Norway’s sovereign wealth fund returned to Tesla, Rivian and Ford in the fourth quarter, purchasing 38 million shares after fully exiting its position three months earlier.

The world’s largest sovereign wealth fund re-entered the US automotive sector after it liquidated its holdings across all three companies during the third quarter.

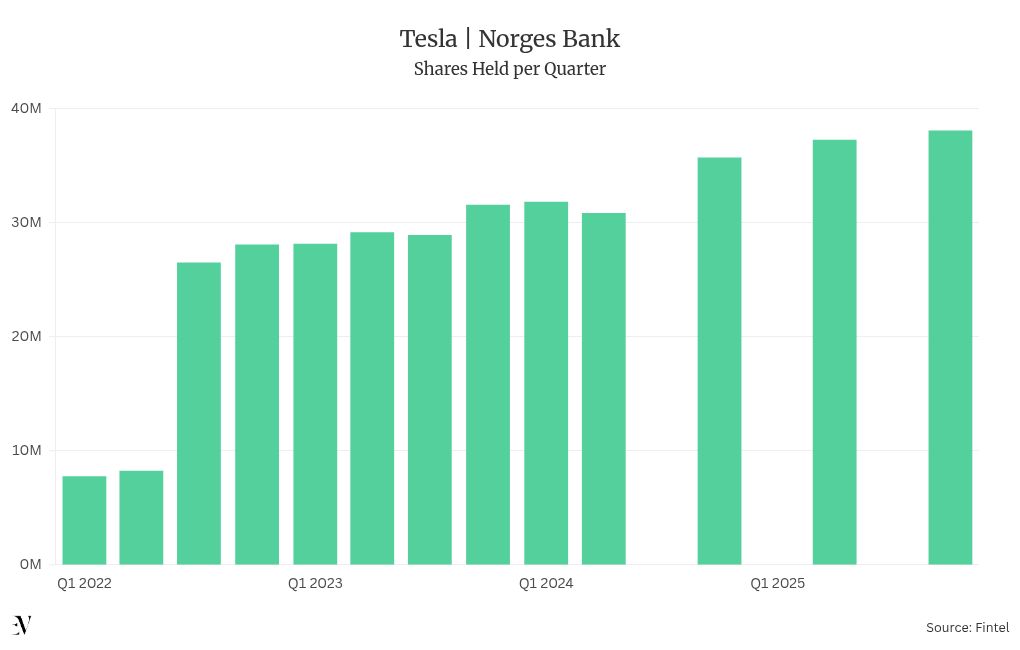

Norges Bank Investment Management, which manages over $2.24 trillion in assets, reported holding 38,086,143 Tesla shares as of December 31.

The stake was valued at approximately $15.4 billion based on the quarter-end closing price, according to a portfolio update filed with the US Securities and Exchange Commission on Tuesday.

The fund had sold its entire Tesla stake during the third quarter after holding 37,272,002 shares worth nearly $11.84 billion as of June 30.

Volatile History

Norges Bank’s relationship with Tesla has been marked by dramatic swings in recent years.

The fund first invested in Tesla with a stake of around 450,000 shares and grew its position to approximately 1 million shares by the end of 2018.

Tesla‘s two stock splits — a 5-for-1 split in August 2020 and a 3-for-1 split in 2022 — drove the fund’s share count from around 1.5 million in the second quarter of 2020 to approximately 26 million by the third quarter of 2022.

The position peaked at 37 million shares in the second quarter of 2025, representing a 42% increase over three years, before the fund liquidated its entire holding in the third quarter.

The fourth-quarter repurchase marks the second time Norges Bank has fully exited and then re-entered Tesla within a single year.

The fund had also dumped all its shares at the beginning of 2025 before reopening its position in the second quarter.

Musk’s Pay Package

The return to Tesla came after Norges Bank publicly opposed CEO Elon Musk’s compensation plan.

Two days before Tesla‘s Annual Shareholder Meeting on November 6, the fund announced it would vote against the proposal.

The plan tied up to $1 trillion in compensation to targets including a $7.5 trillion market capitalization, the deployment of 1 million robotaxis, and the delivery of 1 million Optimus humanoid robots.

Norges Bank said at the time it would “continue to seek constructive dialogue with Tesla on this and other topics.”

Tesla shareholders ultimately approved the plan.

