USD 12.47 billion in 2026, with the market projected to grow to USD 27.09 billion by 2034, registering a CAGR of 10.18 percent during the forecast period. Market growth is driven by increasing demand for sustainable mobility solutions, rising fuel prices, supportive government policies promoting green transportation, and growing health awareness among consumers. Expanding urbanization, development of cycling infrastructure, and rising adoption of electric mobility across daily commuting and recreational activities are further accelerating market expansion across Europe.

Key Market Trends

Strong shift toward eco friendly transportation alternatives to reduce carbon emissions and traffic congestion.

Increasing government incentives and subsidies encouraging electric bicycle adoption.

Growing popularity of pedal assist electric bicycles for urban commuting and leisure cycling.

Rapid advancements in battery efficiency, lightweight frame materials, and smart connectivity features.

Rising demand for long range and high performance electric bicycles across urban and rural markets.

Segmental Insights

Based on type, the pedal assist or pedelec segment was the largest contributor to the Europe electric bicycles market in 2025. The segment’s dominance is attributed to its user friendly riding experience, regulatory acceptance across European countries, and suitability for daily commuting.

Based on battery type, the lithium ion batteries segment led the market by capturing a significant share in 2025. Lithium ion batteries are preferred due to their higher energy density, longer lifecycle, faster charging capability, and lightweight design.

Based on motor type, the hub motors segment held the majority share of the Europe electric bicycles market in 2025. Hub motors are widely adopted due to their cost efficiency, low maintenance requirements, and smooth integration within bicycle wheel systems.

Regional Insights

Germany dominated the Europe electric bicycles market, supported by its strong manufacturing ecosystem, well developed cycling infrastructure, and deeply rooted cycling culture. High consumer awareness regarding sustainable transportation and strong distribution networks further strengthen Germany’s leadership position.

Other European countries are also witnessing rapid adoption, supported by urban mobility initiatives, environmental regulations, and increasing consumer preference for clean energy transportation solutions.

Competitive Landscape

The Europe electric bicycles market is highly competitive, with established bicycle manufacturers and component suppliers focusing on technological innovation, battery optimization, and smart mobility integration. Companies are investing in advanced drive systems, lightweight materials, and digital connectivity features to enhance performance and user experience. Strategic partnerships and expansion of dealer networks remain key growth strategies. Prominent players operating in the market include Accell Group NV, Bosch eBike Systems, Giant Manufacturing Co Ltd, Pon Holdings BV, Trek Bicycle Corporation, Scott Sports SA, Riese and Müller GmbH, Specialized Bicycle Components, Haibike under Yamaha and Accell Group, and Cube Bikes.

Europe Electric Bicycles Market Size

The Europe electric bicycles market size was valued at USD 11.32 billion in 2025 and is projected to reach USD 27.09 billion by 2034 from USD 12.47 billion in 2026, growing at a CAGR of 10.18%.

An electric bicycle (e-bike) is a conventional bicycle with an integrated electric motor and a rechargeable battery to assist with propulsion. This regulatory framework has fostered a diverse market catering to commuters, recreational riders, and cargo transport needs. The adoption of e-bikes has been significantly accelerated by a powerful convergence of environmental policy, urban planning, and shifting consumer preferences. As per sources, a high majority of the European Union’s population resides in cities, creating significant pressure on urban infrastructure and increasing the demand for efficient, low-emission, and sustainable alternatives to private car use. Urban population concentration, supported by a widespread, established network of cycling paths across the EU, provides a strong foundation for integrating electric bicycles into daily commuting and, urban mobility.

MARKET DRIVER Stringent EU Climate Policy and Urban Decarbonization Mandates

The continent’s unwavering political commitment to climate action and the decarbonization of urban transport is a key driver of the Europe electric bicycles market. The European Union’s primary environmental framework is driving a shift toward cleaner transportation by integrating sustainable mobility requirements into broader regional and local laws. Cities across the bloc are implementing Low Emission Zones that restrict or penalize the entry of internal combustion engine vehicles, while simultaneously investing heavily in cycling infrastructure. This regulatory push is complemented by substantial public financial incentives. For instance, Some European regions keep supporting e-bike purchases, but national-level funding in major countries has either been reduced or completely withdrawn. Advocacy groups for cycling note that coordinated policy efforts have successfully transitioned electric bicycles from specialized equipment to a central component of sustainable city life.

Aging Population and the Demand for Accessible Mobility Solutions

The region’s pronounced demographic shift toward an older population has created a substantial demand for accessible and physically manageable transportation, which is propelling the expansion of the Europe electric bicycles market. The steady rise in the median age within the European Union, coupled with a shrinking working-age population, makes it vital to develop sustainable, accessible transit solutions that require low physical effort. The electric assist function of an e-bike perfectly addresses this need, enabling individuals with reduced stamina or joint issues to travel longer distances, navigate hilly terrain, and carry groceries or other loads with ease. This demographic tailwind has made e-bikes a popular choice for seniors seeking to maintain an active lifestyle and social connectivity. Reflecting a broader shift toward healthy, active aging, e-bikes are emerging as a critical mobility aid across Europe. By providing cardiovascular benefits through assisted pedaling, these vehicles allow a growing number of residents to maintain independence, replace car trips, and remain physically active without intense strain.

MARKET RESTRAINTS Persistent High Upfront Purchase Cost

Its relatively high initial purchase price compared to conventional bicycles remains a restraint to the Europe electric bicycles market. E-bikes are becoming more accessible at the entry level, yet purchasing a high-end or reliable model is still a major expense for most households. This cost barrier is particularly acute in Southern and Eastern European member states where average disposable incomes are lower. Although government subsidies help, they often do not fully bridge the affordability gap, especially for premium models with advanced features like integrated batteries or sophisticated drive systems. Research indicates that high initial purchase costs, along with infrastructure limitations and safety concerns, continue to be the primary obstacles discouraging potential users from purchasing e-bikes in Europe, despite strong environmental motivations. This financial hurdle slows the market’s penetration into middle and lower-income demographics, limiting its potential to become a truly universal mode of transport across all socioeconomic strata of the European population.

Inadequate and Fragmented Charging Infrastructure

The lack of a standardized and widely available public charging infrastructure also hampers the growth of the Europe electric bicycles market. Unlike electric cars, which benefit from a rapidly expanding network of dedicated charging stations, e-bike users are largely expected to charge their vehicles at home or at work. This model is insufficient for long-distance touring cyclists or for urban residents living in apartments without private storage or power outlets. The absence of secure, weather protected bike parking with integrated charging points in city centers and along popular cycling routes creates a significant range anxiety for potential users. According to research on European consumer behavior, a significant portion of people who do not currently own an electric bicycle are worried about the battery running out of power during their rides, a concern that discourages potential adoption. This infrastructure gap, which varies greatly from one municipality to another, represents a critical missing piece in the ecosystem needed to support the next wave of e-bike adoption, particularly for use cases beyond simple daily commutes.

MARKET OPPORTUNITIES Expansion of Micro-Mobility as a Service Models

The rapid expansion of micro-mobility as a service, particularly through docked and dockless e-bike sharing schemes, acts as a key growth enabler for the Europe electric bicycles market. These services, operated by both public transit authorities and private companies, remove the barriers of ownership cost and maintenance, allowing users to access an e-bike for a single trip or a short-term subscription. This model is proving highly effective in dense urban environments where it seamlessly integrates with existing public transport networks, solving the critical “last mile” problem. Major European capitals are experiencing rapid expansion in shared electric bicycle infrastructure, with Parisian authorities heavily prioritizing the integration of electric-assist bikes into their public transportation network to replace private vehicles and boost sustainable mobility. As per sources, such shared systems not only increase overall e-bike usage but also serve as a powerful gateway, converting first-time users into eventual private owners. This trend opens a new, high-volume commercial channel for manufacturers and creates a virtuous cycle of familiarity and acceptance that drives the entire market forward.