Rivian

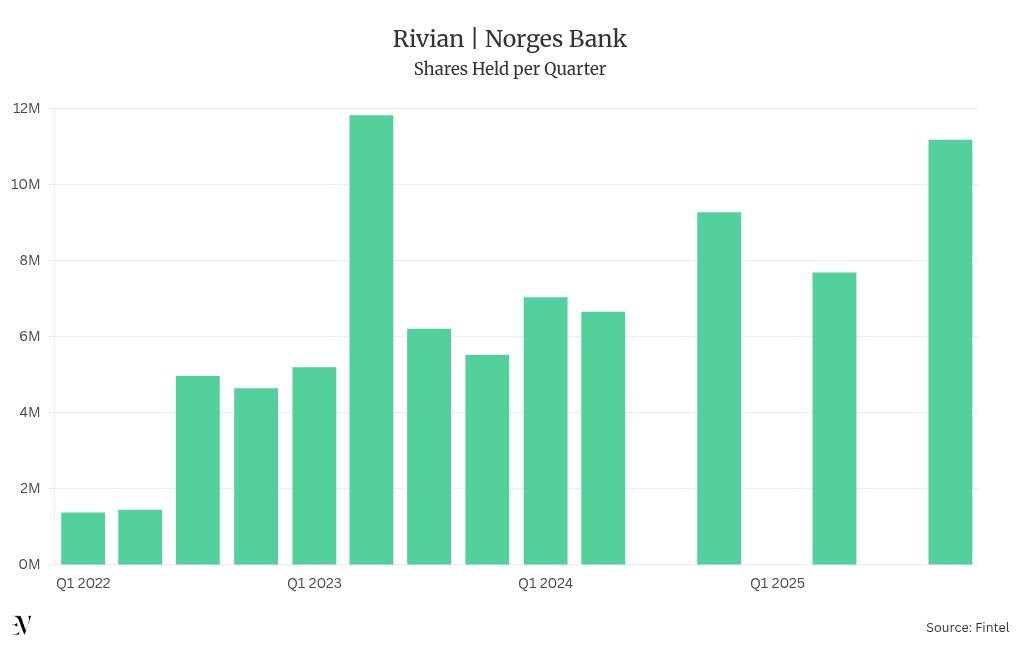

Norges Bank also returned to Rivian, purchasing 11,178,246 shares in the fourth quarter after selling its entire stake in the third quarter.

The fund had held 7,687,722 Rivian shares as of June 30 before fully exiting. The new position represents a 45% increase from that previous holding.

Like Tesla, Rivian has seen volatile ownership from the Norwegian fund.

Norges Bank fully exited the Irvine-based EV maker in the first quarter of 2025, returned in the second quarter, exited again in the third quarter, and has now re-entered in the fourth quarter.

The fund first invested in Rivian with approximately 2 million shares at the end of 2021, shortly after the EV maker’s November IPO.

Its position peaked at nearly 11.8 million shares in the second quarter of 2024.

The EV maker lifted earlier this Tuesday the media embargo on the R2 prototypes, with several content creators and car revieweres such as MKBHD and Doug DeMuro publishing their videos about the brand’s upcoming mid-size SUV.

Ford

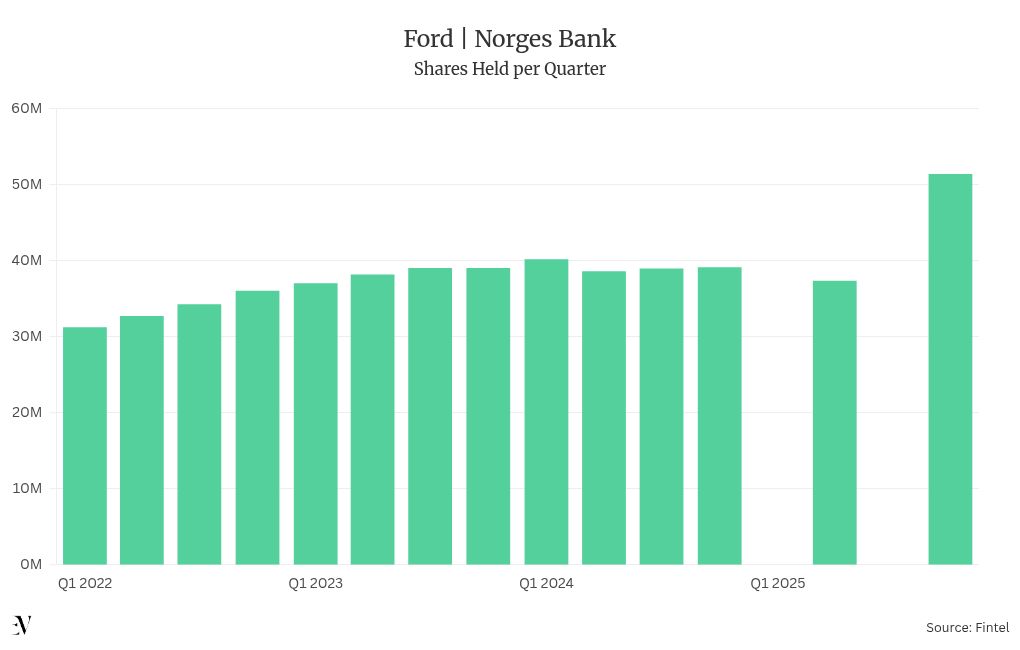

Norges Bank returned to Ford with a record 51,465,255 shares, its largest position in the Detroit automaker since first investing in the company.

The fund had exited its entire Ford stake in the third quarter after holding approximately 31.3 million shares as of June 30.

Norges Bank first entered Ford in 2012 and has maintained a position in the company for most of the past decade, though this marks the second time it has fully exited and re-entered the stock within 2025.

The company will reports its fourth quarter earnings results later this Wednesday, after the US markets close.