Technological Innovation in Battery and Motor Systems

Continuous technological innovation, specifically in the domains of battery energy density and motor efficiency, opens lucrative avenues for the Europe electric bicycles market. The development of next-generation lithium-ion and solid-state batteries promises to deliver lighter weight, longer range, and faster charging times, directly addressing key user concerns. Simultaneously, advancements in mid-drive and hub motor technology are yielding more powerful, quieter, and more responsive assistance systems that enhance the natural feel of cycling. These innovations are not merely incremental; they are redefining the capabilities of the e-bike, enabling new categories like high-performance electric mountain bikes and heavy-duty electric cargo bikes to flourish. As reported by the European Patent Office, patents for electric bike powertrains and battery management systems have experienced significant, sustained growth, indicating a strong pipeline of future product innovations. This relentless pace of innovation will continue to expand the e-bike’s appeal to new user segments and solidify its position as a versatile and indispensable tool for modern European life.

MARKET CHALLENGES Rising Incidence of E-Bike Theft and Security Concerns

The alarming rise in e-bike theft has become a major deterrent to purchase and use, which is degrading the growth of the European electric bicycles market. The high resale value of the bike itself and its easily removable, expensive battery makes it a prime target for thieves. In cities like Amsterdam and London, police reports indicate that e-bikes are stolen at a rate several times higher than that of traditional bicycles. This pervasive security issue forces owners to invest in multiple, heavy-duty locks and seek out secure, monitored parking, adding to the cost and inconvenience of ownership. As per research, organized crime groups have increasingly turned their attention to the lucrative trade in stolen e-bikes and components, making recovery extremely difficult. This climate of insecurity undermines the very convenience and freedom that e-bikes are meant to provide, eroding consumer confidence and potentially stalling market growth, particularly in urban centers where the risk is perceived to be highest.

Complex and Evolving Regulatory Landscape

A complex and sometimes inconsistent regulatory environment can create uncertainty for both consumers and manufacturers, which impedes the expansion of the Europe electric bicycles market. The European Union maintains a unified legal standard for low-speed electric bicycles, treating them identically to traditional cycles. However, higher-speed variants are legally categorized as motorized transport, leading to a fragmented regulatory landscape where rider requirements and road access vary significantly between different countries. Furthermore, individual cities are enacting their own rules on where e-bikes can be ridden, speed limits in certain zones, and noise restrictions. This regulatory fragmentation complicates product development and marketing for manufacturers who must tailor their offerings to different national markets. As per a study, efforts to create a more unified framework are ongoing, but the current ambiguity can confuse consumers and act as a subtle brake on the adoption of more advanced e-bike models that fall into these regulatory grey areas.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2025 to 2034

Base Year

2025

Forecast Period

2026 to 2034

CAGR

10.18%

Segments Covered

By Type, Battery Type, Motor Type, and Region

Various Analyses Covered

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Accell Group NV, Bosch eBike Systems, Giant Manufacturing Co. Ltd, Pon Holdings BV, Trek Bicycle Corporation, Scott Sports SA, Riese and Müller GmbH, Specialized Bicycle Components, Haibike, and Cube Bikes

SEGMENTAL ANALYSIS By Type Insights

The pedal assist or pedelec segment was the largest segment in the Europe electric bicycles market by accounting for a substantial share in 2025. The dominance of the pedelec segment is driven by the European Union’s legal framework, which defines a standard bicycle as one where the motor only provides assistance when the rider is pedaling and cuts out at twenty-five kilometers per hour. This regulatory alignment has made pedelecs the default choice for consumers, as they are classified as regular bicycles, requiring no license, registration, or insurance. The design philosophy of pedelecs also resonates with the European cycling culture, which emphasizes physical activity and the joy of riding. According to the Confederation of the European Bicycle Industry, maintaining a legal distinction that categorizes pedal-assisted electric bicycles as bicycles, rather than mopeds, has been vital for encouraging widespread adoption, allowing users to balance electric power with active pedaling, making them a premier choice for commuting, leisure, and cargo logistics across Europe.

The hybrid segment combining pedal assist is on the rise and is expected to be the fastest growing segment in the market by witnessing a CAGR of 12.4% from 2026 to 2034 due to a specific user need for enhanced versatility in challenging urban and peri-urban environments. The integrated throttle provides a crucial boost for starting from a standstill on steep inclines, navigating through heavy traffic, or assisting riders with temporary physical limitations, without sacrificing the primary pedal-assist functionality. This dual-mode capability is particularly appealing in cities with significant topographical variation, such as Lisbon or parts of Italy, where pure pedal assist can be taxing. Research indicates that electric bicycle buyers increasingly value motor assistance as a tool for managing challenging terrain and steep inclines, particularly as a means to overcome geographical barriers. European markets lean toward standard pedal-assist systems, whereas specialized power solutions are recognized for enhancing accessibility and boosting confidence in elevated environments. This targeted demand is pushing manufacturers to develop compliant models that offer this flexibility within the EU’s legal boundaries, driving innovation and market expansion in this specialized segment.

By Battery Type Insights

The lithium-ion batteries segment led the Europe electric bicycles market by capturing a significant share in 2025. The leading position of the lithium-ion batteries segment is attributed to its superior technical and economic profile compared to older technologies like sealed lead acid. Li-ion batteries offer a significantly higher energy density, which translates to a much lighter weight and longer range for the same physical size, a critical factor for a vehicle that is ridden and often carried. They also boast a far longer cycle life, enduring hundreds more charge cycles before significant degradation, which reduces the total cost of ownership over the bike’s lifespan. Driven by the need for superior energy efficiency and improved weight, lithium-ion technology has established itself as the standard for European electric bicycles. This shift, combined with advances in battery management systems, enables manufacturers to prioritize sleek, integrated designs that enhance both the aesthetic appeal and practical usability of modern, high-performance, pedal-assisted, commuting, and cargo bikes.

The lithium-ion battery segment is also the fastest growing, as the obsolete sealed lead acid technology continues its rapid decline. The growth within the Li-ion segment itself is propelled by continuous advancements in cell chemistry and battery management systems. Manufacturers are increasingly adopting newer formulations like lithium nickel manganese cobalt oxide which offer even better energy density and thermal stability. This relentless innovation allows for the development of e-bikes with ranges exceeding one hundred kilometers on a single charge, directly addressing one of the primary consumer concerns. According to the European Patent Office, innovation and patent filings for specialized battery technologies, particularly lithium-ion systems designed for electric mobility and personal transportation, have experienced a robust increase in recent years. This focus on R&D ensures that the Li-ion segment will maintain its leadership and continue to drive the market forward by enabling new use cases and enhancing user confidence in e-bike performance and reliability.

By Motor Type Insights

The hub motors segment held the majority share of the Europe electric bicycles market in 2025. The supremacy of the hub motors segment is credited to its simplicity, lower cost, and ease of integration into a wide variety of bicycle frames. This design places the entire motor assembly within the wheel hub, resulting in a straightforward drivetrain that requires minimal maintenance and is less prone to mechanical issues compared to more complex systems. For entry-level and mid-range e-bikes, which constitute the bulk of the market, the hub motor offers a compelling balance of performance and affordability. Its widespread adoption is also supported by a mature supply chain and a large base of technicians familiar with its installation and repair. Industry analysis from the Confederation of the European Bicycle Industry indicates that the affordability and dependability of hub-driven systems were crucial to initiating the widespread, mainstream adoption of e-bikes across Europe, acting as the primary technology that made electric cycling accessible to consumers.

The mid-drive electric motor segment is expected to exhibit a noteworthy CAGR of 14.1% from 2026 to 2034, as it becomes the preferred choice for premium and performance-oriented e-bikes. Unlike hub motors, a mid-drive system is mounted at the bike’s bottom bracket, powering the crank directly and leveraging the bicycle’s existing gear system. This central placement results in a lower center of gravity, which dramatically improves handling, stability, and ride quality, especially on uneven terrain or during cornering. The integration with the gears also allows the motor to operate at its most efficient RPM across a wider range of speeds and gradients, leading to superior hill-climbing ability and extended battery range. According to technical evaluations by the German testing organization ADAC, electric bicycles equipped with mid-drive motors are favored for providing a more intuitive, balanced riding experience and superior efficiency when traversing hilly or varied terrain. This performance advantage is driving their adoption in high-end city, trekking, and mountain e-bikes, where user experience and capability are paramount.

REGIONAL ANALYSIS Germany Electric Bicycles Market Analysis

Germany dominated the Europe electric bicycles market, a position supported by its robust manufacturing base and a deeply ingrained cycling culture. The country accounts for a 28.6% share in 2025, which is driven by a combination of strong domestic production and high consumer demand. German consumers are known for their preference for high-quality, durable, and technologically advanced products, which has fostered a thriving ecosystem of premium brands like Bosch, whose drive systems are used in a majority of e-bikes sold across the continent. Germany is strengthening its position as a European leader in e-bike adoption through robust government support for cycling infrastructure and high consumer demand. The national focus on sustainable mobility, driven by federal policies and the expansion of cycling pathways, creates a favorable environment for the rapid growth of the electric bicycle market.

Netherlands Electric Bicycles Market Analysis

The Netherlands was the next prominent country in the Europe electric bicycles market by capturing a 15.6% share in 2025. This expansion is fuelled by an exceptionally high per capita ownership rate and a market where e-bikes have become the dominant form of new bicycle sales. A significant portion of all new bicycles sold in the country are electric. This phenomenon is rooted in the nation’s flat topography, extensive and safe cycling infrastructure, and a cultural norm where the bicycle is the primary mode of transport for all ages and social classes. The e-bike, particularly the comfortable step-through city model, has seamlessly integrated into this culture, extending the practical range of daily trips for commuting, shopping, and social visits. According to data from the Knowledge Institute for Mobility Policy (KiM) and Statistics Netherlands (CBS), the average Dutch person maintains a consistently high volume of annual cycling, supported largely by the increasing adoption of electric bicycles, which have become a crucial factor in sustaining active mobility across older demographics.

France Electric Bicycles Market Analysis

France represents a dynamic and rapidly expanding market for electric bicycles in Europe, holding a significant market share of approximately twelve percent. The French market is distinguished by a strong government push to promote e-bikes as a key instrument for urban decarbonization and reducing car dependency. Coordinated national and local purchase incentive schemes in France have been highly effective in stimulating demand for electric bikes, with particularly strong incentives targeted at lower-income households and for cargo, folding, or adapted models to encourage cargo and utility applications. This policy-driven growth is complemented by major investments in cycling infrastructure in cities like Paris, Lyon, and Bordeaux, which are actively transforming their urban landscapes to be more bike-friendly. Bolstered by public support and a strong focus on utility and cargo, the French e-bike market has seen significant growth in recent years, cementing France’s position as a major driver of the European electric mobility sector despite recent market adjustments.

Belgium Electric Bicycles Market Analysis

Belgium holds a prominent place in the European electric bicycles market due to a unique combination of progressive policy and a strategic geographic location. The country has been a pioneer in offering substantial tax incentives, allowing employees to receive a company-funded e-bike as a tax-free benefit, which has created a powerful corporate channel for e-bike adoption. This policy, combined with a dense network of high-quality cycling routes that connect its major cities of Brussels, Antwerp, and Ghent, has fostered a strong commuter culture centered around the e-bike. The Belgian market is also notable for its openness to innovation, serving as a key test market for new e-bike models and services from both domestic and international manufacturers. According to research, the e-bike is now seen as a mainstream and practical alternative to the car for daily commutes of up to twenty kilometers, a trend that is reshaping urban mobility patterns across the country.

Italy Electric Bicycles Market Analysis

Italy is anticipated to grow in the European electric bicycles market during the forest period owing to a strong preference for stylish, lightweight, and agile e-bikes that reflect the country’s renowned design heritage. Consumers often favor models with integrated batteries and minimalist frames that blend seamlessly into the historic urban centers of cities like Rome, Milan, and Florence. The e-bike has become a popular solution for navigating the narrow, congested streets of these cities, where parking is scarce and traffic is a constant challenge. Furthermore, the rise of e-bike tourism in Italy’s scenic countryside and along its extensive coastal paths has created a significant demand for high-performance trekking and touring models. As per sources, the e-bike is increasingly viewed not just as a means of transport but as a lifestyle accessory that enhances the quality of urban and rural living.

COMPETITIVE LANDSCAPE

The competitive landscape of the Europe electric bicycles market is a complex interplay between specialized component suppliers, established bicycle brands, and new entrants from the technology sector. The market is characterized by intense rivalry centered on technological innovation, brand prestige, and service quality rather than price alone. A clear division exists between companies offering premium, high-performance e-bikes with integrated systems and those targeting the mid-range segment with more standardized components. Competition is further intensified by the rise of direct-to-consumer brands that leverage digital marketing to challenge traditional retail models. Success in this environment requires a holistic strategy that combines cutting-edge product design, a robust and reliable supply chain, a seamless customer experience from purchase to after-sales service, and a strong alignment with the European values of sustainability and active mobility.

KEY MARKET PLAYERS

Some of the notable key players in the Europe electric bicycles market are

Accell Group NV Bosch eBike Systems Giant Manufacturing Co. Ltd Pon Holdings BV Trek Bicycle Corporation Scott Sports SA Riese & Müller GmbH Specialized Bicycle Components Haibike (Yamaha and Accell Group) Cube Bikes Top Players in the Market Bosch eBike Systems is a foundational technology provider in the European electric bicycles market, supplying its high-performance drive units and battery systems to a vast array of premium bicycle brands across the continent. Its contribution to the global market is immense, as its components are widely regarded as the industry benchmark for quality, reliability, and sophisticated software integration. Bosch has strengthened its position by continuously innovating its product line, most recently launching its fourth generation Active Line and Performance Line motors with enhanced connectivity features. The company has also invested heavily in its dealer network, providing specialized training and diagnostic tools to ensure a high standard of service and support, which reinforces its reputation as a trusted partner for both manufacturers and end consumers. Accell Group is a leading European bicycle conglomerate with a powerful portfolio of iconic brands including Haibike, Winora, and Lapierre, which span the full spectrum of the e-bike market from urban commuters to high-end mountain bikes. Its global contribution lies in its vertically integrated business model, which combines strong brand identity with advanced in-house engineering and a vast distribution network. To fortify its market stance, Accell Group has recently accelerated its direct-to-consumer sales channel while simultaneously expanding its physical retail presence through flagship stores in key European cities. This dual-channel strategy allows the company to build deeper customer relationships and gather valuable data to inform future product development and marketing strategies. Giant Manufacturing, a global bicycle giant headquartered in Taiwan, holds a significant and influential presence in the European electric bicycles market through its own brand and its role as a major contract manufacturer. In Europe, Giant leverages its reputation for innovation and quality to offer a comprehensive range of e-bikes under its own name, from city models to performance road and mountain variants. The company has recently intensified its focus on sustainability, launching new e-bike models built with recycled materials and establishing a pan-European recycling program for end-of-life batteries. This commitment to environmental responsibility, combined with its extensive R&D capabilities, positions Giant as a forward-thinking leader shaping the future of the European e-bike industry. Top Strategies Used by the Key Market Participants

Key players in the Europe electric bicycles market are deploying a multi-pronged strategic approach to secure their competitive advantage. They are heavily investing in research and development to create lighter, more powerful, and longer-range drive systems and batteries. Simultaneously, they are forging strong partnerships with traditional bicycle brands to integrate their proprietary technology into a wide range of frames. Another core strategy involves building comprehensive after-sales ecosystems, including certified service centers and digital platforms for diagnostics and over-the-air software updates. Finally, they are actively engaging in policy advocacy to support the expansion of cycling infrastructure and favorable regulations, recognizing that a thriving e-bike market depends on a supportive public environment.

MARKET SEGMENTATION

This research report on the European electric bicycles market has been segmented and sub-segmented based on categories.

By Type

Pedal Assist/ Pedelecs Power on Demand Pedal Assist with Power on Demand

By Battery Type

Sealed Lead Acid Li-Ion Battery

By Motor Type

Hub Motor Mid Drive Electric

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe